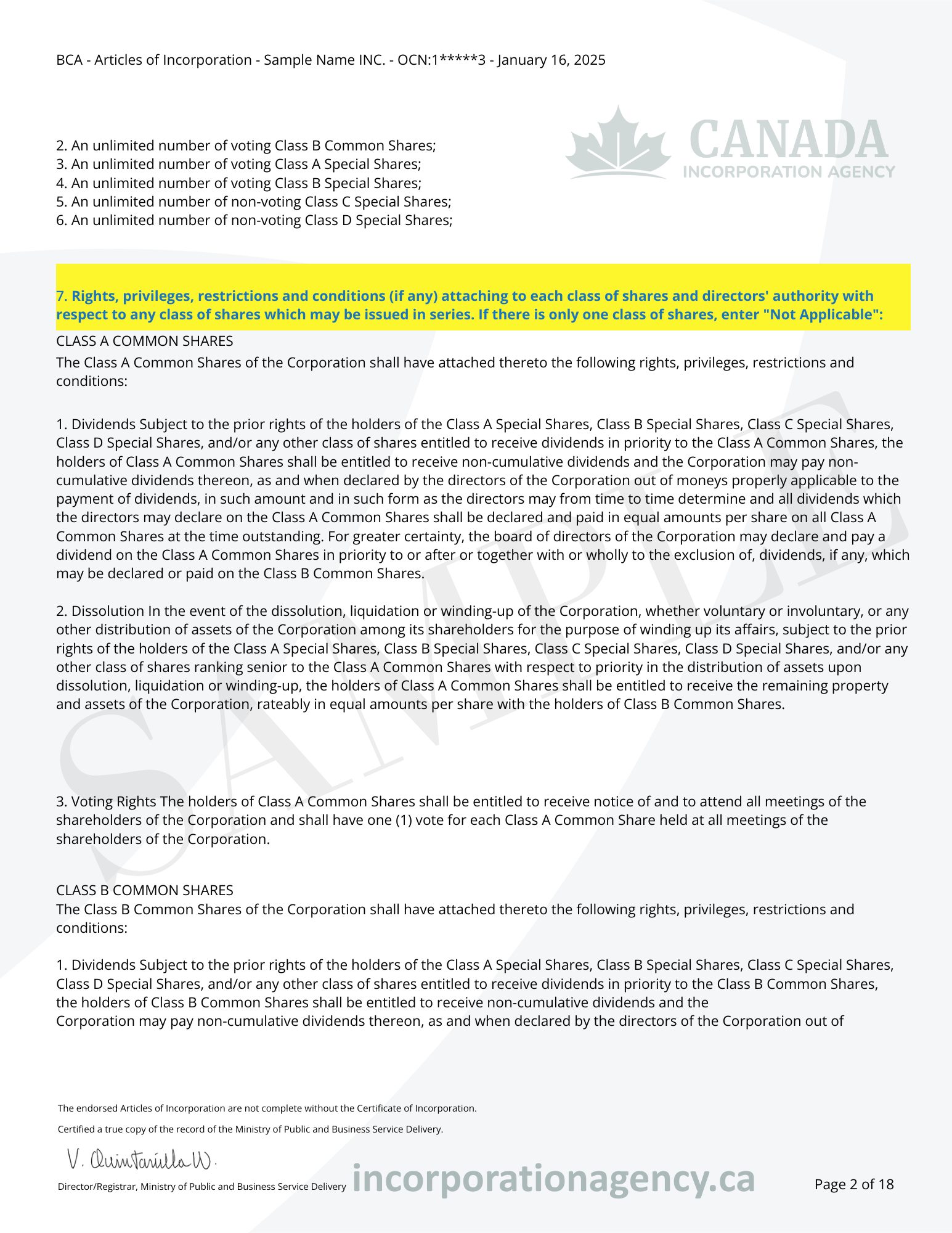

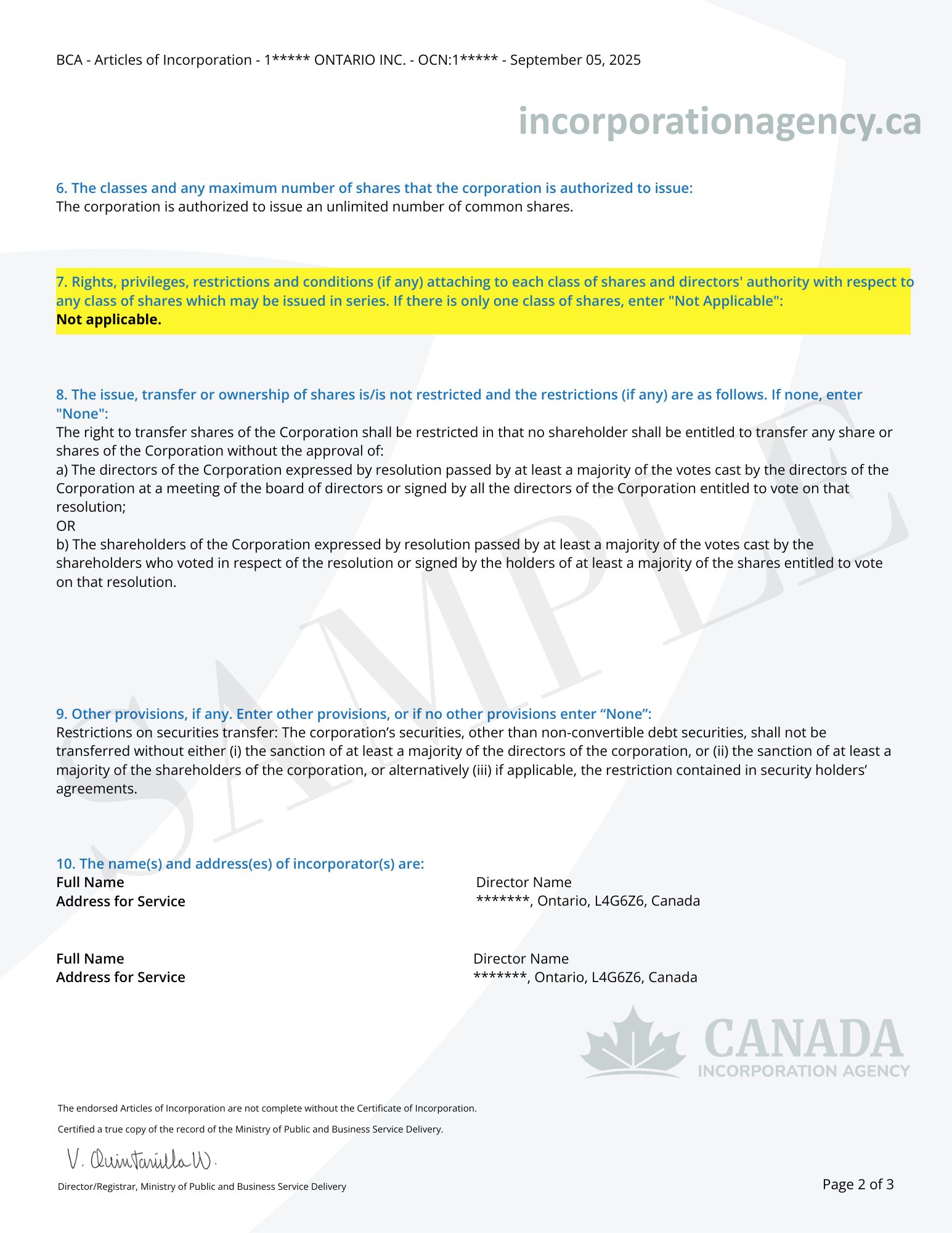

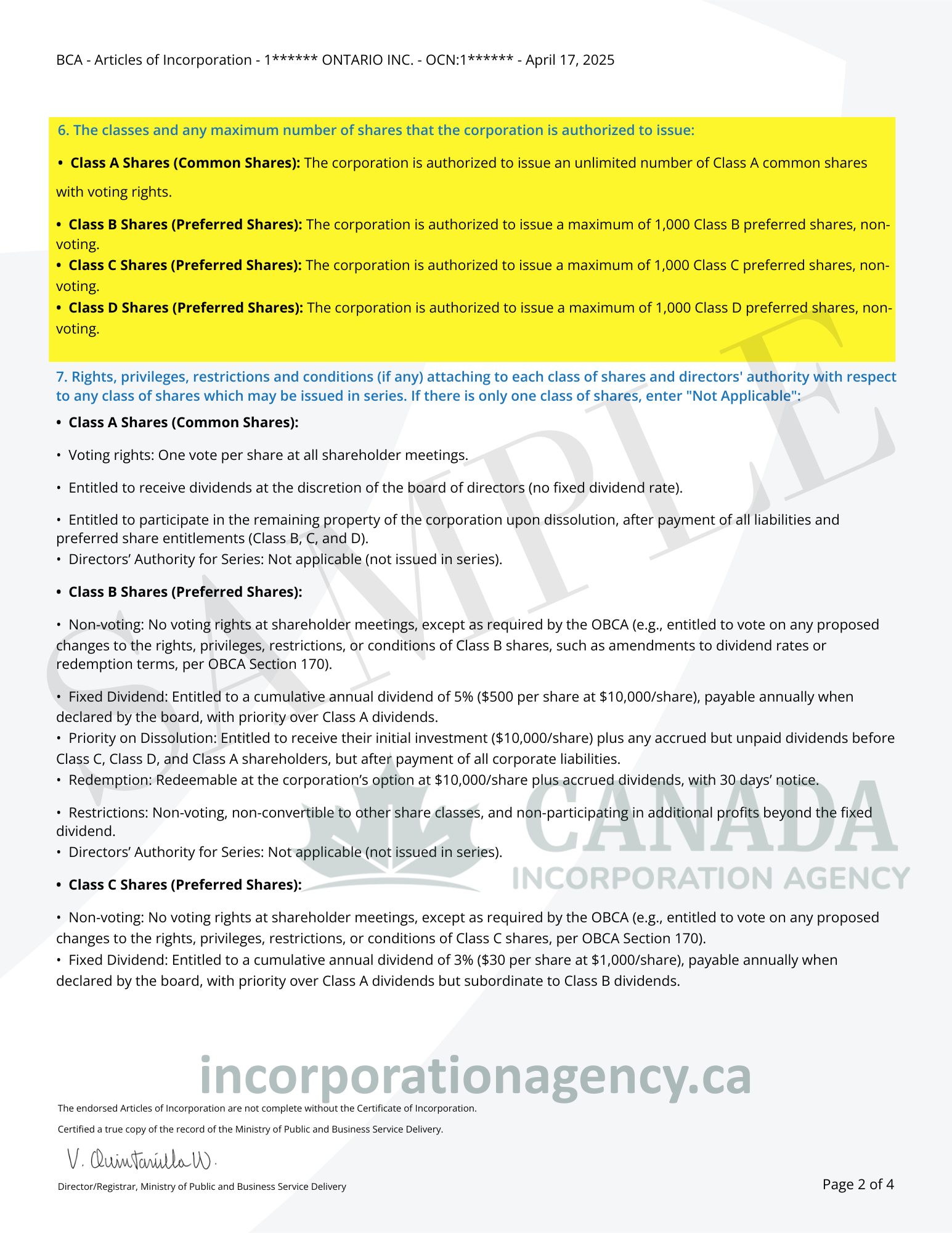

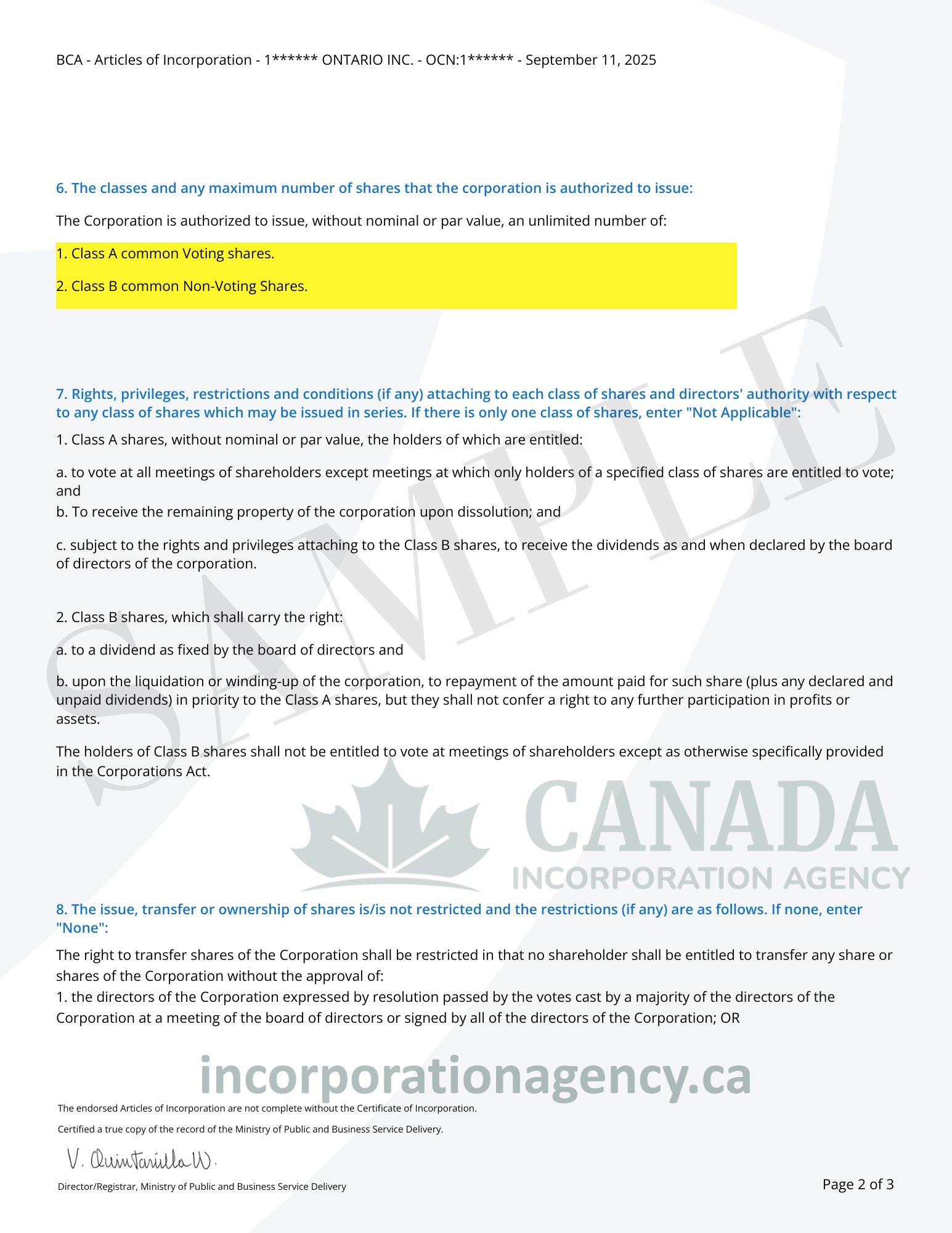

Creating a personalized share class means creating specific types of shares, such as Class A, Class B, or preferred shares, that offer varying rights, voting capabilities, and financial interests to shareholders. By introducing these unique share classes, you can retain authority over corporate decisions, handle dividend allocations, and dictate how assets are divided in the event of liquidation of the corporation.