An Official Intermediary of the Federal and Provincial Government

An Official Intermediary of the Federal and Provincial Government

1-Hour Service Available

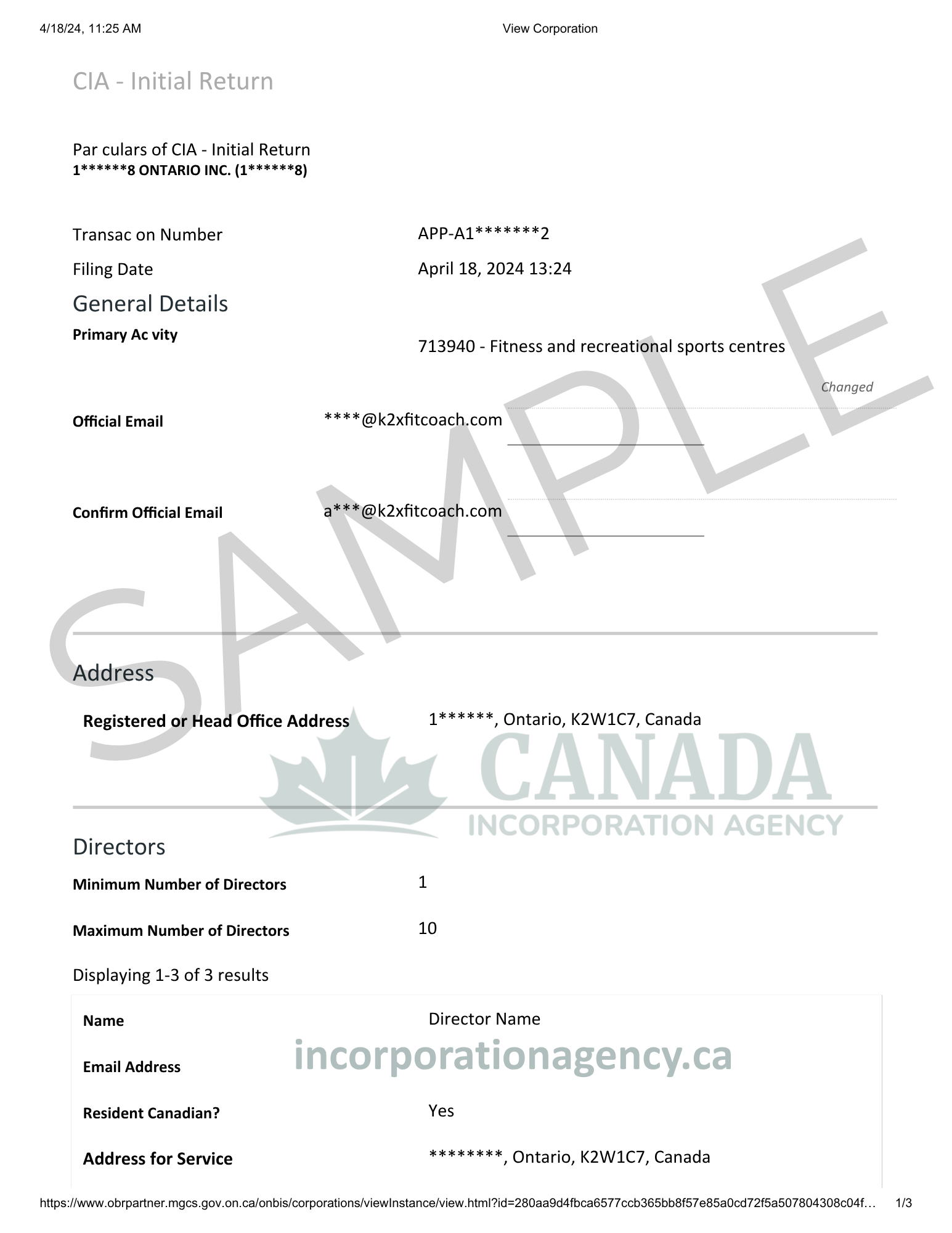

We’re an official intermediary for the Province of Ontario.

Fast. Simple. Transparent. No Hidden Fees.

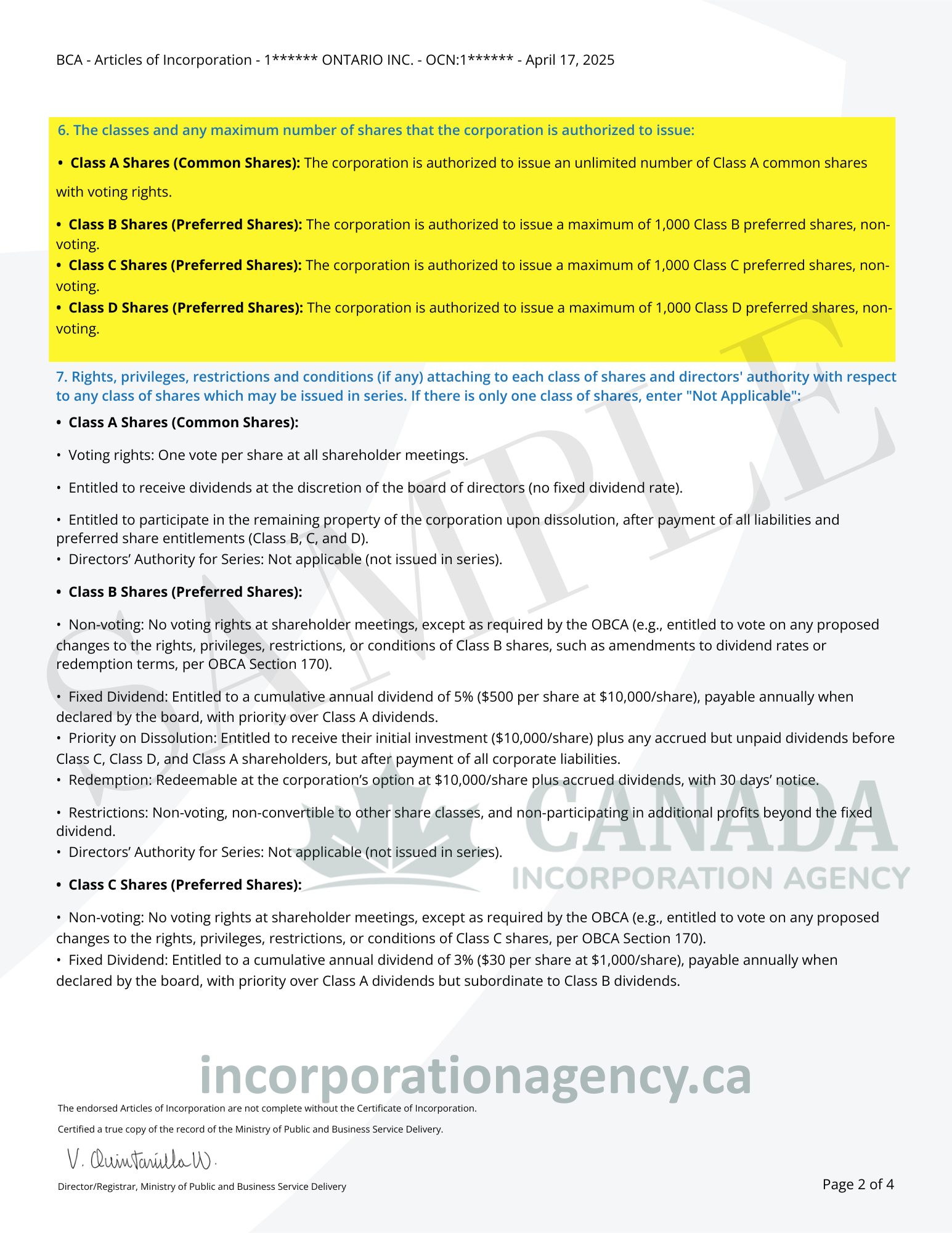

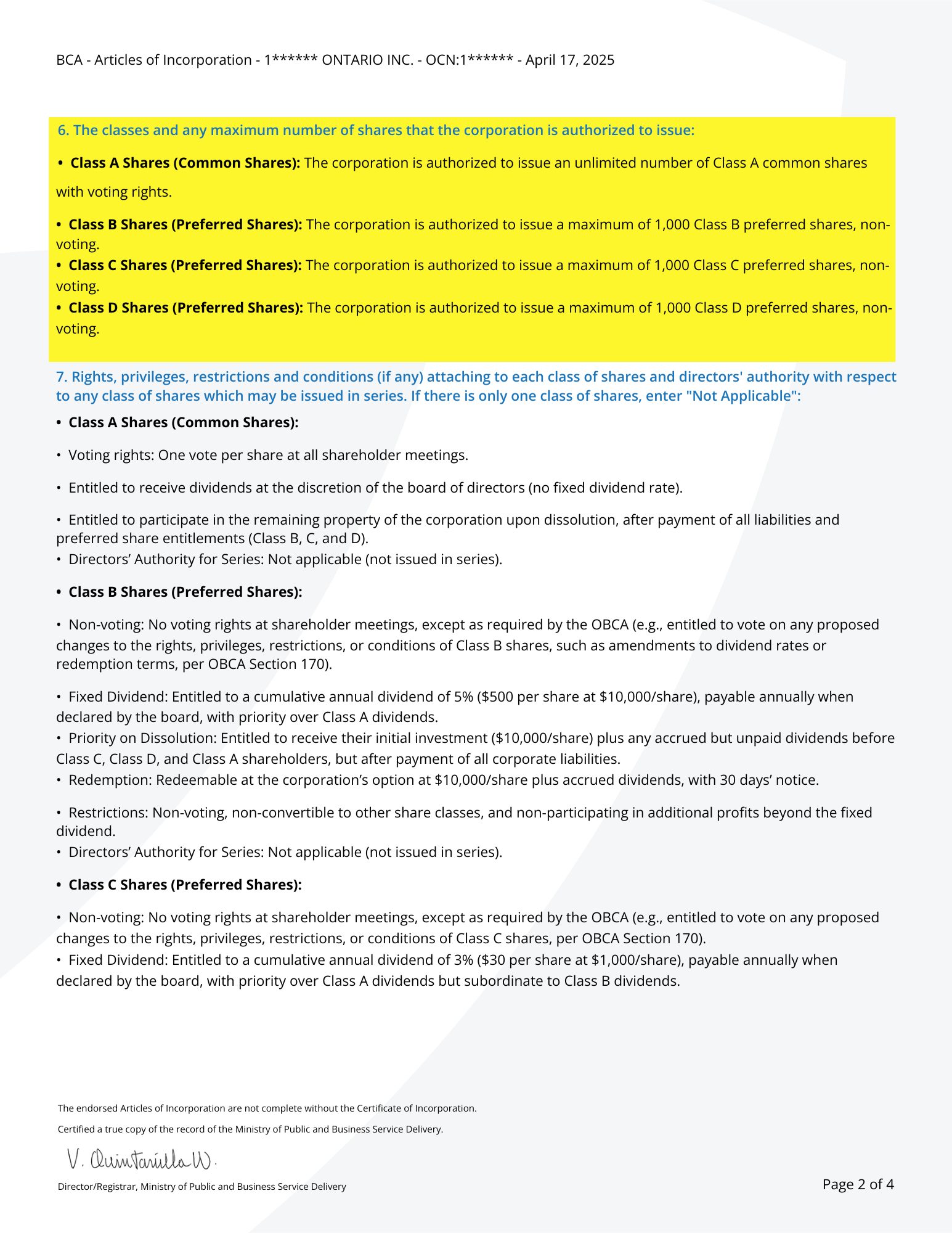

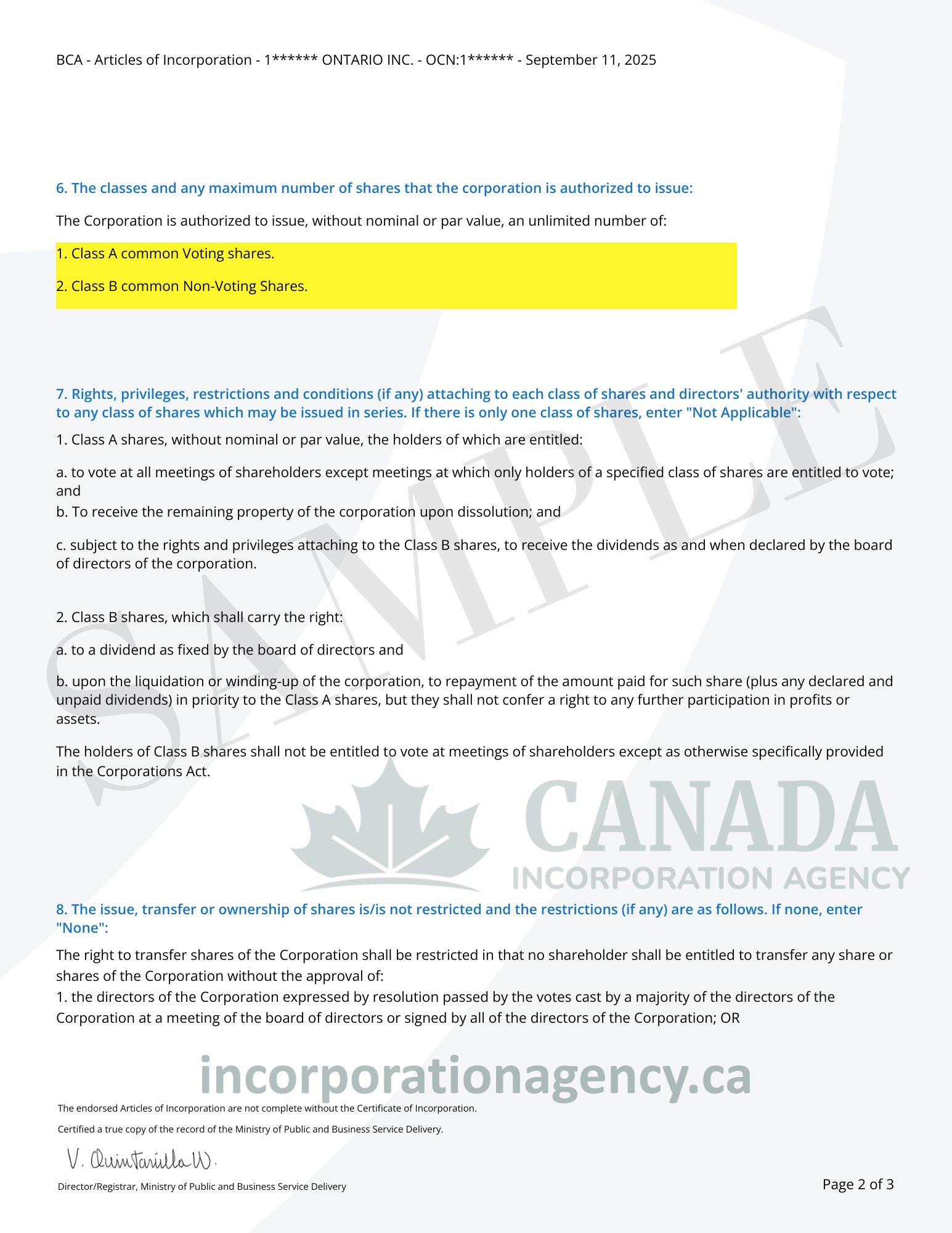

Here are a few key differences between a Standard Ontario Corporation and a Professional Ontario Corporation

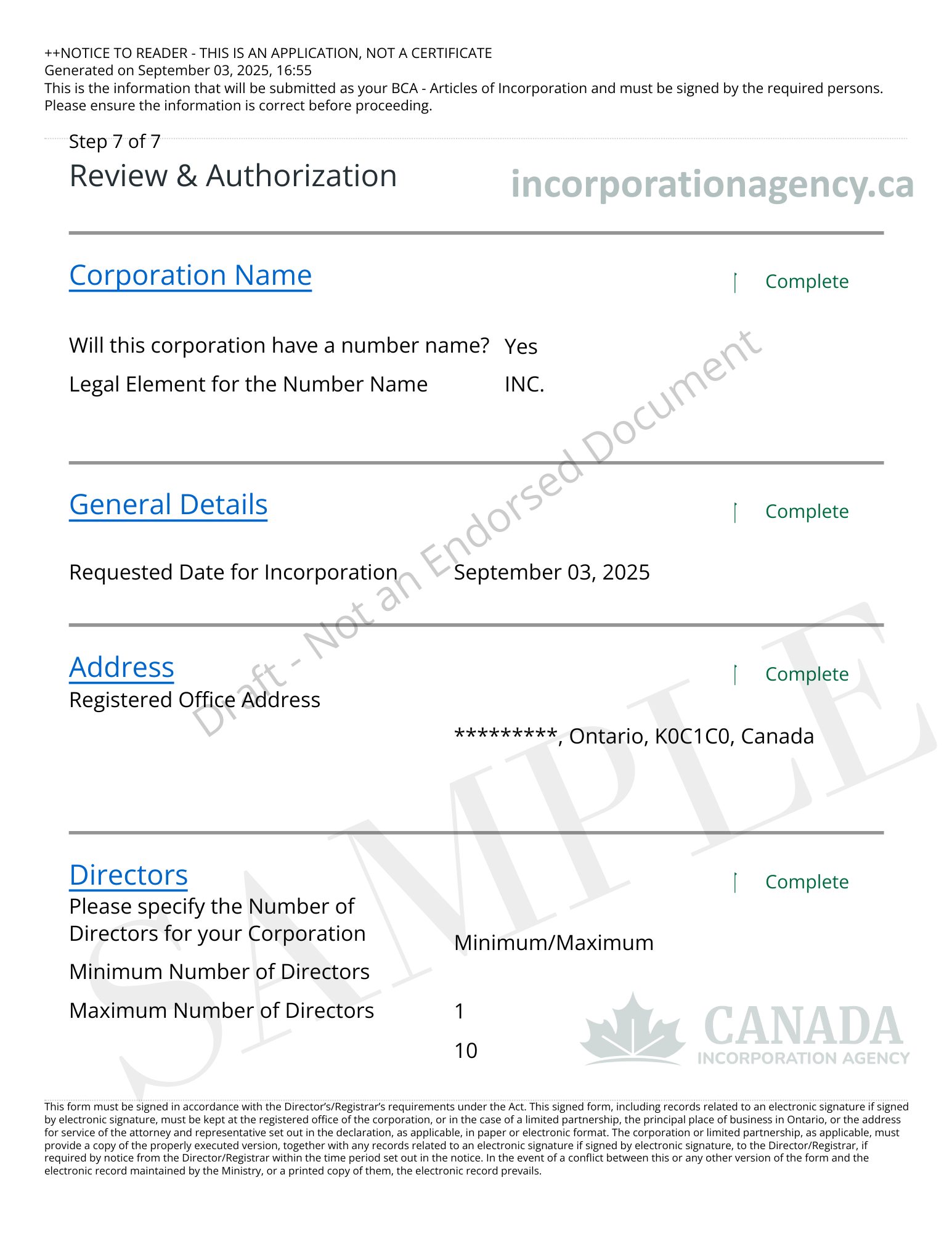

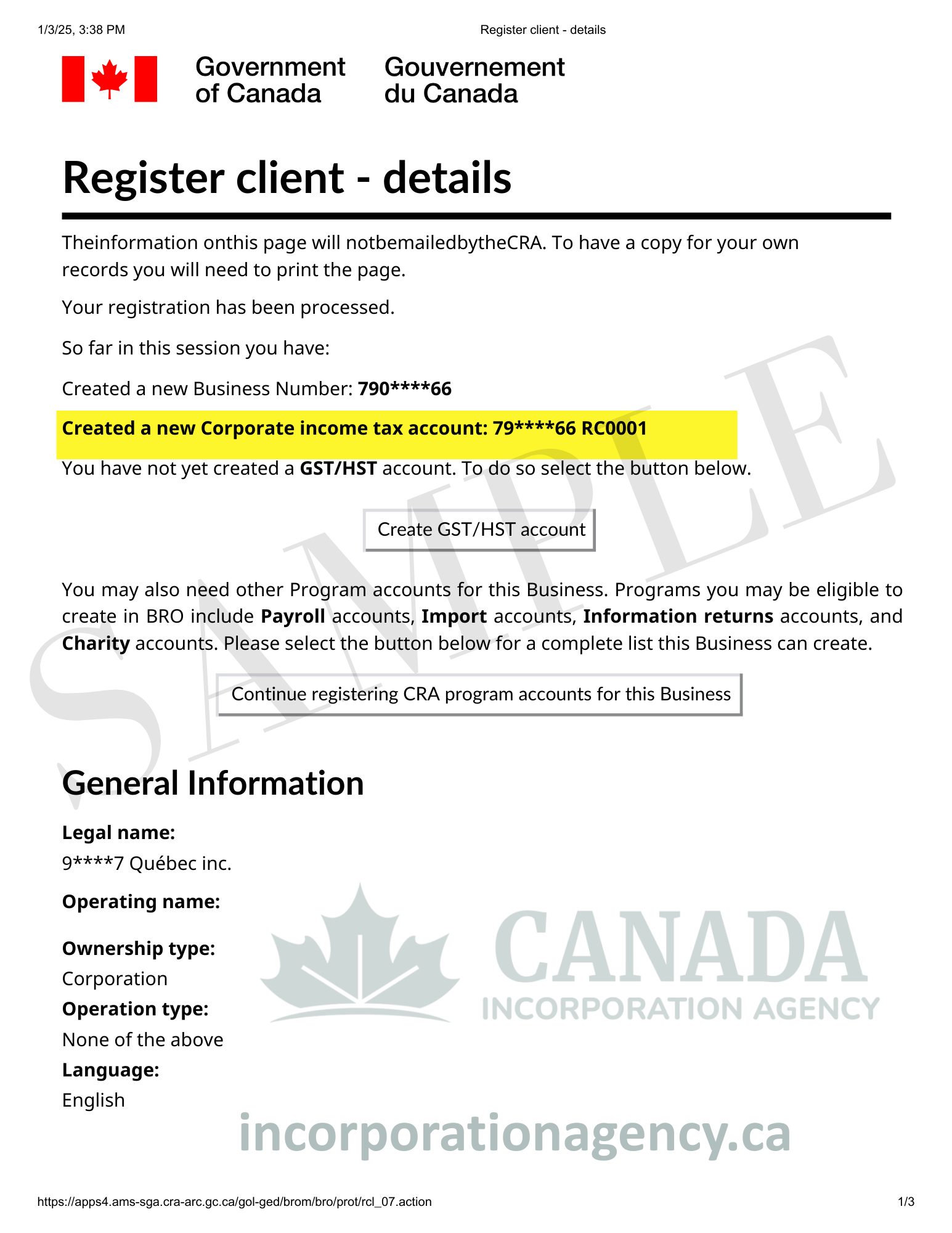

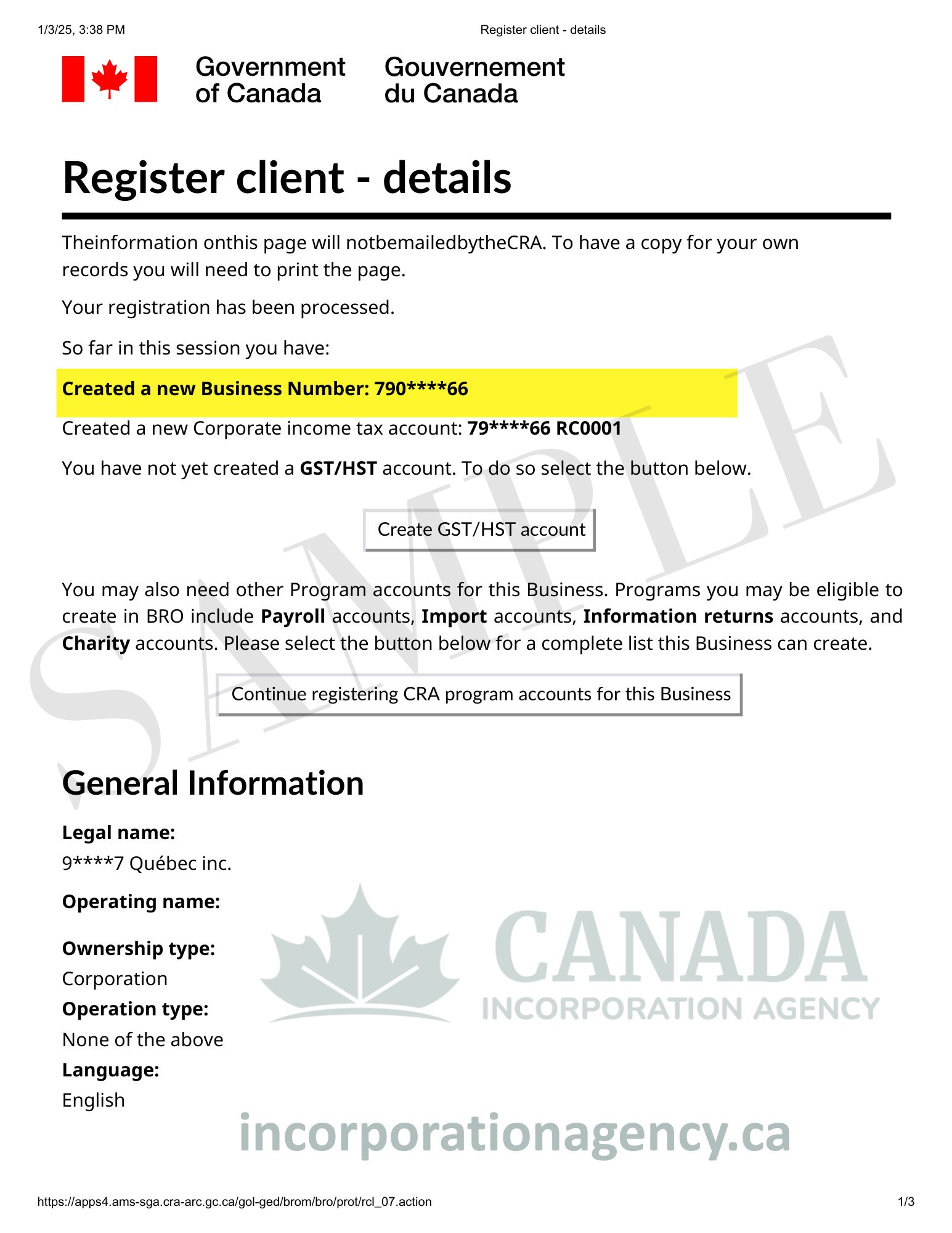

Kick things off by completing our easy step-by-step form. You can place your order using a credit card, PayPal, or e-transfer—whichever is most convenient.

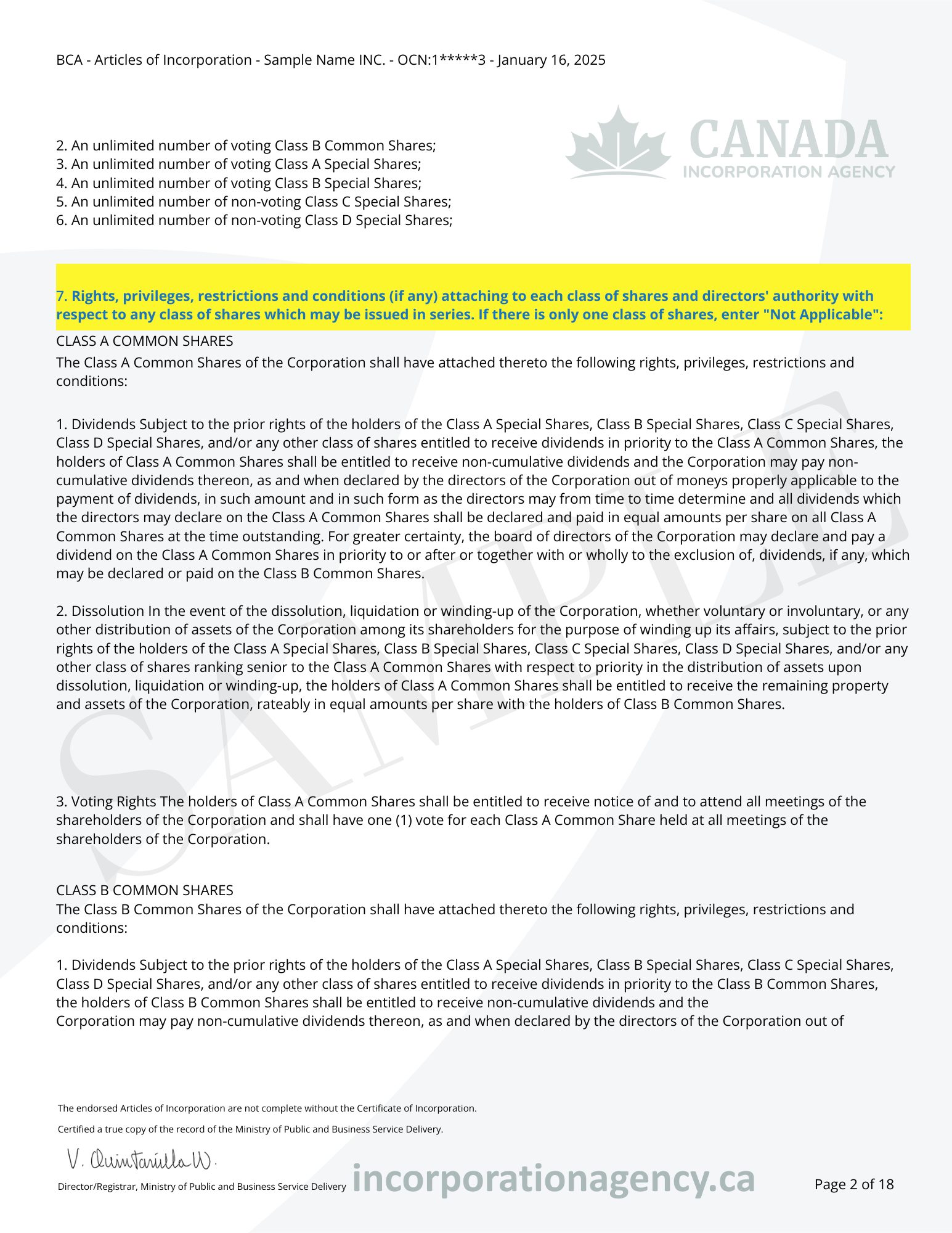

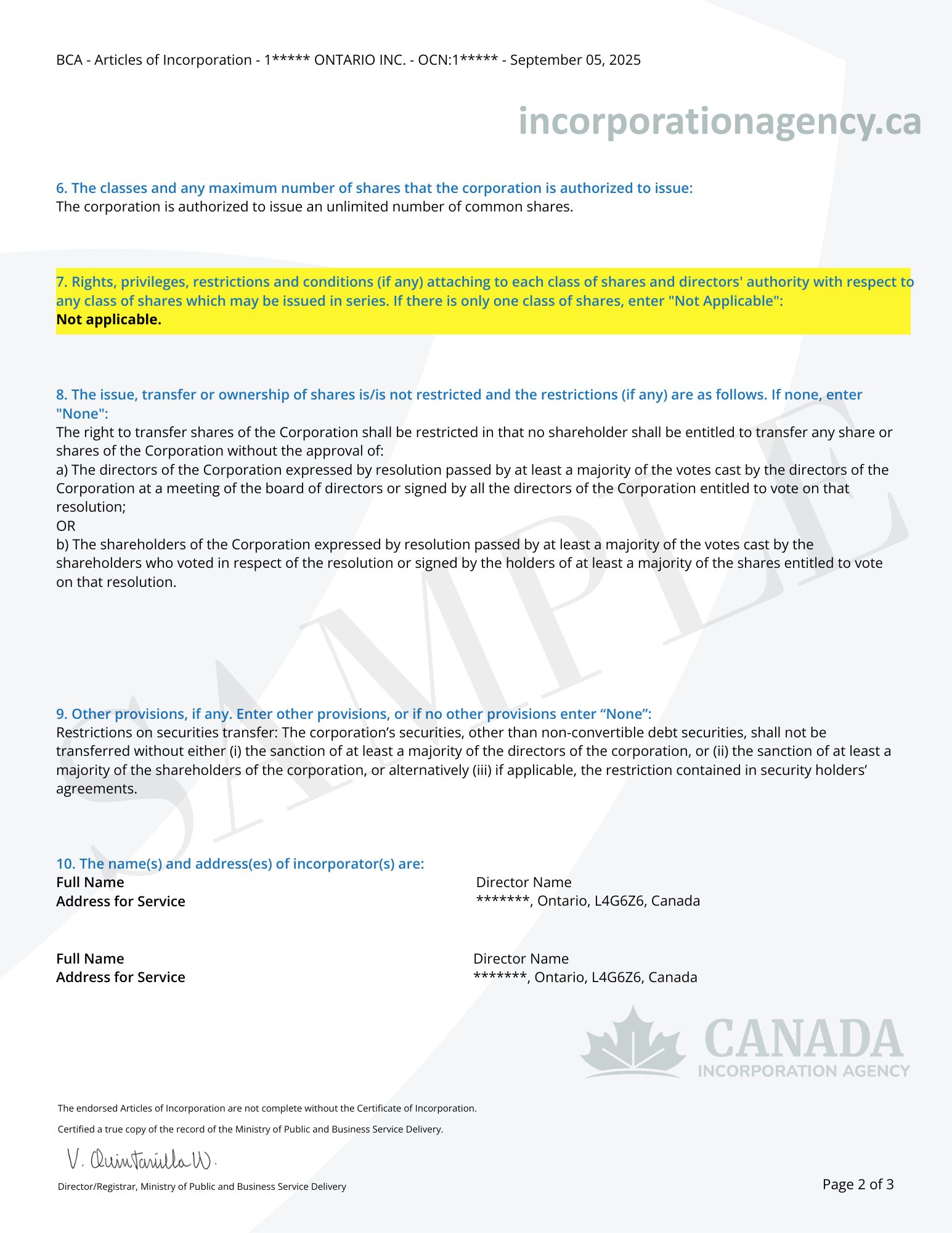

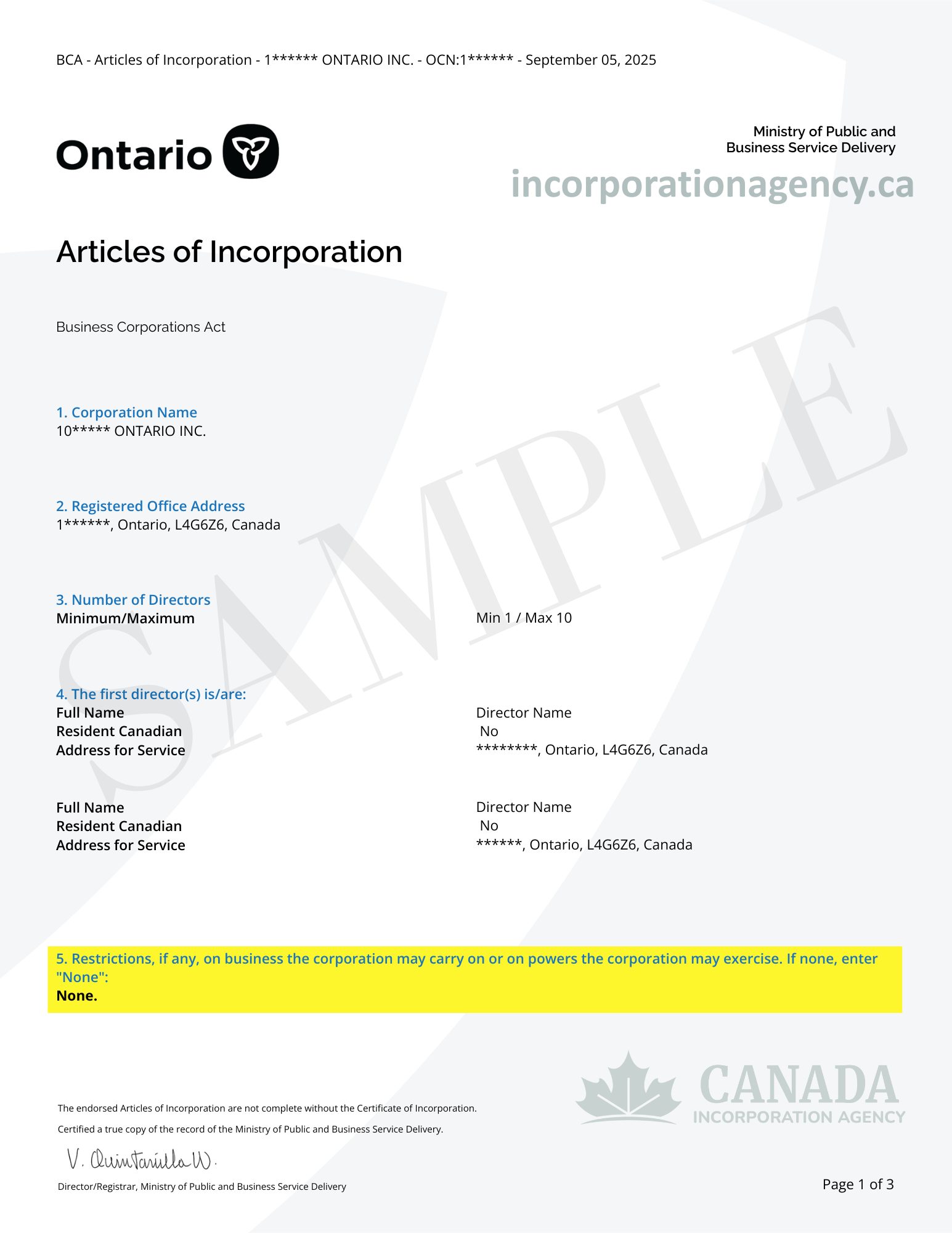

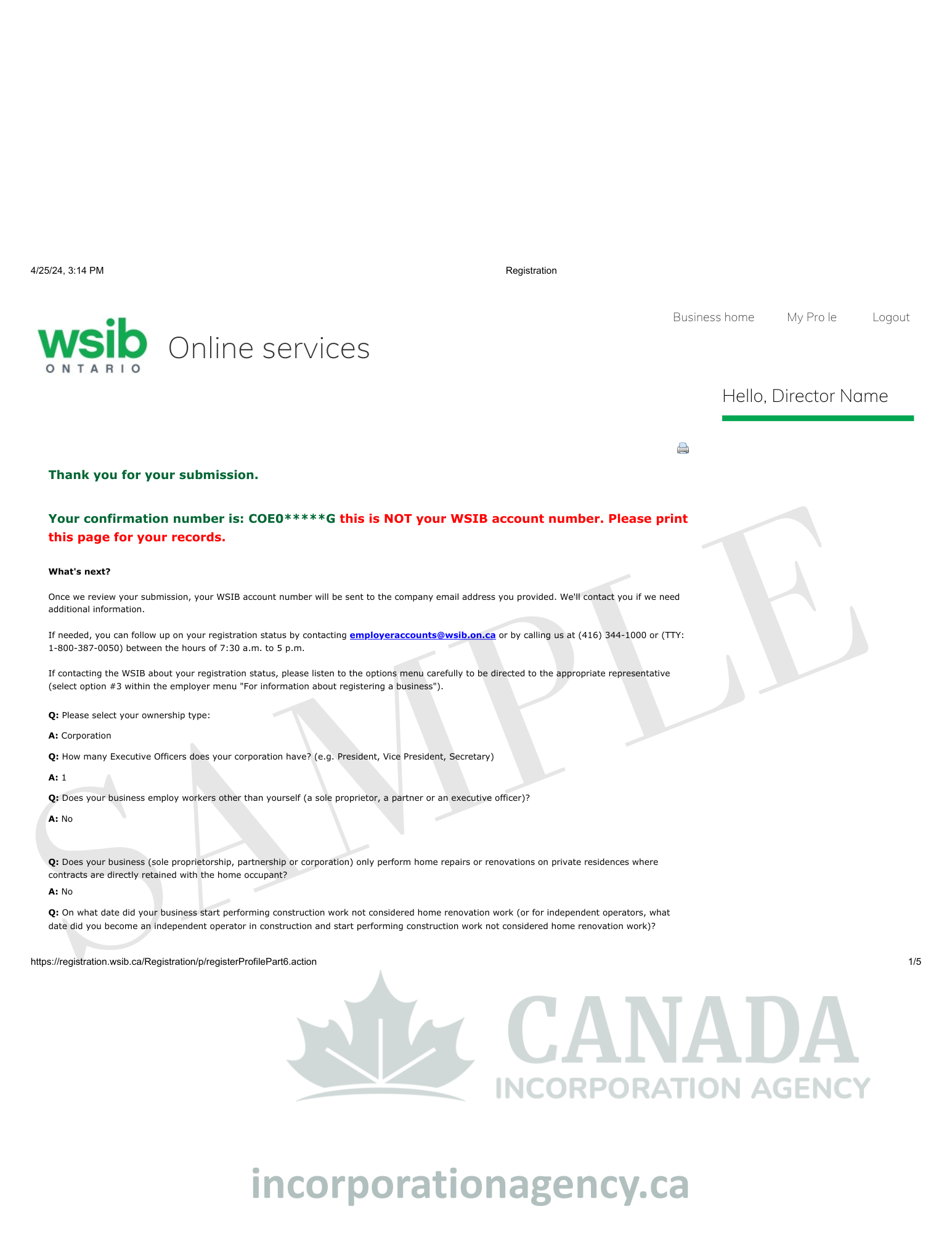

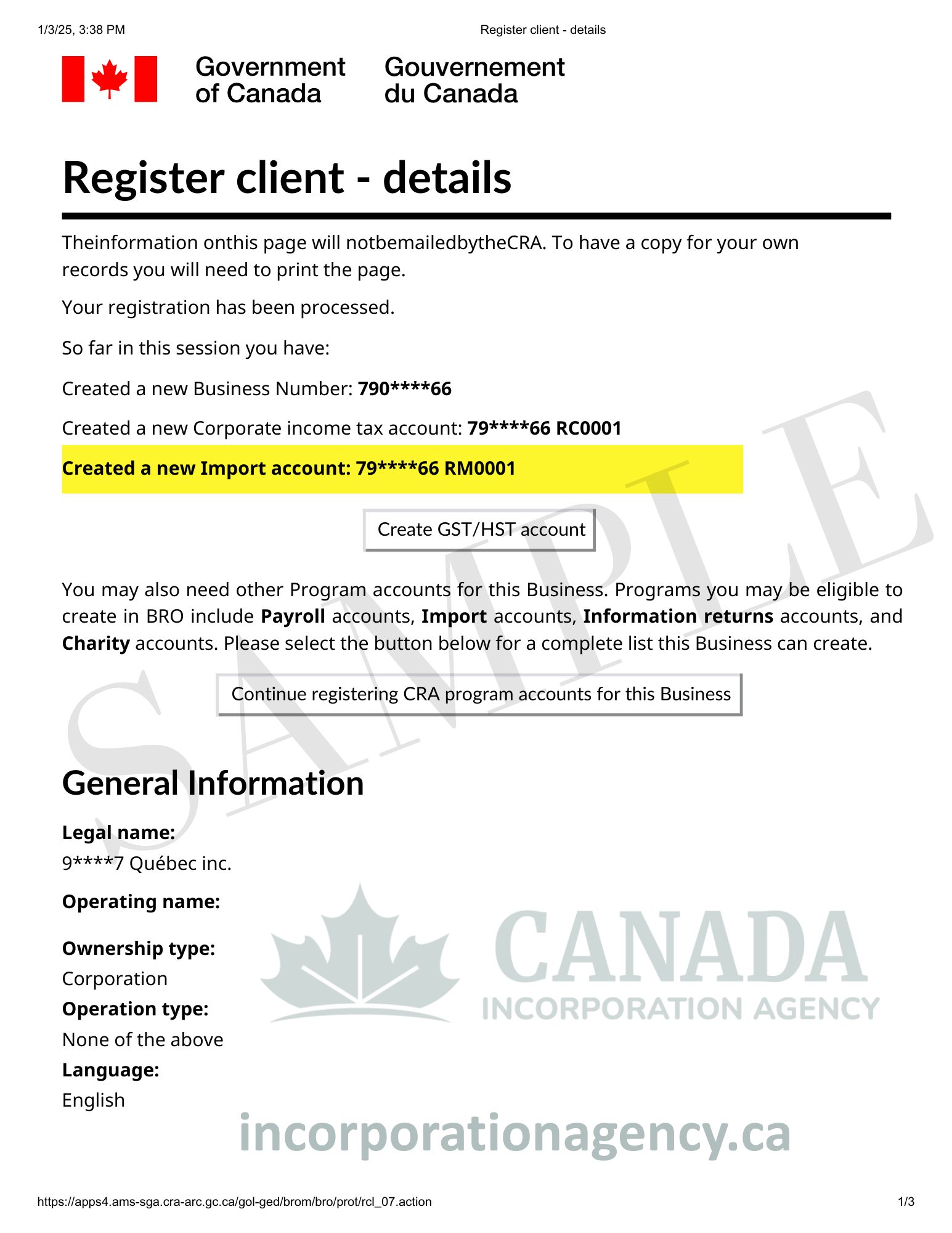

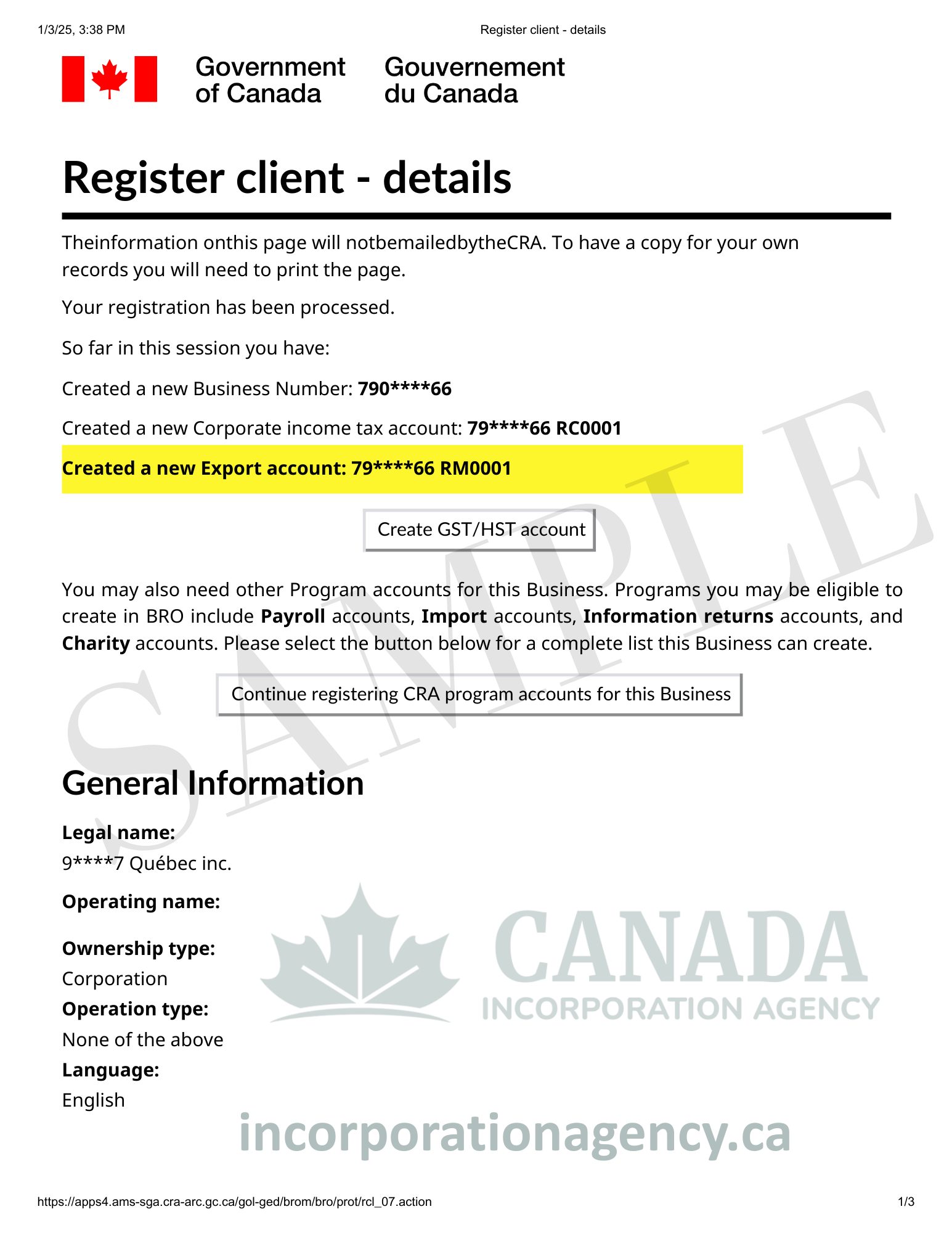

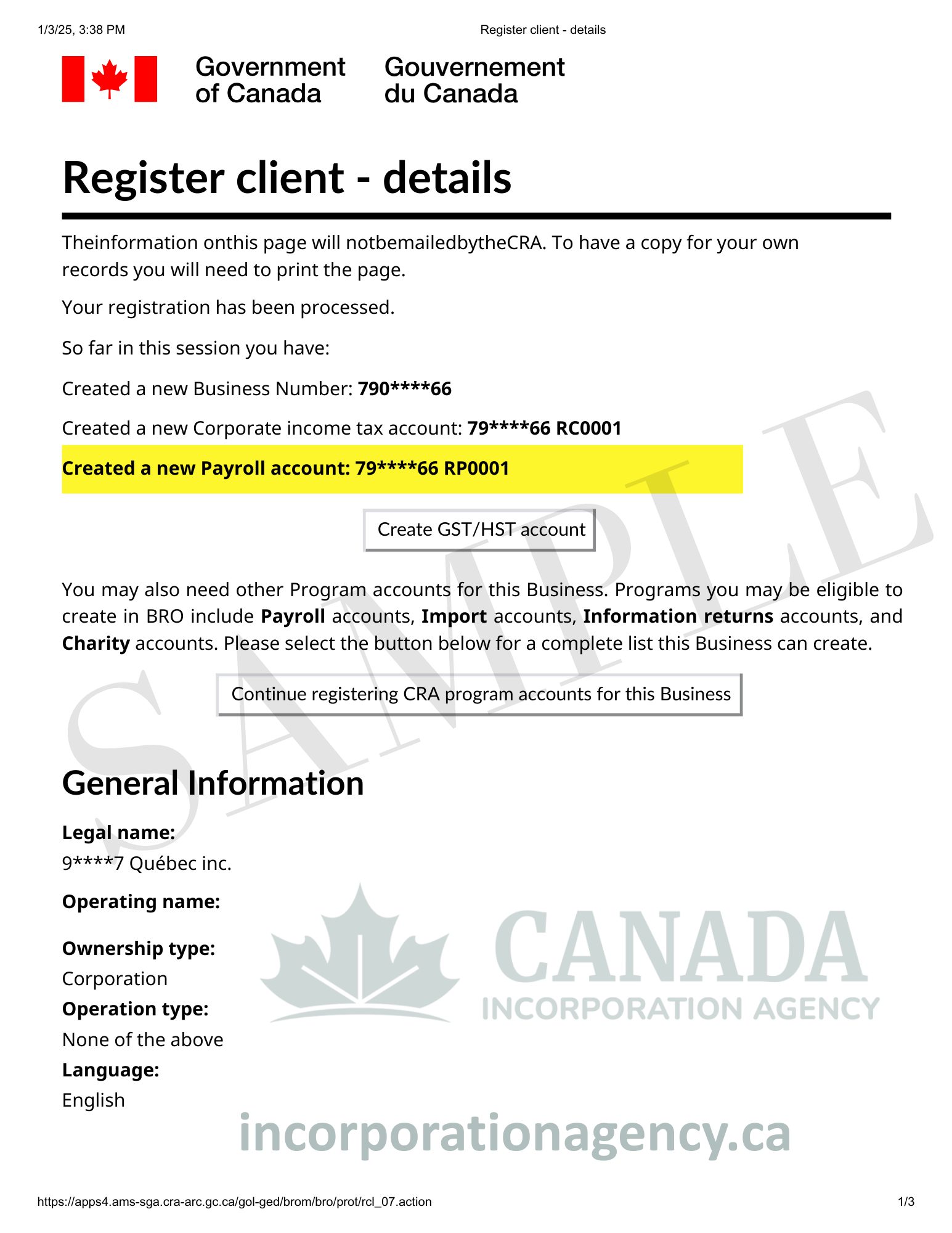

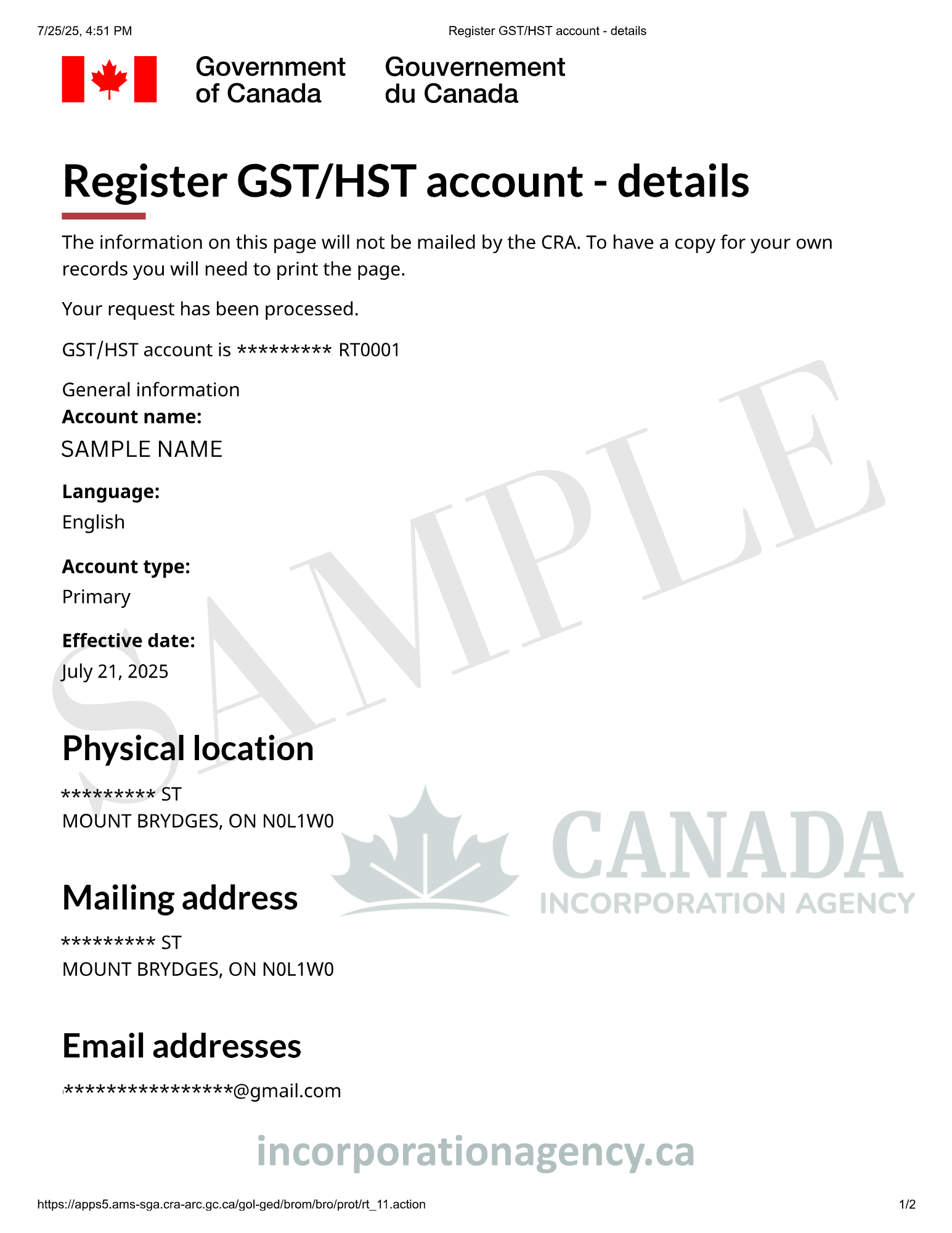

Once your payment is confirmed, our experienced registry agent reviews everything and files your documents with the appropriate Ontario government office. No need to worry about red tape or delays.

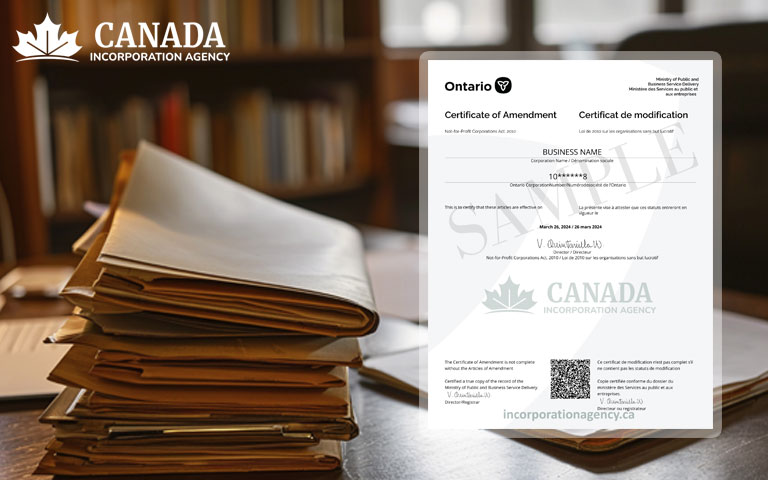

Ontario Professional Corporation Registration doesn’t have to be complicated. You’ll receive your official Certificate and Articles of Incorporation right in your inbox—often in just a few business hours.

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

Only members of regulated professions can form a Professional Corporation in Ontario. Common examples include:

Physicians

Dentists

Chartered Professional Accountants (CPAs)

Lawyers

Engineers

Chiropractors

Optometrists

You must hold a valid license and be in good standing with your regulatory college or association.

– Reduce corporate tax rates applicable to active business income

– Liability protection for corporate obligations (other than professional malpractice)

– Income Deferral and Investment Opportunities

– Professional image and consistency

Yes, you can incorporate online by completing a simple form on Canada Incorporation Agency website, it will take around 15 minutes. After completing the payment, we will send you a confirmation email, and our agent will contact you to confirm all the order details. We will incorporate your company and email the Certificate and Articles of incorporation to you.

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

If your Ontario business needs a makeover – this article is for you. Perhaps you

Running a business is like being the captain of a ship. Sometimes you need to

If you and your friend have a brilliant business idea, and you want to team