NOVA SCOTIA NON-PROFIT CORPORATION

1-Hour Service Available

Only $1299 (Agency + Government Fee Included)

We’re an official intermediary for the Province of Nova Scotia.

Fast. Simple. Transparent. No Hidden Fees.

Nova Scotia Non-Profit Packages

Nova Scotia Non-Profit Corporation

- Registered under the Nova Scotia Non-Profit Corporations Act

- Filing Fee: Only $1299 (Includes the Government Fee)

- Customizable Articles of Incorporation

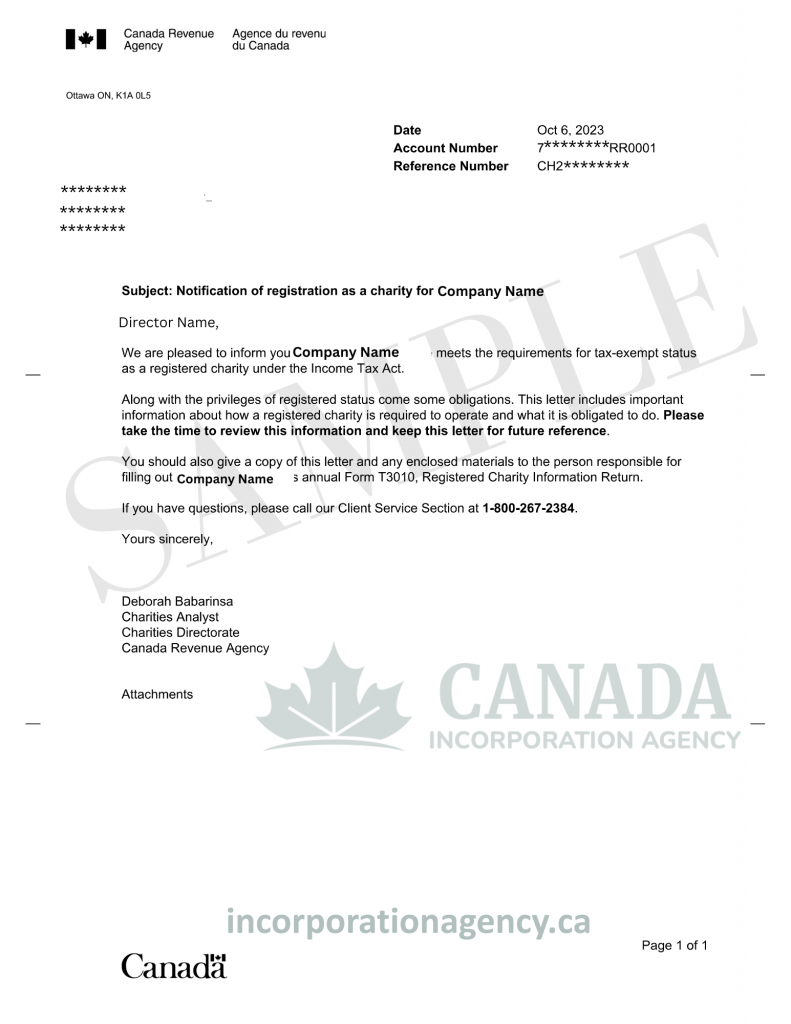

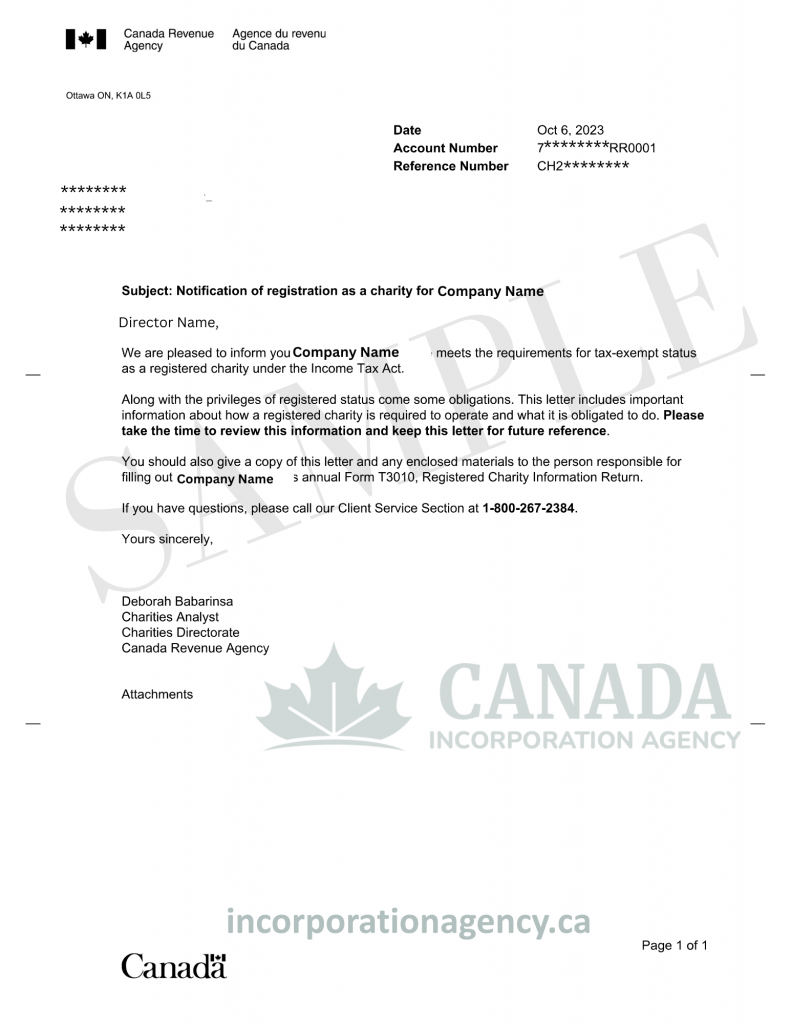

Nova Scotia Registered Charity

- Special status approved by the Canada Revenue Agency

- Registration of a Non-Profit (first step) can be completed in 2 business days

- Offers tax advantages and can issue donation receipts

Nova Scotia Charity Status Application

- Charitable purpose is required: relief of poverty, advancement of education or religion, etc.

- Drafting the charitable objects carefully by a team of professionals.

- Applying to the Canada Revenue Agency to become a registered charity in Nova Scotia.

Nova Scotia Co-operative Incorporation

- Built for shared ownership with democratic decision-making

- Registration completed in 2-3 business days

- Members have limited liability

Benefits of Nova Scotia Non-Profit Corporation

- Members’ and Directors’ Limited Liability: When your organization is incorporated, it becomes a separate legal entity that shields directors and members from personal liability as long as they act in good faith.

- Increased Transparency and Credibility: Formal status, supported by bylaws, clearly defined leadership roles, and filing requirements, instills confidence in grant providers, volunteers, and the general public.

- Obtaining Federal and Provincial Funding: Nonprofits in Nova Scotia must be legally incorporated in order to participate in funding programs.

- Future-Proofing and Continuity: Regardless of leadership changes, your business continues to operate so that your objective is accomplished year after year.

- Governance Clarity: Adopting formal bylaws creates clear rules for membership, decision-making, resolving conflicts, and following provincial standards.

To learn more, simply explore the Nova Scotia Societies Act.

Feature | Nova Scotia Standard Corporation | Nova Scotia Non-Profit Corporation |

|---|---|---|

Purpose | Operates to earn profit for shareholders | Operates for social, cultural, charitable, or community goals (not for making profit) |

Profit Distribution | Can distribute profits as dividends to shareholders | Cannot distribute profits to members or directors |

Ownership | Owned by shareholders | No shareholders—has members or directors |

Tax Status | Pays corporate taxes on profits | May qualify for tax-exempt status (if registered charity) |

Fundraising Options | Sales, investments, and business revenue | Donations, grants, membership fees |

Directors | At least 1 director | At least 3 directors are required |

Naming Restrictions | Must include “Limited,” “Ltd.,” “Inc.,” or “Corp.” | Cannot use “Limited,” “Ltd.” unless special approval |

Residency Requirement | No requirement | No requirement, unless you plan to register a Charity status |

Start Your Incorporation Now

Just 3 Simple Steps

Fill out the online form

Kick things off by completing our easy step-by-step form. You can place your order using a credit card, PayPal, or e-transfer—whichever is most convenient.

We handle the filing

Once your payment is confirmed, our experienced registry agent reviews everything and files your documents with the appropriate Nova Scotia government office. No need to worry about red tape or delays.

Receive your incorporation documents

Incorporating a Non-Profit Organization in Nova Scotia doesn’t have to be complicated. You’ll receive your official Certificate and Articles of Incorporation right in your inbox—often in just a few business hours.

What Our Clients Are Saying

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

Watch our informative guide and learn how to incorporate an Nova Scotia non-profit

Frequently Asked Questions

What is a Non-profit organization in Nova Scotia?

A Non-profit organization in Nova Scotia is an entity formed to carry out activities for social, cultural, educational, religious, or charitable purposes, not to earn profit for its members. Any profit earned must be used to support the organization’s objectives.

What’s the difference between a Non-profit and a charity?

Agency (CRA) and is eligible to issue tax receipts for charitable donations. A regular not-for-profit cannot issue tax receipts and has wider objectives, including sports clubs, cultural organizations, or community associations.

What are the benefits of incorporating as a Non-profit in Nova Scotia?

- Limited liability protection for directors and members

- Legal recognition and credibility

- Ability to enter into contracts, own property, and receive grants

- Continuity regardless of changes in membership

How much does it cost to incorporate a non-profit in Nova Scotia?

The government fee is $1299 if you file directly online through the Nova Scotia Business Registry. Third-party services may charge more for convenience (and moral support).

Do I have to file anything every year?

Yes! Nova Scotia nn-profits must file an Annual Return, keep corporate records updated, and may need to file taxes depending on activities. You’ll also want to hold an annual general meeting (AGM) unless you’re exempt.

Can I convert a non-profit into a for-profit company later?

Nope! Once a non-profit, always a non-profit. If you want to switch gears into entrepreneurship, you’ll need to incorporate a new for-profit business separately.

Do I need a lawyer to incorporate a non-profit in Nova Scotia?

It’s not required, but it’s a good idea—especially if you’re planning to apply for charitable status. Canada Incorporation Agency has a team of professional lawyers and filing agents that can help you out with the paperwork for your Non-Profit. Bylaws, governance, and CRA compliance can get complicated. Or use a professional service to make life easier.

Do I need bylaws?

Absolutely! Bylaws are the rules for how your organization will run—think of them as your corporate playbook. You’ll need to adopt them within 60 days of incorporating. They don’t need to be filed, but they do need to exist (and actually be followed).

Can I make money in a non-profit?

Yes, but any profit must be used to advance the organization’s goals—not to line your pockets. You can pay staff and contractors, but your board members typically can’t receive profit distributions.

Latest News & Blog Posts

How to Do a Land Title Search in Ontario: The Complete and Free Beginner’s Guide

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Federal Name Approval Process: Everything You Need to Know

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

BC Name Approval Guide: How to Register Your Business Name in British Columbia

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

Ontario Articles of Amendment: Complete Guide for 2026

If your Ontario business needs a makeover – this article is for you. Perhaps you

How to Make Changes to Your Business in Canada: Filing a Notice of Change

Running a business is like being the captain of a ship. Sometimes you need to

How to Register a General Partnership in PEI: Your Guide 2026

If you and your friend have a brilliant business idea, and you want to team