Professional Payroll Services Set Up

Get Your Payroll Running Smoothly on Time

Only $99 + Government Fee

Make payroll stress-free from day one. Our experts will handle every detail

Fast. Simple. Transparent. No Hidden Fees.

Payroll Set Up Package

Payroll Set Up Package

✔ Issue tax-deductible receipts to donors

✔ Access grants and government funding

✔ Pay no income tax on most types of revenue

✔ Full Application Preparation

✔ Boost trust and visibility in your community

WHY US

Why Choose Us for Payroll Set Up?

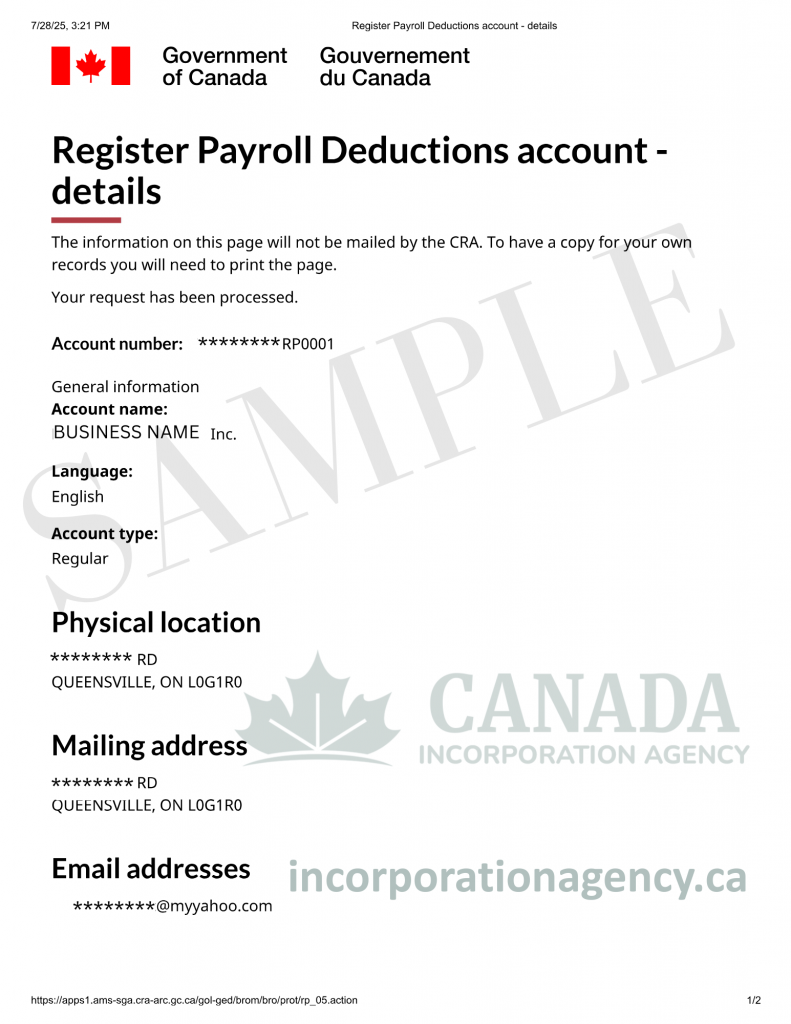

Setting up payroll correctly is crucial for paying your employees on time, calculating deductions accurately, and staying compliant with CRA and provincial requirements. Our payroll setup service gets your business ready to process payroll smoothly from day one – effortless, accurate, and worry-free.

- We review your staffing, pay schedules, and benefit structures to configure payroll accurately.

- We set up your business payroll accounts with the Canada Revenue Agency and any required provincial agencies.

- We implement and configure a payroll platform that suits your business—ensuring pay periods, deductions, and direct deposits are set up correctly.

- All employees are added with accurate personal information, tax forms, and pay rates.

- We ensure deductions for CPP, EI, income tax, and other required withholdings are calculated correctly.

- We walk you through running your first payroll and provide support for future pay periods.

Get started on registering and setting up your payroll services. We support and set you up from start to finish with information and guidance all throughout.

Quick. Compliant. Done Right the First Time.

Start Payroll Services in

Just 3 Simple Steps

Fill out the online form

Kick things off by completing our easy step-by-step form. You can place your order using a credit card, PayPal, or e-transfer—whichever is most convenient.

We set everything up

Our team registers your payroll accounts, configures your system, and inputs employee data.

Run payroll with confidence

We guide you through your first payroll cycle and ensure you’re set for ongoing success.

What Our Clients Are Saying

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

Learn More About Payroll Set Up Services With Our Informative Video Below

Frequently Asked Questions

Do I need a payroll account with CRA?

Yes. A business must register for a payroll account before paying employees and remitting deductions.

How long does setup take?

Most payroll setups can be completed within 2–5 business days once all information is received.

Can you set up payroll for remote employees?

Absolutely—we handle payroll setups for employees in multiple provinces.

What deductions are mandatory in Canada?

Typically CPP/QPP, EI, and federal/provincial income tax, plus any required provincial levies.

Do you integrate with existing accounting software?

In most cases, incorporating a business in Ontario online is fast. You’ll usually receive your official documents within a few hours. If you go the manual route, expect it to take longer—anywhere from 2 to 5 business days.

Can I switch payroll providers?

Yes. Incorporating a business in Ontario online is the preferred method for most entrepreneurs. It’s efficient, paperless, and often includes real-time support and automated error checks to speed things up.

What if I make a payroll mistake later?

Yes. Incorporating a business in Ontario online is the preferred method for most entrepreneurs. It’s efficient, paperless, and often includes real-time support and automated error checks to speed things up.

Do you handle T4 and year-end reporting?

Latest News & Blog Posts

How to Do a Land Title Search in Ontario: The Complete and Free Beginner’s Guide

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Federal Name Approval Process: Everything You Need to Know

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

BC Name Approval Guide: How to Register Your Business Name in British Columbia

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

Ontario Articles of Amendment: Complete Guide for 2026

If your Ontario business needs a makeover – this article is for you. Perhaps you

How to Make Changes to Your Business in Canada: Filing a Notice of Change

Running a business is like being the captain of a ship. Sometimes you need to

How to Register a General Partnership in PEI: Your Guide 2026

If you and your friend have a brilliant business idea, and you want to team