So, you’ve decided to take the leap from “just an idea” to “legally recognized empire builder” in the wonderful province of Manitoba? First of all, congratulations! Whether you want to open the next big tech startup in Winnipeg, a cozy bakery in Brandon, or a llama-rental business in rural Manitoba (hey, I don’t judge), you’re going to need to incorporate.

But don’t worry- incorporating in Manitoba doesn’t have to feel like deciphering hieroglyphics. I’ll walk you through the steps of how to register a Manitoba corporation and make the process feel way less boring. Grab a coffee (or something stronger—incorporation paperwork is a lot) and let’s dive in.

Why Incorporate in Manitoba?

Manitoba may not always be the first place that comes to mind when people think of “business hotspots,” but it’s actually a fantastic province for entrepreneurs. Here’s why:

- Affordable fees compared to some other provinces.

- Strong local economy fueled by agriculture, manufacturing, and tech.

- Credibility boost -customers and investors take you more seriously if you’re a legally recognized Manitoba corporation.

Plus, imagine telling your friends at dinner parties: “Oh, I’m the director of a Manitoba corporation.” It sounds fancy, doesn’t it?

Step-by-Step Guide to Incorporating in Manitoba

Okay, let’s break down how to register a business in Manitoba without making your brain melt.

Step 1: Name Your Business

Your business needs a name that’s unique, legal, and not something like “Best Business Ever 12345.” Manitoba is picky about names.

- Do a name search: You’ll need a name pre-search (a fancy database search to make sure your name isn’t already taken).

- Be distinctive: “Prairie Consulting Ltd.” will pass, but “The Consulting Company” probably won’t. A distinctive word in a business name is the unique element that sets your company apart from others and makes the name eligible for approval. It’s the creative part of the name (like Amazon or PrairieSky), unlike generic or descriptive terms such as Consulting or Bakery. For a name to pass the NUANS or provincial registry review, it should include three parts: a distinctive element (e.g., MapleLeaf), a descriptive element (what you do, like Accounting), and a legal element (Ltd., Inc., Corp.). For example, SilverFox Technologies Inc. works because SilverFox is distinctive, Technologies is descriptive, and Inc. is the legal part.

All the rules you can find in the “Choosing Your Business Name” document from the Manitoba Government.

- Think branding: Choose something easy to remember (and easy to Google).

Pro tip: If you’re not feeling creative, just slap your name + “Inc.” at the end. Done.

Step 2: Decide Your Business Structure

You’ve got options:

- Sole proprietorship (basically you = the business).

- Partnership (you and your buddy, splitting profits and arguments).

- Corporation (the business is its own legal entity).

We’re focusing on corporations here because, let’s be real, that’s the big leagues.

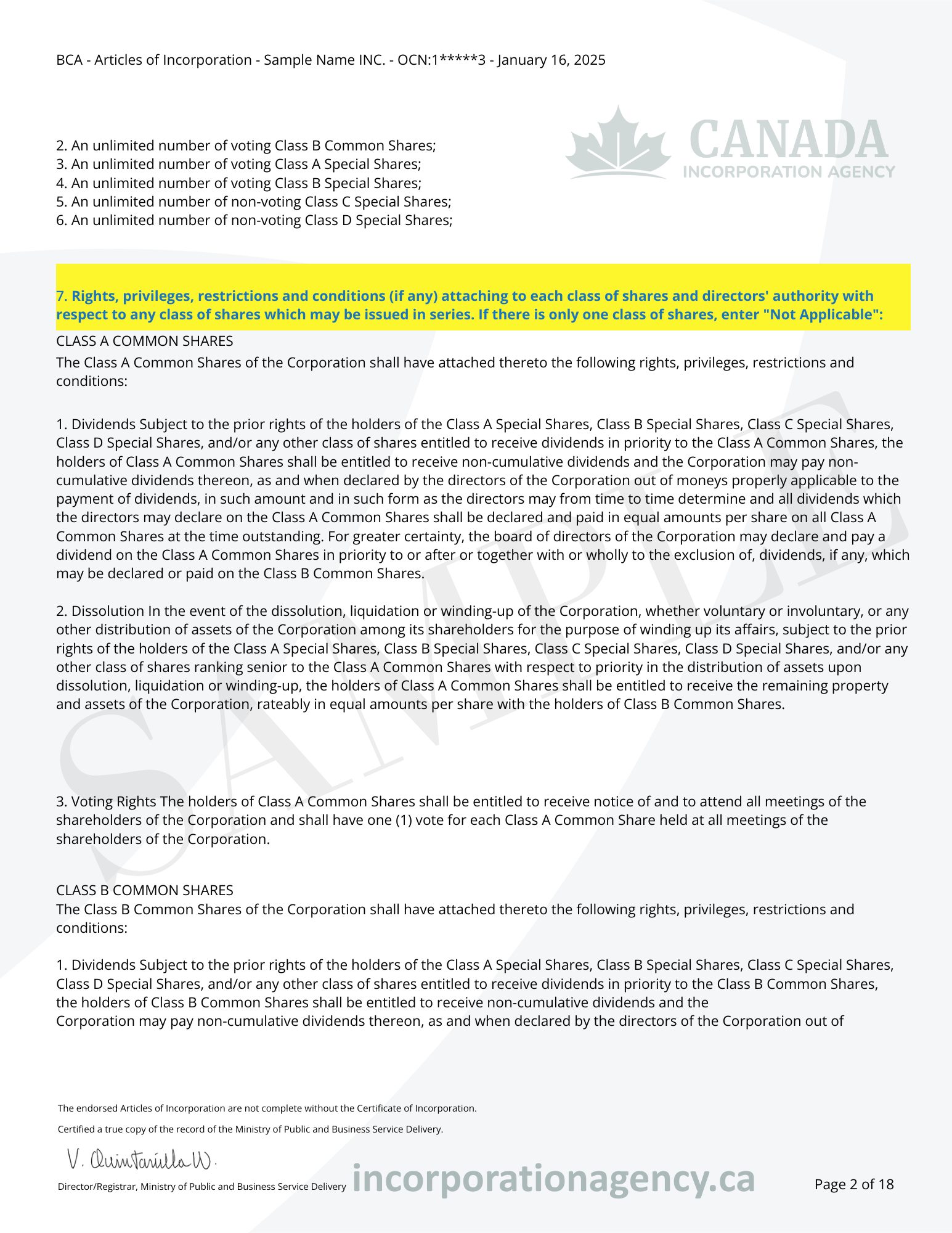

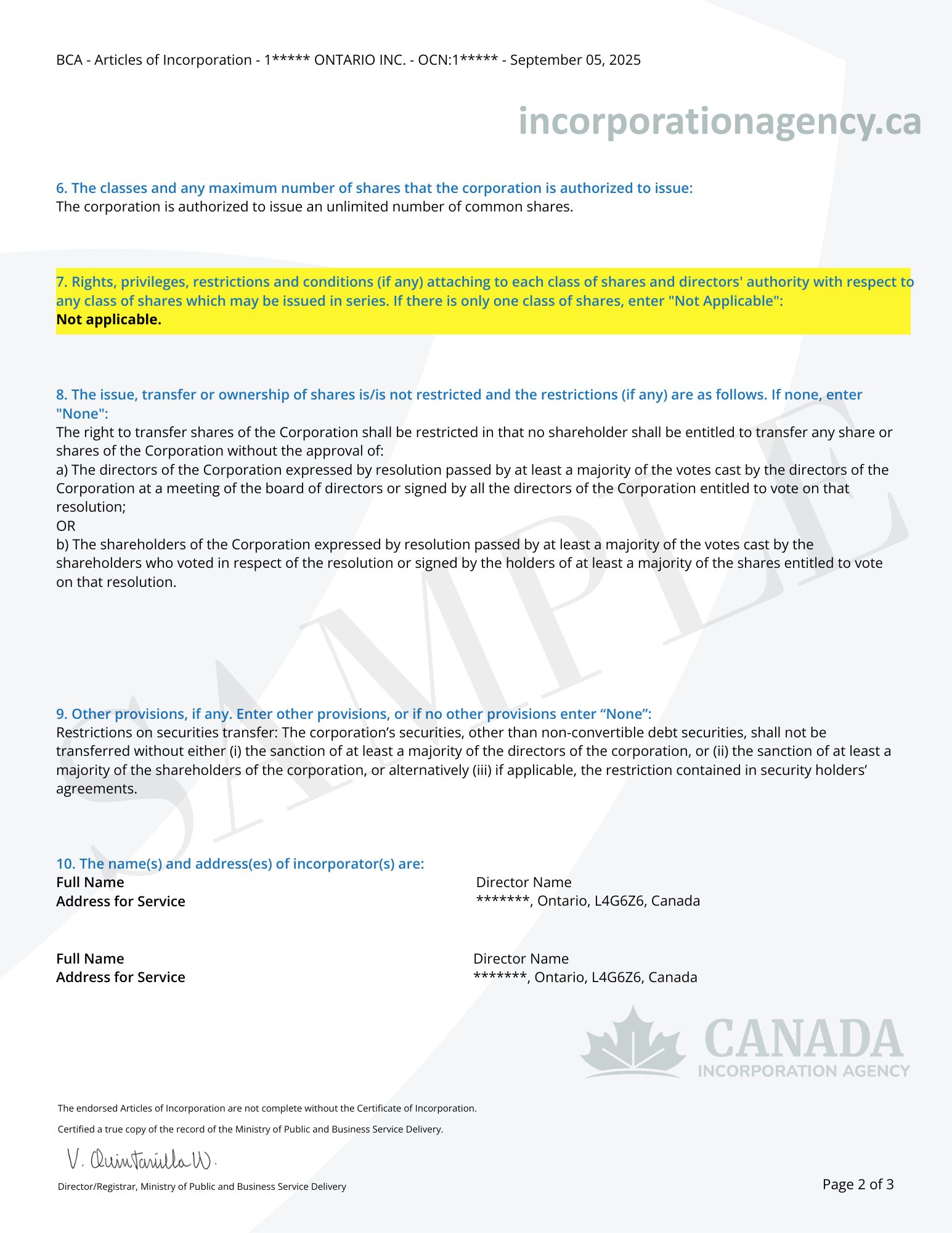

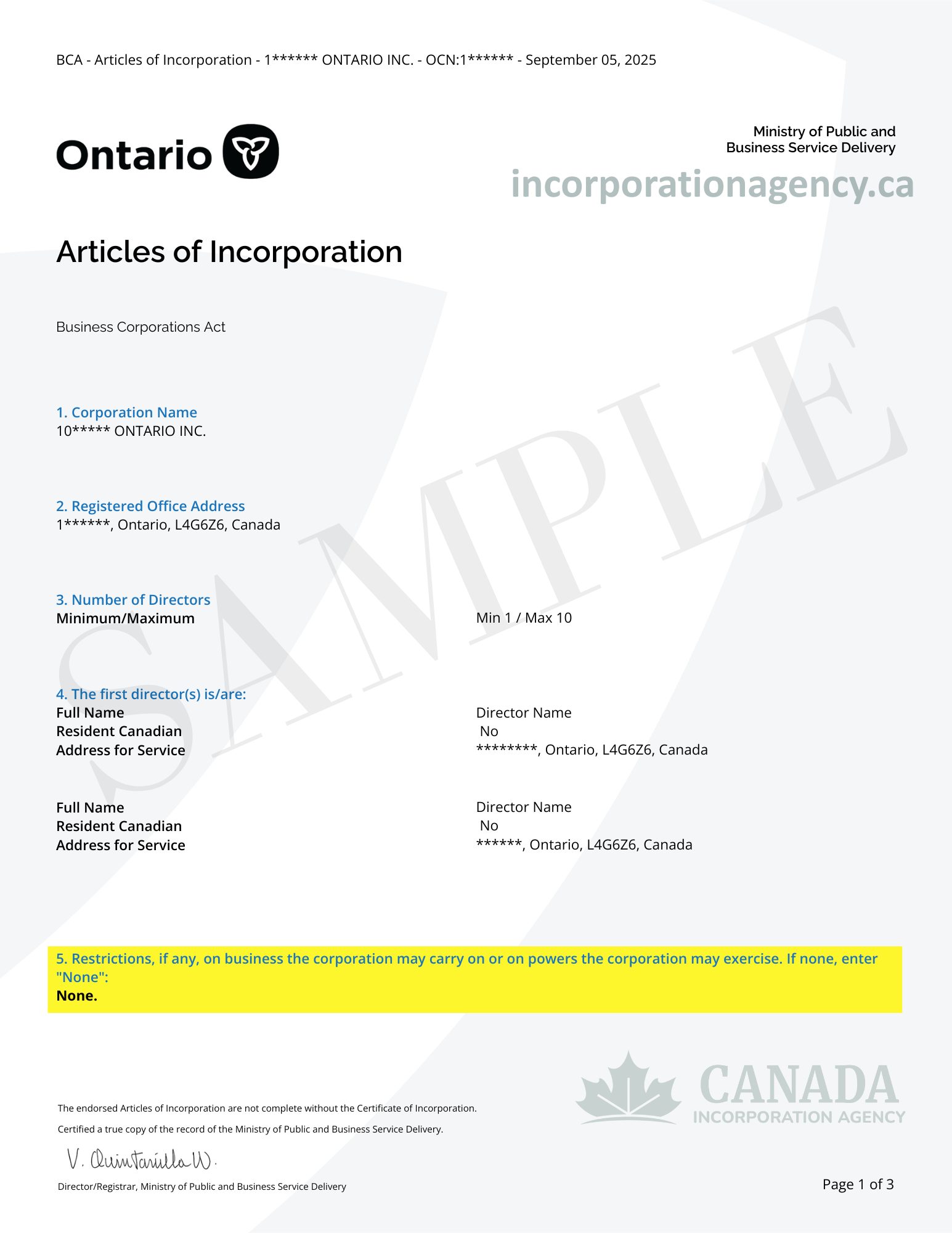

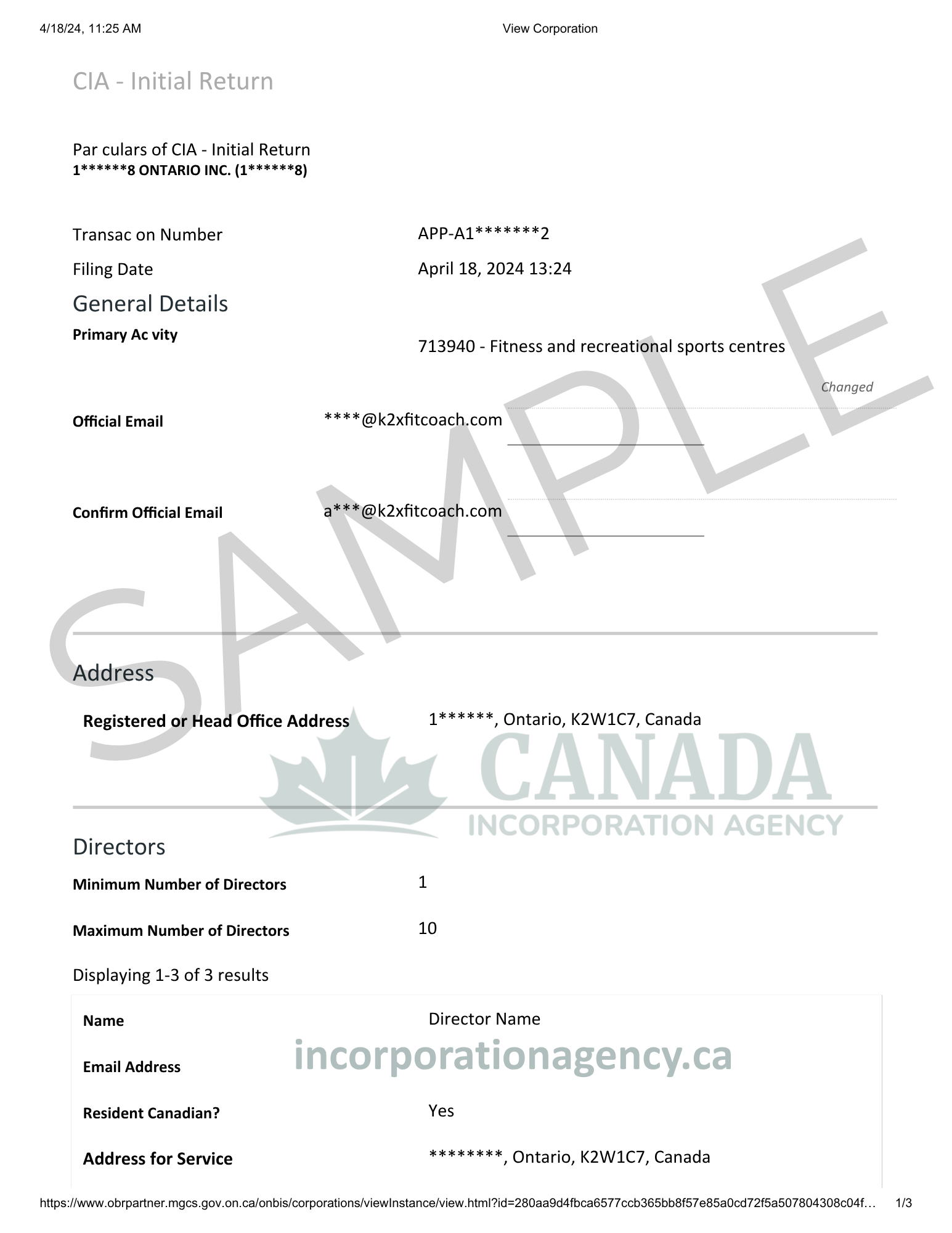

Step 3: File Articles of Incorporation

This is the official “birth certificate” of your business. You’ll submit it to the Manitoba Business Registry.

The Articles will ask:

- Your corporation’s name.

- The number of directors.

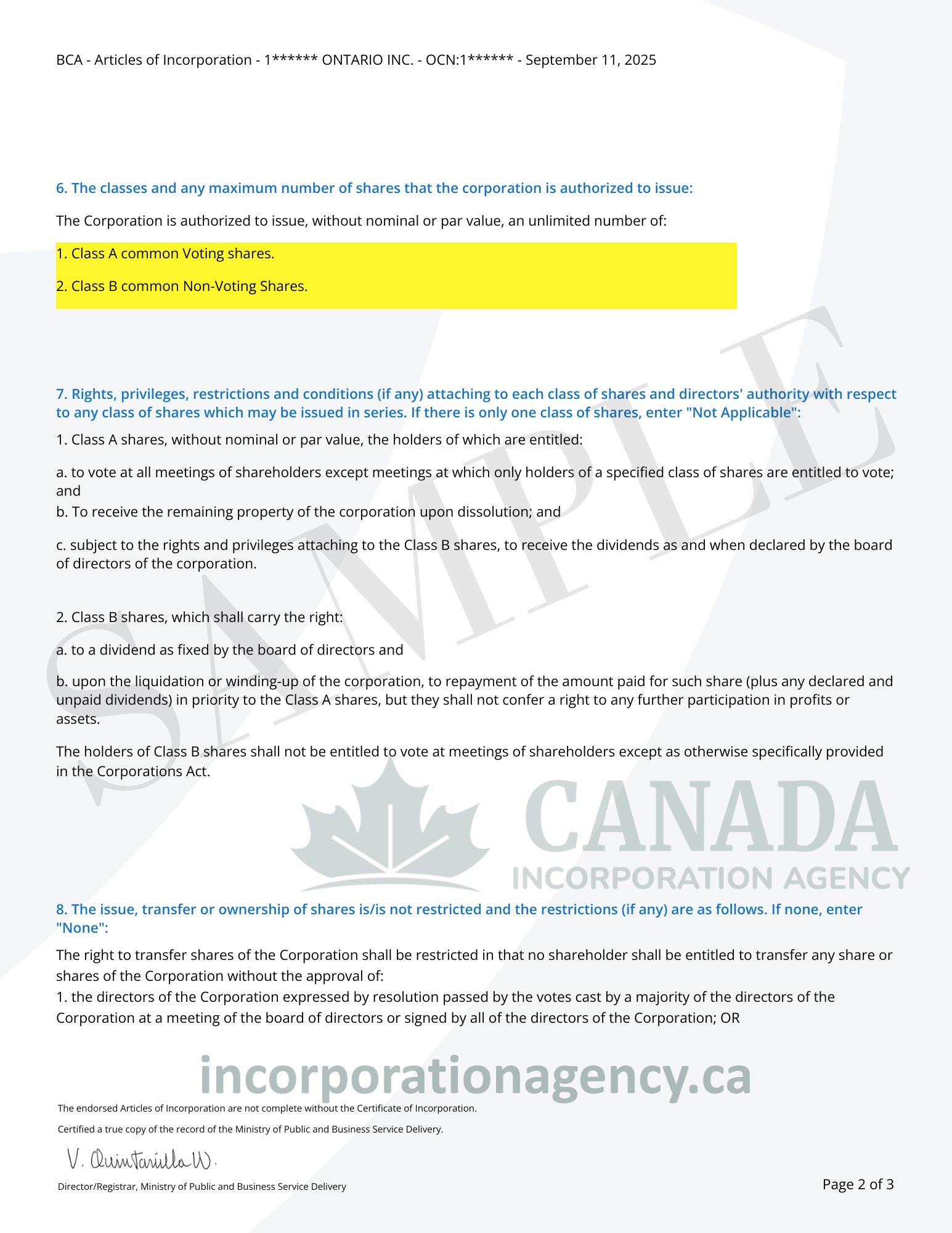

- Share structure.

- Registered office address (yes, you need a real address, not your cousin’s shed). In case you don’t have the physical address in Manitoba we can provide you with a registered office address and the mail scanning service.

Once this is filed, congrats—you’ve officially got a company registration Manitoba stamp of approval!

Step 4: Create a Corporate Minute Book

This isn’t optional. You’ll need:

- Articles of Incorporation.

- Bylaws.

- Meeting minutes.

- Share certificates.

It sounds intimidating, but think of it as your company’s diary—only way less juicy.

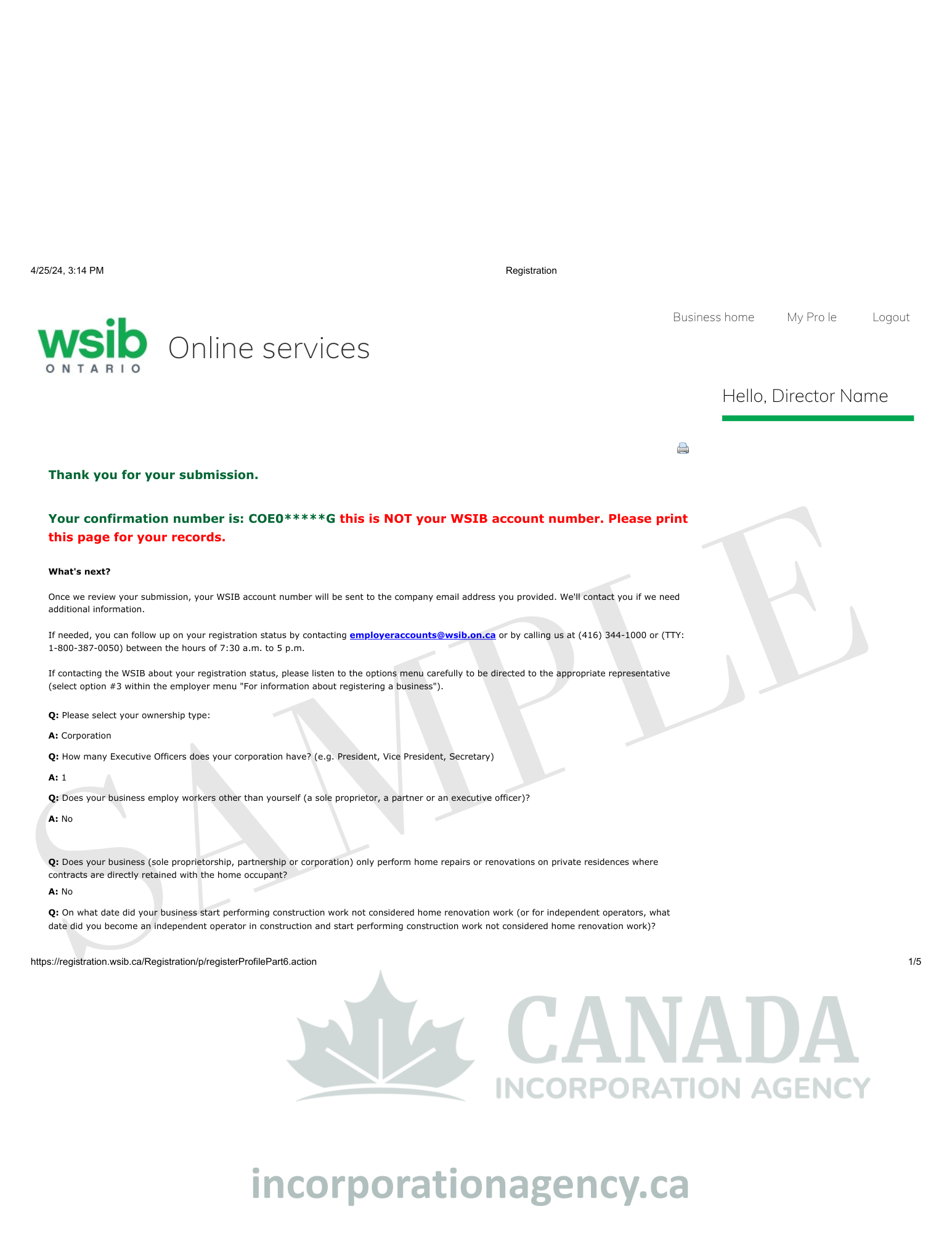

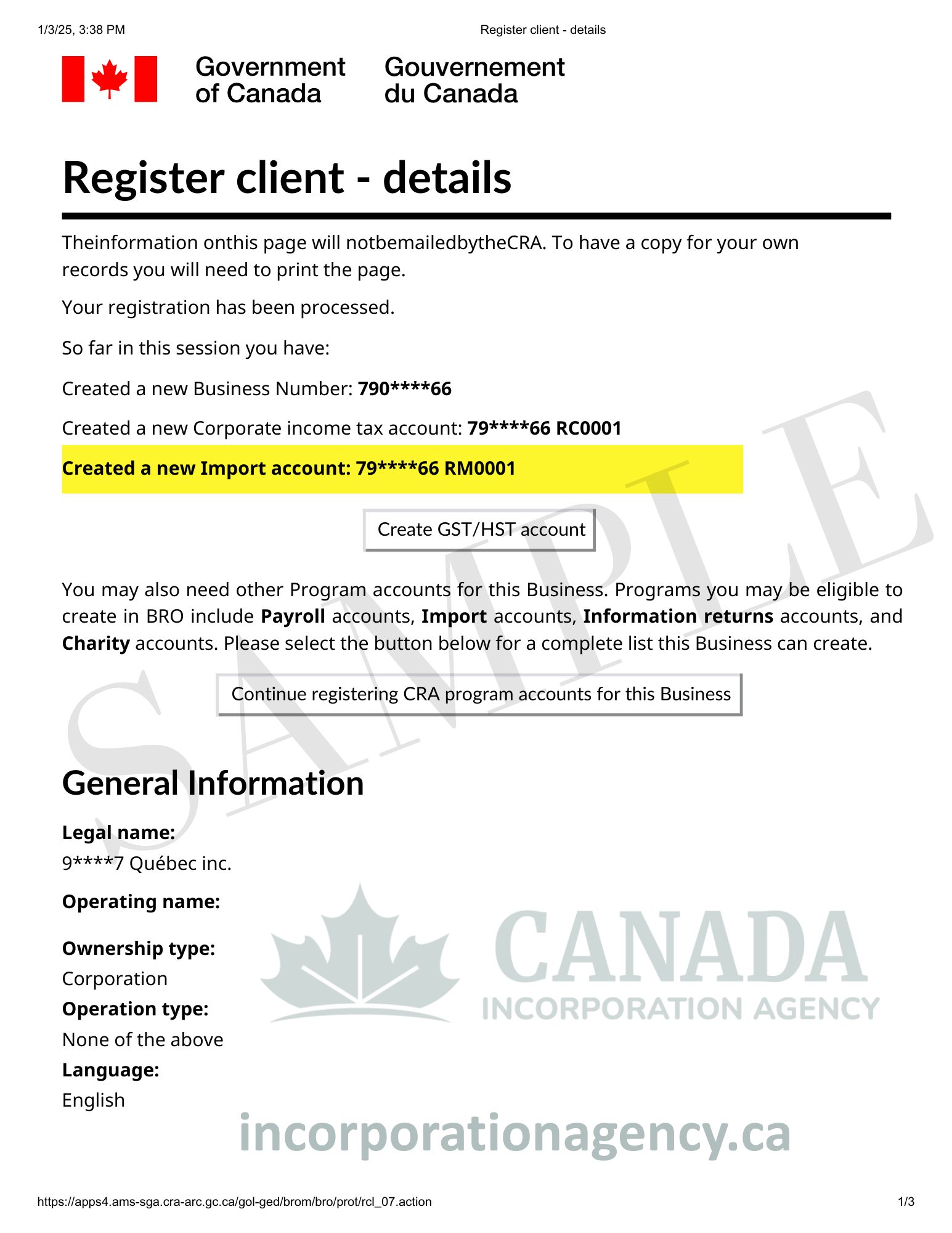

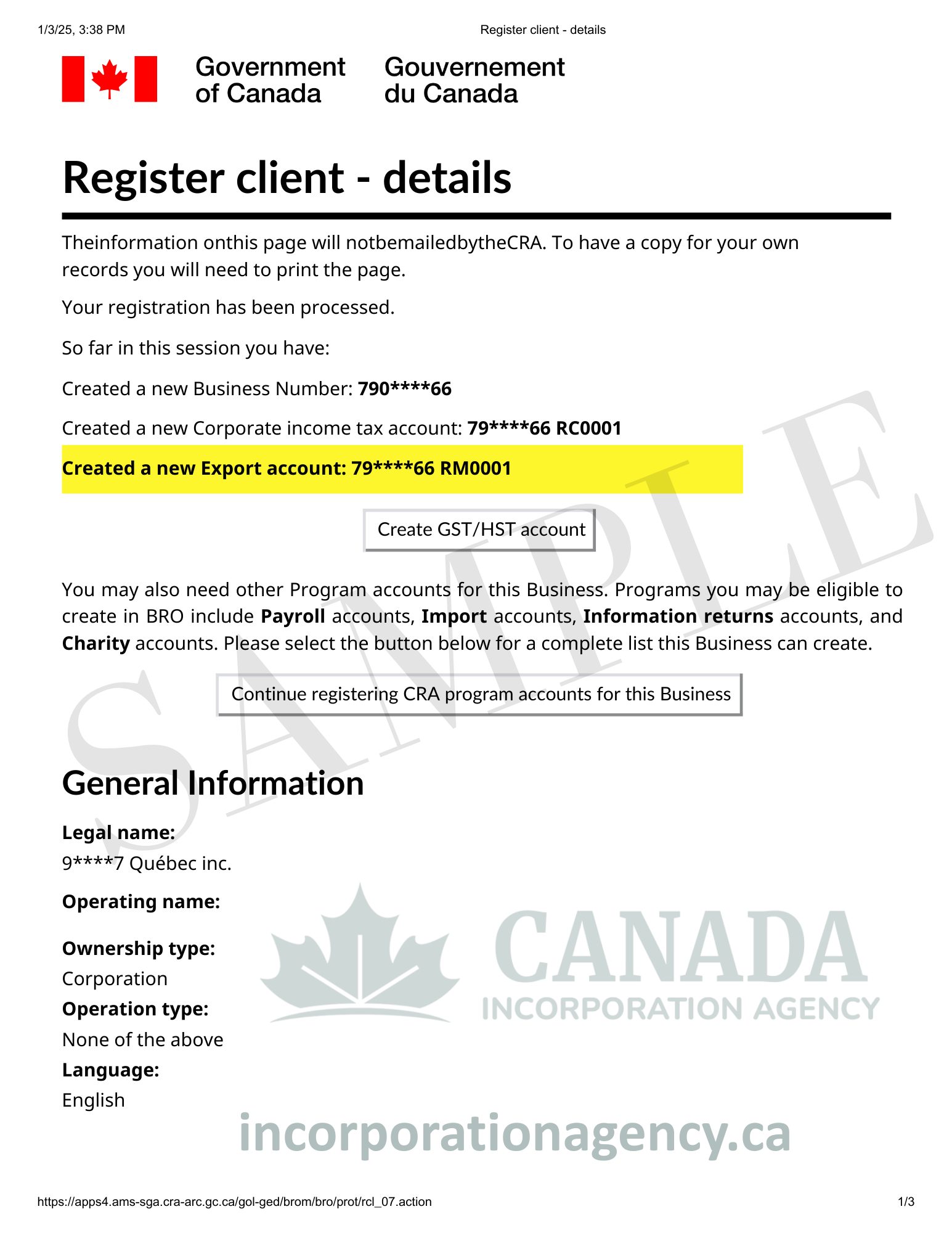

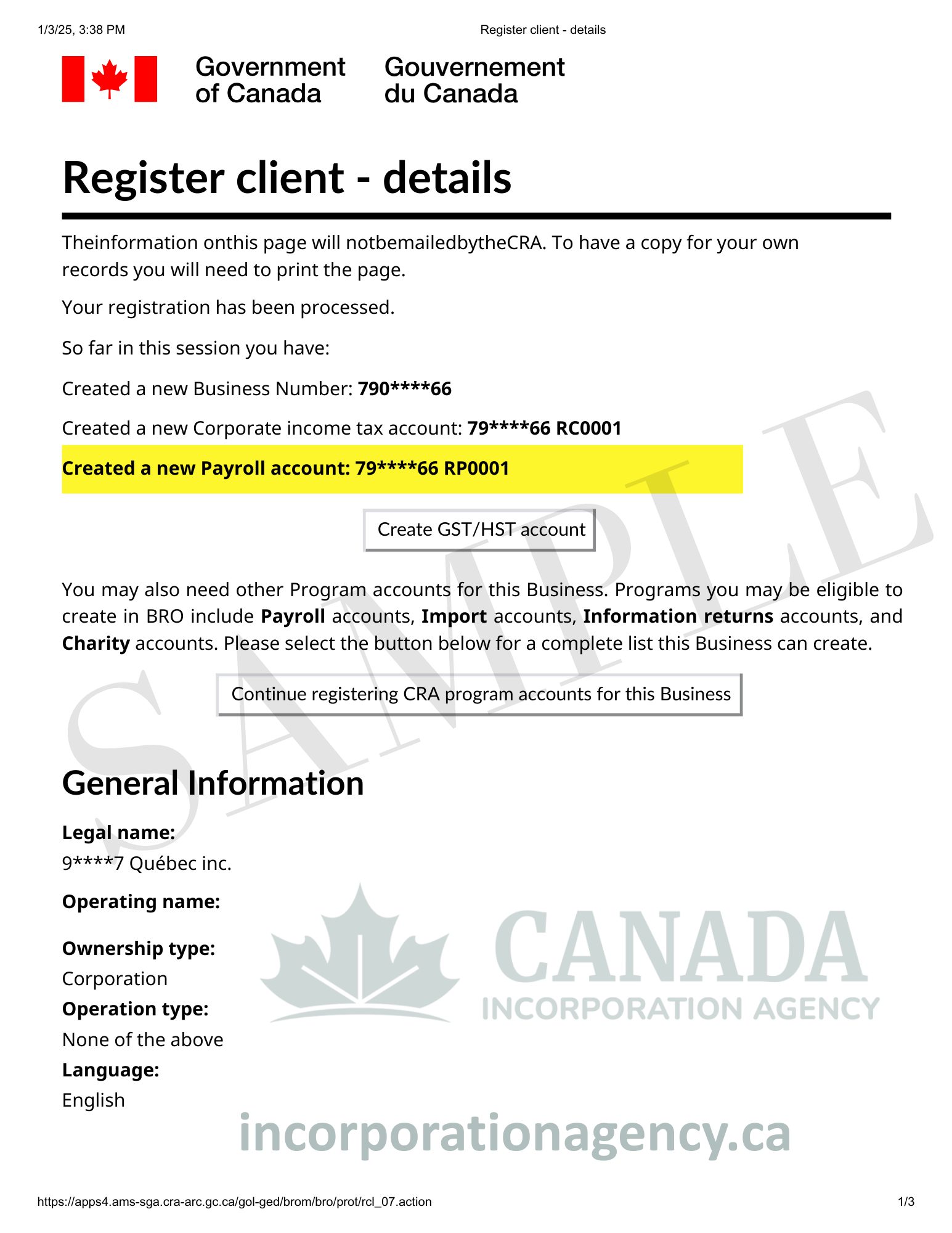

Step 5: Register for Taxes

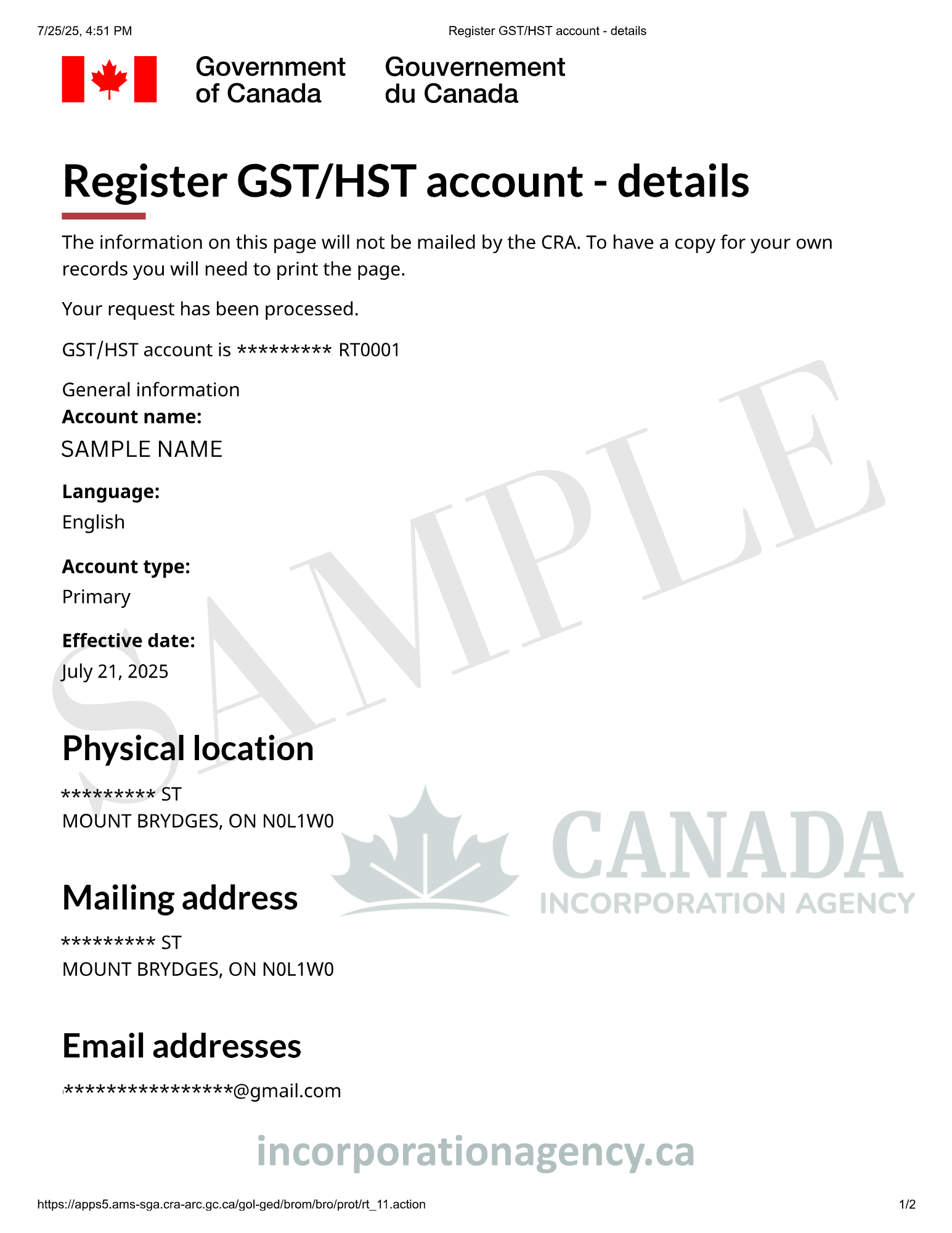

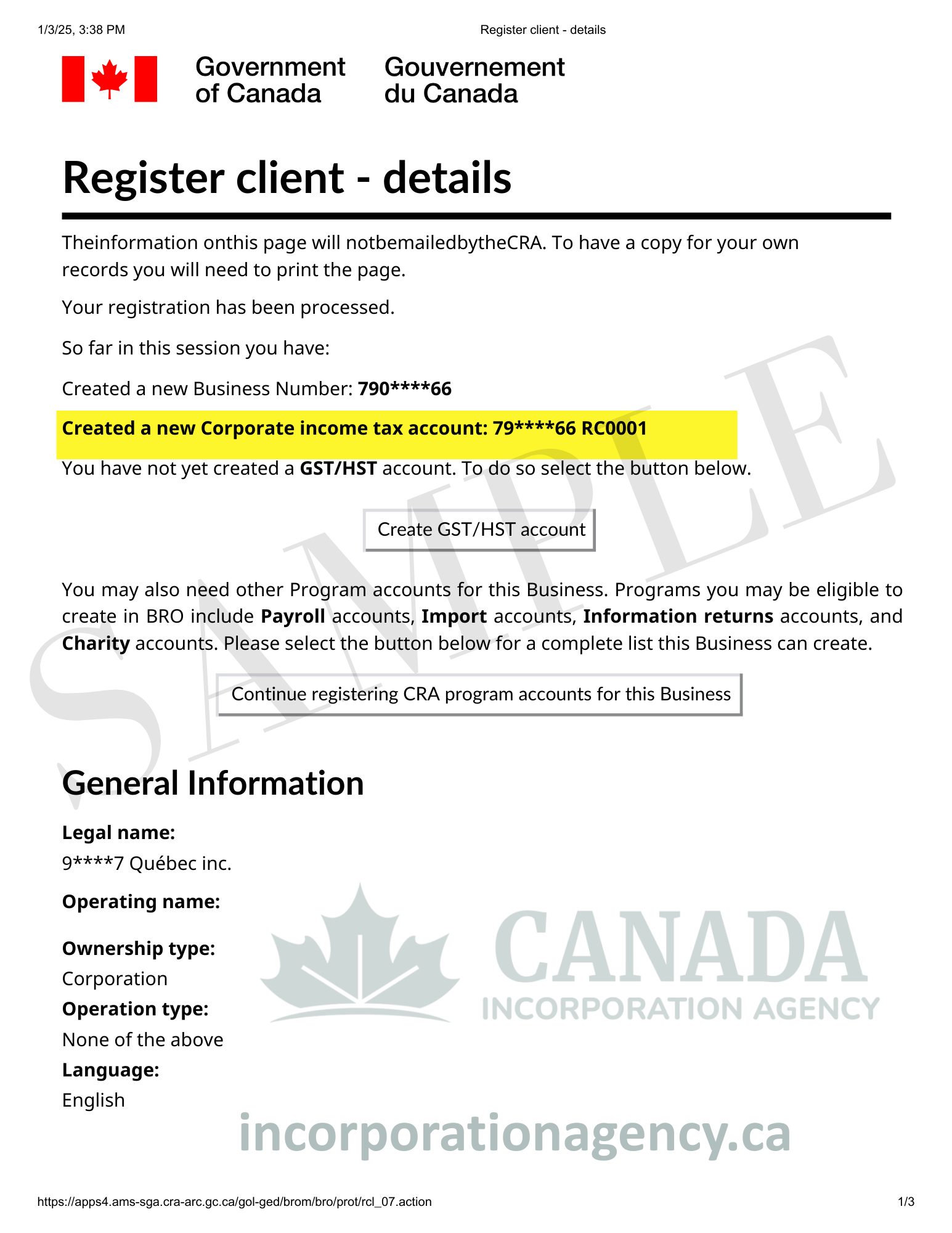

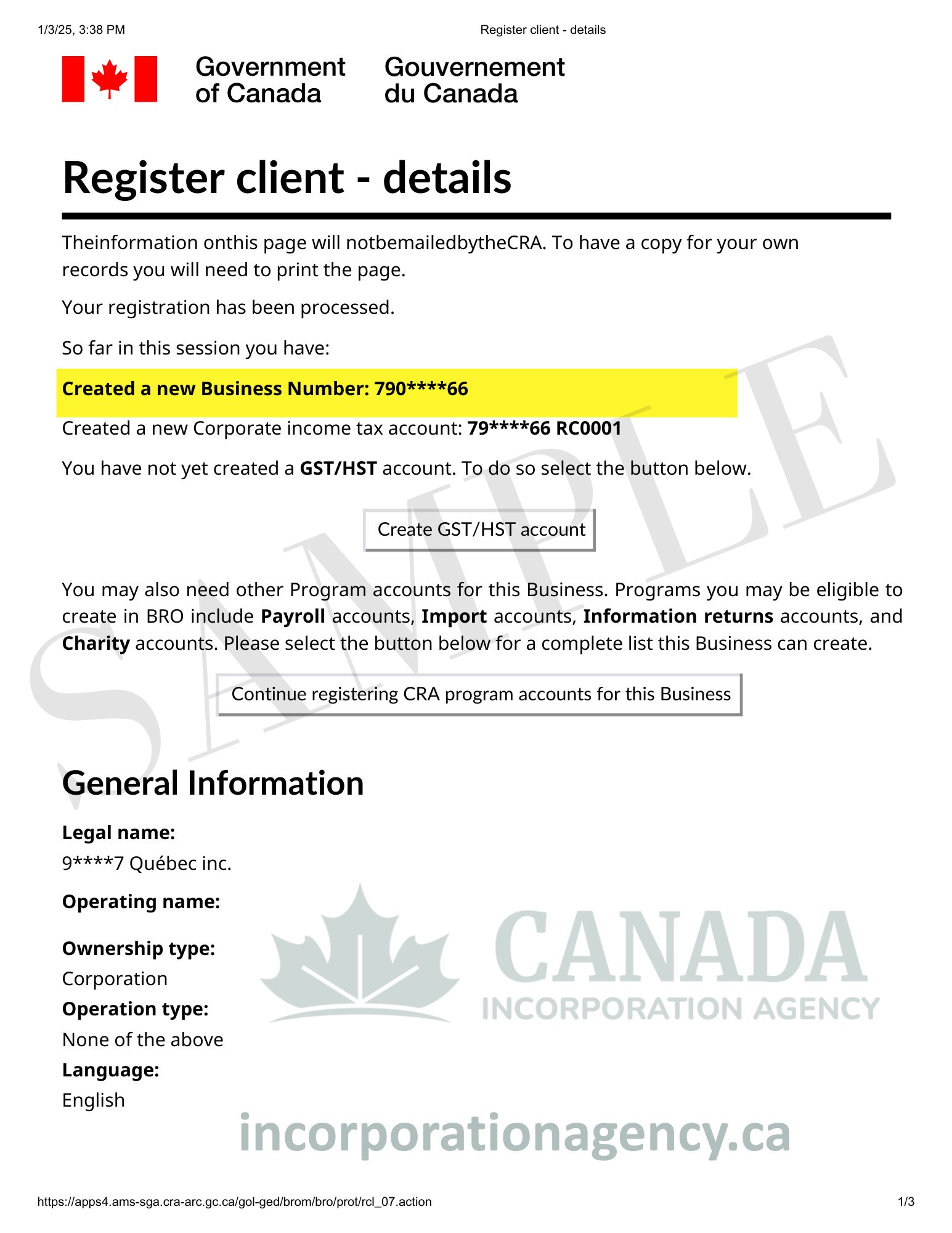

If your company is going to earn more than $30,000 annually (and I believe in you), you’ll need a GST/HST number. You may also need a payroll account if you hire employees.

Step 6: Maintain Your Corporation

Being incorporated isn’t a one-time party—it’s an ongoing relationship. Every year you need to:

- File an annual return with the Manitoba business registry.

- Keep your corporate records updated.

- Pay your renewal fees.

If you are confused with all the paperwork, we are here to help you. Canada Incorporation Agency will provide you an annual support and do all the required filings.

Think of it like feeding a Tamagotchi—it needs regular attention, or it’ll “die.”

Example: Incorporating “Prairie Llama Rentals Inc.” in Manitoba

Let’s make this real with an example:

Meet Anna. She’s starting a business renting llamas for weddings and children’s birthday parties (yes, it’s a thing). Here’s how she goes through Manitoba business registration:

- Business name search: She searches “Prairie Llama Rentals Inc.” in the NUANS system. Good news—no one else thought of this.

- Articles of Incorporation: Anna files her paperwork online with the Manitoba Business Registry. She lists herself as the sole director, sets up her share structure, and provides her Winnipeg office address.

- Minute book: Anna creates a binder with bylaws, resolutions, and share certificates for herself (Anna is both the boss and the shareholder—efficient!).

- Taxes: She registers for a GST number because she expects more than $30,000 revenue. (People love llamas!)

- Annual maintenance: Every year, Anna files her annual return with the company registration Manitoba system.

And just like that, Anna is the proud owner of Prairie Llama Rentals Inc., and her llamas are strutting down the aisle at weddings across Manitoba.

Costs of Incorporating in Manitoba

Let’s talk money:

- Manitoba name approval: around $99.

- Filing Articles of Incorporation: $495 (online).

- Annual return filing: $300.

Not bad for turning your idea into a legit business empire.

Pros and Cons of Incorporating in Manitoba

Incorporating a business in Manitoba has some great benefits. The biggest one is protection—because your corporation is its own legal “person,” your personal stuff (like your house or car) is usually safe if the business runs into trouble. It also makes your business look more serious and professional, which can help when dealing with customers, banks, or investors. On top of that, Manitoba’s fees to incorporate are fairly reasonable, and you might be able to save on taxes once your business grows.

That said, there are some downsides too. Incorporation means more paperwork and rules to follow. You’ll need to keep corporate records, file annual returns with the Manitoba Business Registry, and stay on top of other requirements. It also costs more than just registering as a sole proprietor, and those extra tax benefits really only kick in once you’re making a decent profit.

So, is it worth it? If you’re starting a small side gig, incorporation might feel like too much work. But if you’re serious about building a business that lasts, protecting yourself legally, and looking more professional, then incorporating in Manitoba is usually the way to go.

FAQs: Incorporating in Manitoba

1. Can I incorporate a business in Manitoba online?

Yes! You can complete the whole process online through the Manitoba Business Registry portal. No need to wrestle with a fax machine.

2. Do I need a lawyer to incorporate in Manitoba?

Not necessarily. You can DIY, but many entrepreneurs hire a lawyer or incorporation service to avoid mistakes.

3. How long does it take to incorporate in Manitoba?

If your name is approved, incorporation can be done in just a few business days.

4. Can I use a home address as my registered office?

Yes, as long as it’s a physical Manitoba address (no P.O. boxes or sketchy storage lockers).

5. What happens if I don’t file my annual return?

Your corporation can be dissolved. And you’ll have to start over, which is basically like playing Monopoly and landing on “Go to Jail.”

Final Thoughts

Starting a Manitoba corporation isn’t as terrifying as it seems. With some patience, a bit of paperwork, and maybe a llama or two, you can officially register a business in Manitoba and join the ranks of real entrepreneurs.

Remember:

- Pick a unique name.

- File your Articles of Incorporation with the Manitoba Business Registry.

- Keep up with your annual returns.

So, are you ready to make your dream official with a company registration Manitoba process? Go forth, future CEO. Manitoba is waiting for your big idea!