File Your Extra-Provincial Annual Return

Start Your Business in Just 1 Hour

Only $99 + Government Fee

Stay Compliant with Provincial Corporate Filing Requirements

Fast. Simple. Transparent. No Hidden Fees.

Extra-Provincial Annual Return Packages

Ontario Annual Return

- Stay compliant with easy Ontario Annual Return filing.

- Filing Fee: Just $99 + Government Fee

- 2 Hour Rush Processing Queue Available

Alberta Annual Return

- File your Alberta Annual Return quickly and hassle-free.

- Filing Fee: Just $99 + Government Fee

- Get your Alberta Annual Return done quickly with our 2 Hour Rush option.

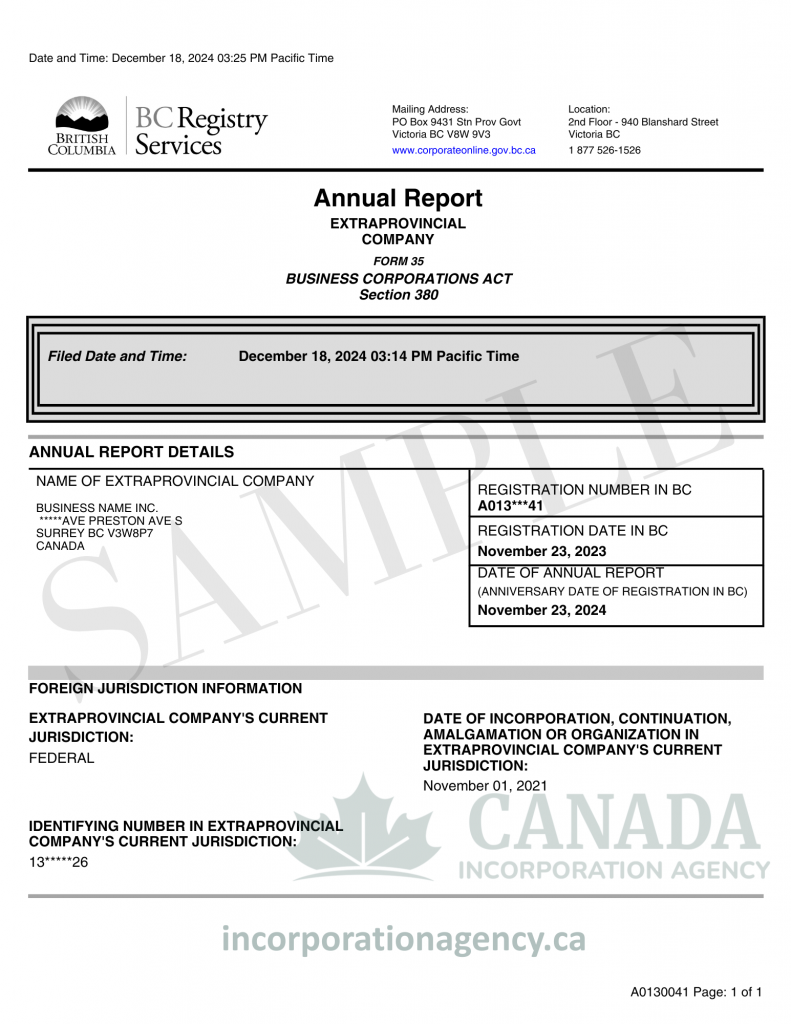

BC Annual Return

- Stay penalty-free with accurate, on-time submissions.

- Filing Fee: Just $99 + Government Fee

- Fast-track your filing with 2 Hour Rush option.

Federal Annual Return

- File your Federal Annual Return quickly and accurately.

- Filing Fee: Just $99 + Government Fee

- 2 Hour Rush Processing available for urgent needs.

MB Annual Return

- File your MB Annual Return easily and on time.

- Filing Fee: Just $99 + Government Fee

- 2 Hour Rush Processing available for urgent filings.

Quebec Annual Return

- File your Quebec Annual Return quickly and correctly.

- Filing Fee: Just $99 + Government Fee

- Get your Quebec Annual Return filed within 2 hours.

Why Choose Us To File Your Extra-Provincial Annual Returns?

If your corporation is registered extra-provincially in any Canadian province, you’re required to file an annual return with that province. We make this process quick, accurate, and hassle-free -ensuring your business remains in good standing. We also offer guidance for federal corporations expanding into any province.

Here’s what sets us apart:

- Nationwide Coverage: We handle EPR filings in every Canadian province and territory.

- Fast Processing: We ensure accurate, compliant filings with fast turnaround times.

- Affordable Pricing: Transparent, all-inclusive fees—no hidden charges.

- Registered Agent Services: We provide agent-for-service representation if required in your selected province.

Whether you are federally incorporated or provincially registered in a different jurisdiction, you must register in each province where your company actively conducts business.

Quick. Compliant. Done Right the First Time.

Start Filing Your EP Annual Return

Just 3 Simple Steps

Fill out the online form

Kick things off by completing our easy step-by-step form. You can place your order using a credit card, PayPal, or e-transfer—whichever is most convenient.

We handle the filing

Our team prepares the appropriate annual return for the province and files it on your behalf. Once your payment is confirmed, our experienced registry agent also reviews everything and files your documents with the appropriate government office. No need to worry about red tape or delays.

Receive your incorporation documents

Once submitted, you’ll receive confirmation that your annual return has been filed and your company remains compliant.

What Our Clients Are Saying

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

Filing the Annual Report in Canada – What You Need to Know

Frequently Asked Questions

Is the annual return the same as a tax return?

No. This is a corporate filing for the provincial registry—not a tax return with CRA.

What is the deadline to file?

Filing deadlines vary by province but are generally due annually by the anniversary of your registration date.

What happens if I don’t file my extra-provincial annual return?

Failure to file may result in late fees, penalties, or dissolution of your registration in that province.

I didn’t make any changes to my business—do I still need to file?

Yes. Even if your information hasn’t changed, filing is still required each year.

Do federal corporations need to file EP annual returns too?

Yes—if a federal corporation is registered extra-provincially, it must file in that province each year.

Can you file for multiple provinces at once?

Absolutely. Let us know which provinces you’re registered in, and we’ll handle all applicable filings.

Latest News & Blog Posts

How to Do a Land Title Search in Ontario: The Complete and Free Beginner’s Guide

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Federal Name Approval Process: Everything You Need to Know

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

BC Name Approval Guide: How to Register Your Business Name in British Columbia

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

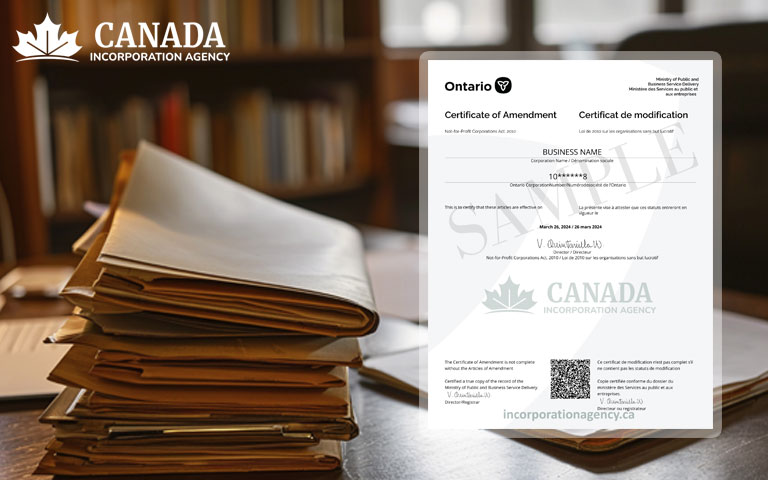

Ontario Articles of Amendment: Complete Guide for 2026

If your Ontario business needs a makeover – this article is for you. Perhaps you

How to Make Changes to Your Business in Canada: Filing a Notice of Change

Running a business is like being the captain of a ship. Sometimes you need to

How to Register a General Partnership in PEI: Your Guide 2026

If you and your friend have a brilliant business idea, and you want to team