CORPORATE INCOME TAX (RC) ACCOUNT REGISTRATION

Fast Corporate Tax ID (RC) Account Set Up

Only $99 + Government Fee

Set Up Your RC Account or Any CRA Account

Fast. Simple. Transparent. No Hidden Fees.

Corporate Tax ID (RC) Account Package & More

Corporate Tax ID

✔ Also known as the Corporate Income Tax Account

✔ Assigned when you incorporate a business in Canada

✔ Used to file and pay corporate income taxes

✔ Linked to your CRA Business Number (BN)

✔ Required even if your corporation has no income

CRA Business Number

Who Needs a Business Number:

✔ Incorporated businesses

✔ Sole proprietors charging GST/HST

✔ Employers hiring staff

✔ Importers/exporters

✔ Charities and nonprofitst

Payroll Account

✔ Required if you hire employees in Canada

✔ Used to deduct and remit:

1) Income tax

2) Canada Pension Plan (CPP)

3) Employment Insurance (EI)

✔ Needed to file T4 slips and summaries annually

✔ Must be registered before your first pay run

PST/QST Account

A PST/QST Account is used for:

✔ PST (Provincial Sales Tax) – Required in provinces like BC, SK, MB

✔ QST (Quebec Sales Tax) – Required if you sell to customers in Quebec

✔ Collect and remit provincial tax on taxable goods/services

✔ File PST/QST returns as required by the province

✔ Stay compliant with provincial tax laws

GST/HST Account

A GST/HST account is used for:

✔ Collect, File, or Claim Federal taxes

✔ Remit GST/HST to the CRA

✔ Claim Input Tax Credits (ITCs) for GST/HST paid on business expenses

✔ File GST/HST returns (monthly, quarterly, or annually)

✔ Stay compliant with Canadian tax laws if your revenue exceeds $30,000 annually

Why Choose Us to Set Up a Corporate Tax ID (RC) Account?

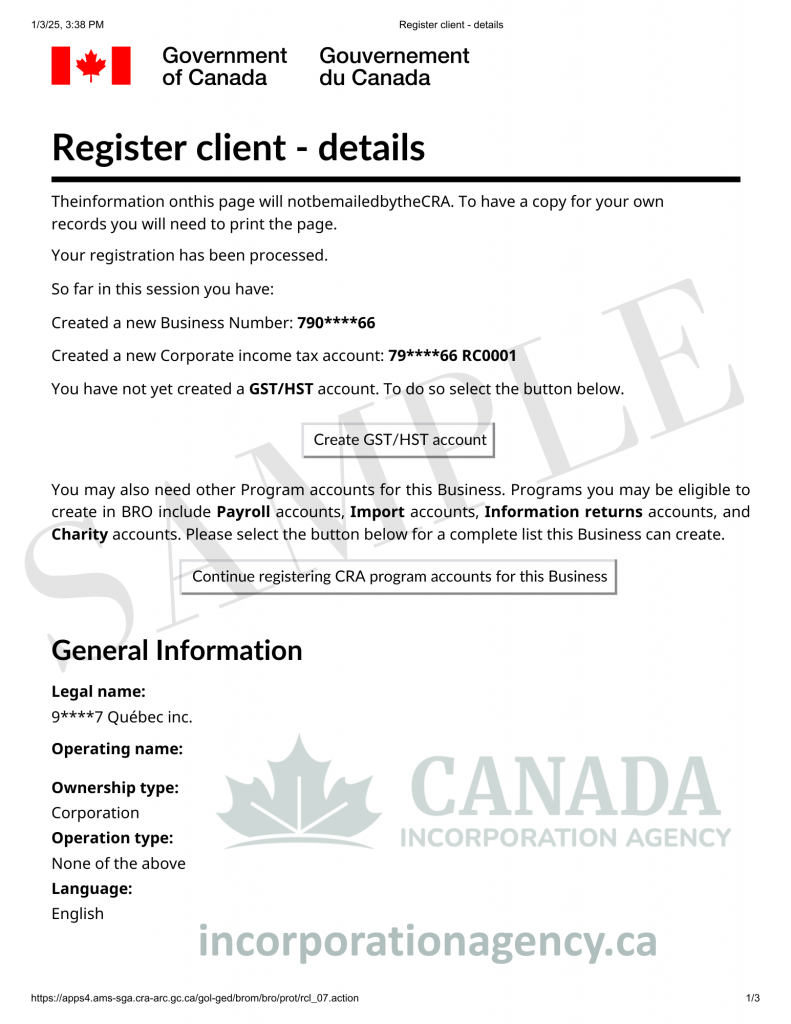

Need your Corporate Tax ID account registered and set up? We set you up for success with our Corporate Tax ID services quickly and accurately! Typically, your corporation income tax program account will include the letters RC and a four-digit reference number.

Here’s what sets our services apart:

- Seamless RC account filing via CRA – We handle the registration of your corporate income tax account through CRA’s Business Registration Online (BRO), ensuring full accuracy and compliance.

- All required documents? We've got you – We confirm that your incorporation certificate, jurisdiction, date, and business name are correct before filing—preventing registration delays.

- Support for non‑resident corporations – Whether you're operating from within or outside Canada, we assist in registering a corporate income tax account tailored to your legal status.

- Helpful for new and existing BNs – Whether you're registering a new BN or adding an RC account to your existing BN, our process is optimized to make it seamless.

Quick. Compliant. Done Right the First Time.

Get your Corporate Tax ID In

Just 3 Simple Steps

Share Your Details

Submit your legal name, certificate/jurisdiction of incorporation, date of incorporation, and business number (or request one). We confirm all information to meet CRA requirements

We handle the filing

Our team registers your corporate tax account linking it under your Business Number. If needed, we also register your BN simultaneously.

Receive your information

Once processed, CRA issues your 15-character account ID, formatted like 123456789 RC 0001. We email it directly—ready for your annual T2 return and instalment filings.

What Our Clients Are Saying

Trustindex verifies that the original source of the review is Google. Very helpful. Awesome experiencePosted onTrustindex verifies that the original source of the review is Google. my experience with Brianna has been phenomenalPosted onTrustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!

Learn More About Corporate Tax ID's and Registering Wth Our Informative Video Below

Frequently Asked Questions

What is a corporate tax (RC) account?

This is your CRA-managed account for reporting and remitting corporate income tax. It’s identified by your BN, “RC” code, and reference number. e.g., 123456789 RC 0001.

Who needs the RC account?

Any federally or provincially incorporated entity (or non-resident corporation conducting business in Canada) must register for an RC account.

Can I file taxes before I receive my account number?

It’s best to wait until you receive the official RC account identifier before filing your T2 return or making instalments.

When is my corporate tax return due?

Your T2 corporate return is due within 6 months after your fiscal year-end. Instalment payments are typically required monthly or quarterly.

What if directors change or aren’t resident in Canada?

CRA requires up‑to‑date director information, including SIN and residency status. Non‑resident directors must declare status via CRA communication.

Latest News & Blog Posts

How to Do a Land Title Search in Ontario: The Complete and Free Beginner’s Guide

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Federal Name Approval Process: Everything You Need to Know

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

BC Name Approval Guide: How to Register Your Business Name in British Columbia

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

Ontario Articles of Amendment: Complete Guide for 2026

If your Ontario business needs a makeover – this article is for you. Perhaps you

How to Make Changes to Your Business in Canada: Filing a Notice of Change

Running a business is like being the captain of a ship. Sometimes you need to

How to Register a General Partnership in PEI: Your Guide 2026

If you and your friend have a brilliant business idea, and you want to team