Ah, Prince Edward Island. Known for its red sand beaches, fresh seafood, and, of course, Anne of Green Gables. But beyond the charming scenery, PEI is also a great place to launch a small business. If you’re looking to start a business in Prince Edward Island, one of the simplest and most affordable options is setting up a sole proprietorship PEI.

Now, don’t panic—this isn’t some bureaucratic nightmare where you’ll drown in paperwork. Registering a sole proprietorship in PEI is straightforward, fast, and cheaper than your weekend lobster boil (well, almost). In this guide, we’ll walk you through everything you need to register sole proprietorship PEI, with some humor sprinkled in to keep things light.

What is a Sole Proprietorship in PEI?

Think of a sole proprietorship as the “starter pack” of business ownership. It’s just you—no shareholders, no directors, no complicated annual meetings where people fight over who gets the last muffin.

Key features:

- One owner (you!) runs the show.

- All profits are yours—yay!

- All debts are yours too—not so yay.

- Simple setup compared to incorporation.

In short: if you want to test the waters before committing to the big corporate world, sole proprietorship registration in PEI is your best friend.

PEI Sole Proprietorship vs Corporation

Now let’s see if the Sole Proprietorship is really right for you, or maybe you should consider Incorporating your business.

| Feature | Sole Proprietorship (PEI) | Corporation (PEI) |

|---|---|---|

| Ownership | Owned and operated by one individual | Owned by shareholders; managed by directors |

| Liability | Owner has unlimited personal liability for debts and obligations | Limited liability – shareholders’ personal assets are protected |

| Startup Cost | Low (~$90 for registration) | Higher (~$250+ for incorporation in PEI; more if federal) |

| Taxes | Income reported on owner’s personal tax return | Separate corporate tax return; potential tax advantages (lower small business tax rate) |

| Business Name Protection | Name registered only in PEI | Stronger name protection; federal incorporation provides Canada-wide protection |

| Paperwork & Compliance | Minimal paperwork, easy to maintain | Annual filings, corporate records, and compliance required |

| Continuity | Ends when the owner retires, closes, or passes away | Continues to exist regardless of ownership changes |

| Raising Capital | Limited to owner’s personal savings or loans | Can raise money by issuing shares or attracting investors |

| Decision-Making | Full control by the owner | Decisions made by directors and shareholders |

| Best For | Freelancers, small businesses, side hustles | Businesses planning to grow, scale, or attract investors |

Why Choose a Sole Proprietorship in Prince Edward Island?

Besides the obvious “easy and cheap” part, here are some solid reasons:

- Low startup costs: Keep that extra cash for marketing or maybe…a round of oysters.

- Full control: You call the shots—no waiting for shareholder approval.

- Easy taxes: File your business income under your personal tax return.

- Flexibility: If your side hustle grows, you can always incorporate later.

Steps to Register a Sole Proprietorship in PEI

So, how do you actually do this? Let’s break it down into bite-sized steps so you don’t get overwhelmed.

Step 1 – Pick Your Business Name

Your name matters. “Joe’s Plumbing” says reliable, while “Plumbtastic Unicorn Solutions” might confuse people (or attract a very niche audience).

- You can simply operate under your own legal name.

- Or, if you want something catchy, you’ll need to register a business name.

Pro tip: Check the Nuans Canada Online to make sure your name is available. You don’t want your future empire to be called “Not Really Dave’s Donuts.” We advise you to do a quick name search, using the Nuans Canada Online search system. In that way you will know for sure if there’re some conflicting names, it will save you a lot of money. You will also need to obtain a NUANS Reservation Report to register a name in Prince Edward Island. The report will reserve your name for 90 days. Please don’t include any legal suffixes like “inc.” or “ltd.” in the end of your name as this is an unincorporated business.

Step 2 – Fill Out the Registration Form

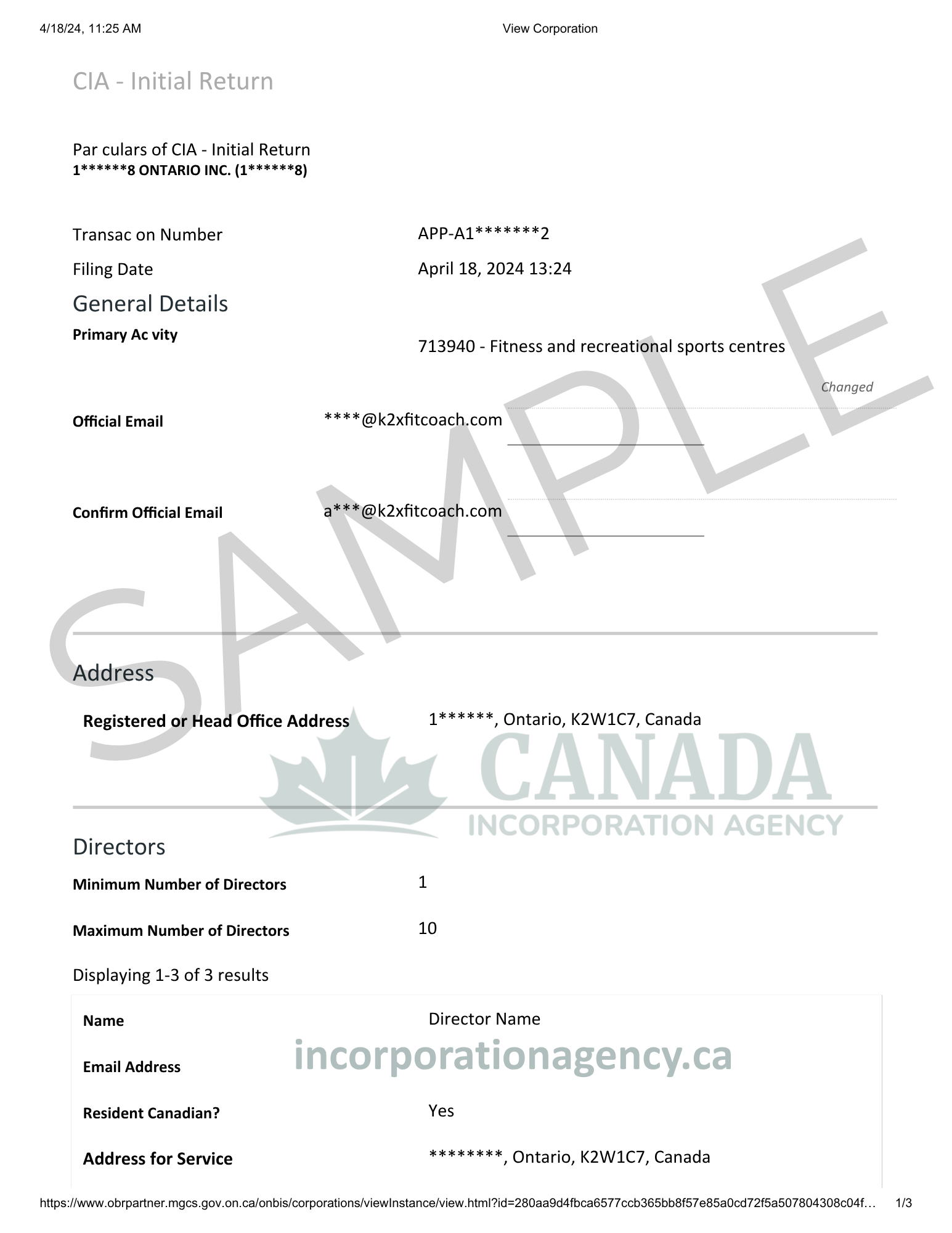

Head to the Canada Incorporation Agency website. The good news is that you can do it completely online, from the comfort of your home.

You’ll need:

- Your chosen business name.

- Your full legal name and contact info.

- The type of business you’ll operate.

- Your business address.

Step 3 – Pay the Registration Fee

Registration costs around CAD $300 (subject to updates). Compared to Netflix, that’s about half a year’s worth of entertainment—but here, you’re investing in yourself.

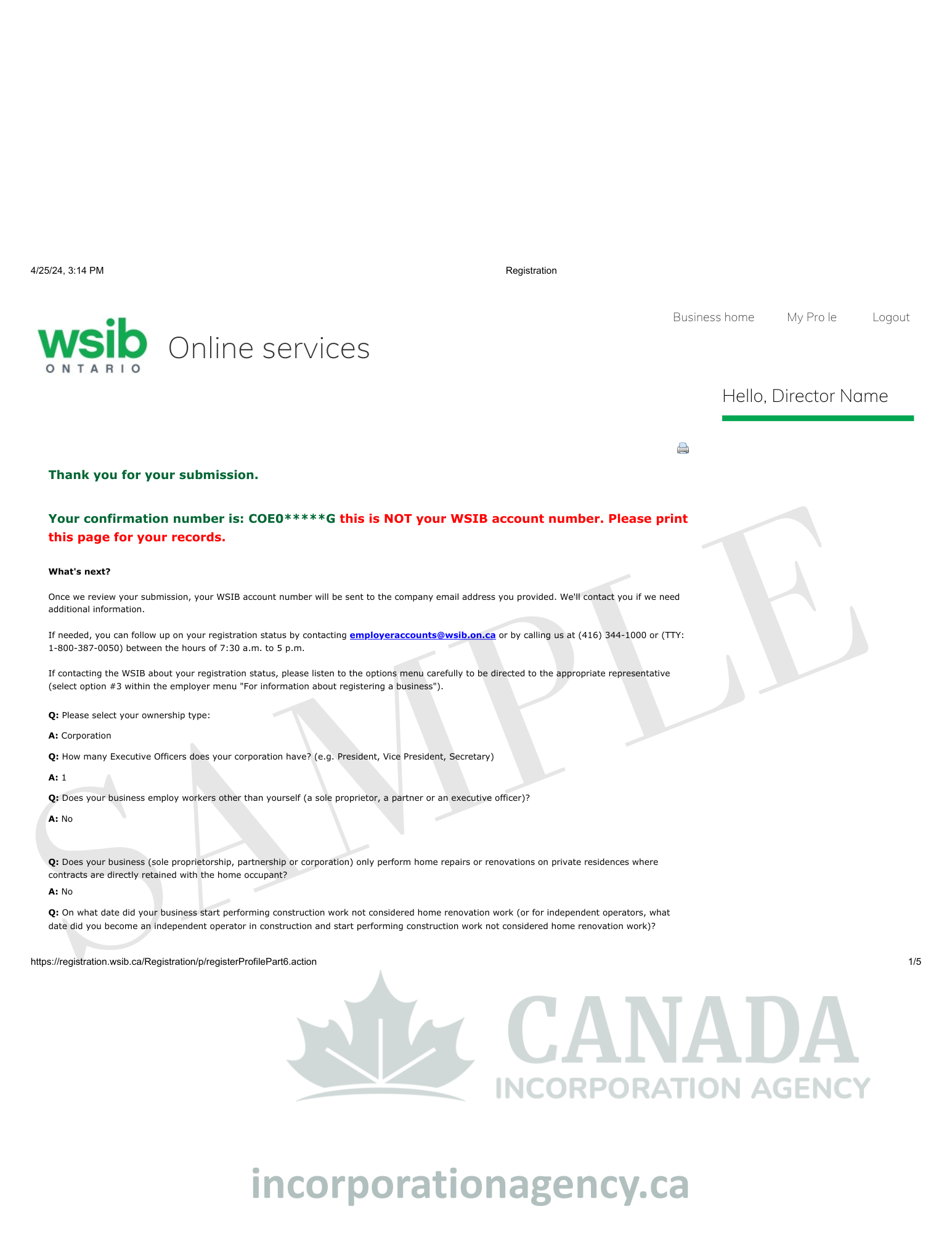

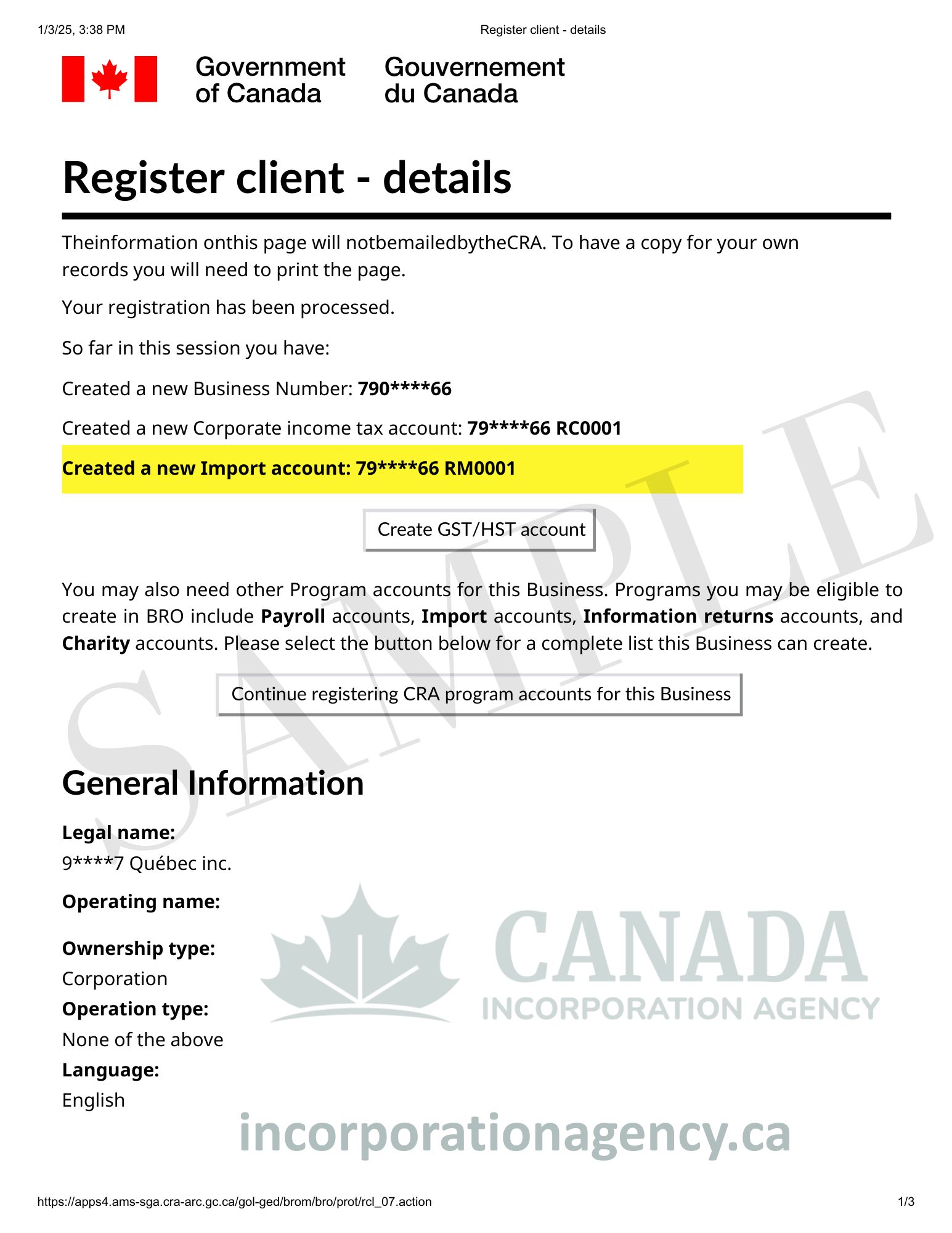

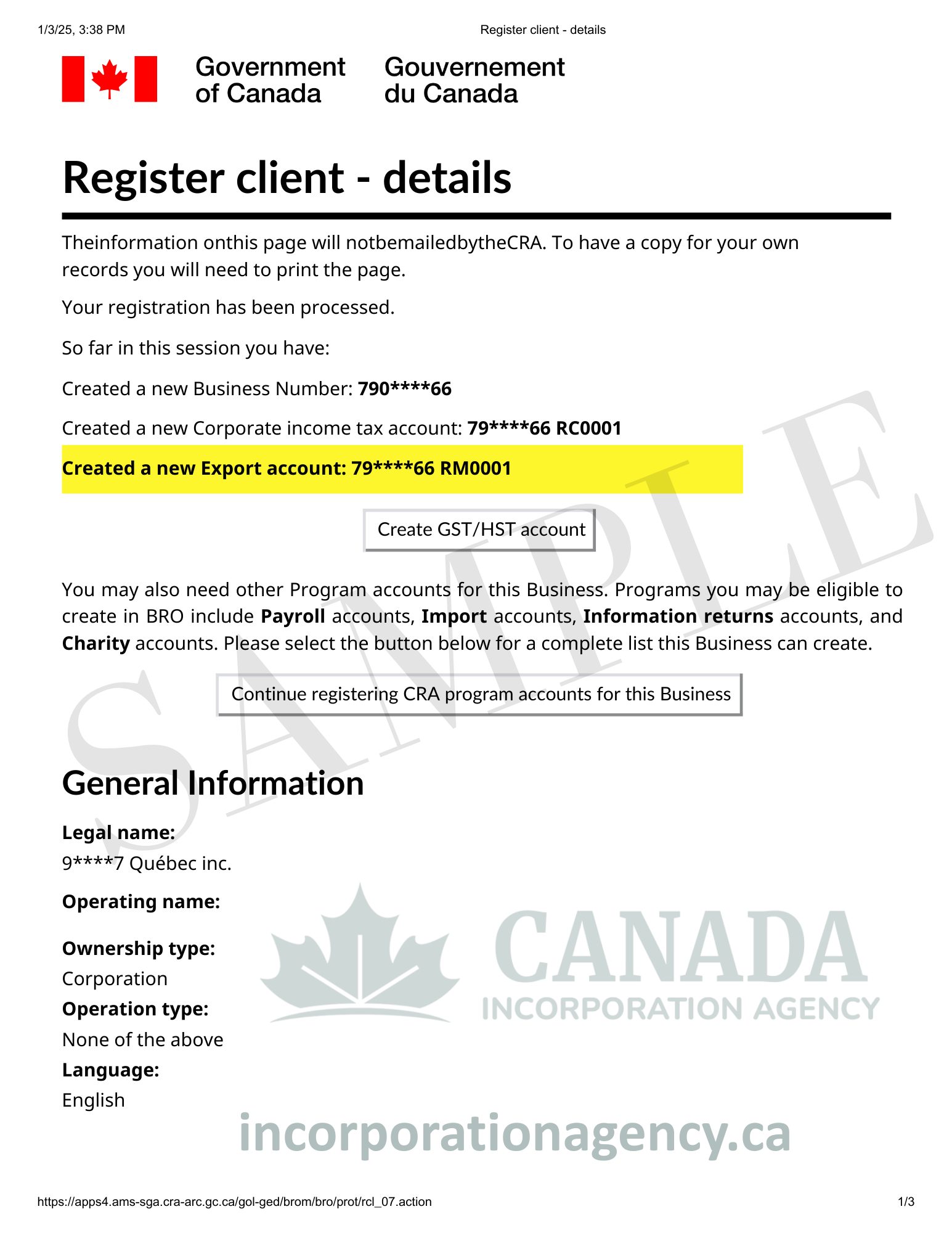

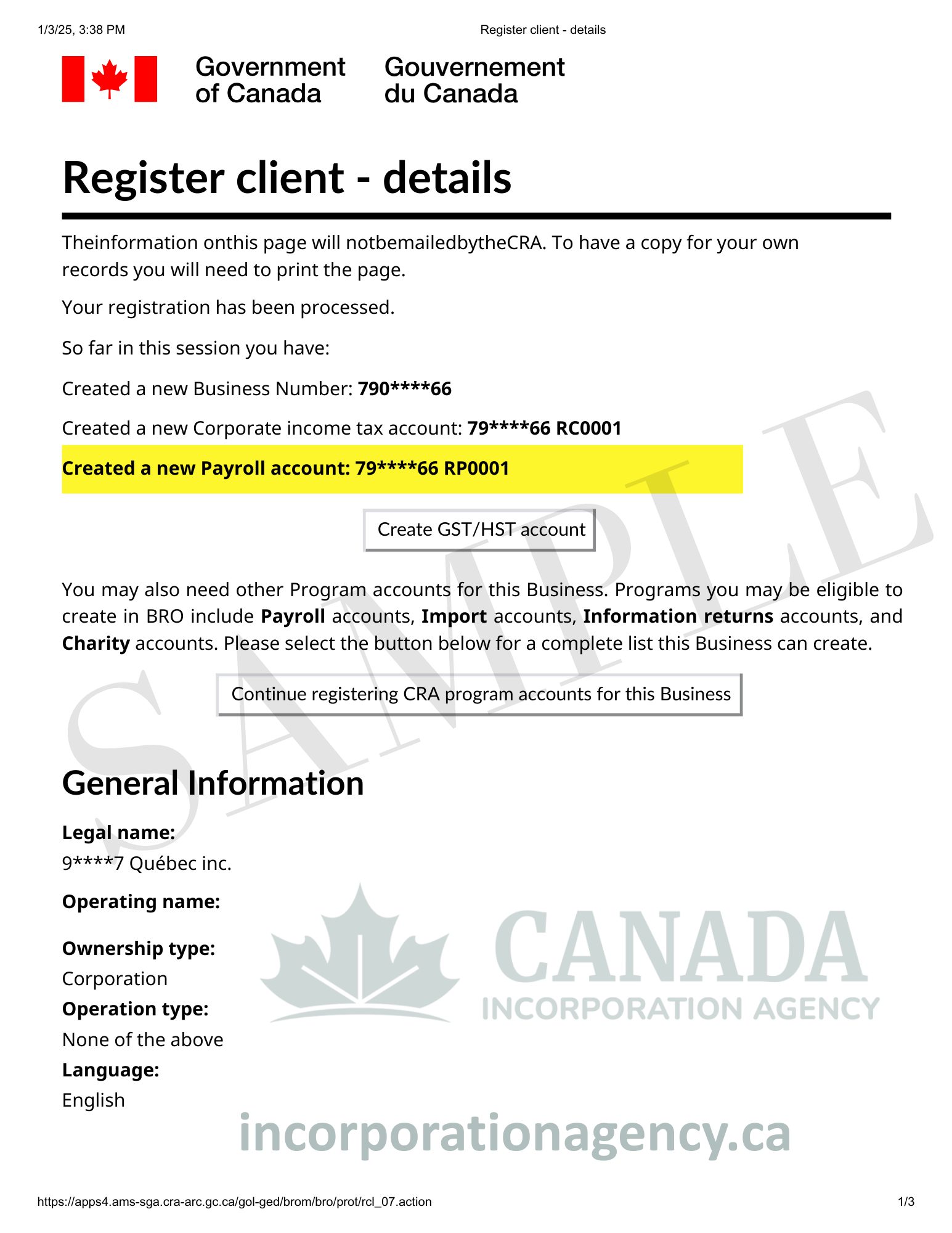

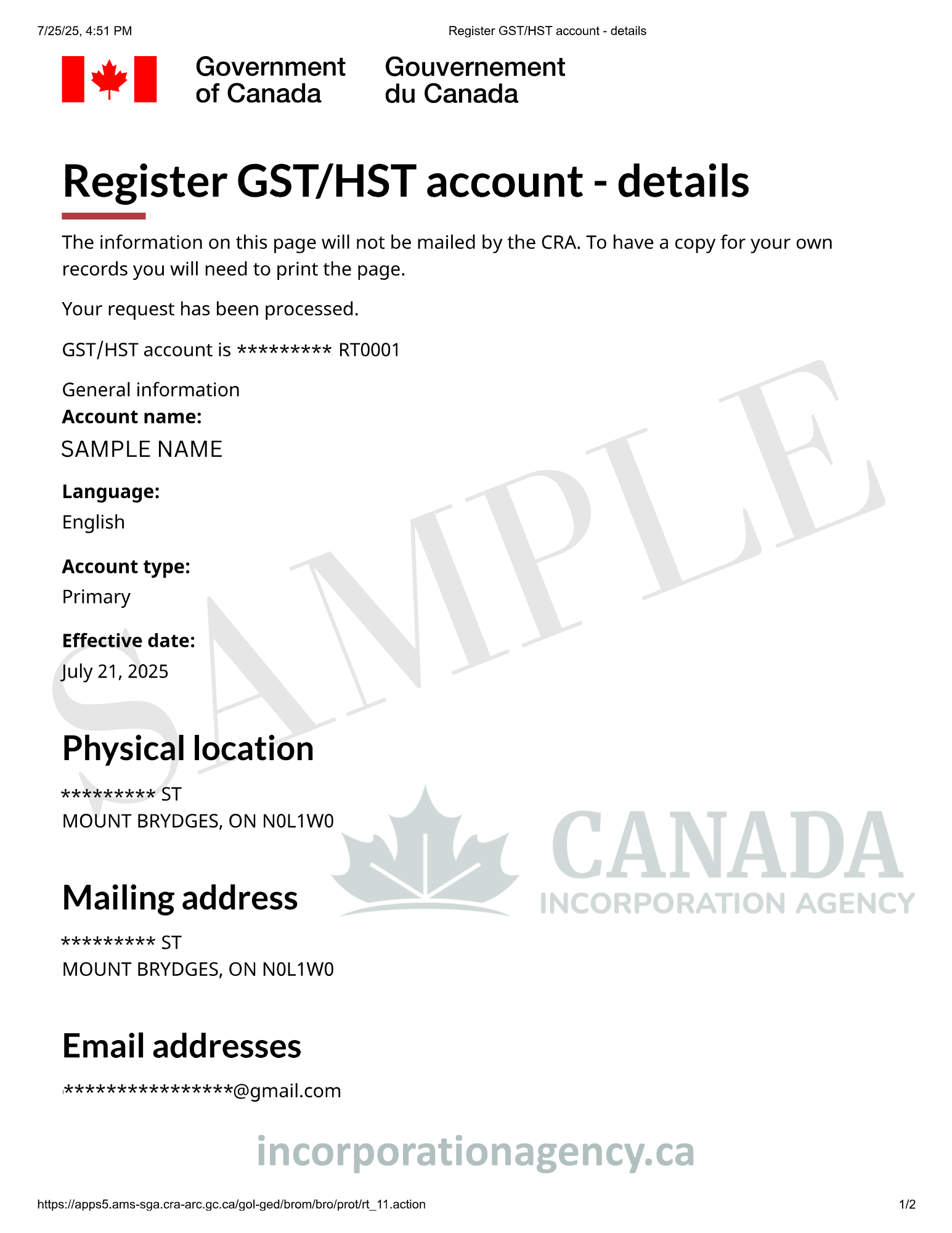

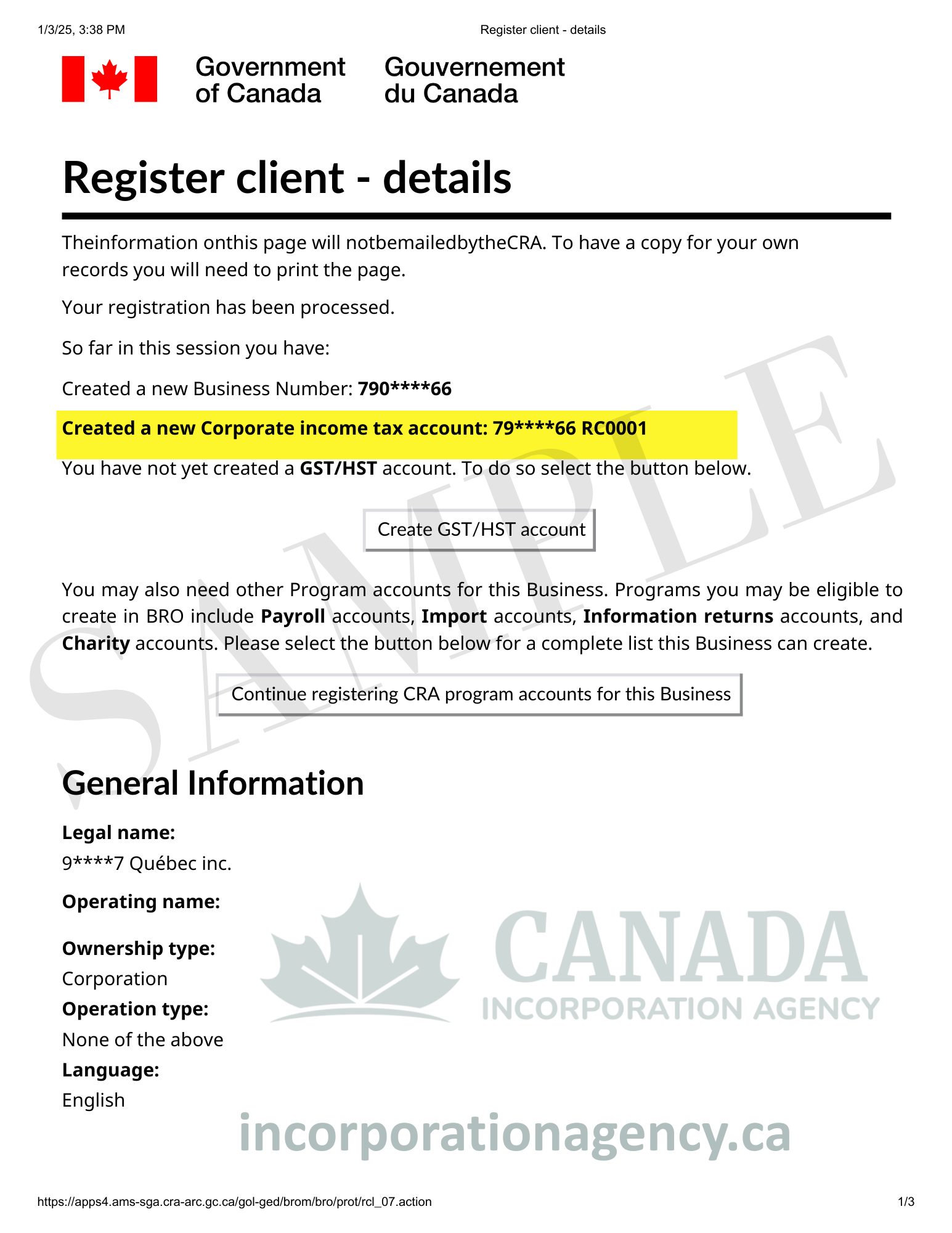

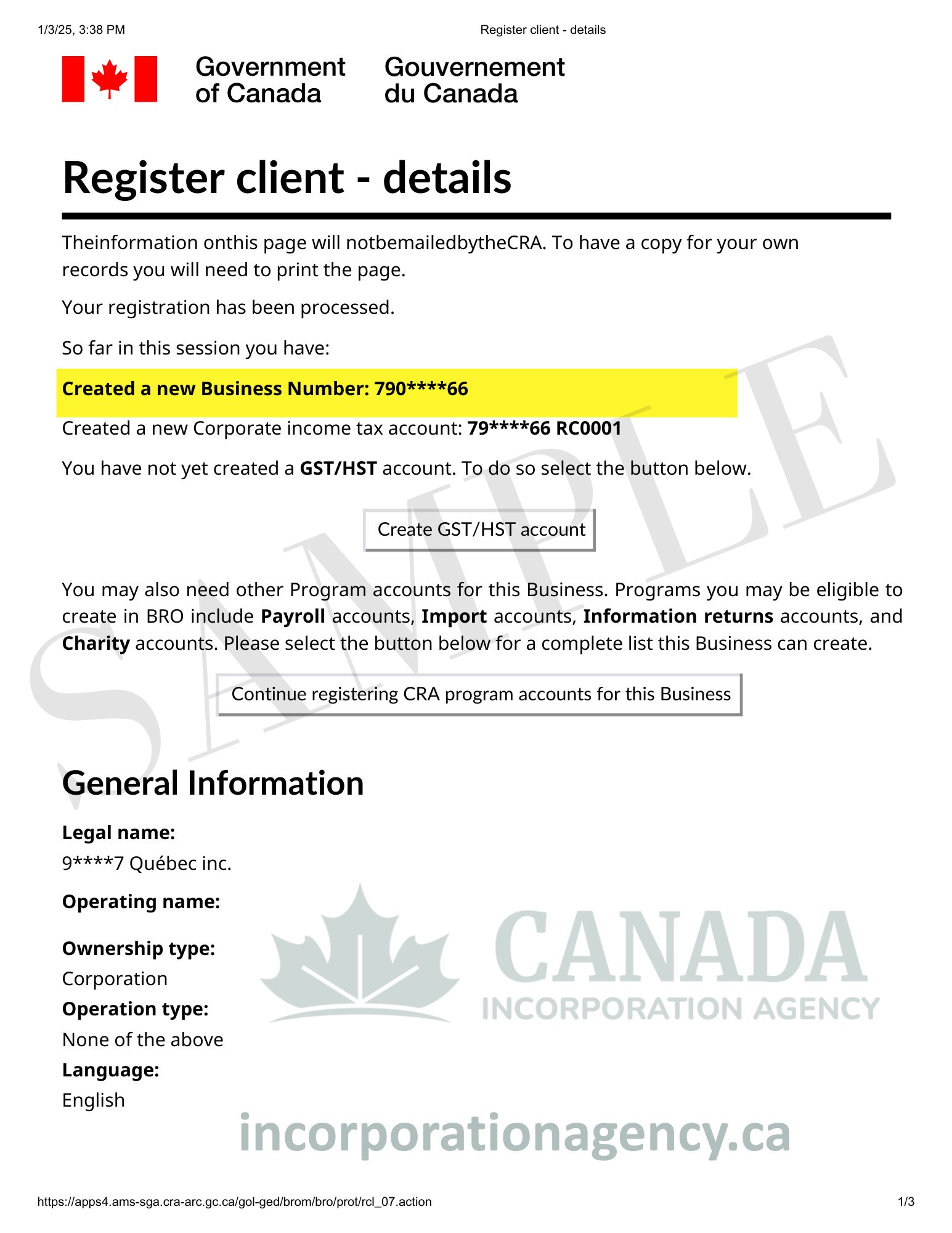

Step 4 – Get Your Business Number (BN)

Once registered, you may need a Business Number (BN) from the Canada Revenue Agency. This depends on whether you:

- Expect to earn over $30,000 annually (then you need a GST/HST account).

- Plan to hire employees (then you need a payroll account).

If you don’t want to waste your time in long waiting lines on the phone, just contact Canada Incorporation Agency at 647-945-8893 and we will be happy to assist you.

Step 5 – Check for Licenses or Permits

Some businesses (like restaurants, daycares, or health services) need additional licenses. Contact your local municipality to avoid “oops, I forgot” moments. You can also check the Biz Pal website that has information about all business licenses across Canada.

Step 6 – Keep Good Records

Grab a cute notebook, download accounting software, or hire an accountant. Just don’t toss receipts in a shoebox and hope for the best (future-you will not thank you).

Example of Registering a Sole Proprietorship in PEI

Meet Emily, a local baker in Charlottetown. She wants to open “Emily’s Sweet Treats” and sell her famous raspberry pies.

Here’s what she does:

- Emily searches the NUANS Canada database and confirms “Emily’s Sweet Treats” is available.

- She fills out the business name registration online, enters her details, and pays $300.

- Emily applies for a GST/HST account since she expects to exceed $30,000 in sales.

- She checks with the City of Charlottetown and applies for a food service license.

Within days, Emily is ready to bake, sell, and delight her customers with warm pie.

Renewing Your Sole Proprietorship in PEI

Here’s the catch: your registration doesn’t last forever. A PEI sole proprietorship needs to be renewed every three years.

Renewal process:

- Log in to the PEI business registry.

- Confirm or update your business details.

- Pay the renewal fee (similar to the initial one).

Treat yourself to a celebratory lobster roll—you’ve earned it.

FAQs About Sole Proprietorship in PEI

Do I need a lawyer to register?

Nope! You can do it yourself online. But if you’re unsure, a lawyer or business service provider can help.

How long does registration take?

If you register online, it can be approved within a few business days.

Do I need a separate bank account?

It’s not required, but highly recommended to keep your personal and business expenses separate.

What if I want to change my business name later

You can register a new business name at any time.

How often do I need to renew?

Every three years. Don’t forget, or your registration could lapse.

Final Thoughts

Registering a sole proprietorship PEI is one of the easiest ways to step into the world of entrepreneurship. It’s affordable, straightforward, and perfect for small ventures or testing a business idea.

So whether you’re baking pies like Emily, freelancing as a graphic designer, or opening a cozy café on the island, don’t wait. Register sole proprietorship PEI today and make your business dreams come alive.

And if you ever get overwhelmed, contact the Canada Incorporation Agency, visit our website or give us a call at 647-945-8893, and we will help to clarify all the information about business registration in PEI.