NEW BRUNSWICK NON-PROFIT CORPORATION

1-Hour Service Available

Only $99 + Government Fee

We’re an official intermediary for the Province of New Brunswick

Fast service. Easy process.Fully Transparent Pricing.

New Brunswick Non-Profit Packages

New Brunswick Non-Profit Incorporation

- Registered under the New Brunswick Companies Act – Part II (Non-Profit)

- Includes name reservation and customized Articles of Incorporation

- Filing processed directly with Service New Brunswick

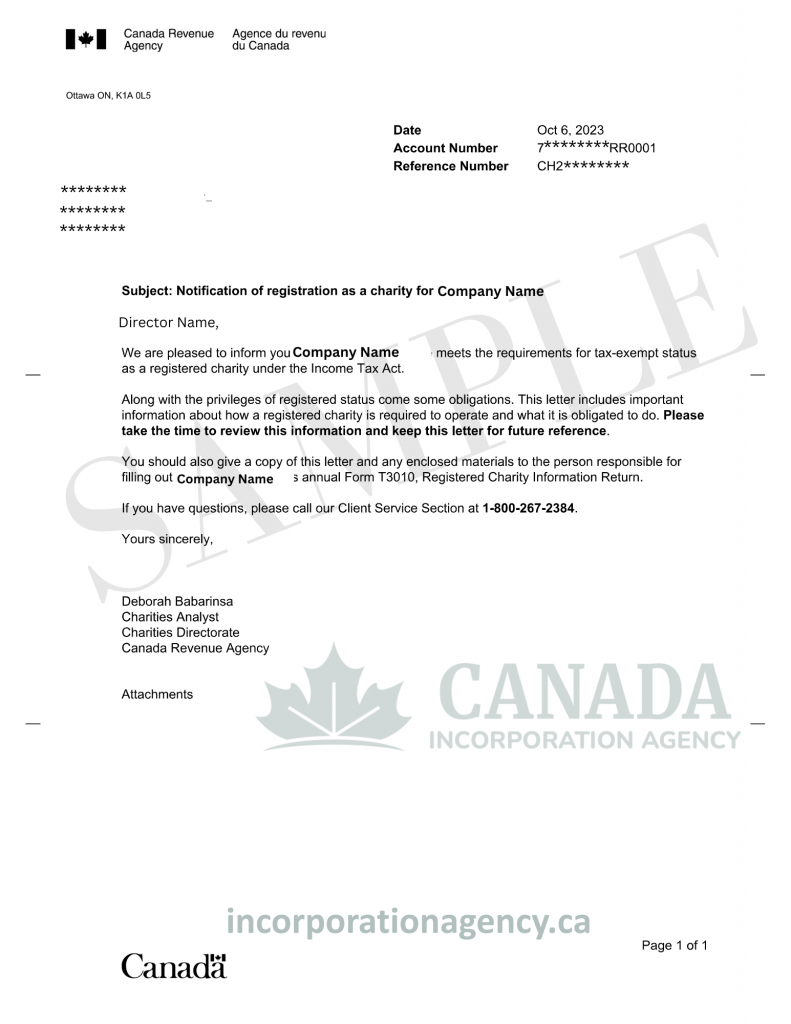

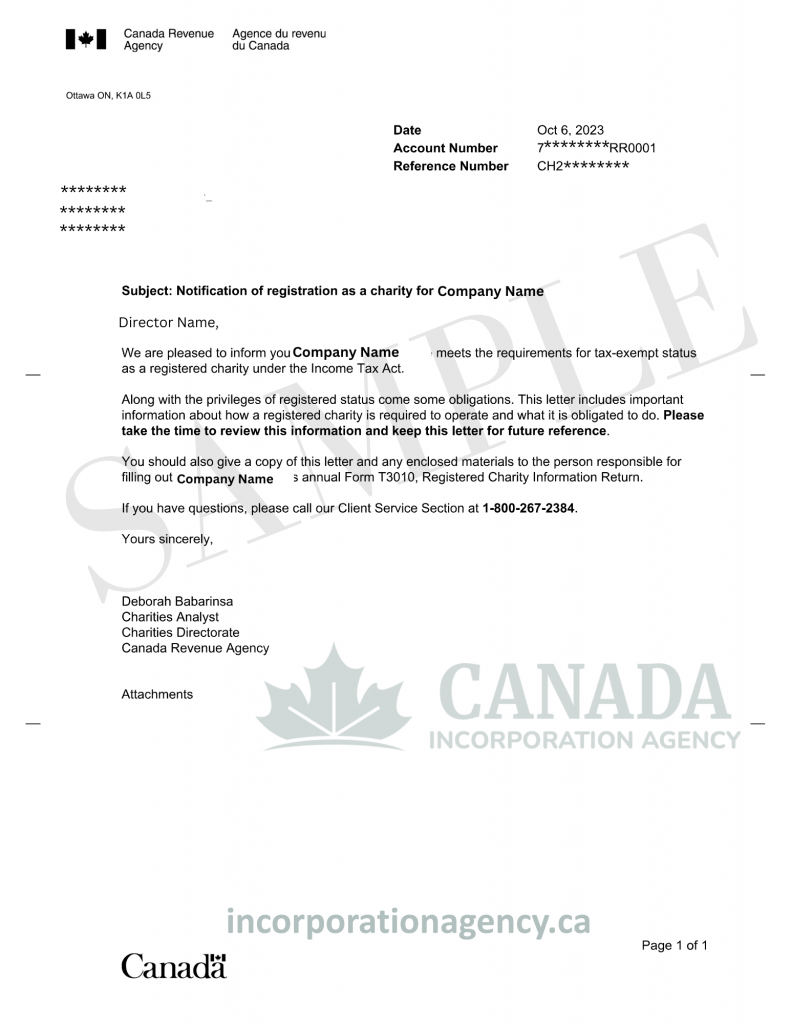

New Brunswick Registered Charity

- Full CRA charity application prepared after provincial incorporation

- Charitable purposes drafted to meet both provincial and federal requirements

- Enables your organization to issue official donation receipts and enjoy tax benefits

New Brunswick Charity Status Application

- Careful drafting of charitable objects aligned with CRA guidelines

- Full preparation and submission of all required CRA application forms

- Step-by-step support through the entire charity registration process

New Brunswick Co-operative Incorporation

- Registered under the New Brunswick Co-operative Associations Act

- Built for democratic decision-making and shared ownership models

- Offers limited liability and full legal recognition for members

Benefits of a New Brunswick Non-Profit Corporation

Provincial Legal Recognition: Incorporating a non-profit in New Brunswick grants your organization official legal status under the Companies Act – Part II.

Limited Liability for Directors and Members: Once incorporated, your organization becomes a separate legal entity. This protects directors, officers, and members from personal liability for the nonprofit’s debts or obligations—provided they act in good faith and fulfill their legal duties.

Professional Credibility and Public Trust: An incorporated non-profit is widely viewed as more stable and reputable by the public, funders, and government agencies. With formal bylaws, clearly defined leadership positions, and regular filing obligations, you demonstrate that you respect transparency and good governance.

Access to Federal and Provincial Funding:Many funding programs in New Brunswick require organizations to be incorporated. Incorporation also lays the foundation for registering as a federal charity, which allows you to issue tax-deductible donation receipts and access national funding opportunities.

Continuity Through Leadership Transitions: Your nonprofit will also continue to exist even if members or directors quit. Incorporation also ensures that your mission has the potential to continue uninterrupted, irrespective of who is at the helm.

Clear Governance Structure: Incorporation brings to life a formal structure of governance that is established through its bylaws. That aids a nonprofit society with its rules of membership, settling internal disputes, and compliance with the province.

Key Points About an New Brunswick Non-Profit Corporation

- Has to be non-profit in nature - Your company has to be set up for something other than profit, such as education, religion, social welfare, arts, or volunteer work. Every dollar must be reinvested into your mission.

- Requires at least three incorporators - Under the New Brunswick Companies Act – Part II, you must have at least three incorporators. These can be individuals or businesses, and they are not required to be residents of New Brunswick.

- Need a registered office in New Brunswick - A physical street address within the province is required. P.O. boxes are not accepted. This will serve as your official business address for receiving government and legal correspondence.

- Approval of names is needed - Service New Brunswick must first approve the name of your company to guarantee it is unique and not misleading before filing. Some words—like "Foundation" or "Association"—may call for more review or explanation.

To learn more, simply explore the New Brunswick Corporations Act.

Start Your Incorporation Now

Just 3 Simple Steps

Fill out the online form

Start by completing our quick and easy step-by-step form. You can place your order using credit card, PayPal, or e-transfer—whichever method works best for you.

We handle the filing

Once your name is approved and your details are reviewed, our experienced filing team prepares your incorporation documents and submits them directly to Service New Brunswick. No guesswork, no delays.

Receive your incorporation documents

You’ll get your official Certificate and Articles of Incorporation delivered straight to your inbox—often within just a few business days. Everything you need to move forward with confidence.

What Our Clients Are Saying

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

Watch our informative guide and learn how to incorporate an New Brunswick non-profit

Frequently Asked Questions

Do I need to live in New Brunswick to incorporate a non-profit there?

No, you don’t need to be a resident of New Brunswick to incorporate a non-profit in the province. However, you must provide a registered office address located within New Brunswick, and some local presence is helpful for administrative matters.

How many people are required to start a non-profit in New Brunswick?

To incorporate under the New Brunswick Companies Act – Part II, you need at least three incorporators. These can be individuals or organizations, and they do not need to reside in the province.

Can my New Brunswick non-profit also register as a charity?

Yes. After incorporating your organization in New Brunswick, you can apply to the Canada Revenue Agency (CRA) for charitable status. If approved, your non-profit will be able to issue tax-deductible receipts and access additional federal funding programs.

What documents are needed to incorporate a non-profit in New Brunswick?

You’ll need to submit a Name Reservation, Articles of Association, and Notice of Registered Office. It’s also recommended to prepare bylaws that outline how your organization will be governed.

What are the benefits of incorporating a non-profit in New Brunswick?

Incorporation gives your organization legal status, limited liability protection for directors, and improved access to funding. It also provides long-term stability and greater credibility with donors, volunteers, and granting agencies.

Latest News & Blog Posts

How to Do a Land Title Search in Ontario: The Complete and Free Beginner’s Guide

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Federal Name Approval Process: Everything You Need to Know

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

BC Name Approval Guide: How to Register Your Business Name in British Columbia

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

Ontario Articles of Amendment: Complete Guide for 2026

If your Ontario business needs a makeover – this article is for you. Perhaps you

How to Make Changes to Your Business in Canada: Filing a Notice of Change

Running a business is like being the captain of a ship. Sometimes you need to

How to Register a General Partnership in PEI: Your Guide 2026

If you and your friend have a brilliant business idea, and you want to team