When most people hear “offshore company,” visions of tropical islands, secret vaults, and James Bond-style business dealings come to mind. But in reality, incorporating an offshore company in Canada is much less glamorous—and much more practical.

If you’re an entrepreneur, investor, or business owner looking to expand internationally, opening a business in Canada as a foreign entity or subsidiary can offer tax advantages, credibility, and access to North American markets. Let’s break it down step by step, with examples, and a sprinkle of humor so you don’t fall asleep halfway through.

What is an Offshore Company in Canada?

An offshore company in Canada refers to a company that is incorporated outside of Canada but does business or holds a corporate presence within the country. In some cases, it can also mean a foreign entity registering a branch, subsidiary, or representative office in Canada to legally operate.

If you’re asking “what is a foreign company in Canada?”, it’s essentially a company incorporated outside Canada that wants to do business here. They might:

- Sell products or services

- Open a corporate bank account

- Hire employees

- Enter into contracts

The key point is that while the company’s main incorporation may be abroad, it still must comply with Canadian corporate laws when operating here.

Why Open an Offshore Company in Canada?

Canada is often considered one of the most business-friendly countries in the world. Here’s why many entrepreneurs decide to open offshore company in Canada:

- Access to North American Markets: Canada provides a gateway to the US and other international markets.

- Credibility: Having a Canadian presence can make investors and clients take you more seriously.

- Legal Protection: Incorporating a foreign company as a subsidiary corporation gives it legal recognition under Canadian law.

- Tax Planning Opportunities: Certain corporate structures can optimize taxes, though professional advice is a must.

- Ease of Business: Canada has a stable banking system, clear laws, and a straightforward registration process.

Think of it as planting a maple tree in your global business garden—you might have started elsewhere, but Canada’s soil is great for growth.

Offshore Company vs Foreign Company in Canada

It’s easy to mix these up, so here’s a quick comparison:

| Feature | Offshore Company in Canada | Foreign Company in Canada |

|---|---|---|

| Definition | Company incorporated outside Canada, doing business in Canada | Any foreign company registering a branch or subsidiary in Canada |

| Legal Status | Must register to do business | Must register as extra-provincial or federal foreign entity |

| Purpose | Optimize taxes, establish Canadian presence | Conduct business, hire employees, or open bank accounts |

| Compliance | Must follow Canadian corporate law for registered branches/subsidiaries | Same, plus reporting as foreign entity |

How to Open an Offshore Company in Canada

Here’s a step-by-step guide to offshore company registration in Canada:

Step 1: Decide on the Structure

You can operate as:

- Subsidiary Corporation: A Canadian corporation owned by the foreign parent company. Provides liability protection and separates the foreign and Canadian entities.

- Branch Office: An extension of the foreign company. Simpler setup, but the parent company is fully liable for Canadian operations.

Most foreign companies prefer a subsidiary corporation for legal and financial protection.

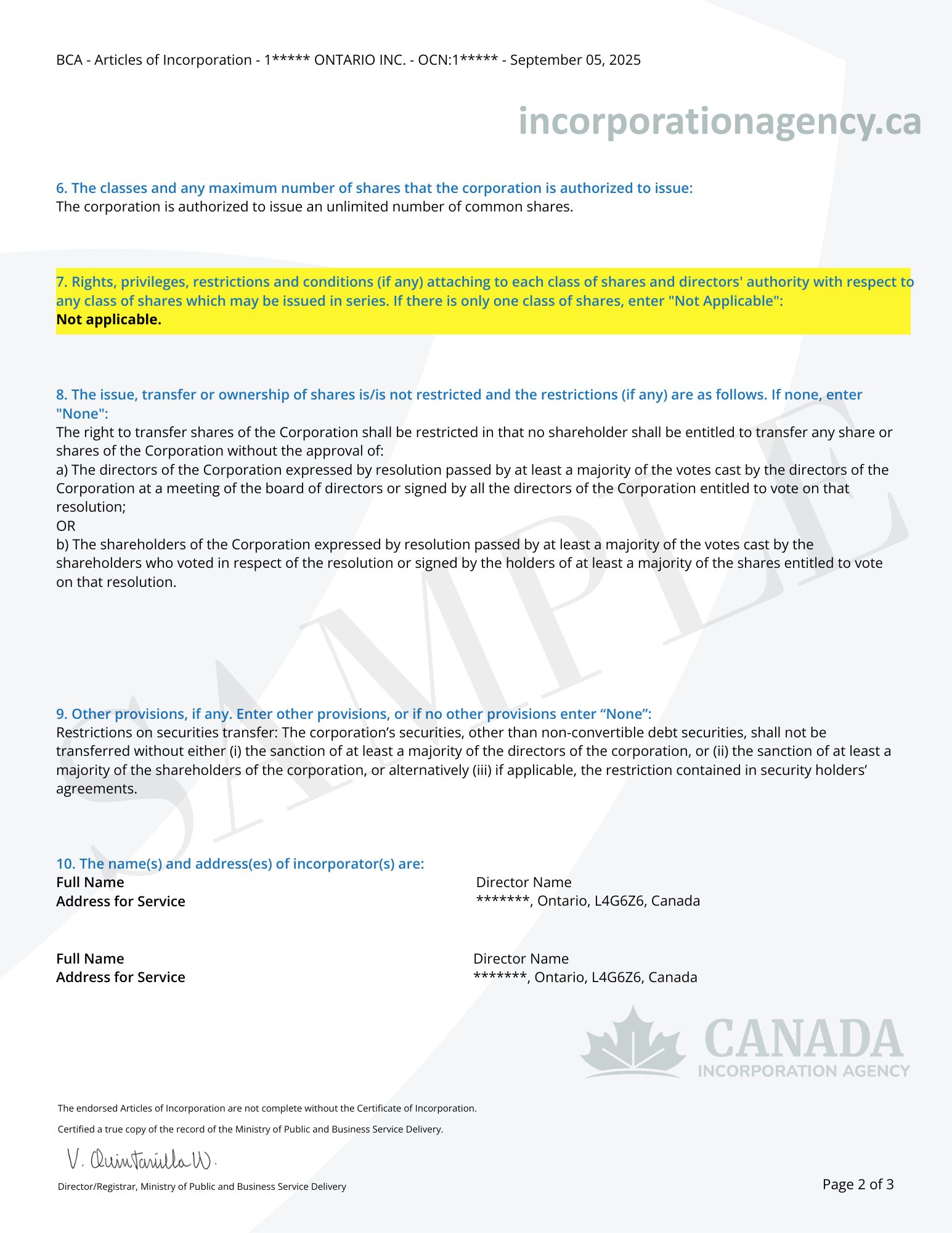

Step 2: Choose Federal or Provincial Incorporation

Canada allows businesses to incorporate at:

- Federal Level: Can operate in all provinces, name protection across Canada.

- Provincial Level: Limited to a single province. For example, incorporating in Ontario gives you rights to operate primarily in that province.

Step 3: Reserve a Name

Pick a unique corporate name and perform a NUANS search to ensure it’s not already in use.

Step 4: File Incorporation Documents

Submit the necessary forms to either:

- Federal Registry: If you’re incorporating federally

- Ontario Business Registry: If incorporating provincially

Documents typically include:

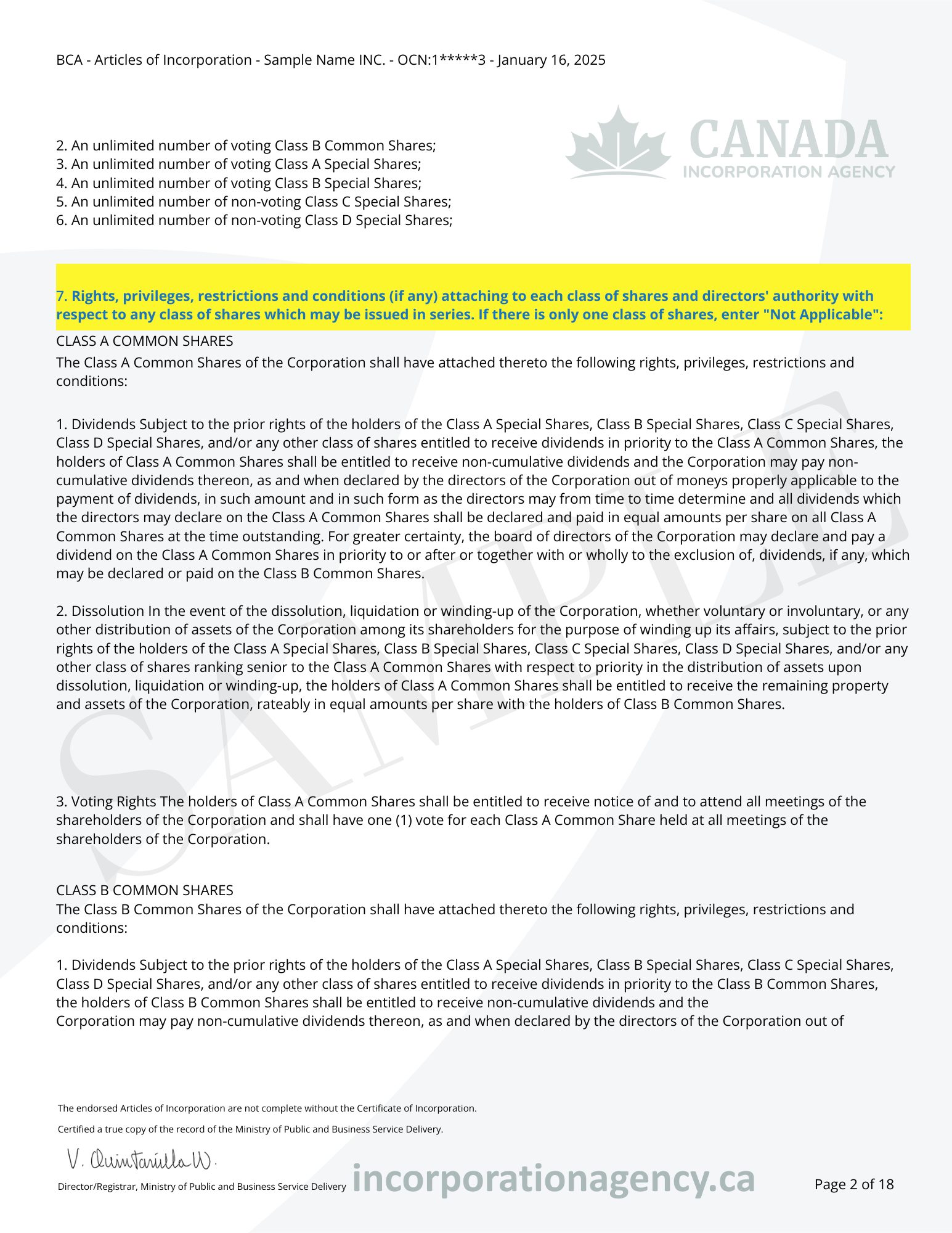

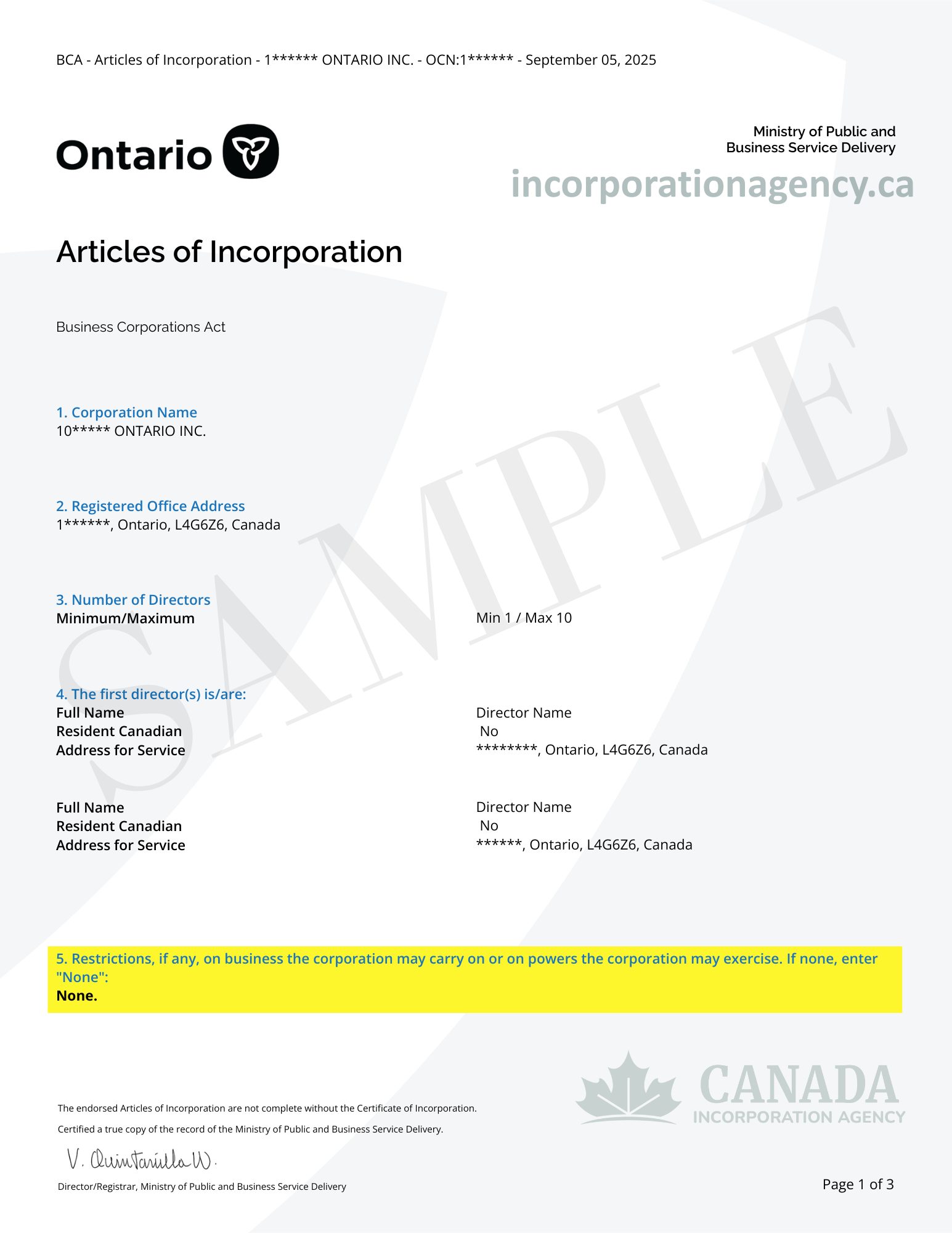

- Corporate name

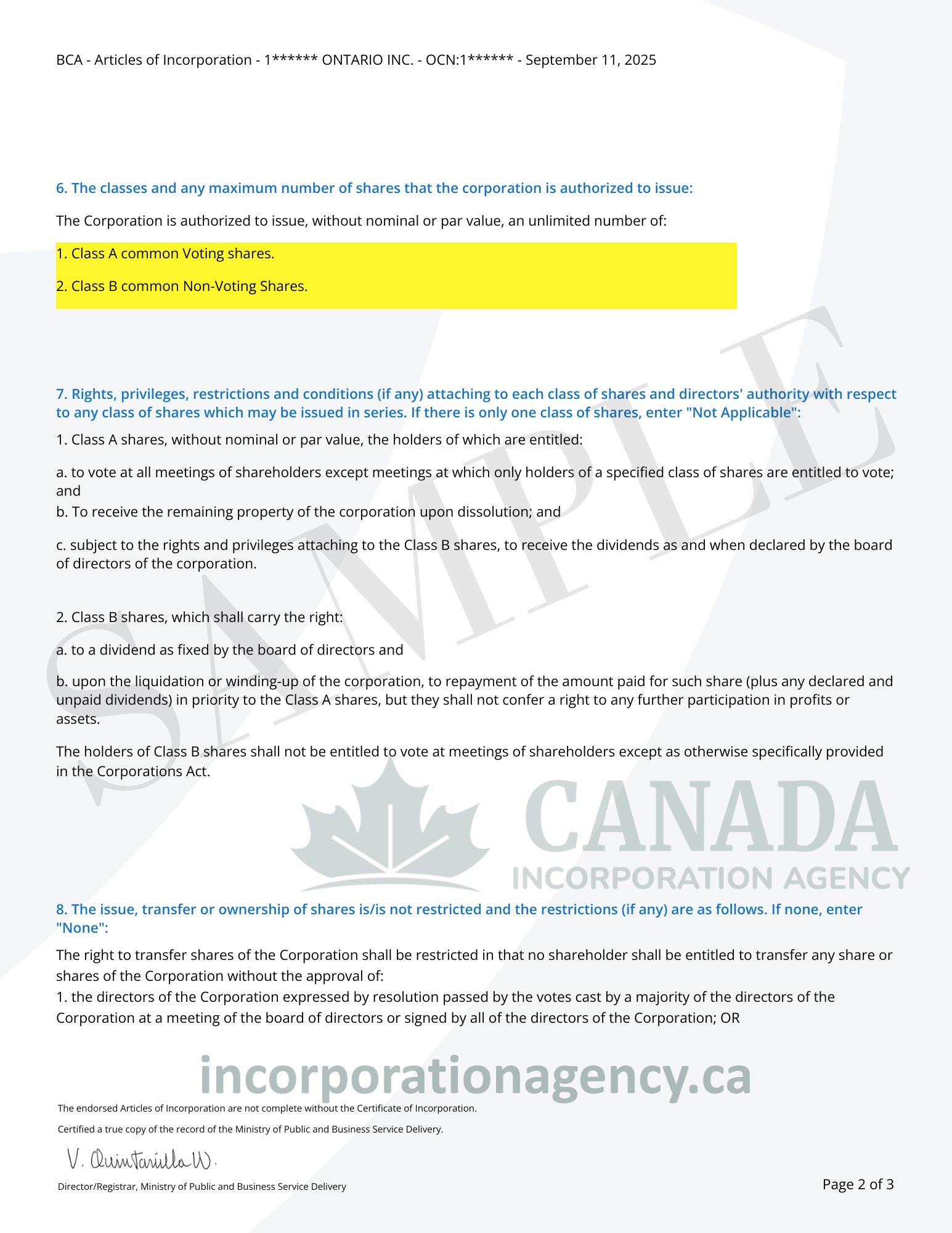

- Share structure

- Registered office in Canada

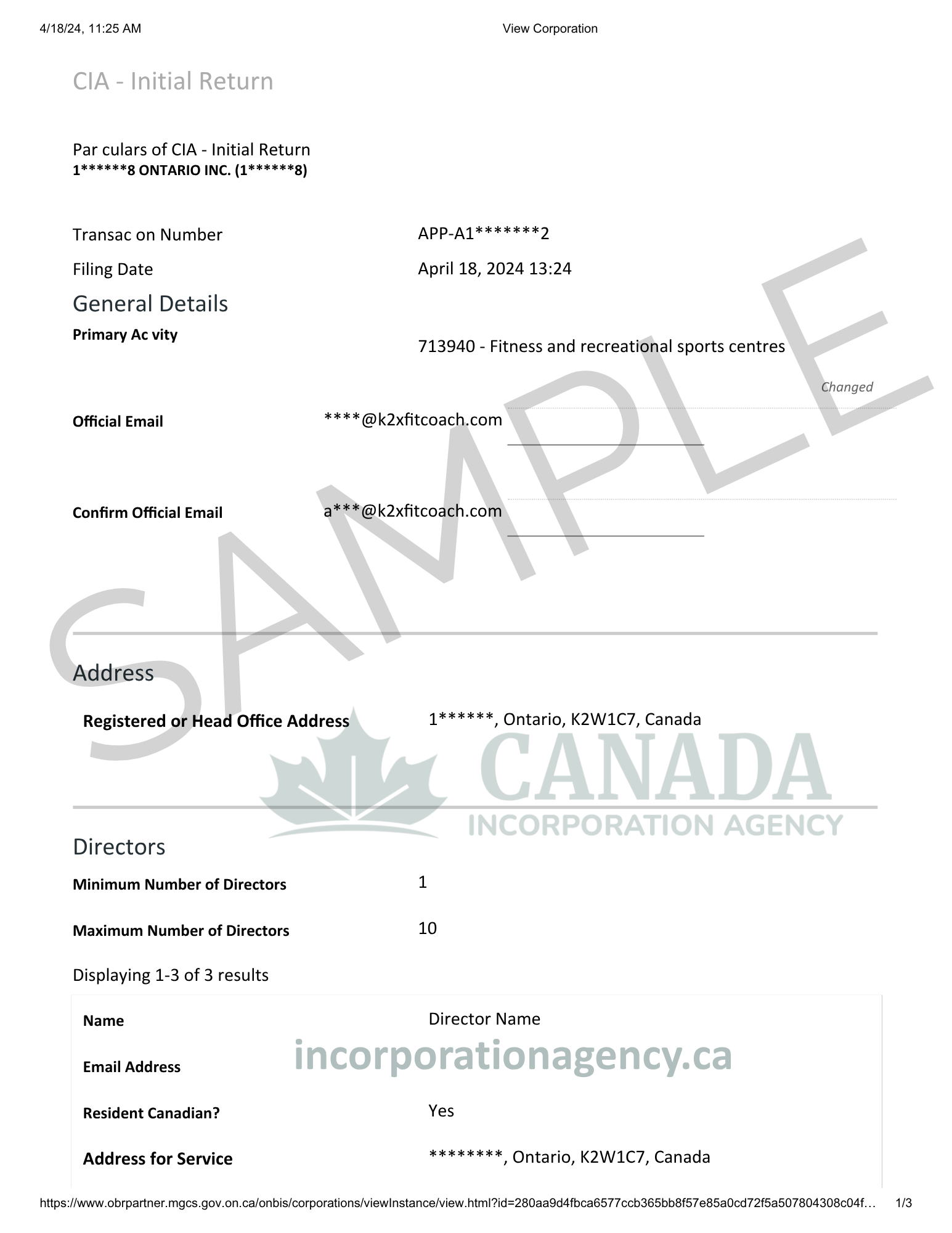

- Directors’ information

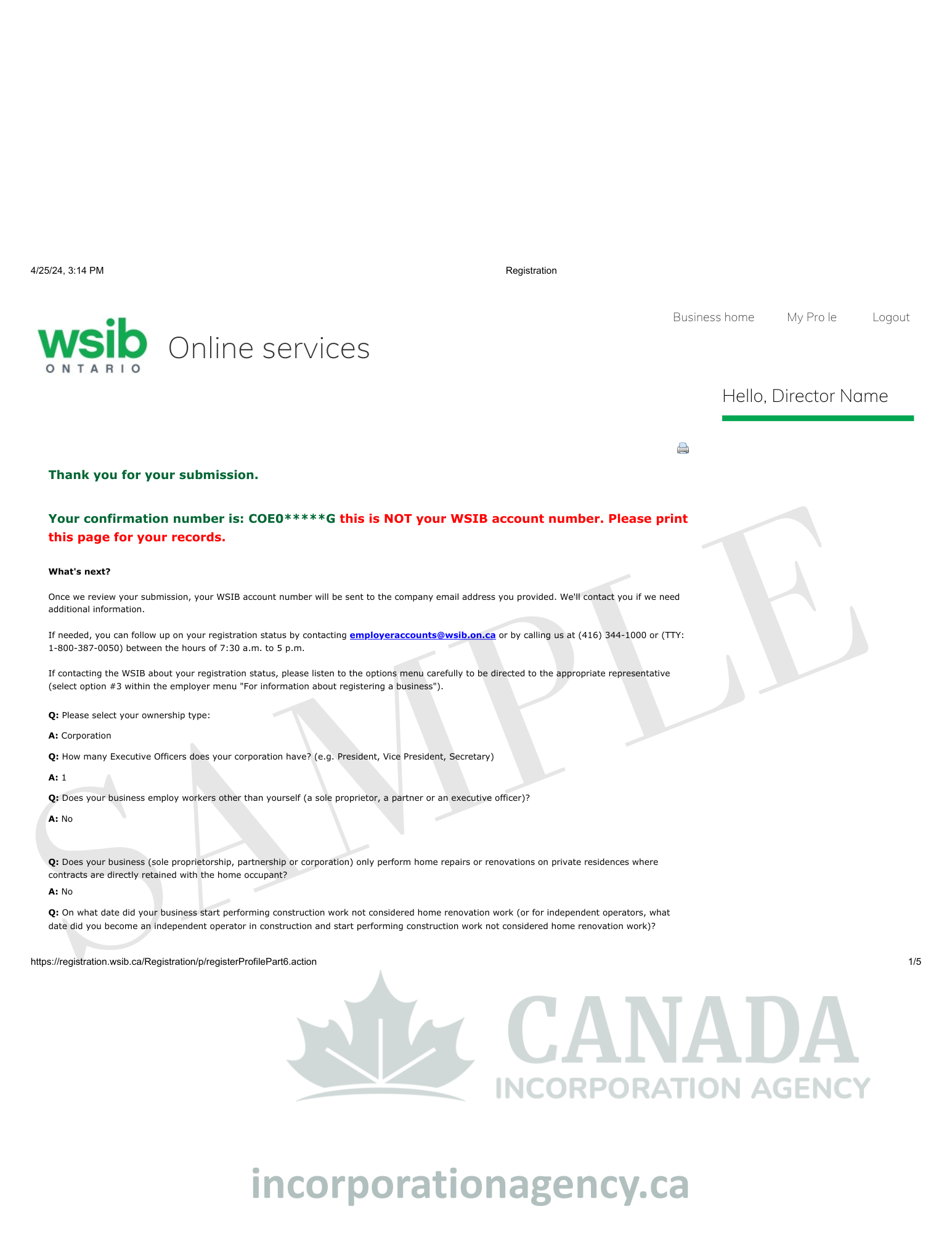

Step 5: Register as a Foreign Company

Once incorporated, your company may also need to register as a foreign company in Canada if it’s conducting business but isn’t yet a subsidiary. This ensures compliance with local laws.

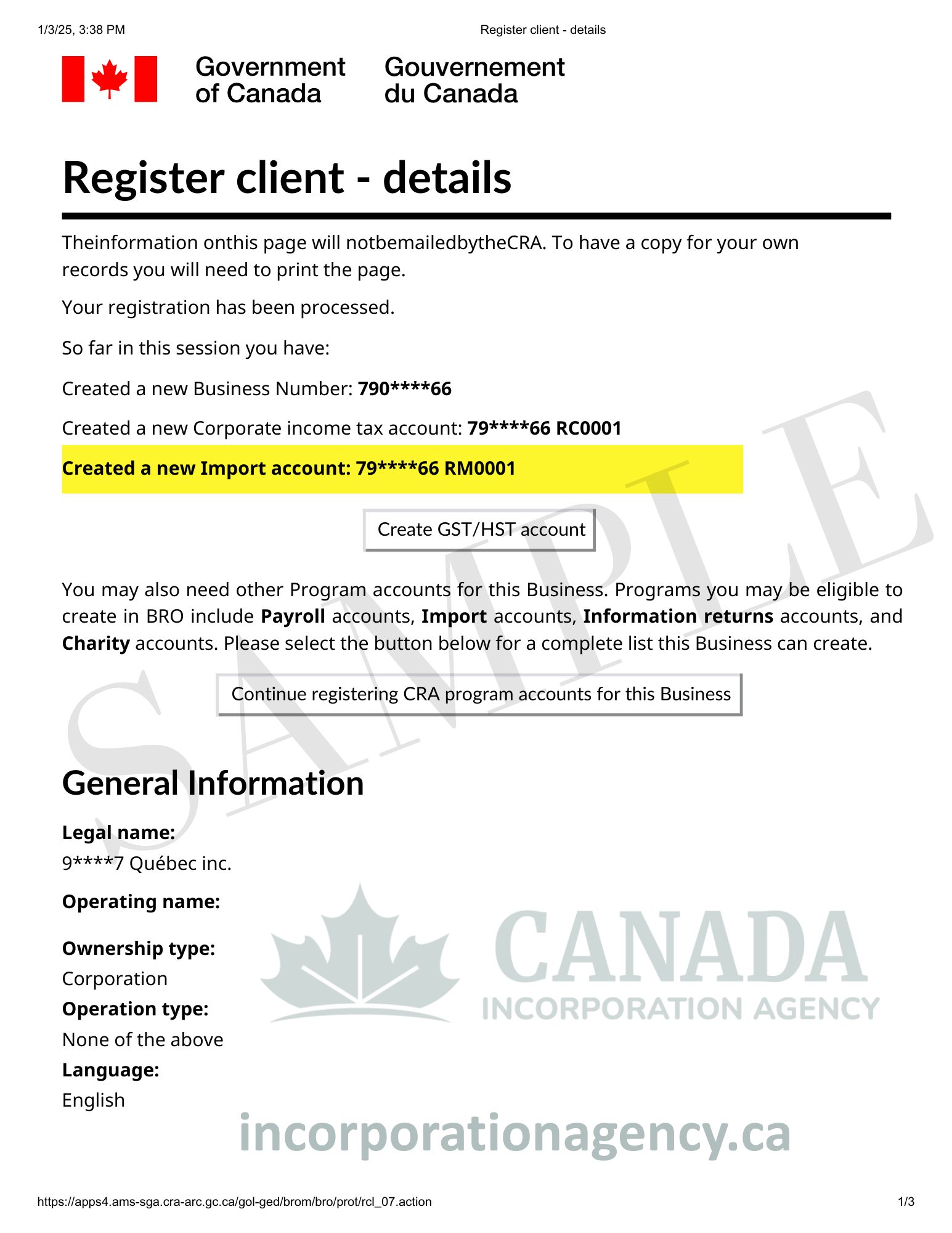

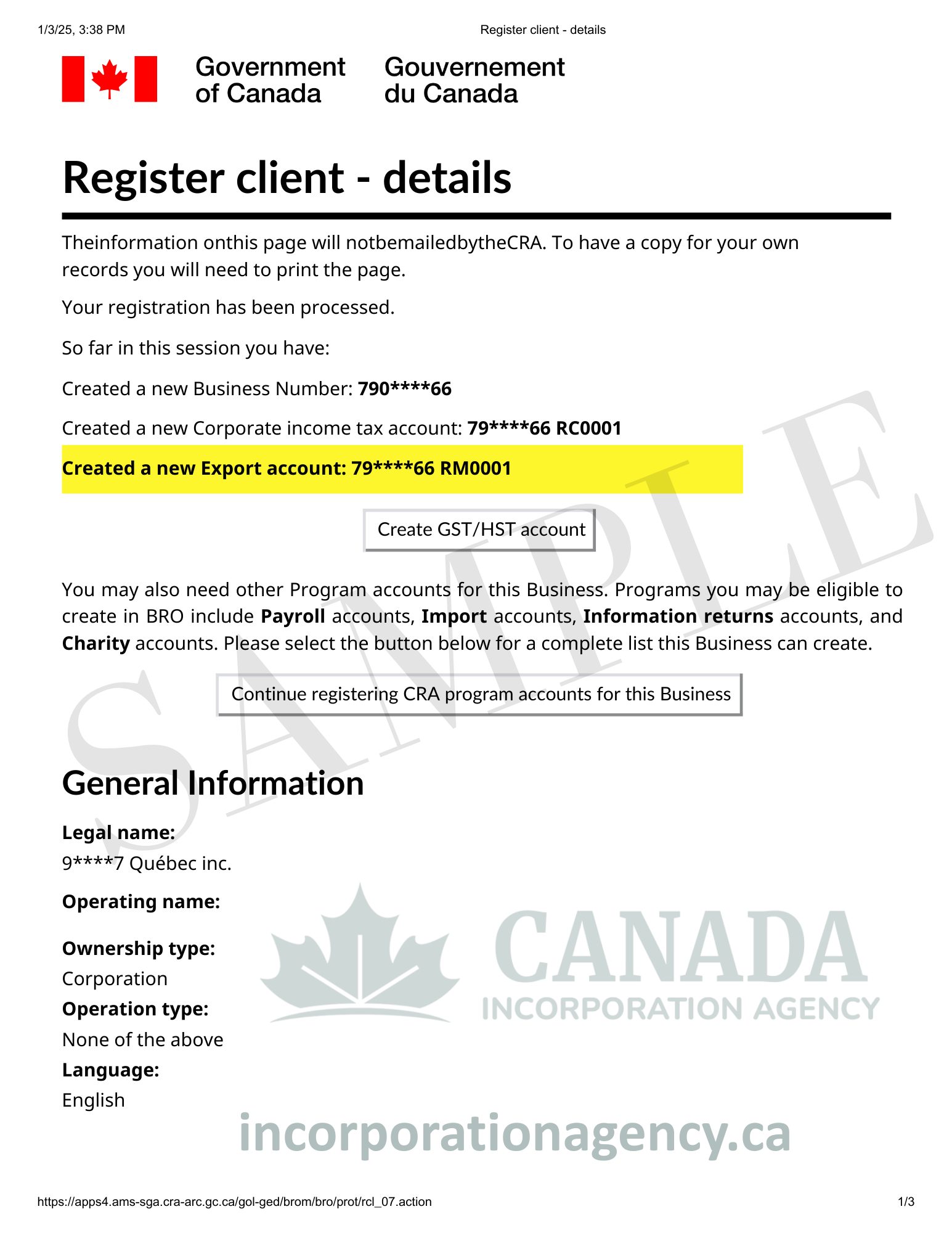

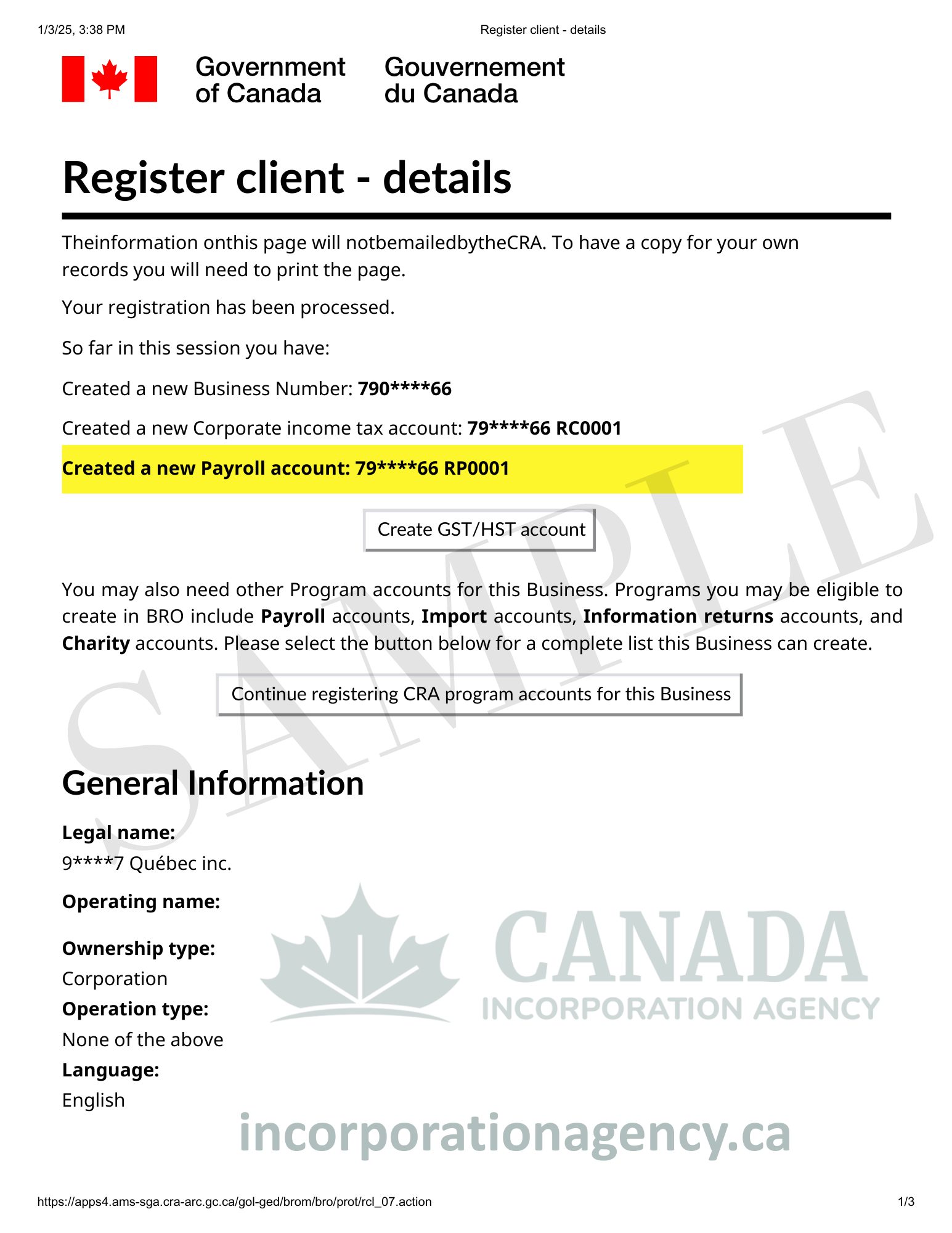

Step 6: Open Bank Accounts & Comply with Tax Requirements

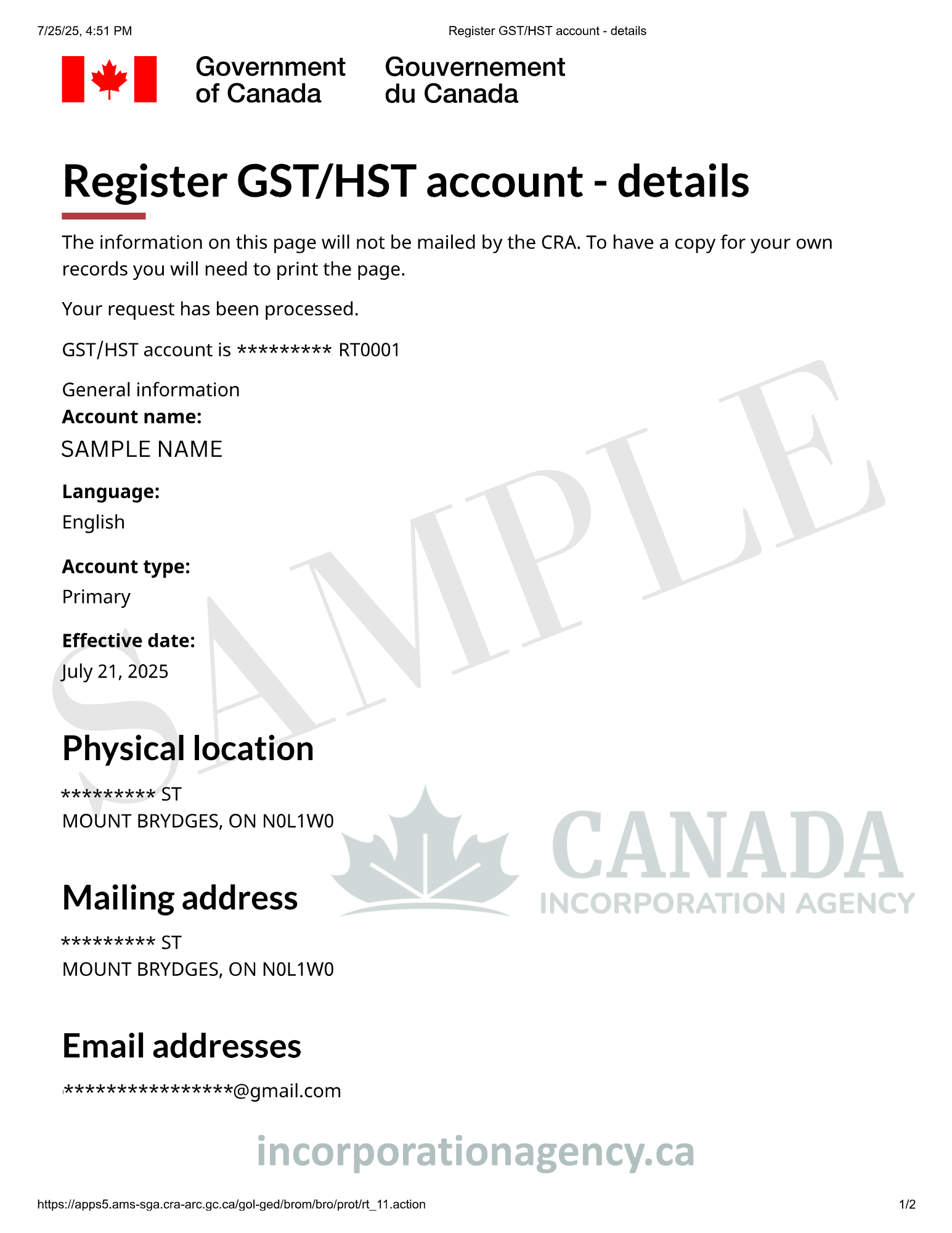

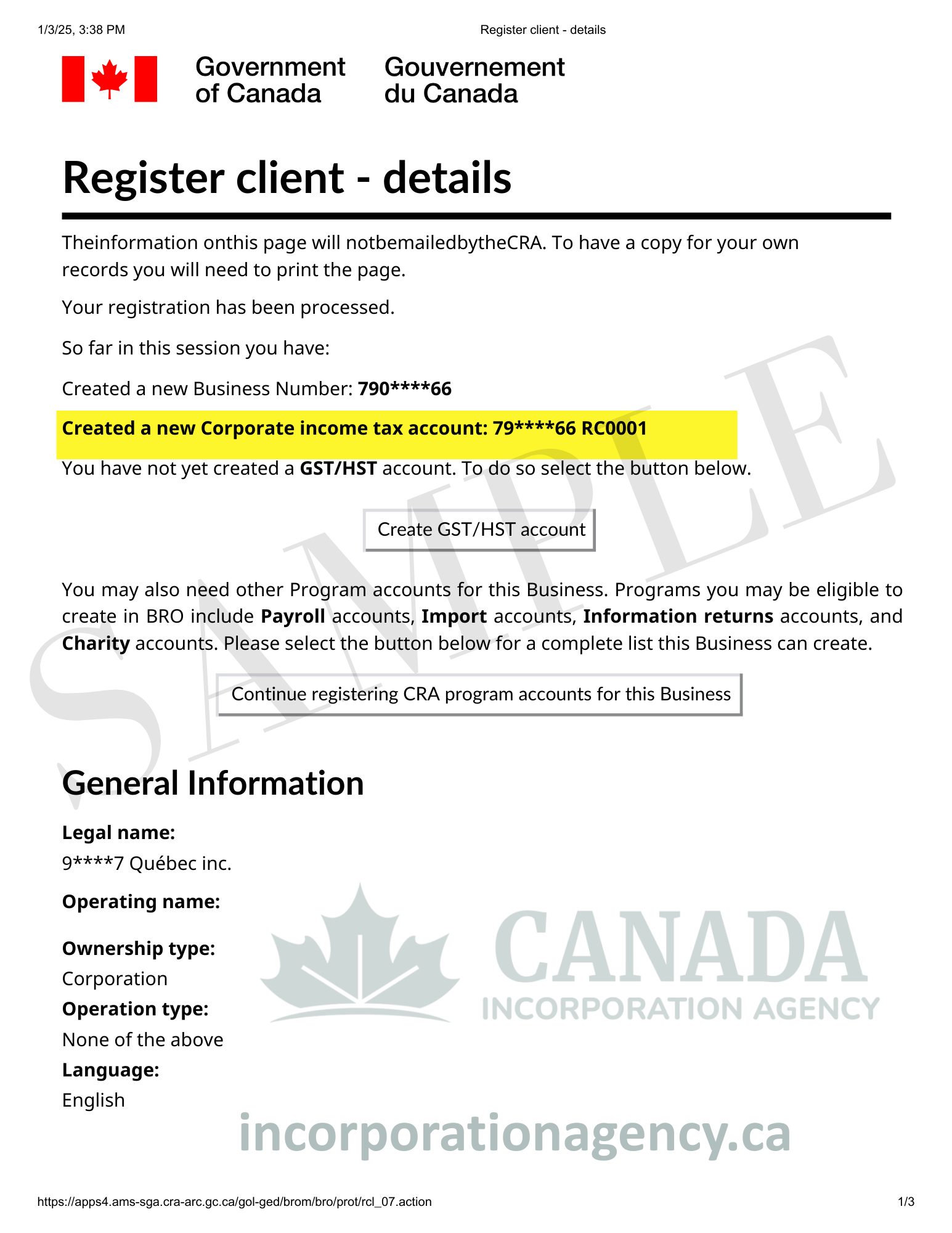

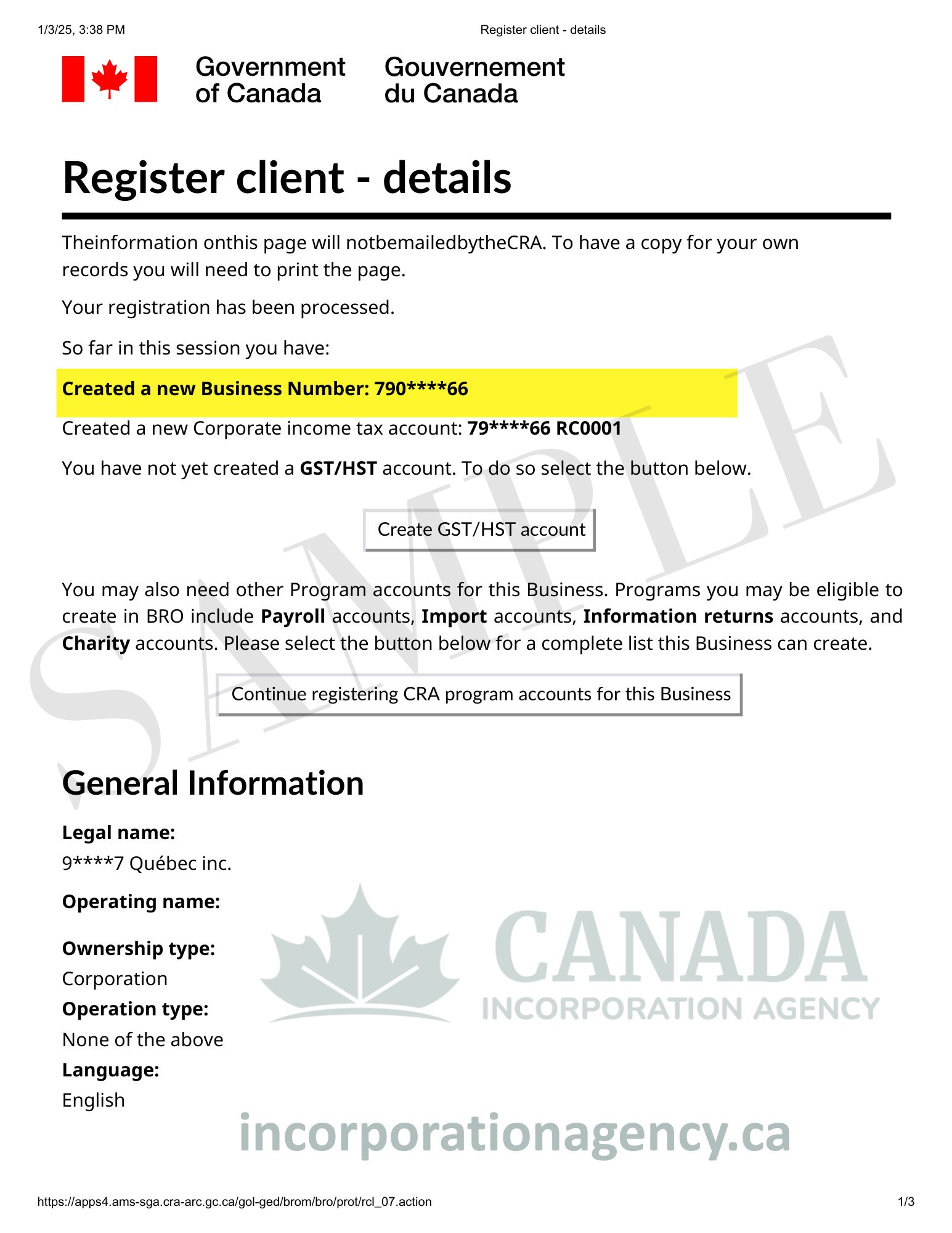

Open a corporate bank account in Canada and get a Business Number (BN) from the CRA for taxation, payroll, and GST/HST purposes.

Example: Registering an Offshore Corporation in Ontario

Let’s say a tech company called “GlobalTech Ltd.” is incorporated in the Cayman Islands and wants to establish a presence in Canada. Here’s how they do it in Ontario:

- Decide on Structure: They choose to form a subsidiary corporation called “GlobalTech Canada Inc.”

- Name Reservation: A NUANS search confirms that “GlobalTech Canada Inc.” is available.

- File Articles of Incorporation: Submitted to the Ontario Business Registry, including share structure, directors, and Canadian registered office.

- Register as a Foreign Company (if necessary): Ensures compliance with extra-provincial rules.

- Open Bank Accounts & Obtain BN: Sets up banking, GST/HST, and payroll accounts.

Within a few weeks, GlobalTech Canada Inc. is fully operational and legally recognized in Ontario, giving the company instant credibility with Canadian clients and investors.

Maintaining Your Offshore Company in Canada

Owning an offshore or foreign subsidiary comes with ongoing responsibilities. To keep your offshore company in Canada in good standing:

- File Annual Returns: Both federal and provincial corporations must file annual returns. Missing this can lead to penalties or dissolution.

- Maintain Corporate Records: Keep an up-to-date minute book with director and shareholder details.

- Hold Annual Meetings: Directors and shareholders must meet yearly to approve financial statements and corporate decisions.

- Update Corporate Information: Any changes to directors, shareholders, or office addresses must be filed promptly.

- Comply with Tax Obligations: File corporate income tax returns and other applicable filings with the CRA.

Think of it as maintaining a small Canadian branch of your global empire—neglect it, and you might face fines or reputational issues.

FAQs About Offshore Company Incorporation in Canada

1. Can any foreign company open an offshore company in Canada?

Yes, but it must comply with Canadian corporate laws and registration requirements.

2. What is a subsidiary corporation?

A subsidiary corporation is a Canadian company owned by a foreign parent company. It limits liability and allows local operations.

3. How much does it cost to incorporate a foreign company in Canada?

Costs vary depending on province or federal incorporation and legal assistance, usually ranging from $500–$2,000 CAD plus professional fees.

4. What is the difference between a branch office and a subsidiary?

A branch office is part of the foreign company and carries full liability; a subsidiary is a separate legal entity, limiting liability.

5. Do offshore companies pay taxes in Canada?

Yes. Any income earned in Canada by the subsidiary or branch is subject to Canadian taxation.

6. Can I hire employees in Canada as a foreign company?

Yes, but you must comply with federal and provincial employment laws, register for payroll, and remit taxes.

Wrapping It Up

Incorporating an offshore company in Canada isn’t about tropical islands and spy movies—it’s about credibility, legal compliance, and strategic growth. Whether you’re creating a subsidiary corporation or registering a foreign company in Canada, understanding the process and ongoing obligations is crucial.

Canada offers a stable, business-friendly environment, making it an attractive option for entrepreneurs and global investors. By following proper registration, compliance, and maintenance steps, your offshore company can thrive, giving you a strong foothold in North America.

So go ahead, plant your corporate flag in Canada—just leave the spy gadgets and martinis to James Bond.