Starting up is exciting! If you’re looking to open a business in Alberta, you’ve come to the right place. What we have here is a step-by-step guide that will walk you through all the things you need to know about Alberta business registration, from choosing your business structure to getting all of your documents sorted out.

Whether you are opening a retail storefront, building a consulting firm, or creating the next tech behemoth, discovering how to register a company in Alberta is your first crucial move toward success.

Understanding Business Registration in Alberta

Before we go into the details of registration, let’s define what registering a business really means. Registering a business means you’re formally informing the government the following statement: “I’m going to start a company!” This makes your business legitimate and it becomes your prerogative to do business within the province of Alberta.

The Alberta business registry is the database where all the businesses in the province receive entry. Just think of it as a giant directory that maintains records of all the companies operating in Alberta.

Why Register Your Business in Alberta?

You may ask yourself, “Is registration really necessary?” Here’s why it’s important:

- It’s the law: Most businesses require registration to be lawful.

- Protect your business name: Registration prevents people with similar names from using it.

- Opens doors: You require registration to open a bank account, obtain loans, and recruit workers.

- Builds trust: Clients trust more when dealing with registered companies.

- Tax purposes: One must be registered in order to file business taxes correctly.

Types of Businesses You Can Register in Alberta

Alberta lets you pick among many business types. Each of them comes with rules, advantages, and regulations. Let us explain them in simple terms.

This is the simplest business type. Sole proprietorship implies you’re the only owner, and you run everything yourself.

Advantages:

- Inexpensive and simple to start

- You control all decisions

- Simple tax filing (business income reported on business return; you do the payroll)

- Less paperwork than other business types

Disadvantages:

- You are personally responsible for all business debts

- If you’re sued by someone, you can lose your personal assets

- Harder to get business loans

- Business ends if you pass away or can’t work

Best For: Freelancers, consultants, little shop owners, and all new solo low-risk businessmen.

A partnership exists when two or more individuals share and operate the business. There are two forms:

All the partners equally enjoy profits and responsibilities/debts (or according to the terms of the partnership agreement).

Advantages:

- Easy to set up

- Share the workload and skills

- More people to invest money

- Partners can support each other

Disadvantages:

- Each partner is responsible for what the other partners do

- Disagreements can hurt the business

- Personal assets are at risk

- Partnerships can be tricky if someone wants to leave

This kind of business registration has two types of partners:

General partners: Manage the business and has an unlimited liability

Limited partners: They invest funds but do not operate the business, and their risks are limited to the funds they contributed

Best For: Individuals beginning with friends, relatives, or professional business associates with whom you feel confident. Suitable also for professional organizations such as law practices or doctors’ offices.

A corporation is a separate legal entity from its owners. This means the business is its own “person” in the eyes of the law.

Advantages:

- Limited liability (your personal assets are protected)

- Easier to raise money from investors

- Business continues even if owners change

- Possible tax advantages

- Looks more professional to clients and partners

Disadvantages:

- More expensive to set up and maintain

- More paperwork and regulations

- Double taxation (corporation pays taxes, then shareholders pay taxes on dividends)

- More complex accounting required

Best For: Businesses that plan to grow big, need investor funding, or have higher risk of lawsuits.

Let’s compare the different business structures in Alberta:

Feature | Sole Proprietorship | Partnership | Corporation |

|---|---|---|---|

Number of Owners | 1 person | 2 or more people | 1 or more shareholders |

Government Fees | $60 | $60 | $275+ |

Setup Complexity | Very Easy | Easy | Complex |

Liability Protection | None (unlimited personal liability) | None (unlimited personal liability) | Yes (limited liability) |

Taxation | Personal tax rate on business income | Partners pay personal tax on their share | Corporate tax rate, then personal tax on dividends |

Paperwork Required | Minimal | Minimal | Extensive (annual returns, meetings) |

Registration Time | Instant (online) | Instant (online) | 1-3 business days |

Raising Money | Difficult | Moderate | Easier (can sell shares) |

Life of Business | Ends when owner quits/dies | Ends when partners dissolve it | Continues indefinitely |

Best For | Freelancers, small shops, low-risk solo ventures | Professional practices, small partnerships | Growing businesses, higher-risk ventures |

Control | Full control | Shared control | Controlled by directors/shareholders |

Tax Planning Options | Limited | Limited | More flexible |

Credibility | Lower | Moderate | Higher |

What You Need Before You Register in Alberta

Business Name

You’re going to require a unique name for your business. The following rules apply:

Sole proprietors and Partnerships: May give your own name or register a trade name

Corporations: Needs to have a distinctive name used by no other company in the province of Alberta

Naming Tips:

- Make it memorable and simple to spell

- Verify the availability for the domain name

- Avoid similar-sounding names to already established businesses

- Does not use prohibited terms such as “bank” or “university” without authority

- Conduct a name pre-search to see if your name is available and not conflicting with any other names.

Personal Information:

- Your complete full name

- Home Address

- Contact details (email and phone)

Business Information:

- Business Address (even if it’s home)

- Mailing Address (if different)

- Your business activities

Step-by-Step Guide to Register a Business in Alberta

Let’s move on to the practical steps of business registration in Alberta. The good news is that you can register an Alberta business online which makes it quite simple!

Step 1: Choose Your Business Structure

Decide which business type suits you best. Ask yourself:

- How much risk you’re comfortable with

- Whether you want partners

- Your growth plans

- How much money you want to invest

- Tax implications

If you’re in doubt, consult with the Canada Incorporation Agency. Simply call us at 647-945-8893, and our experienced filing agent is going to help you to choose the right business structure.

Step 2: Search for Your Business Name

Before registering, check if your chosen name is available. Here’s how:

- Visit the Canada Incorporation Agency website (incorporationagency.ca)

- Use the NUANS search tool

- Search the corporate registry Alberta database for similar names

- Make sure no one else is using your exact name

You can also check the trusted NUANS report providers like Nuans Canada Online or Online Business Registry.

Step 3: Register Your Business Online

The easiest way to handle business registration in Alberta is through the Canada Incorporation Agency service.

For Sole Proprietorships and Partnerships:

- Go to the Canada Incorporation Agency website.

- Click on “Business Registration”

- Select “Sole Proprietorship”, “Alberta Sole Proprietorship”

- Fill out the registration form with:

- Your business name

- Business address (must be a physical address in Alberta).

- Owner/partner information

- Business activities

- Alberta agent for service

- Pay the registration fee

- Submit your application

You’ll get your confirmation email immediately!

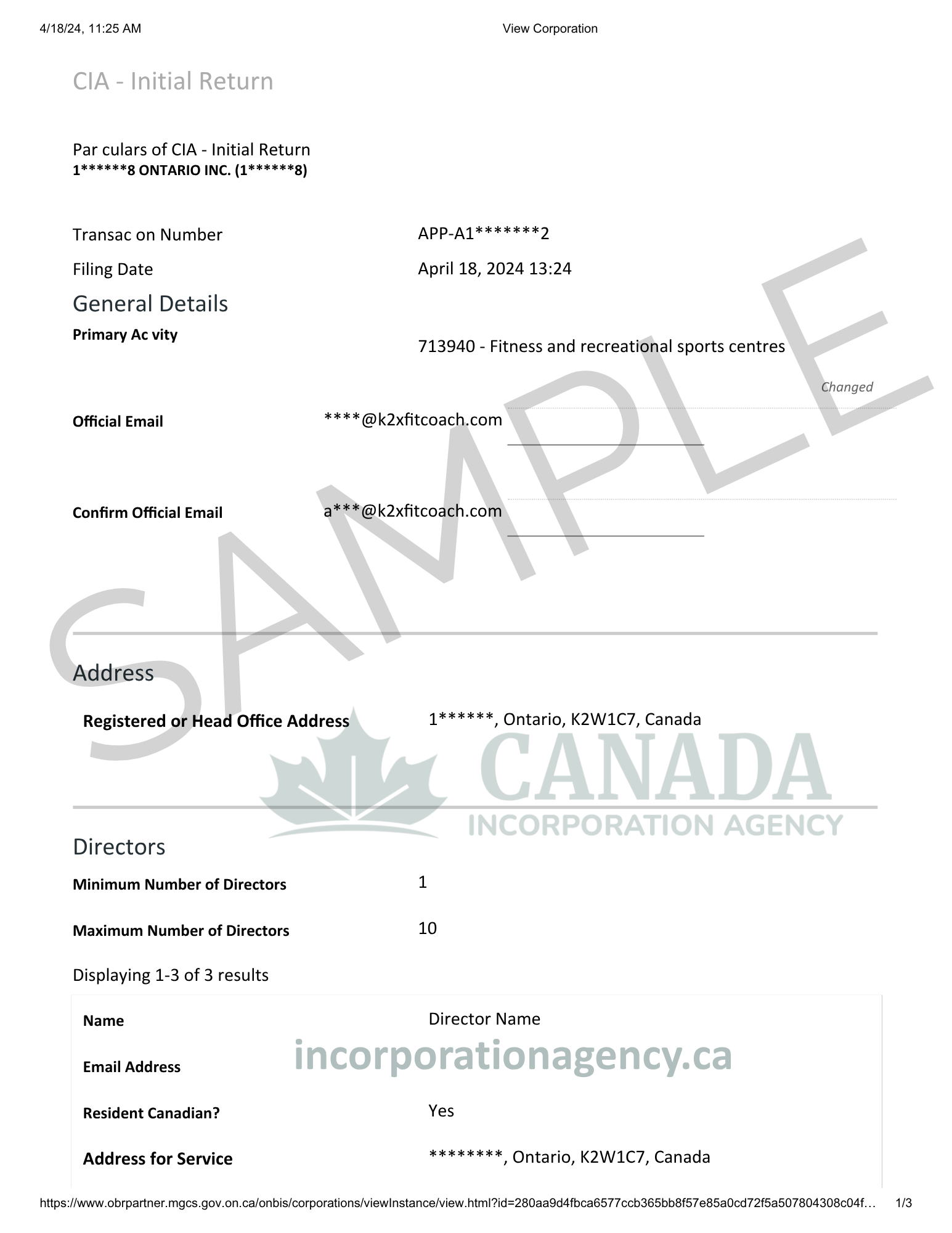

For Corporations:

Registering a corporation is pretty similar:

- Visit the Canada Incorporation Agency website

- Select “Incorporate”, “Incorporate in Alberta”

- Complete the online form with your information:

- Choose: a numbered or named corporation

- Business address (must be a physical address in Alberta).

- Directors/officers/incorporators information

- Business activities

- Choose the share structure

- Alberta agent for service

- Select the Bylaws & Minutes

- Upload your NUANS name search report

- Pay the incorporation fee

- Submit your application

We will send your confirmation email immediately!

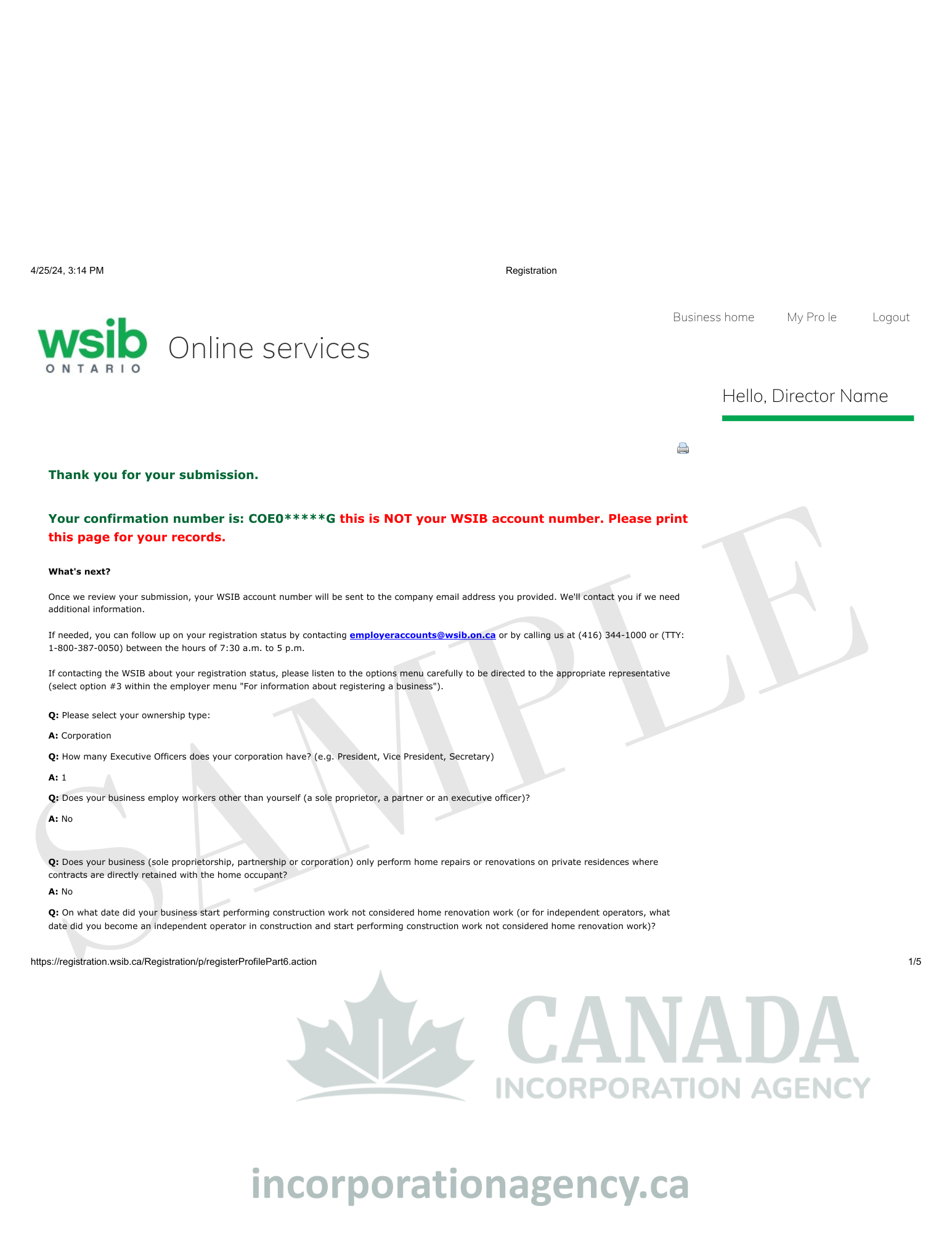

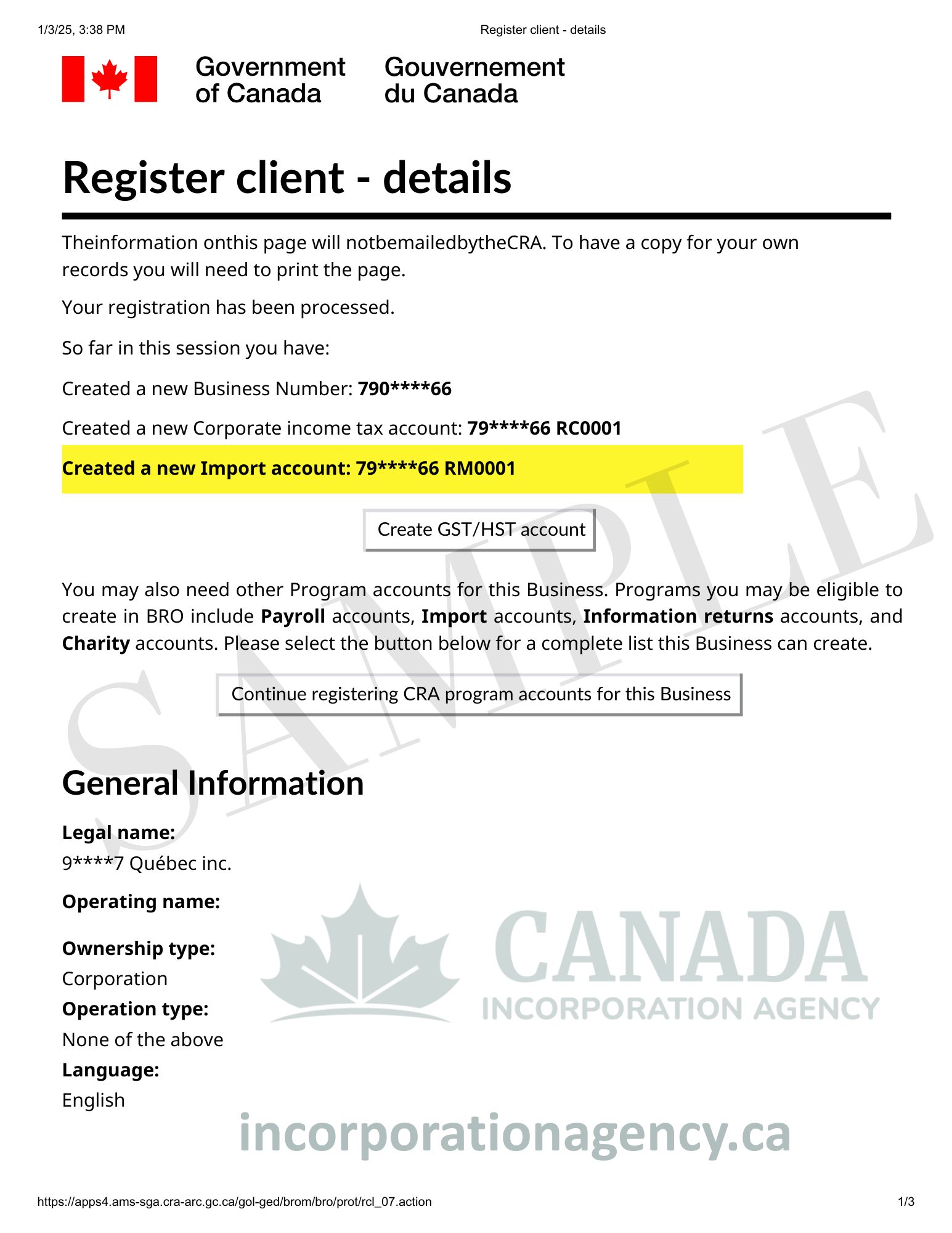

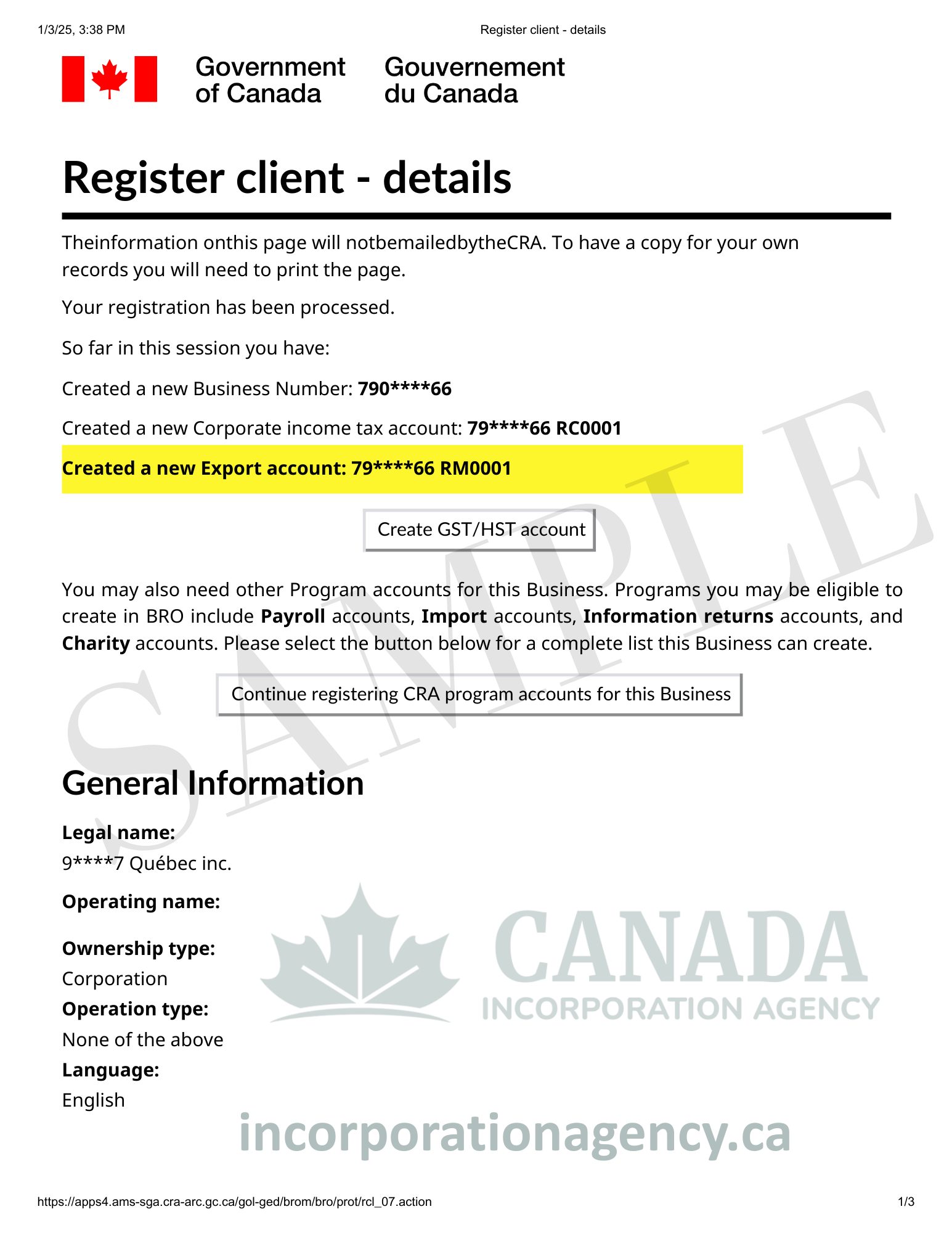

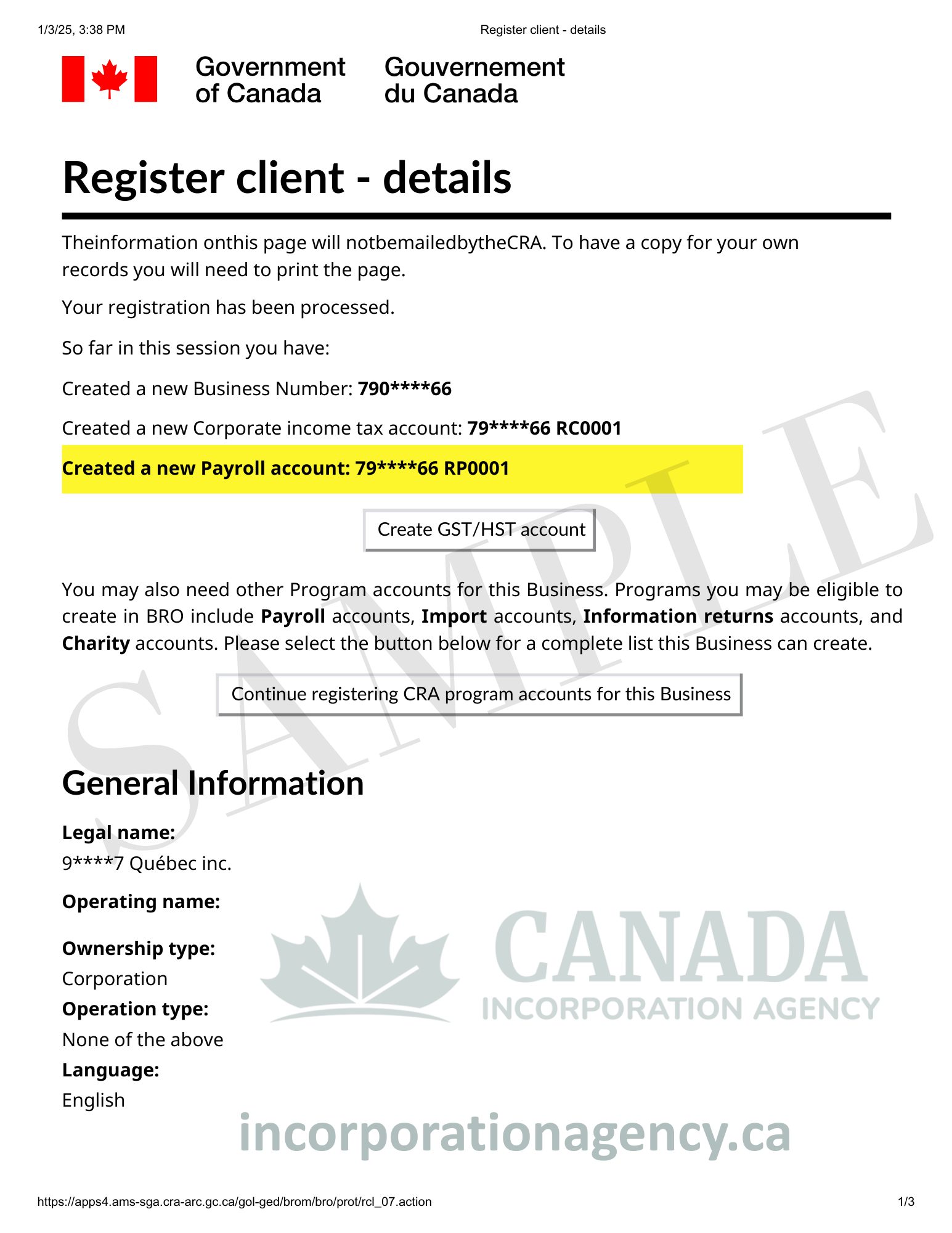

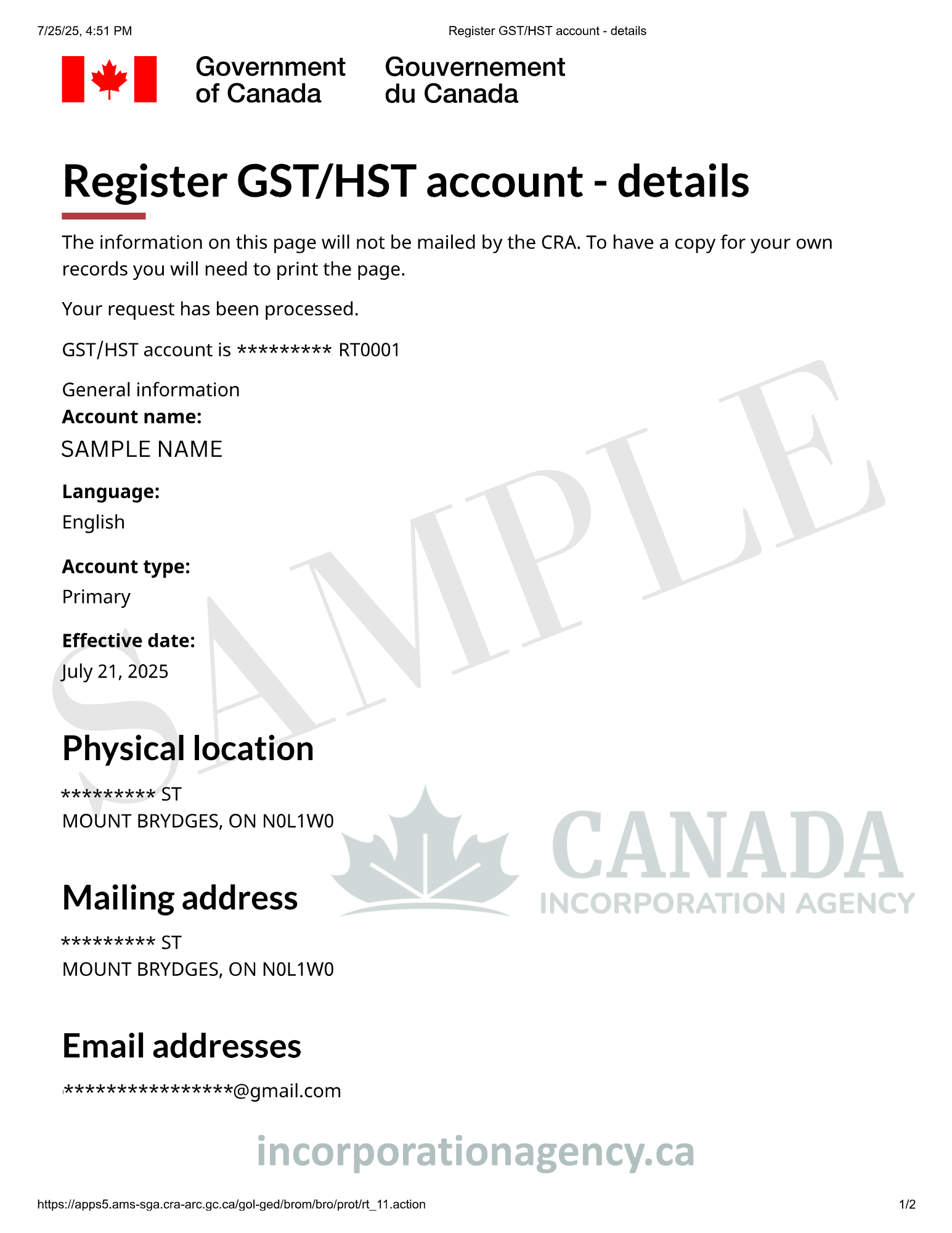

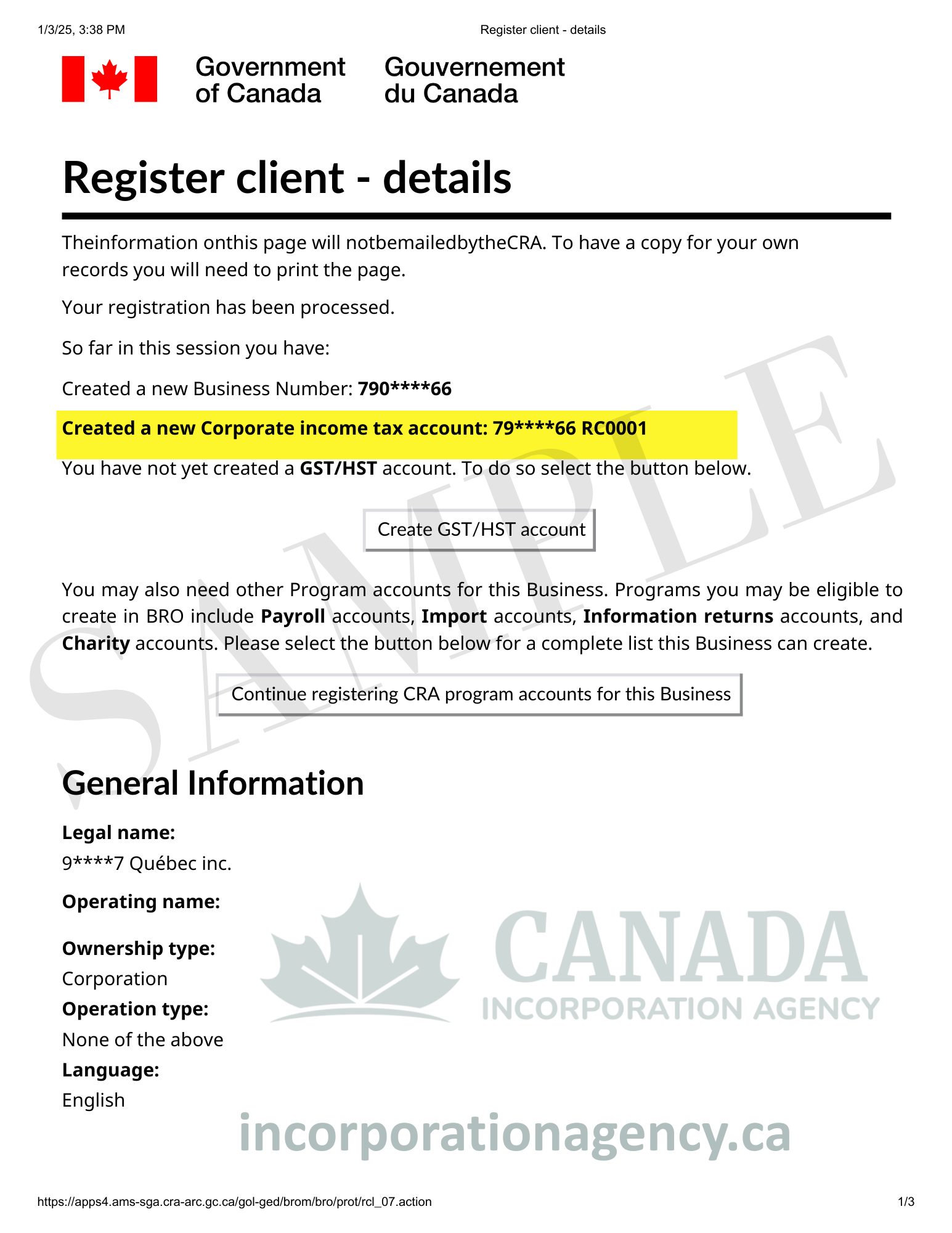

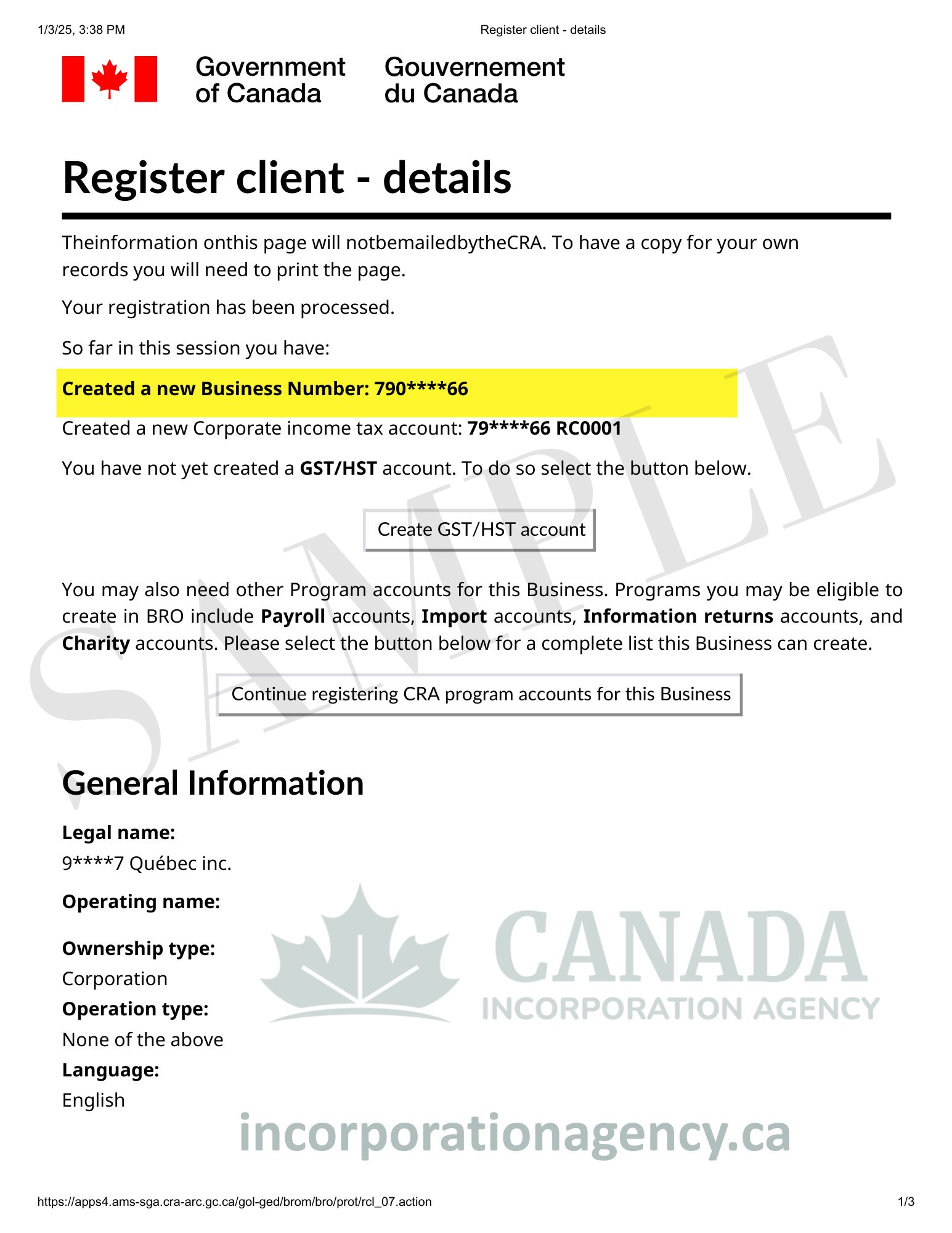

Step 4: Sign Up for a Business Number (BN)

Once you register at the provincial level, you require a Business Number for a Federal Government. This is used for:

- GST/HST registration

- Payroll accounts (if you’re hiring employees)

- Import/Export accounts

- Corporation Income Tax accounts

How to get your BN:

- Visit the Canada Incorporation Agency website

- Select the “Business Growth” service, and after that select “CRA Business Number”.

- Fill out the online form and complete the payment.

- We will email your 9-digit Business Number to you.

Step 5: Register for GST/HST

If your company earns more than $30,000 revenue annually, you would be required to register for GST/HST. Even if you earn less, you may voluntarily register.

Step 6: Register for Provincial Payroll Tax Account

If you’re hiring employees, register with the Alberta government for:

Step 7: Get Necessary Permits and Licenses

Depending on your business type, you might need additional permits:

- Food businesses: Health permits from Alberta Health Services

- Construction: Safety codes permits

- Retail: Business licenses from your municipality

- Home-based businesses: Home occupation permits

- Professional services: Professional licensing (doctors, lawyers, accountants, etc.)

Check with your city or town hall for local requirements.

Maintaining Your Business Registration

Registration is not a one time thing. You have to keep your details up to date.

Annual Renewals

Most companies have to register again each year:

- Sole proprietorships and partnerships: Depending on the province, for example, in Ontario: must renew every 5 years.

- Corporations: File the corporate annual return each year.

Updating Information

You need to re-register in 14 days if:

- You change your business address

- Partners join or leave

- You change your business name

- Directors change (for corporations)

- Corporate shares are transferred

Cancelling Registration

If you close your business, cancel your registration to avoid annual fees. This also involves:

- Closing your Business Number with CRA

- Cancelling GST/HST registration

- Filing final tax returns

- Cancelling business licenses and permits

Myths and Facts About Business Registration in Alberta

Let’s clear up some common misconceptions:

Myth No. 1: “Only large companies need to register”

FACT: Every business, large or small, needs to register if it’s a for-profit business.Whether you’re a free-lance writer or a restaurateur, you will need to register.

Myth 2: “I can use any name I want for my business”

FACT: A business name has to be original and distinct from existing business names. It also cannot incorporate some prohibited words unless authorized. The Alberta Business Registry rejects the names that don’t meet the requirements.

Myth 3: “Once I register, I’m done forever”

FACT: Registrants are required to have annual renewal and need to change their information whenever it happens. Registration is a continuous duty.

Myth 4: “Incorporating keeps me safe for all liability”

FACT: Although corporations provide liability protection, directors may also be personally liable for fraud, negligence, or failure to remit taxes and wages.

Myth 5: “I don’t have to register if I earn less than $30,000”

FACT: The $30,000 threshold is for GST/HST registration, not for business registration. Most companies are required to register irrespective of income.

Myth 6: “Registration gives me automatic trademark protection”

FACT: Business name registration and trademarks are different. Business registration secures your name in Alberta but the trademarks secure nationally and need to be registered separately for the Canadian Intellectual Property Office.

Myth 7: “I won’t be able to work unless my registration is approved”

FACT: With online registration for partnerships and sole proprietorships, approval is immediate. You may immediately begin conducting business. It may take a few days for corporations but you may begin making preparations in the meantime.

Myth 8: “All business have the same taxes”

FACT: Business structures affect tax rates and rules. Sole owners are taxed personal income tax rates for business activity. Business corporations are taxed the lower corporate tax rates, particularly for small businesses.

Myth 9: “I need a business license to register my business”

FACT: Provincial business registration and business permits (municipal) are different. You register provincially first and obtain local permits when required. They are different processes serving different purposes.

Myth 10: “If my business fails, I’ll be in debt forever”

FACT: This will depend upon your business form. Sole owners and partners are unlimitedly liable but corporations and limited partners are shielded. However, personally guaranteed loans are your responsibility regardless of structure.

Frequently Asked Questions (FAQ)

Q: How long does it take to register a business in Alberta?

A: If a business is registered in Alberta online, sole proprietorships and partnerships are immediately registered. Corporate filings take around 1-3 business days when done online or longer by mail.

Q: Can I incorporate my business if I am not a citizen of Canada?

A: Yes. Business corporations may be registered by non-Canadians. For federal corporations, there is a requirement to have a minimum of 25% directors that are residents in Canada. There is no residency requirement for provincial corporations, sole proprietorships and partnerships.

Q: Do I need a lawyer to register my business?

A: Not necessarily. Partnerships and sole proprietorships are easy enough to register yourself online. For corporations, while it’s not necessary, most use third parties, like Canada Incorporation Agency, so it’s done properly, especially for the harder cases.

Q: Can I register the same business name in different provinces?

A: Business names are registered provincially. If you want to operate in multiple provinces, you need to register in each province. Your name might not be available in other provinces even if it’s available in Alberta.

Q: What’s the difference between a business name and a trade name?

A: Your legal business name is what you register. A trade name (or “doing business as” – DBA) is a business name that you advertise. For example, your legal name may be “John Smith” but you do business as “Smith’s Plumbing Services.”

Q: How do I check if a business name is taken?

A: Conduct a name pre-search, using some trusted service providers like Canada Incorporation Agency. You will have to provide a NUANS report to get your name reserved.

Q: Can I change my business structure later?

A: Yes! Most companies begin as sole proprietorships and incorporate later. But this means that you have to cancel your old registration and register a new one and you have to pay fees.

Q: What if I fail to renew my registration?

A: Your registration expires and you’re no longer legally operating. The corporate registry Alberta may cancel your registration. You’ll need to re-register and may face penalties.

Q: Do I need a physical office to register?

A: Yes. You need to have a physical address to register a business in Alberta. Only P.O.Box is not acceptable. In case, you don’t have a physical address, you can use this registered office address service:

Q: Can I register for more than one business?

A: Yes. You may have several businesses. Each has to be registered. However, you might be able to use the same Business Number for multiple businesses.

Q: What is an extraprovincial registration?

A: If your business is incorporated elsewhere in the province but wants to do business in Alberta, you need a provincial registration. This tells Alberta your business exists elsewhere but will do business here.

Q: Should home-based business companies register?

A: Yes, for the most part. Even if you work from your home, you are required to register your business in the Alberta business registry. You will also need a home occupation permit in your town.

Conclusion: Your Journey Starts Here

Starting a business in Alberta is an exciting experience. Although the registration procedure may seem difficult at first, it’s actually quite straightforward once you understand the steps. The key is to:

- Select the appropriate business structure for your case

- Gather all related information and paperwork

- Use the Canada Incorporation Agency for a faster processing

- Stay on top of renewals and updates

- Seek help when you need it

Keep in mind that thousands of Albertans begin new businesses annually, and the government has made the process as simple as possible. With services such as the Alberta corporate registry online, most registration processes may be done from your home computer. Fear of paperwork shouldn’t stop you from having business goals. Walk through it step by step by using the available resources and don’t be afraid to ask for assistance from business advisors,like Canada Incorporation Agency. Give us a call at 647-945-8893, or visit our website at incorporationagency.ca and our experienced filing agents will guide you every step of the way.

Good luck with your new business! You’ve got this!