CRA BUSINESS NUMBER REGISTRATION

Get Your CRA Business Number (BN) Fast

Only $99 + Government Fee

Set Up Your BN or Any CRA Account

Fast. Simple. Transparent. No Hidden Fees.

CRA Business Number

Who Needs a Business Number:

✔ Incorporated businesses

✔ Sole proprietors charging GST/HST

✔ Employers hiring staff

✔ Importers/exporters

✔ Charities and nonprofitst

GST/HST Account

A GST/HST account is used for:

✔ Collect, File, or Claim Federal taxes

✔ Remit GST/HST to the CRA

✔ Claim Input Tax Credits (ITCs) for GST/HST paid on business expenses

✔ File GST/HST returns (monthly, quarterly, or annually)

✔ Stay compliant with Canadian tax laws if your revenue exceeds $30,000 annually

PST/QST Account

A PST/QST Account is used for:

✔ PST (Provincial Sales Tax) – Required in provinces like BC, SK, MB

✔ QST (Quebec Sales Tax) – Required if you sell to customers in Quebec

✔ Collect and remit provincial tax on taxable goods/services

✔ File PST/QST returns as required by the province

✔ Stay compliant with provincial tax laws

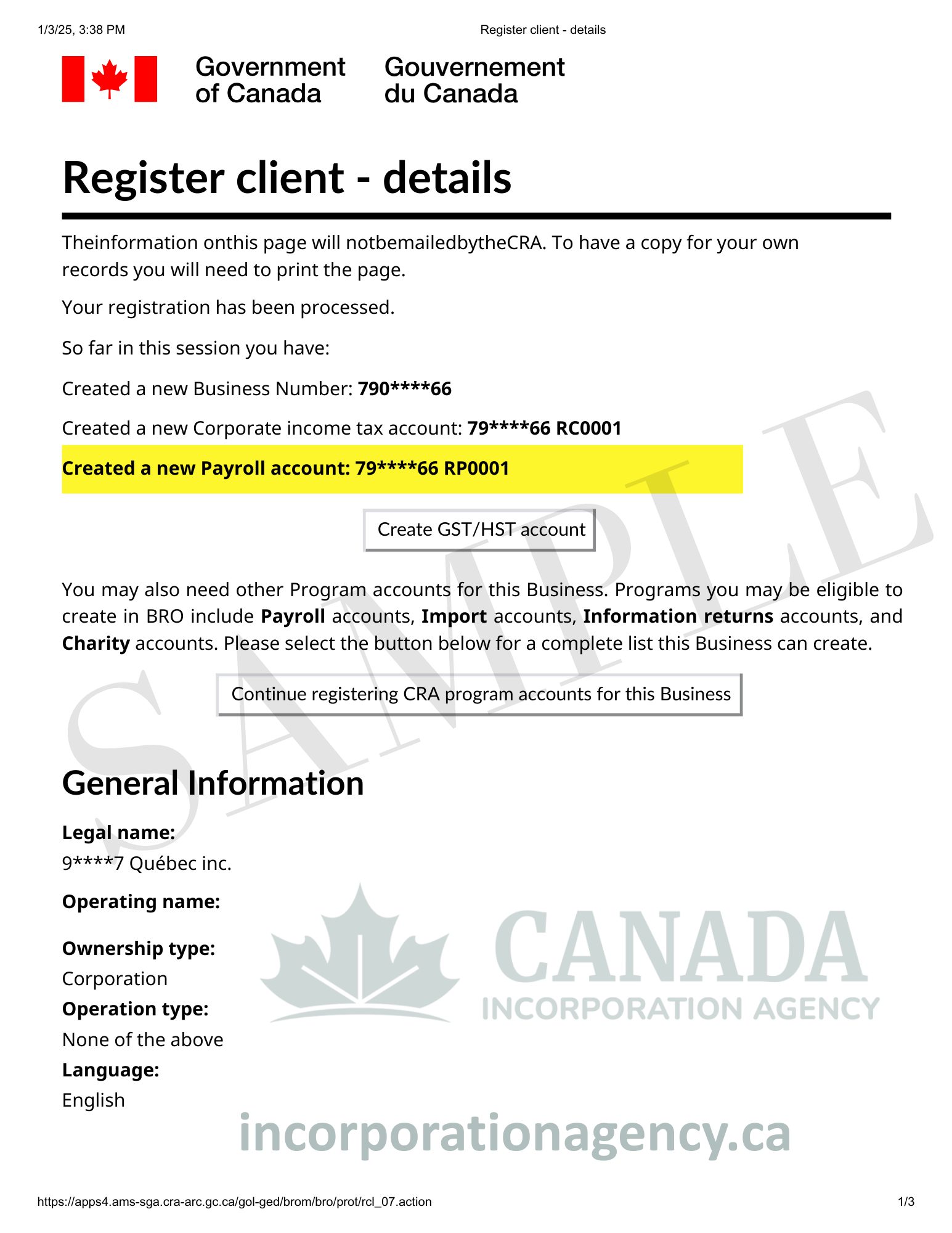

Payroll Account

✔ Required if you hire employees in Canada

✔ Used to deduct and remit:

1) Income tax

2) Canada Pension Plan (CPP)

3) Employment Insurance (EI)

✔ Needed to file T4 slips and summaries annually

✔ Must be registered before your first pay run

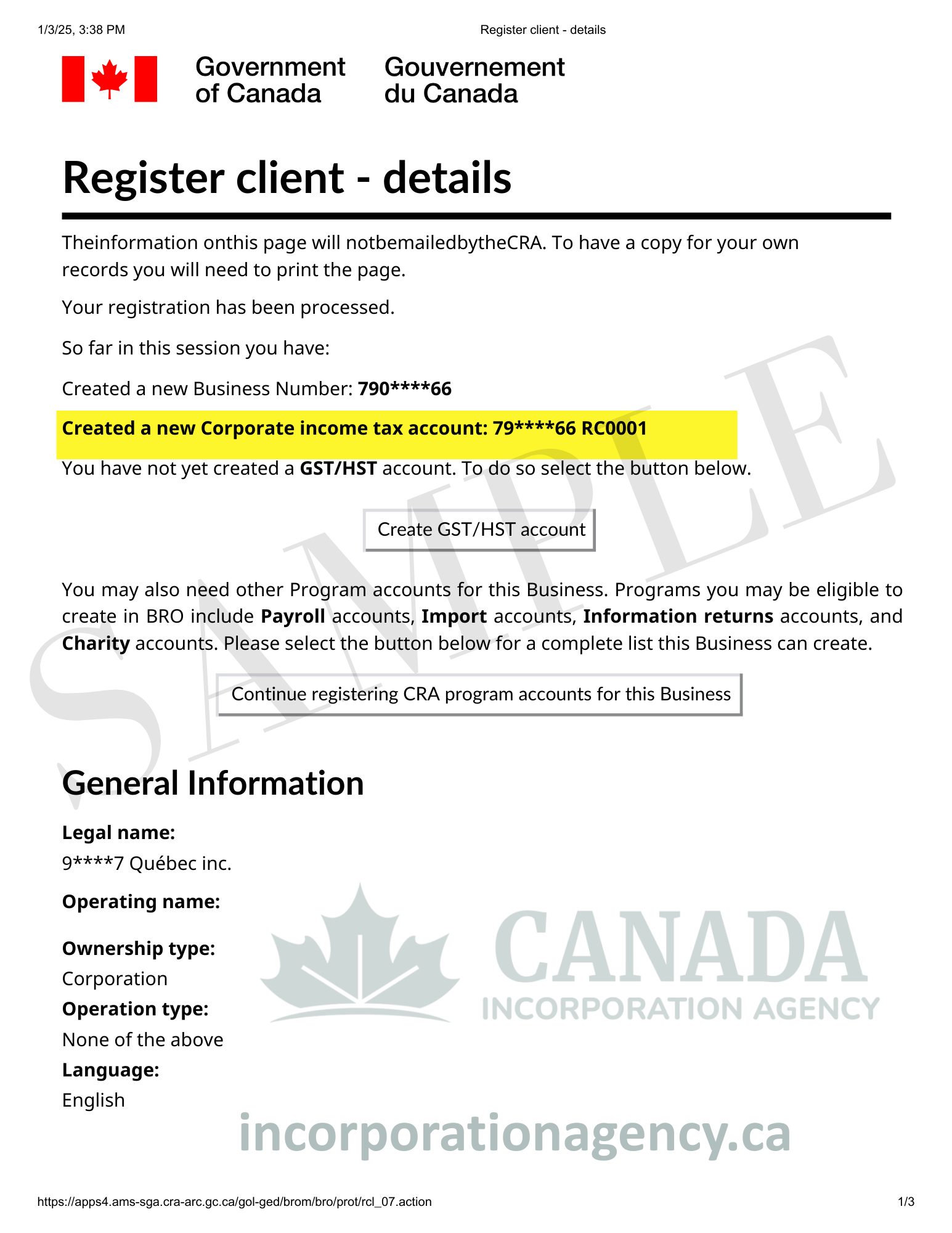

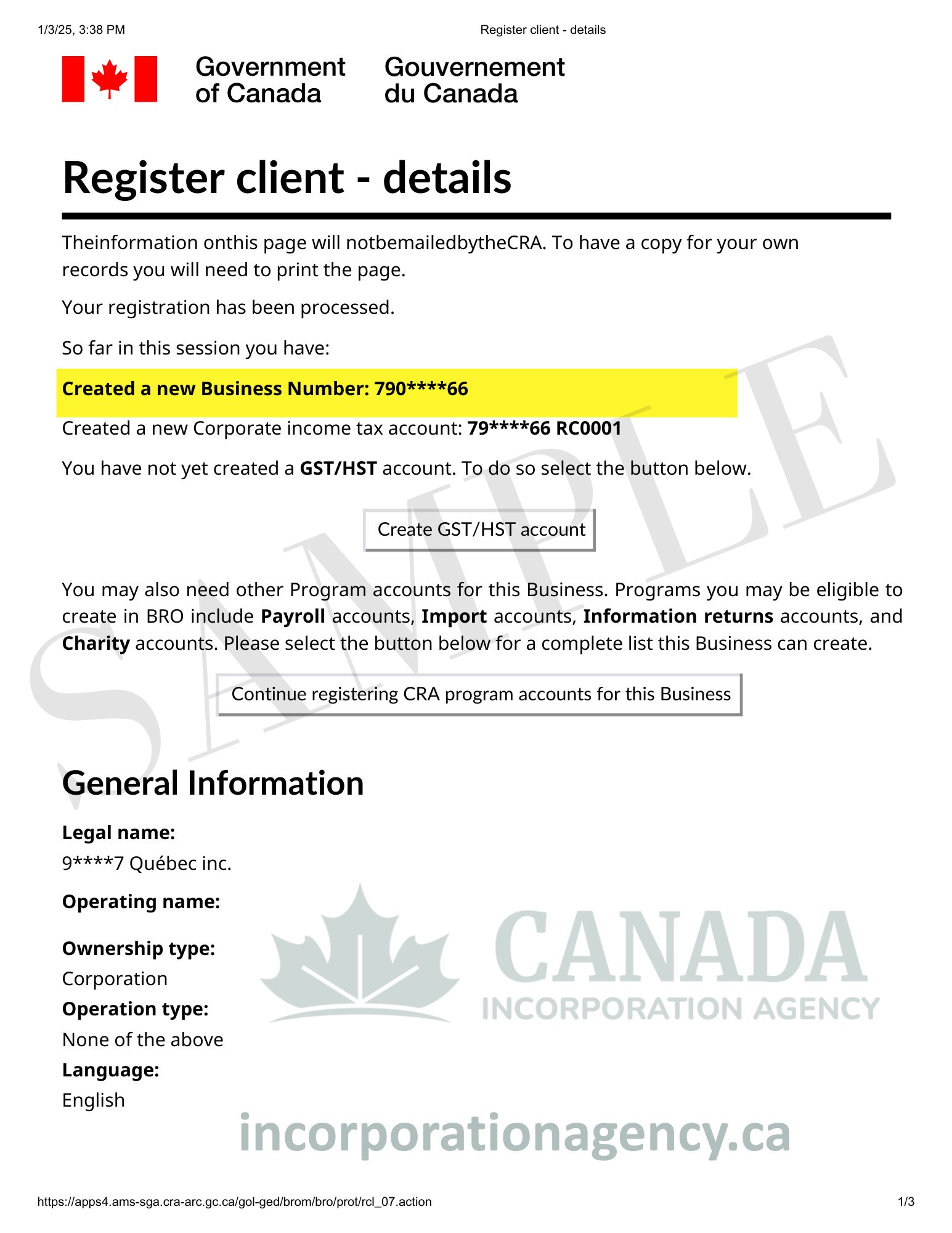

Corporate Tax ID

✔ Also known as the Corporate Income Tax Account

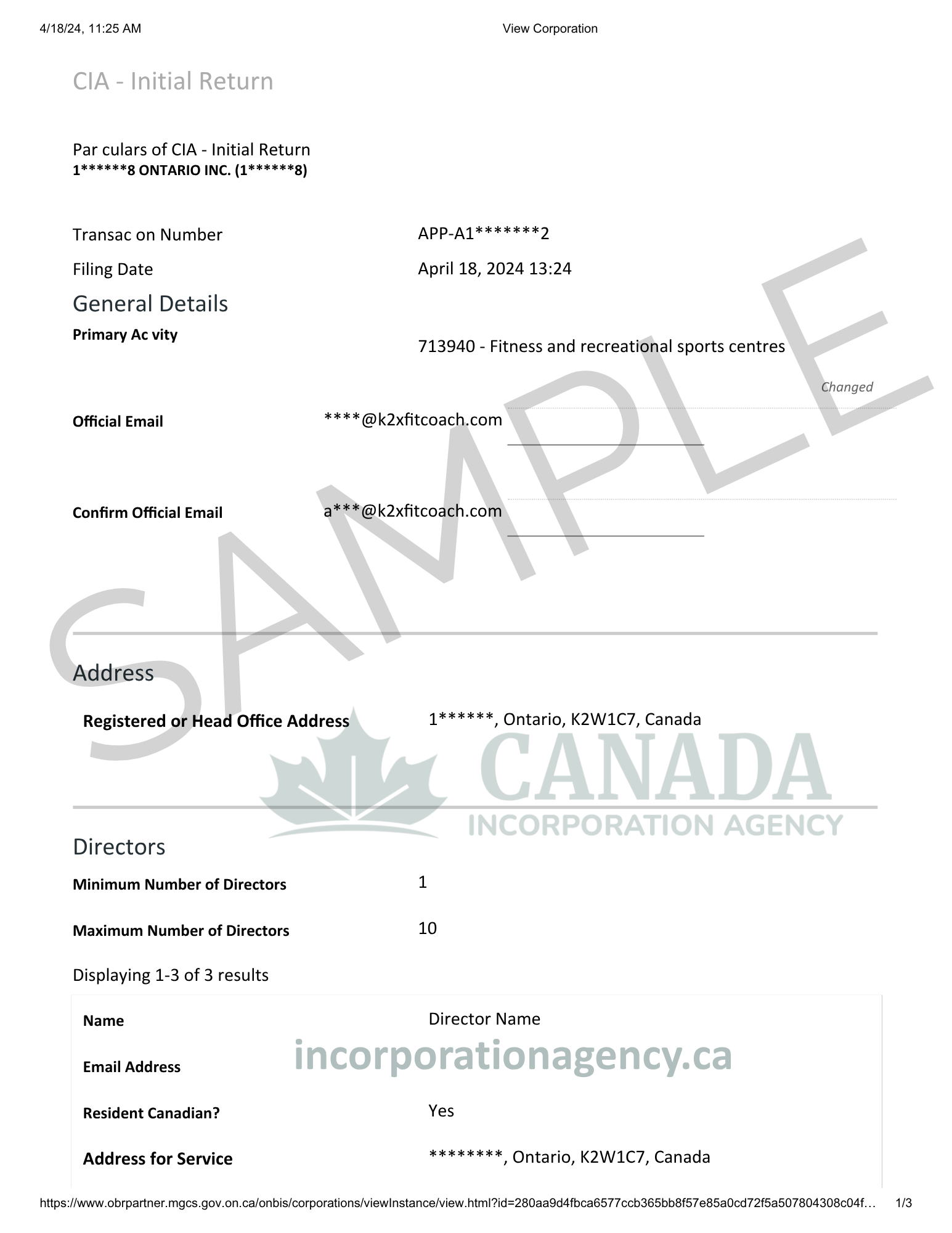

✔ Assigned when you incorporate a business in Canada

✔ Used to file and pay corporate income taxes

✔ Linked to your CRA Business Number (BN)

✔ Required even if your corporation has no income

Why Choose Us for CRA Business Number Registrations?

Get your Business Number (BN) and CRA program accounts (GST/HST, payroll, corporate tax, etc.) quickly, accurately, and securely through us. Let us handle the paperwork while you focus on building your business.

Here’s what sets our services apart:

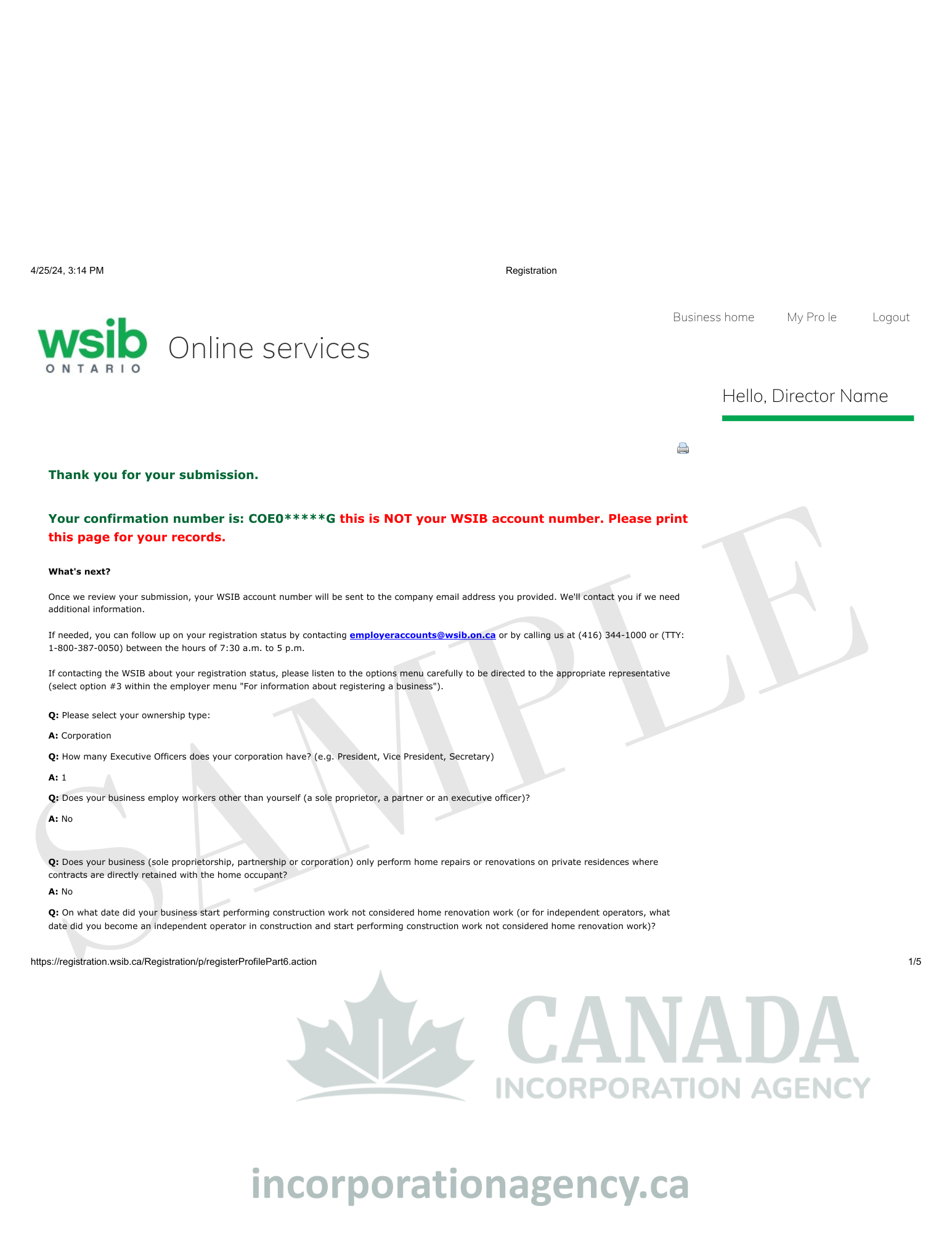

- Fully managed online process –We take care of the complete registration and set up process to obtain your Business Number (BN).

- All-inclusive support – Register for GST/HST (RT), payroll deductions (RP), corporate income tax (RC), information returns (RZ), charities (RR), and more as needed

- Trusted and compliant – We align with CRA’s guidelines and federal standards.

- Ideal for Canadian businesses – Whether you operate in one province or across Canada, we tailor registrations accordingly.

Quick. Compliant. Done Right the First Time.

Secure a Business Number In

Just 3 Simple Steps

Submit Your Business Details

Tell us about your business — name, structure (sole proprietorship, corporation, etc.), owner info, and address. We also help you identify which CRA program accounts (GST/HST, payroll, corporate tax, etc.) you’ll need.

We handle the filing

Our team files your Business Number and selected CRA accounts directly with the Canada Revenue Agency.

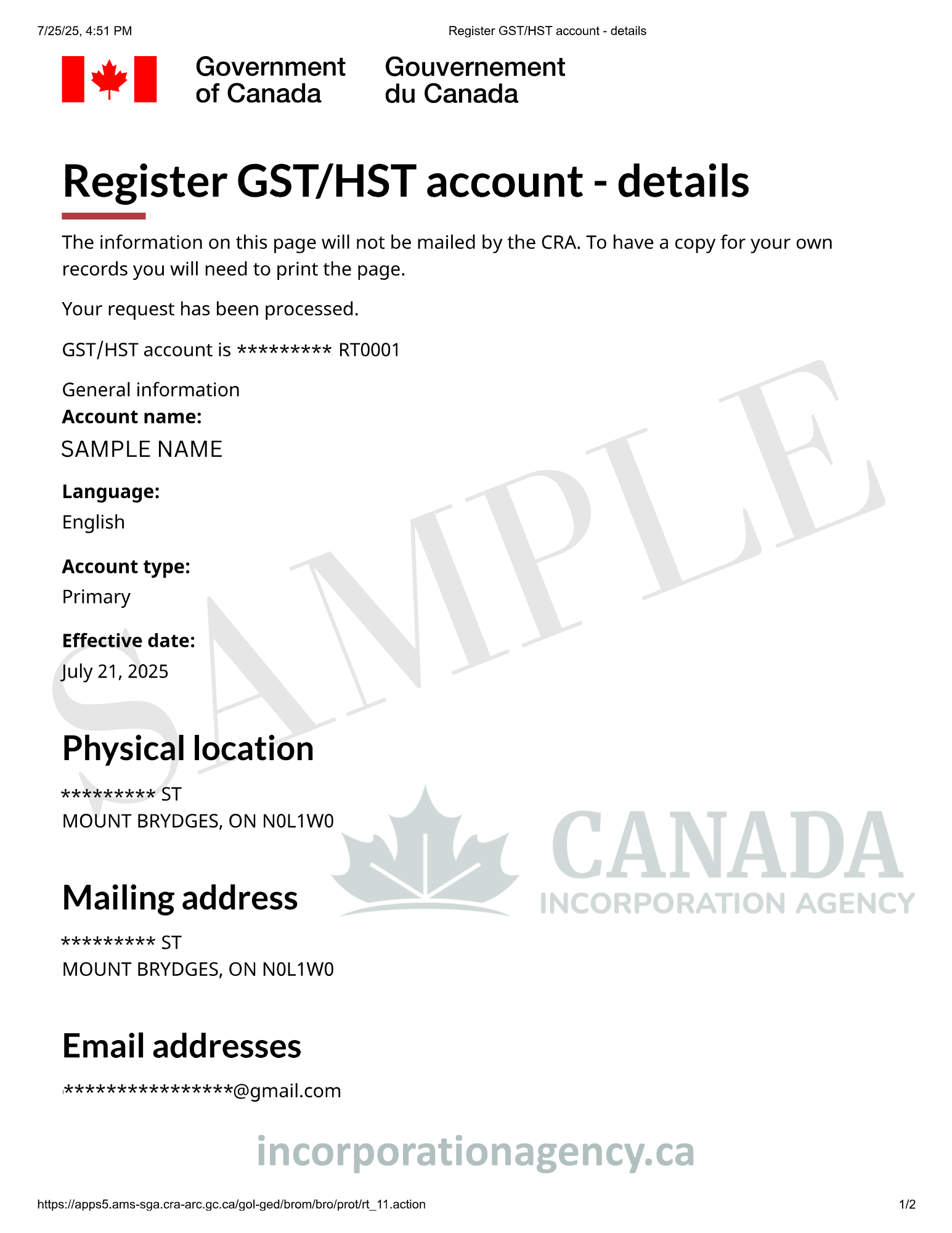

Get your business number

Once processed, we send you your Business Number and any program account numbers via email.

What Our Clients Are Saying

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

Learn More About Getting a CRA Business Number With Our Informative Video Below

Frequently Asked Questions

Who needs a Business Number?

You need a BN if you’re registering for any CRA program account — such as GST/HST (RT), Payroll Deductions (RP), Corporate Income Tax (RC), or Import/Export (RM). It’s also required for incorporated businesses and partnerships in most cases.

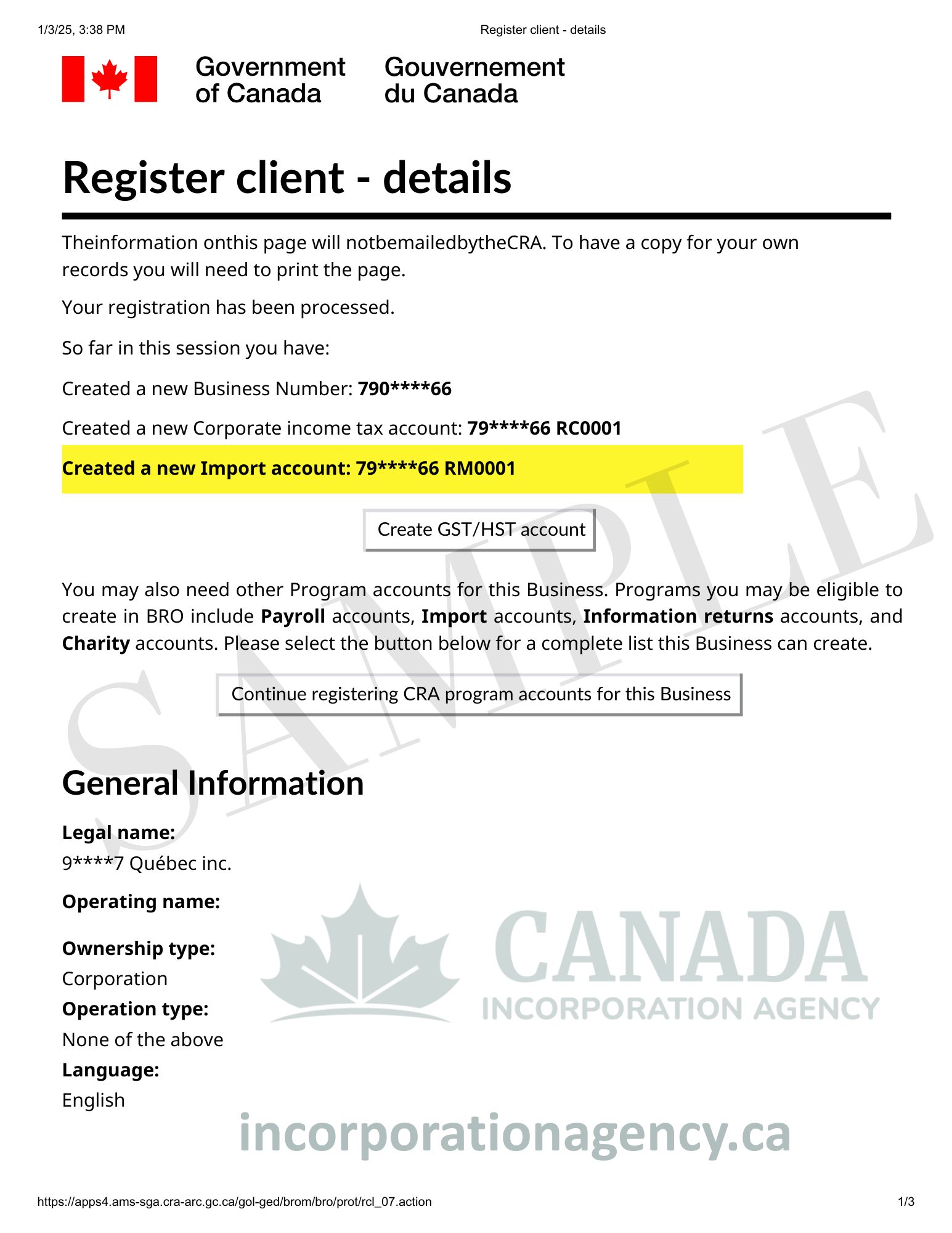

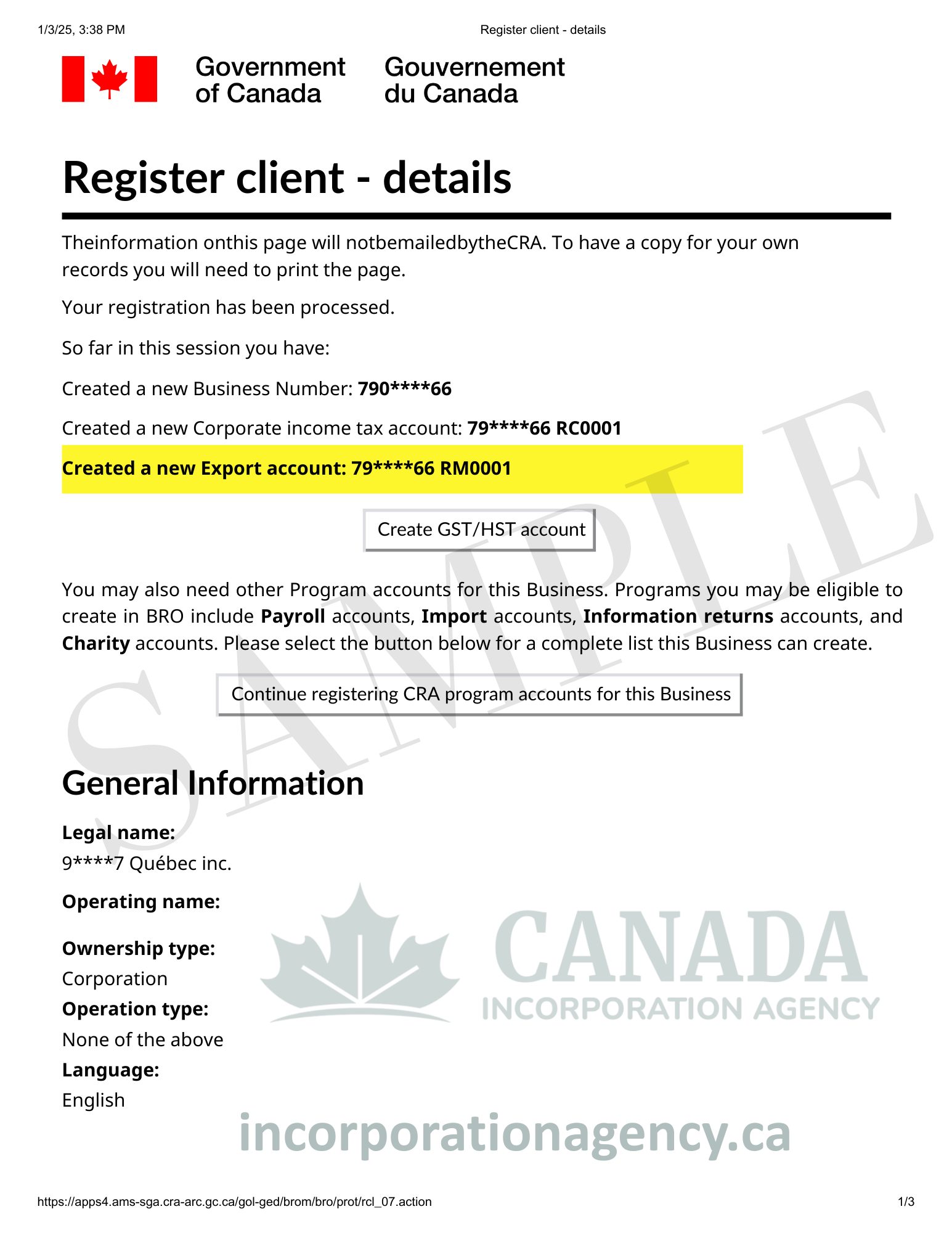

What are CRA program accounts?

These are specific tax accounts linked to your Business Number, such as:

RT for GST/HST

RP for Payroll

RC for Corporate Tax

RM for Import/Export

RR for Charities

Each program account includes a 2-letter identifier and a 4-digit reference number (e.g. 123456789 RT0001).

Can I register for multiple CRA program accounts at once?

Yes. When applying for a Business Number, you can register for all required CRA program accounts at the same time, depending on your business activities.

Do I need a Business Number if I’m self-employed or a sole proprietor?

You may not need a BN right away, but you will need one if you’re:

Charging GST/HST

Hiring employees

Importing/exporting goods

Incorporating your business

How long does it take to get my BN and CRA accounts?

If submitted correctly through Business Registration Online (BRO), your BN and CRA program accounts are typically issued on the same business day. Our agency ensures fast, accurate filings with minimal delays.

Latest News & Blog Posts

How to Do a Land Title Search in Ontario: The Complete and Free Beginner’s Guide

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Federal Name Approval Process: Everything You Need to Know

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

BC Name Approval Guide: How to Register Your Business Name in British Columbia

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

Ontario Articles of Amendment: Complete Guide for 2026

If your Ontario business needs a makeover – this article is for you. Perhaps you

How to Make Changes to Your Business in Canada: Filing a Notice of Change

Running a business is like being the captain of a ship. Sometimes you need to

How to Register a General Partnership in PEI: Your Guide 2026

If you and your friend have a brilliant business idea, and you want to team