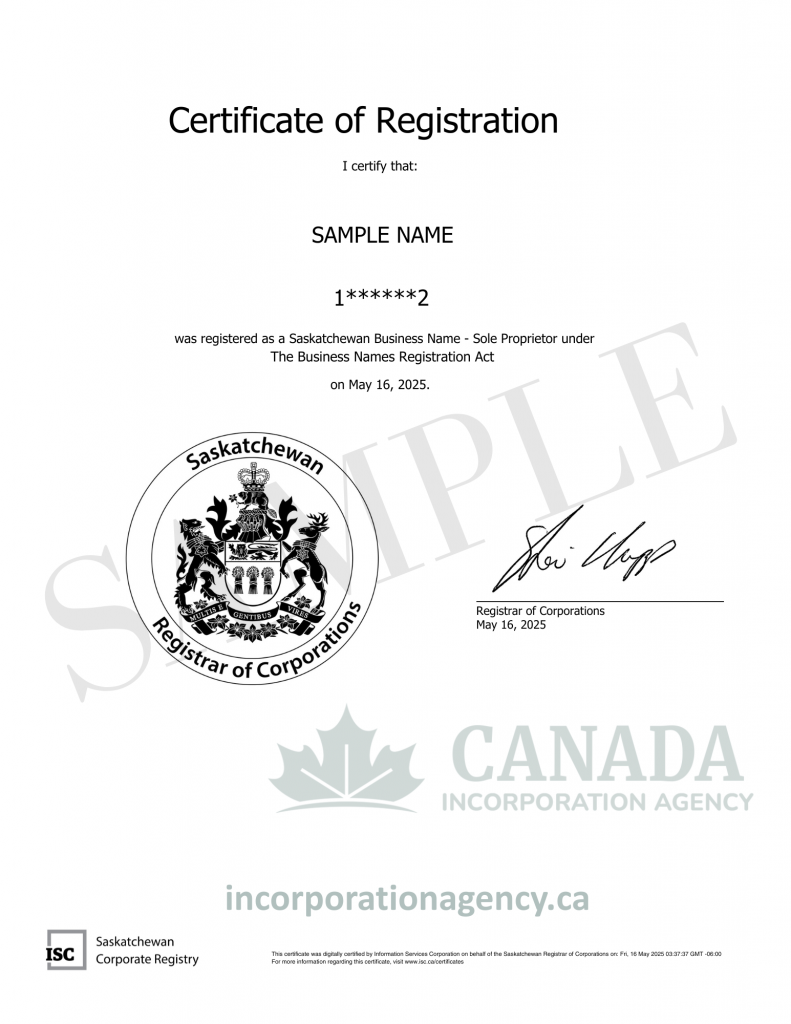

REGISTER A SOLE PROPRIETORSHIP IN SASKATCHEWAN

1-Hour Service Available

Only $99 + Government Fee

We’re an official intermediary for the Province of Saskatchewan.

Register under your personal or business name – No hassle, no delays

Fast. Simple. Affordable

Register Your Business in Saskatchewan

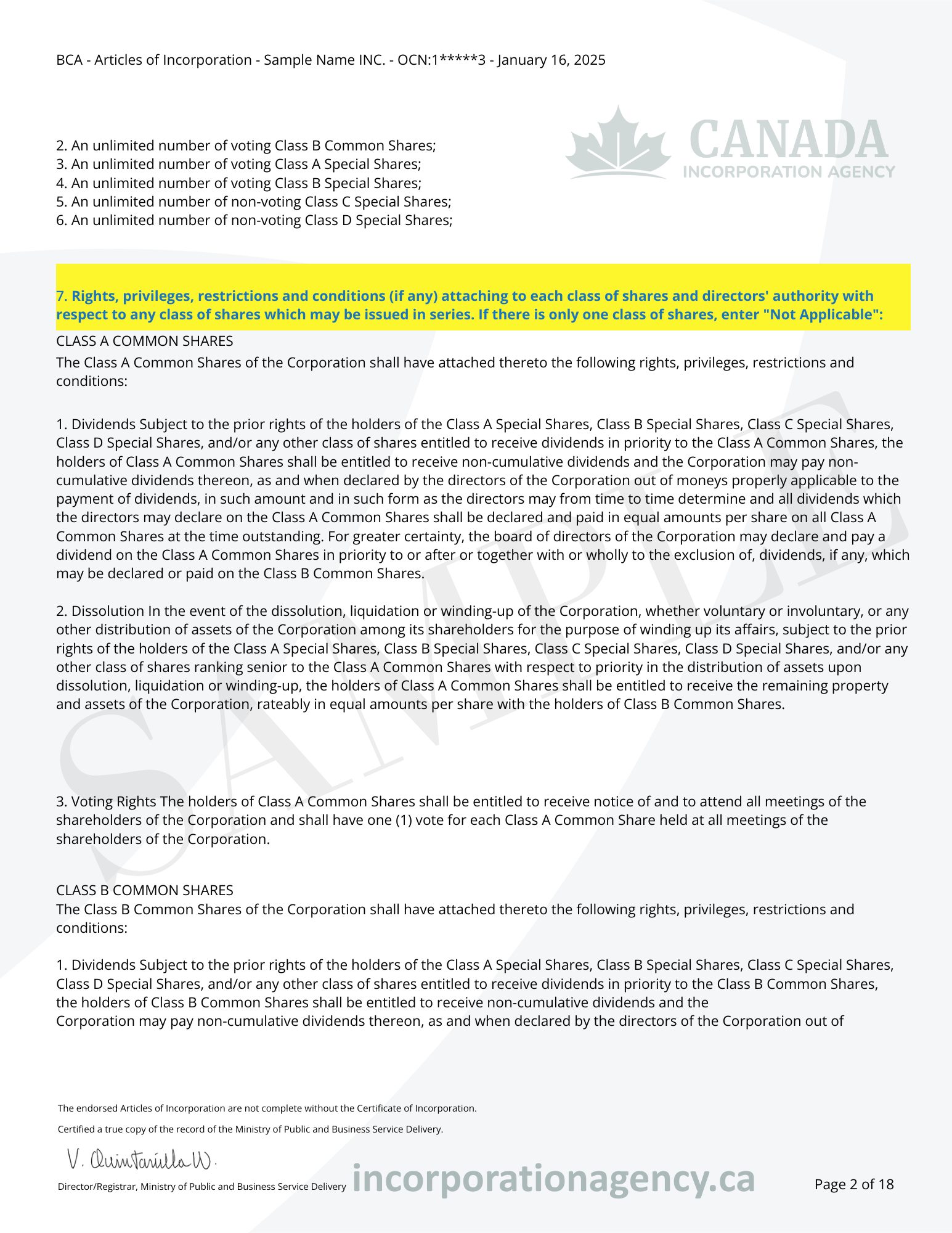

Saskatchewan Sole Proprietorship

- Managed through Information Services Corporation (ISC)

- Simple, low-cost registration

- Great for small businesses and startups

Saskatchewan Trade Name

- Required for operating under a name other than your legal name

- Available for sole proprietors, partnerships, and corporations

- Simple and efficient online registration

Saskatchewan General Partnership

- Simple to set up - no formal registration required unless using a business name

- All partners share equal management rights and responsibilities

- Simple, low-cost registration

Saskatchewan Limited Partnership (LP)

- Requires at least one general partner with unlimited liability

- Must be formally registered with the Saskatchewan government

- Ideal for investors or passive partners seeking liability protection

WHY START WITH US

Why Register a Sole Proprietorship in Saskatchewan?

Thinking of launching your own business? A sole proprietorship is the fastest and most affordable way to get started. It gives you full control, minimal paperwork, and simple tax filing—perfect for new entrepreneurs.

Here’s why it’s a smart first step:

- Low cost and quick to set up

- Fewer government requirements

- Ideal for freelancers, consultants, and small business owners

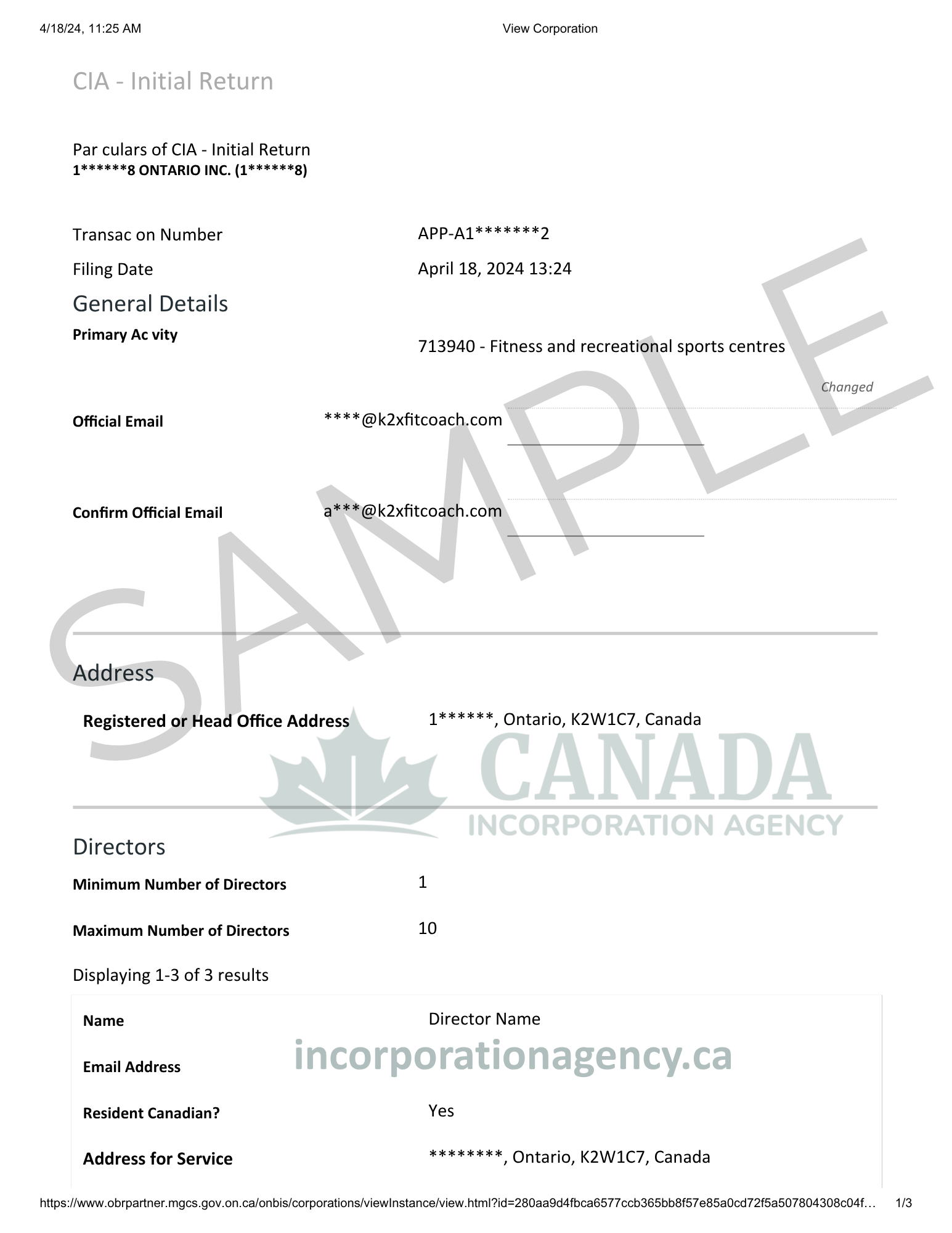

- Final documents are emailed within 2 hours—valid for opening a bank account or beginning operations

Simple. Flexible. Built for First-Time Business Owners.

Start Your Business Registration Now

Just 4 Simple Steps

Fill Out The Online Form

Enter your business name, address, and ownership details

Submit Required your Documents

Upload a valid ID and any necessary details

Review & File your Application

Our team will verify and file your sole proprietorship with the respective registry

Document Ready in 30 Minutes

Your official Registered Document will be emailed to you

What Are the Benefits of Registering a Sole Proprietorship?

Affordable to Start:

One of the biggest advantages of sole proprietorship registration is the low startup cost. This simple business structure gives you flexibility to test, adapt, and pivot your business idea without major upfront expenses.

Quick and Easy Setup:

When you register a sole proprietorship in Canada, the process is fast and straightforward. In just a few clicks, you can complete your sole proprietorship registration and officially start operating.

Simple Tax Filing:

With a Canada sole proprietorship registration, business income is reported on your personal tax return. This makes tax season easier, allowing you to deduct business expenses without dealing with complex corporate tax rules.

What Are the Drawbacks of a Sole Proprietorship?

Personal Liability:

When you register a sole proprietorship, you’re fully responsible for your business’s debts and obligations. There’s no legal separation between you and your business, which means personal assets could be at risk if the business faces financial trouble.

Limited Growth Potential:

As your business grows, a sole proprietorship structure can become limiting. Access to funding, business partnerships, and expansion opportunities may be harder to secure compared to incorporated businesses.

Higher Personal Tax Burden:

Depending on how much your business earns, you may find yourself pushed into a higher personal tax bracket. This is something to consider when deciding how to register a sole proprietorship and manage future financial planning.

What Our Clients Are Saying

Trustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience with this company! My registration was completed early! The agent I spoke with was very knowledgeable & friendly! I would definitely use them again in the future 😊Posted onTrustindex verifies that the original source of the review is Google. Staff was helpful, friendly and knowledgeable helping me with my new business. Would definitely deal with Canada Incorporation Agency again!!

How to Register a Sole Proprietorship in Saskatchewan

Frequently Asked Questions

What is a Sole Proprietorship in Saskatchewan?

A Sole Proprietorship in Saskatchewan is a business owned and operated by one person, who is personally responsible for all debts and obligations of the business.

Do I need to register my Sole Proprietorship in Saskatchewan?

Yes, if you use a business name other than your legal name, you must register your business name with the Saskatchewan Corporate Registry.

How long does it take to register a Sole Proprietorship in Saskatchewan?

Registration is usually quick and can be completed online or in person within a few hours to one business day.

What taxes apply to Sole Proprietors in Saskatchewan?

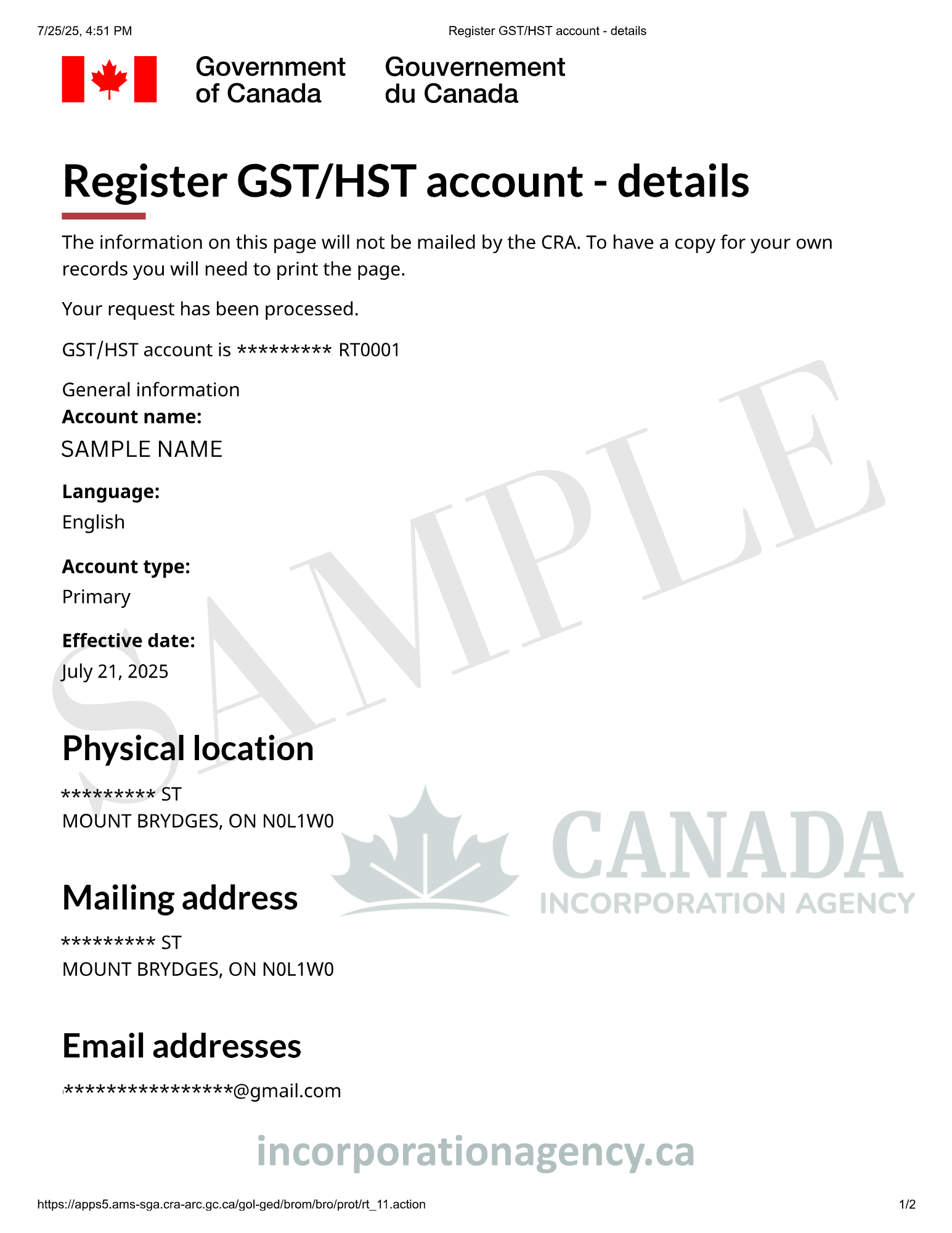

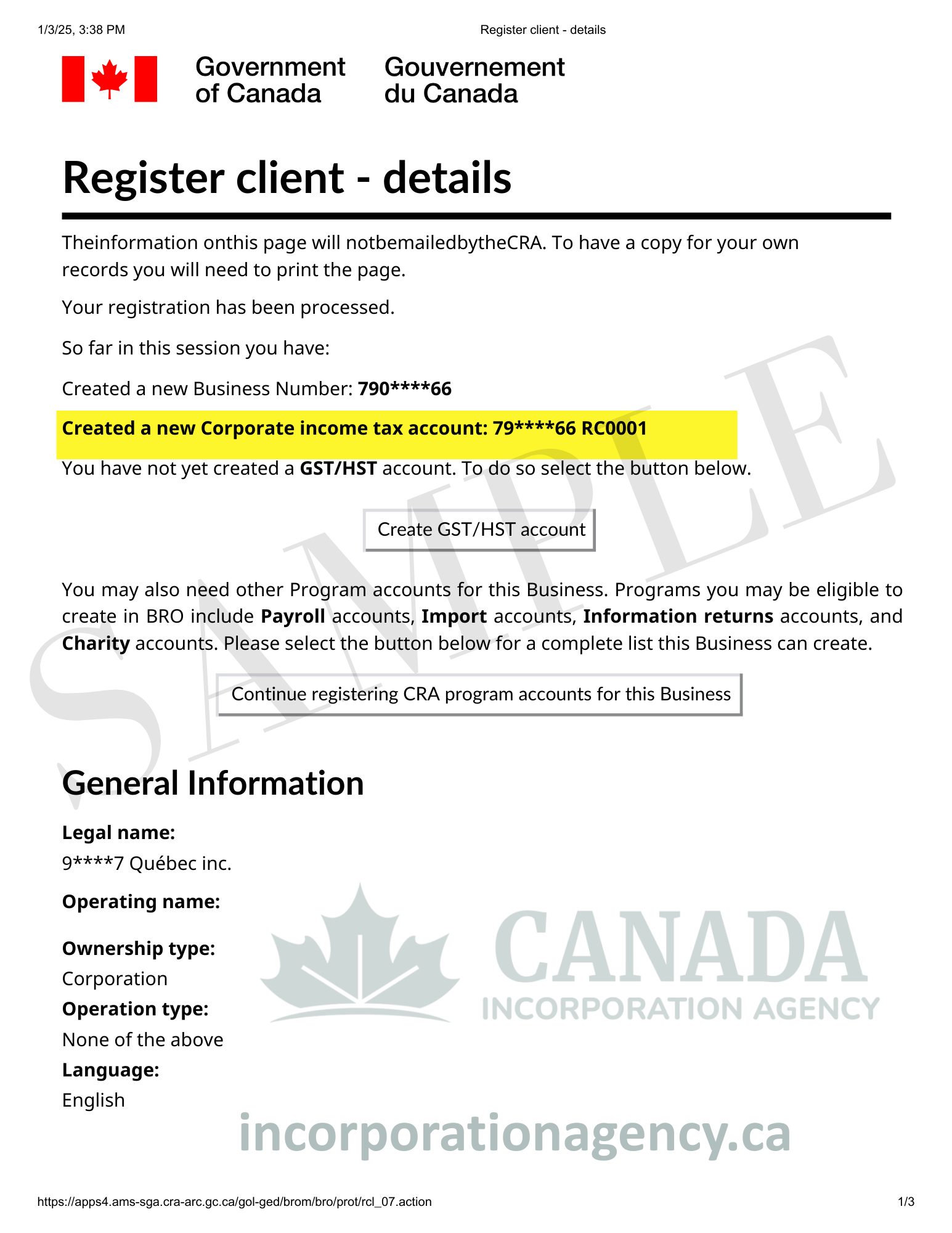

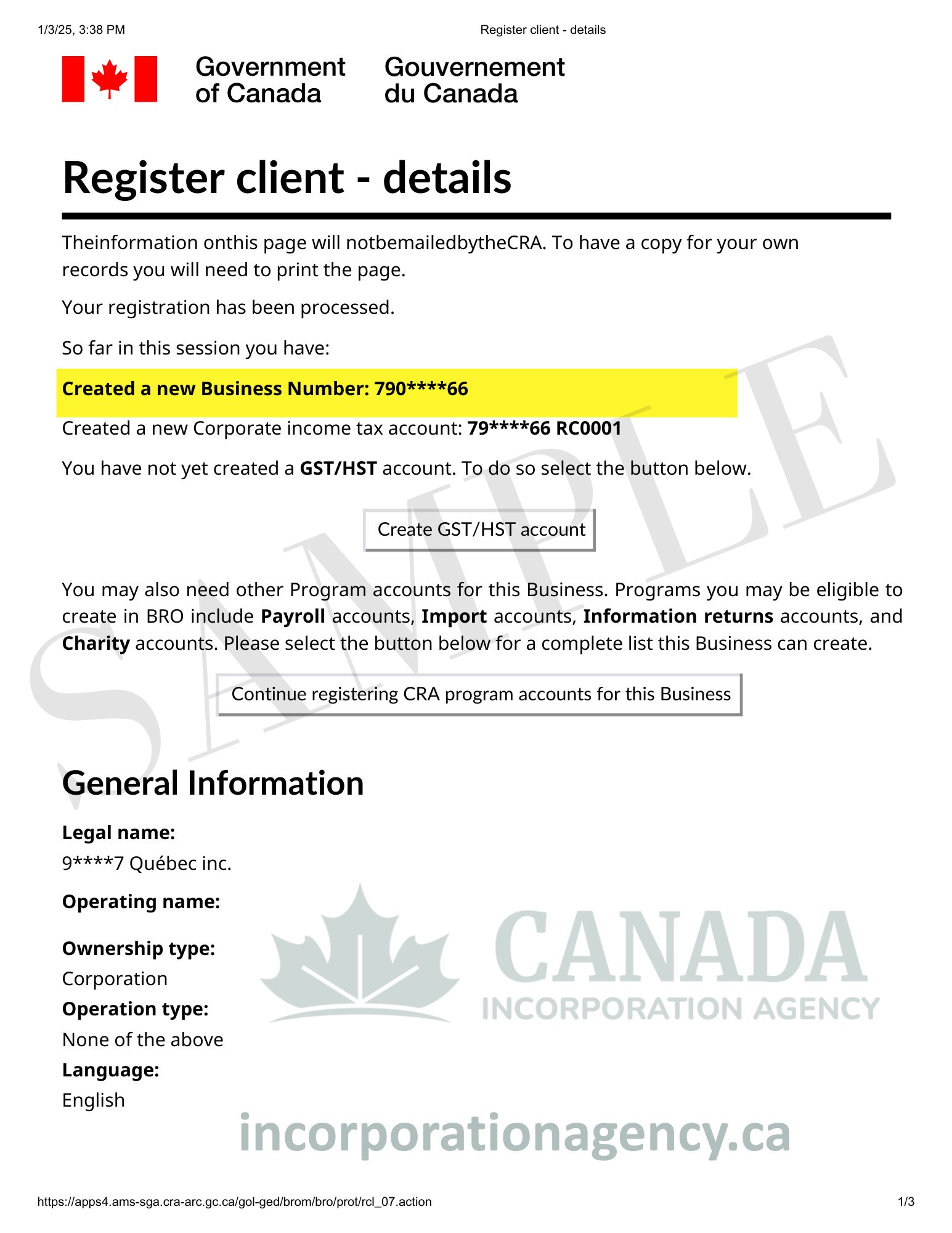

You report business income on your personal tax return. If your revenue exceeds $30,000 annually, you must register for and collect GST and PST as applicable.

Can I open a business bank account with a Sole Proprietorship in Saskatchewan?

Yes. After registering your business name, you can use your registration documents to open a business bank account and separate your business finances from personal accounts.

Latest News & Blog Posts

How to Do a Land Title Search in Ontario: The Complete and Free Beginner’s Guide

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Federal Name Approval Process: Everything You Need to Know

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

BC Name Approval Guide: How to Register Your Business Name in British Columbia

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

Ontario Articles of Amendment: Complete Guide for 2026

If your Ontario business needs a makeover – this article is for you. Perhaps you

How to Make Changes to Your Business in Canada: Filing a Notice of Change

Running a business is like being the captain of a ship. Sometimes you need to

How to Register a General Partnership in PEI: Your Guide 2026

If you and your friend have a brilliant business idea, and you want to team