An Official Intermediary of the Federal and Provincial Government

An Official Intermediary of the Federal and Provincial Government

1-Hour Service Available

Only $99 + Government Fee

We’re an official intermediary for the Province of Ontario.

Fast. Simple. Transparent. No Hidden Fees.

Tax Benefits: Non-profit organizations in Canada are automatically exempt from taxes automatically, if the groups qualify under the definition of an NPO in the Income Tax Act. These groups pay no federal, state, or local taxes, which means more of your funds can go directly to your cause instead of going to the taxman. Just make sure you fit the rules under the Income Tax Act.

Limited Liability Protection: Nonprofits gain the advantage of tax-exempt status and protection of directors, officers, and members from personal liability. Personal assets of officers and board members are generally exempt from organizational debt and liability.

Increased Credibility and Legitimacy: Being incorporated as an Ontario non-profit gives your group a serious credibility boost. People, grant providers, and the public are more likely to trust and support an official organization with paperwork and bylaws in place.

Access to Funding Sources: Non-profit status also makes groups eligible to receive special grants or government funding, and special rates on services or even postage. Public and private grants available to incorporated organizations only can be accessed by some nonprofits.

Perpetual Existence: Unlike unincorporated associations, a corporation continues to exist even if founders or board members leave, providing organizational stability and continuity.

Better Governance Structure: The not-for-profit corporation has an enhanced ability, through its governing documents, to address membership status issues (e.g., removal for unpaid dues or death, and expulsion for disciplinary reasons).

Easier Tax-Exempt Status: While a group or association that has not been formed under state law can apply for tax-exempt status, it is generally easier for a statutory business entity (and especially a corporation) to get IRS approval.

Examples of non-profit organizations

Here are a few types of Ontario non-profit organizations and examples of each:

To learn more, take a look at the Not-for-Profit Corporations Act, 2010, S.O. 2010, c. 15.

Feature | Non-Profit Corporation | Standard Corporation |

|---|---|---|

Purpose | Operates for social, cultural, charitable, or community goals (not for making profit) | Operates to earn profit for shareholders |

Profit Distribution | Cannot distribute profits to members or directors | Can distribute profits as dividends to shareholders |

Ownership | No shareholders—has members or directors | Owned by shareholders |

Tax Status | May qualify for tax-exempt status (if registered charity) | Pays corporate taxes on profits |

Fundraising Options | Donations, grants, membership fees | Sales, investments, business revenue |

Use of Surplus | Reinvested into the organization’s mission | Can be used or distributed at owner's discretion |

Naming Restrictions | Cannot use “Limited,” “Ltd.” unless special approval | Must include “Limited,” “Ltd.,” “Inc.,” or “Corp.” |

Governing Law | Ontario Not-for-Profit Corporations Act (ONCA) | Ontario Business Corporations Act (OBCA) |

Directors | At least 3 directors are required | At least 1 director |

Residency Requirement | No requirement, unless you plan to register a Charity status. | No requirement. |

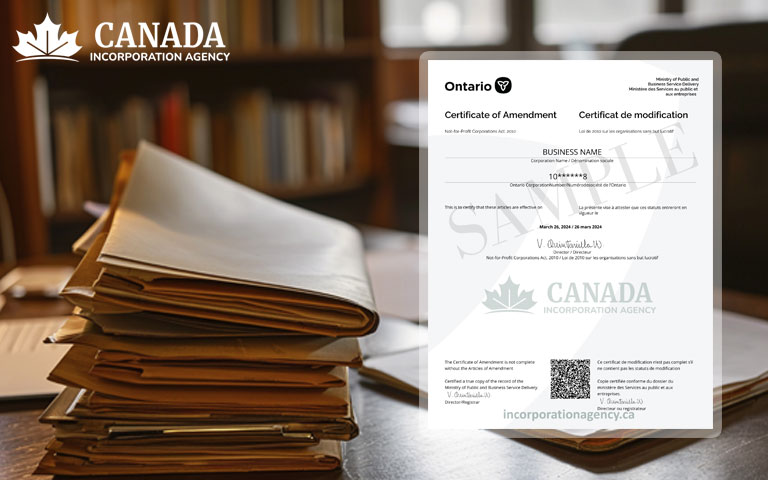

Kick things off by completing our easy step-by-step form. You can place your order using a credit card, PayPal, or e-transfer—whichever is most convenient.

Once your payment is confirmed, our experienced registry agent reviews everything and files your documents with the appropriate Ontario government office. No need to worry about red tape or delays.

Incorporating a business in Ontario doesn’t have to be complicated. You’ll receive your official Certificate and Articles of Incorporation right in your inbox—often in just a few business hours.

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

Limited liability protection for directors and members

Legal recognition and credibility

Ability to enter into contracts, own property, and receive grants

Continuity regardless of changes in membership

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

If your Ontario business needs a makeover – this article is for you. Perhaps you

Running a business is like being the captain of a ship. Sometimes you need to

If you and your friend have a brilliant business idea, and you want to team