An Official Intermediary of the Federal and Provincial Government

An Official Intermediary of the Federal and Provincial Government

1-Hour Service Available

Just $29 + Government Fee

We’re a trusted intermediary for Quebec incorporations.

Clear Pricing. Quick Service. No Surprises.

Forget about the paperwork maze. For a fixed fee of $495, we handle everything swiftly, lawfully, and in full conformity with Quebec’s requirements, including UBO disclosure.

Here’s why we’re trusted by entrepreneurs in Quebec:

Start your Quebec business the proper way, totally compliant and ready to go.

Start your Quebec incorporation by filling out a quick, guided form. Pay securely by card or e-transfer.

Our team reviews and files your documents with the Registraire des entreprises—no delays or red tape.

Receive your Certificate of Incorporation and legal documents by email—often within just a few hours.

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

To incorporate in Quebec, you must submit Articles of Incorporation to the Registraire des entreprises, select a named or numbered corporation, and remit the applicable government fee. Organizations like ours do it all—for you, legally and efficiently.

The incorporation cost in Quebec is a flat fee of 548 CAD + tax with our service. It covers government fees, legal document drafting, ClicSÉQUR code, and email delivery of the incorporation documents.

Yes, you can incorporate a Quebec company fully online. Our system allows you to fill out your form, select a company name, and obtain all official documents by e-mail.

A named corporation permits you to name your business (e.g., Johnson Construction Ltd.), but a numbered corporation has a government-assigned name (e.g., 12345678 Quebec Inc.). Both have the same legal protections.

No, a NUANS report is not necessary when registering a company in Quebec. Quebec has its own business name registry, which makes the naming process quicker and easier than in other parts of Canada.

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

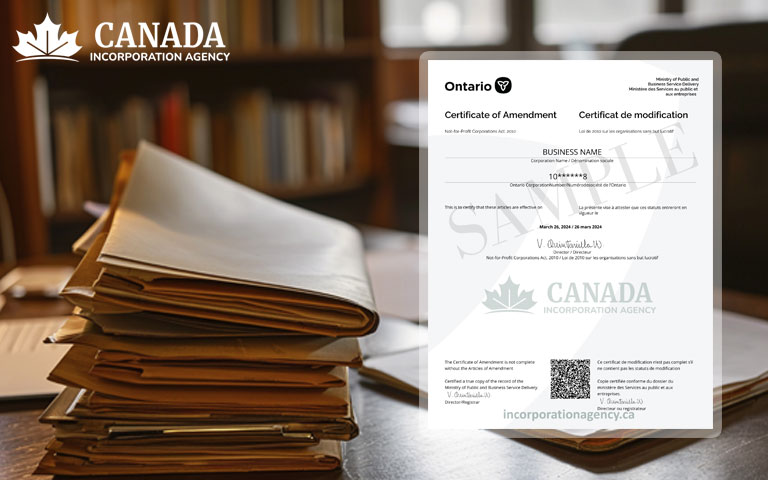

If your Ontario business needs a makeover – this article is for you. Perhaps you

Running a business is like being the captain of a ship. Sometimes you need to

If you and your friend have a brilliant business idea, and you want to team