Incorporate a Personal Real Estate Corporation in Canada

Receive your Certificate and Articles of Incorporation in as little as 2 business hours.

Incorporating a PREC has never been this fast and affordable. Our experienced filing agents review every order to ensure it’s done right the first time, with no hidden costs and no delays.

WHY US

Why Incorporate PREC?

- Lower Tax.

Instead of being taxed personally right away at a high rate (over 50% if you’re making good money), your PREC gets taxed at a much lower corporate rate—around 12% on the first $500,000. That means more money stays in your business to reinvest or save for later.

- Income Splitting Opportinities:

You might be able to pay dividends to family members in lower tax brackets using non-voting shares. This can lower your family’s overall tax bill, especially if you’re the main earner in a high tax bracket.

- Tax Deferral

You still work through your brokerage as usual, but your PREC lets you split your real estate income from your personal finances. That makes things cleaner and opens up tax benefits.

- Planning Strategies

A PREC gives you flexibility to plan ahead, whether it’s saving for retirement, income splitting, or reinvesting earnings. You’ve got tools to optimize your tax situation your way.

PREC Incorporation Packages

Ontario PREC

✔ Designed for licensed real estate professionals in Ontario

✔ Let's you defer taxes and benefit from small business tax rates (12.2%)

✔ The controlling registrant must be a RECO member

✔ Filing can be completed in 2 business hours

✔ We’ll draft your Articles and Certificate of Incorporation for accuracy

✔ Registration for Realtor, Director is Controlling Shareholder

BC PREC

✔ Designed for licensed real estate professionals in British Columbia

✔ Let's you defer taxes and benefit from small business tax rates

✔ The controlling registrant must be a licensed real estate professional with BCFSA

✔ Filing can be completed in 2 business hours

✔ We’ll draft your Articles and Certificate of Incorporation for accuracy

✔ Registration for Realtor, Director is Controlling Shareholder

Alberta PREC

✔ Designed for licensed real estate professionals in Alberta

✔ Let's you defer taxes and benefit from small business tax rates

✔ The controlling registrant must be a licensed real estate professional with RECA

✔ Filing can be completed in 2 business hours

✔ We’ll draft your Articles and Certificate of Incorporation for accuracy

✔ Registration for Realtor, Director is Controlling Shareholder

Quebec PREC

✔ Designed for licensed real estate professionals in Québec

✔ Let's you defer taxes and benefit from small business tax rates

✔ The controlling registrant must be a licensed real estate professional with OACIQ

✔ Filing can be completed in 2 business hours

✔ We’ll draft your Articles and Certificate of Incorporation for accuracy

✔ Registration for Realtor, Director is Controlling Shareholder

Start Your Incorporation Now

Just 3 Simple Steps

Fill out the online form

Kick things off by completing our easy step-by-step form. You can place your order using a credit card, PayPal, or e-transfer—whichever is most convenient.

We handle the filing

Once your payment is confirmed, our experienced registry agent reviews everything and files your documents with the appropriate government office. No need to worry about red tape or delays.

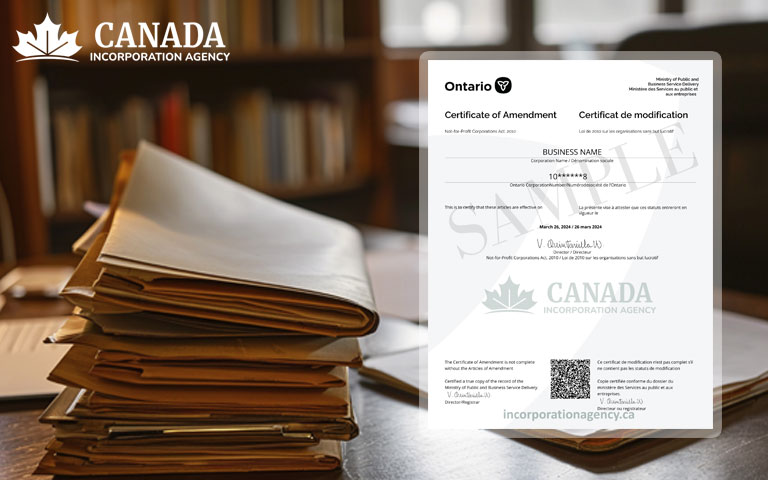

Receive your incorporation documents

Incorporating a personal real estate corporation doesn’t have to be complicated. You’ll receive your official Certificate and Articles of Incorporation right in your inbox—often in just a few business hours.

Key Points of Personal Real Estate Corporation

- Only licensed real estate salespersons and brokers can establish a PREC.

- It allows for tax deferral opportunities, since corporate tax rates are typically lower than personal rates.

- Only one licensed real estate agent can own voting shares.

- A PREC cannot trade in real estate on its own.

- You can split income with family members through non-voting shares (if allowed).

- The PREC must follow the rules set by the provincial real estate regulator (e.g., RECO in Ontario).

Whether you’re starting a PREC in Ontario, BC, Alberta, or New Brunswick, our express service means you don’t have to wait days for government processing.

Quick. Compliant. Done Right the First Time.

PREC vs. Standard Corporation

Feature | Standard Corporation | Professional Corporation |

|---|---|---|

Who Can Incorporate | Licensed real estate agents/brokers only | Anyone (entrepreneurs, professionals, etc.) |

Purpose | To receive income from real estate activities | Any business activity or investment purpose |

Restrictions | Must follow provincial real estate rules; usually one shareholder (the agent) | Fewer restrictions; flexible ownership |

Tax Benefits | Access to small business tax rate; tax deferral | Also gets small business tax rate and benefits |

Income Splitting | Limited or restricted (varies by province) | More flexibility with share classes |

Regulations | Yes – governed by provincial real estate council | No professional regulation unless regulated field |

Naming Rules | Must include legal name of the agent | No such requirement |

What Our Clients Are Saying

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

Get Your Business Name Approved Fast in the Northwest Territories

Frequently Asked Questions

What is a Personal Real Estate Corporation?

Who can incorporate a PREC ?

Only a licensed real estate professional (e.g., realtor or broker) can incorporate a PREC.

What are the benefits of incorporating a Personal Real Estate Corporation?

- Tax deferral – Pay the lower corporate tax rate and defer personal taxes.

- Income splitting – Share income with family members through non-voting shares (if allowed).

- Professional image – Enhances credibility with clients and lenders.

- Limited liability – Provides legal separation between personal and business assets.

- Expense deductions – More flexibility in deducting eligible business expenses.

- Retirement planning – Retain earnings inside the corporation to invest and grow wealth.

Can I incorporate a Personal Real Estate Corporation online?

Yes, you can incorporate online by completing a simple form on Canada Incorporation Agency website, it will take around 15 minutes. After completing the payment, we will send you a confirmation email, and our agent will contact you to confirm all the order details. We will incorporate your company and email the Certificate and Articles of Incorporation to you.

Do I need a lawyer to incorporate a PREC in Canada?

It’s not required, but it’s a good idea. Canada Incorporation Agency has a team of professional lawyers and filing agents that can help you out with the paperwork for your Professional Corporation. Bylaws, governance, and CRA compliance can get complicated.

Latest News & Blog Posts

How to Do a Land Title Search in Ontario: The Complete and Free Beginner’s Guide

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Federal Name Approval Process: Everything You Need to Know

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

BC Name Approval Guide: How to Register Your Business Name in British Columbia

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

Ontario Articles of Amendment: Complete Guide for 2026

If your Ontario business needs a makeover – this article is for you. Perhaps you

How to Make Changes to Your Business in Canada: Filing a Notice of Change

Running a business is like being the captain of a ship. Sometimes you need to

How to Register a General Partnership in PEI: Your Guide 2026

If you and your friend have a brilliant business idea, and you want to team