An Official Intermediary of the Federal and Provincial Government

An Official Intermediary of the Federal and Provincial Government

1-Hour Service Available

Only $99 + Government Fee

We’re an official intermediary for Corporations Canada.

Fast filing. Seamless process. Transparent pricing.

National Legal Status: Your organization becomes a recognized legal entity across Canada. This allows you to open bank accounts, enter contracts, hire staff, and apply for federal and provincial funding programs.

Director and Member Liability Protection: Incorporation limits the personal liability of directors and members—as long as they act responsibly and in accordance with their duties.

Credibility: Donors, government agencies, and national grant providers all generally find a federally incorporated non-profit more credible.

Eligibility for CRA Charity Status:Incorporation is the first step before applying for charitable registration with the CRA, which enables your organization to issue official donation receipts and benefit from tax exemptions.

Governance and Continuity: Non-profit will continue to operate even if directors step down, with clear bylaws guiding elections, meetings, and decision-making processes.

To learn more, simply explore the Canada Not-for-profit Corporations Act

Start by filling out our secure application. Choose your preferred payment method—credit card, PayPal, or e-transfer.

Our experienced filing team handles the preparation of your NUANS name search, Articles of Incorporation, and other required forms. Once reviewed, we file everything electronically with Corporations Canada.

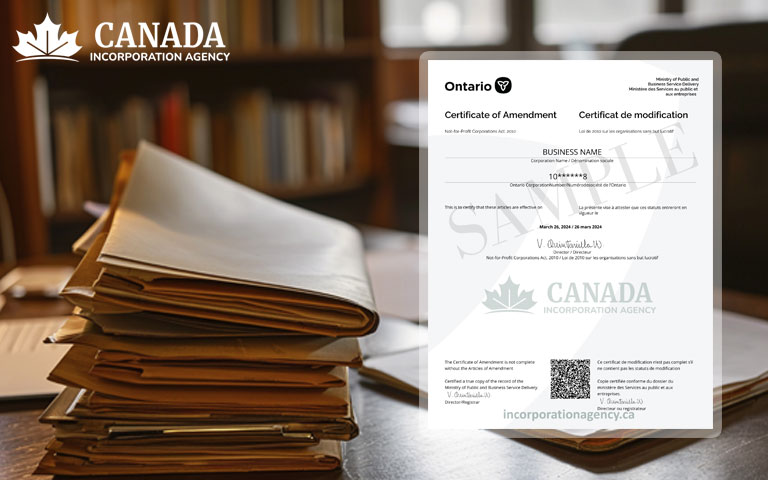

Your official Certificate and Articles of Incorporation will be delivered to your inbox—often within a few business days. Everything you need to move forward with confidence.

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

You’ll need a unique organization name (confirmed through a NUANS report), a registered office in Canada, and at least one director. If you plan to apply for charitable status, you’ll typically need three unrelated directors.

Yes. A NUANS (Newly Upgraded Automated Name Search) report is mandatory to ensure your organization’s name is unique and doesn’t conflict with existing corporations or trademarks.

Federal incorporation provides your non-profit with a legal framework. Separate from this is CRA charity registration, which allows your organization to issue tax receipts and accept charitable donations. You must be incorporated before applying for charitable status

While bylaws aren’t filed with Corporations Canada, they are required for internal governance. They define how your organization operates—covering board responsibilities, member rights, meetings, and dispute resolution.

Once incorporated, your company turns into a legal entity. You then have to adopt your bylaws, name your first directors, and schedule your first board meeting. You have to yearly file an Annual Return with Corporations Canada to keep your active status.

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

If your Ontario business needs a makeover – this article is for you. Perhaps you

Running a business is like being the captain of a ship. Sometimes you need to

If you and your friend have a brilliant business idea, and you want to team