So you’ve come up with an awesome idea you’d like to change the world. Maybe you’d like to bring local animals and forever homes together, support underprivileged kids, or start a quirky library that lends board games. Whatever your idea is, you’d like to make it official. Before you hand out fliers and hold a bake sale, though, there’s one essential step involved: incorporating a non-profit in Alberta.

Don’t worry – we’ve got you covered with step-by-step guidance with a pinch of humor thrown in to keep things interesting. When you’ve finished reading, you will know precisely how to incorporate in Alberta as a non-profit and drive your mission onward.

Why Incorporate a Non-Profit Organization in Alberta?

You might be thinking, “Why could I not just start assisting people without incorporating?” Well, you could technically do that.

However, incorporating offers a tremendous amount of benefits:

- Legal status: Your organization obtains legal status independent of its membership. No more “I’m personally responsible for the fiasco at the bake sale.”

- Limited liability: Protects board members and volunteers from personal liability for debts or lawsuits.

- Funding opportunities: Grants, donations, and fundraising opportunities usually require your non-profit organization to be incorporated.

- Tax benefits: Once registered federally or provincially, your non-profit may qualify for tax exemptions.

In short, incorporation gives your Non-profit organization in Alberta legitimacy and credibility — plus some legal protection when your cat volunteer “helps” with fundraising.

Alberta Non-Profit vs Federal Non-Profit Incorporation

| Feature | Alberta Non-Profit Incorporation | Federal Non-Profit Incorporation |

|---|---|---|

| Jurisdiction | Recognized only in Alberta | Recognized across all of Canada |

| Filing Authority | Alberta Corporate Registry | Corporations Canada (under the Canada Not-for-profit Corporations Act – CNCA) |

| Name Protection | Protected only within Alberta | Protected nationwide (if approved) |

| Purpose | Organized for charitable, religious, social, sporting, or community purposes in Alberta | Organized for national or international activities and a broader scope |

| Filing Process | File with the Alberta Corporate Registry through an authorized service provider | File electronically with Corporations Canada |

| Cost | Generally lower incorporation fees | Moderate fees, slightly higher than provincial |

| Language | Incorporation documents can be in English | Incorporation can be in English, French, or both |

| Annual Filings | Must file annual returns with the Alberta Corporate Registry | Must file annual returns with Corporations Canada (and extra-provincial registration in Alberta if operating there) |

| Extra-Provincial Registration | Not required if activities are limited to Alberta | Required in Alberta (and other provinces) if carrying on activities there |

| Best For | Local organizations focused mainly within Alberta | Organizations that want national or international recognition and operations |

Step 1: Decide on Your Non-Profit Structure

Before you start a business in Alberta, you need to determine your organization’s structure. Non-profits typically have these options:

Society

- Society consists of individuals who come together towards a common objective but do not expect to earn profits.

- Run by a board of directors, societies are ideal for volunteer groups, cultural societies, or community clubs.

Non-Profit Corporation

- A more formalized structure with legal personality separate from members.

- Can enter into contracts, own property, and hire employees under the organization’s name.

Pro Tip: Most serious charity work or grant proposals prefer a formal non-profit corporation.

Step 2: Choosing a Unique Name

Your name is your organization’s first impression — and it needs to be available!

- Check the Alberta corporate registry to make sure no one else has claimed it.

- Keep it clear, memorable, and reflective of your mission.

- For example, “Paws & Claws Rescue Society” immediately tells people you help animals.

- Do a name pre-search to see if your name conflicts with other business names in Alberta.

- To obtain a NUANS Report, you need to submit it to the Alberta Government.

Once you’ve chosen a name, you can move forward with the paperwork.

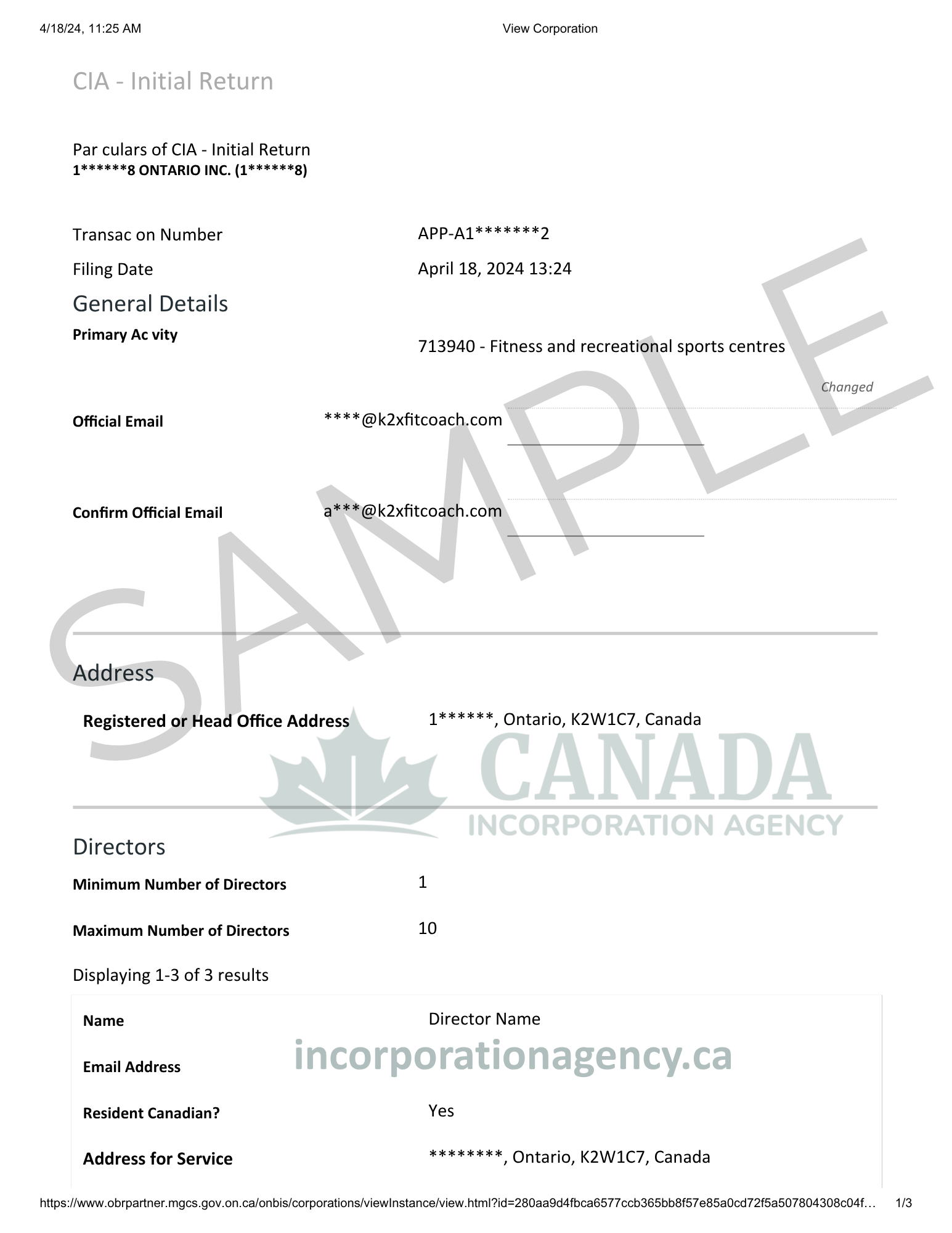

Step 3: Gather the Needed Papers

Incorporating a business in Alberta as a non-profit will require you to provide a few essential documents:

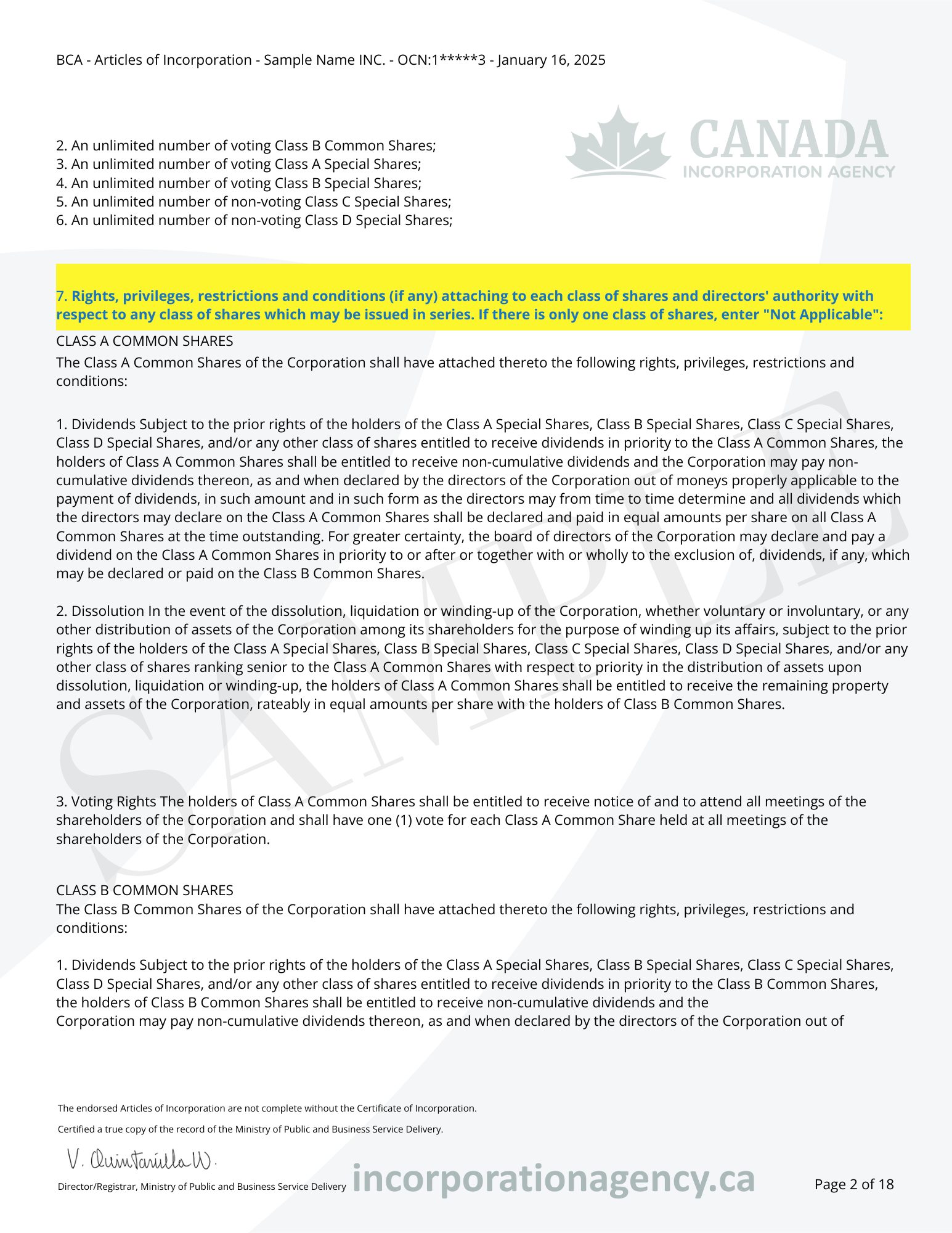

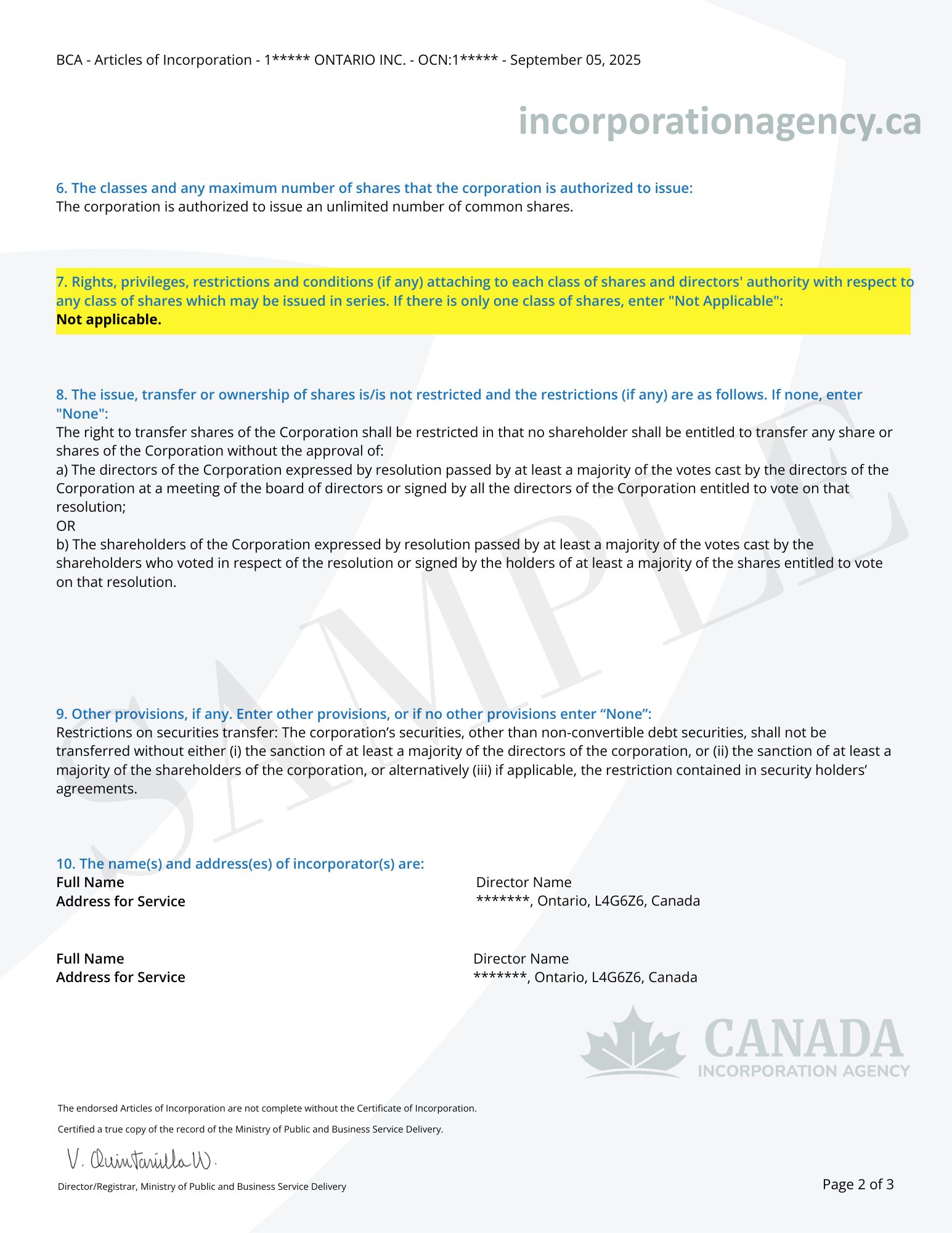

- Articles of Incorporation: This outlines your organization’s blueprint. It consists of your name, purpose, membership requirements, as well as structure.

- Bylaws: How your non-profit will function, like who will choose your board of directors and who will conduct your meetings.

- Notice of Address: Your business’s registered address within Alberta.

Example: You’re registering the name “Paws & Claws Rescue Society.” In your Articles of Incorporation, you state your objects as rescuing and re-homing abandoned animals, your membership will be open to volunteers, and your board will consist of five directors.

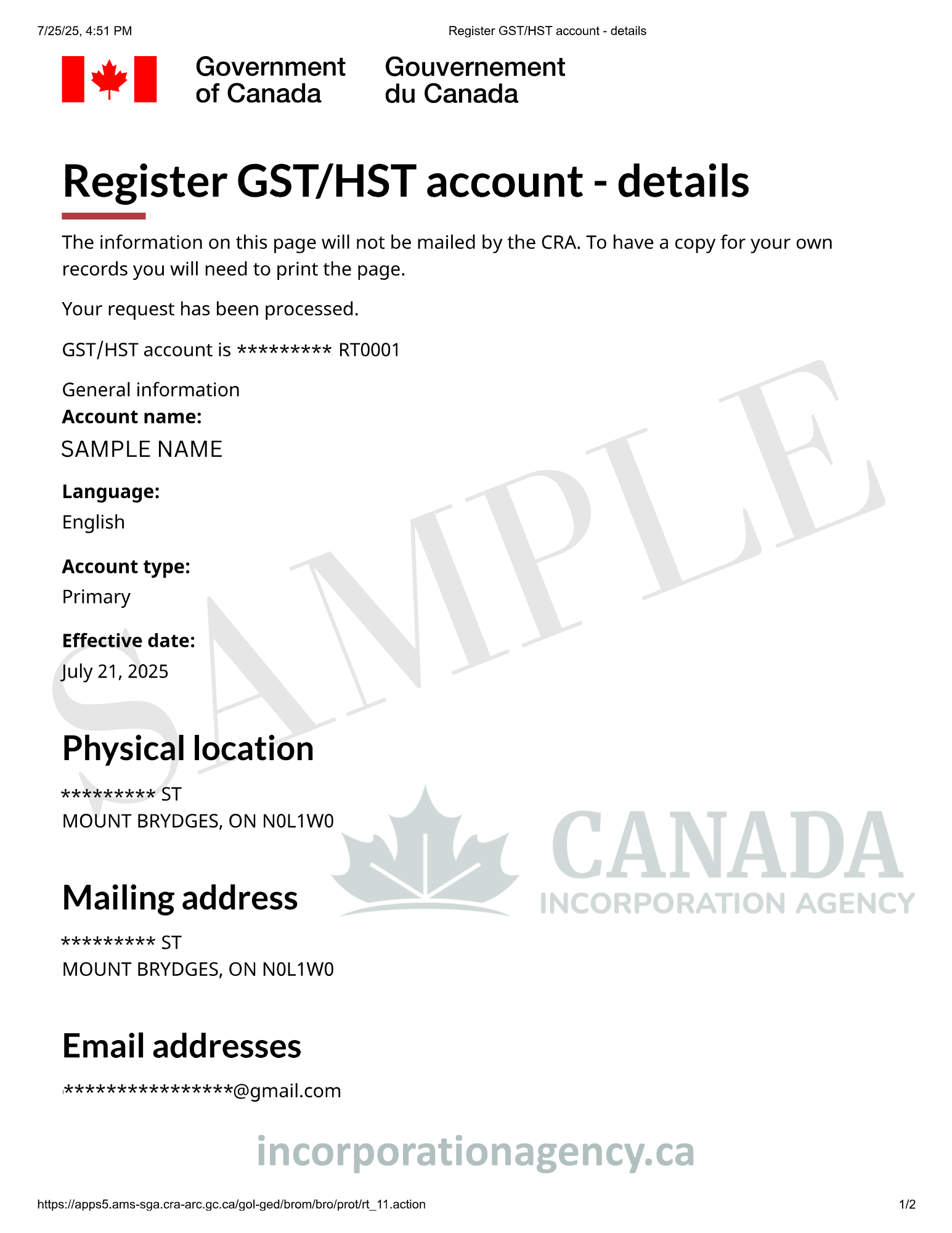

Step 4: File Your Incorporation Documents

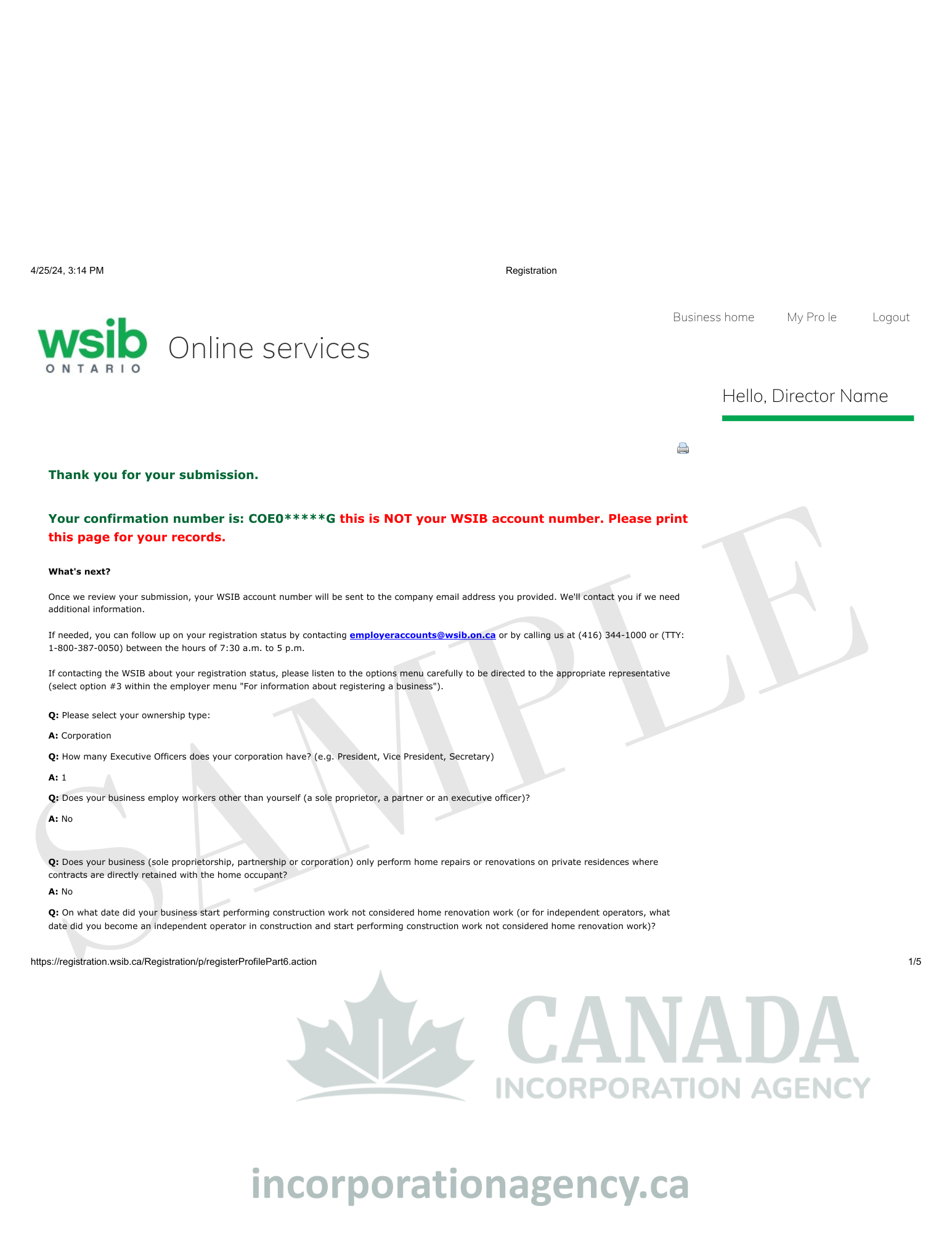

When your papers are ready, you submit them to the Alberta Corporate Registry. If you want everything to be done fast and without any mistakes, you should use a trusted service provider like Business Alberta Online or Canada Incorporation Agency.

Filing Options:

Online: Fastest and most comfortable. All you need to do is complete an online form on our website and we will email the Certificate and articles of Incorporation to you.

In-person: Outdated but works if you like personal contact.

By mail: Old-fashioned, slow but acceptable.

You’ll also pay a filing fee — usually a few hundred dollars. Think of it as a small investment for a lifetime of good deeds (and possibly adorable puppies).

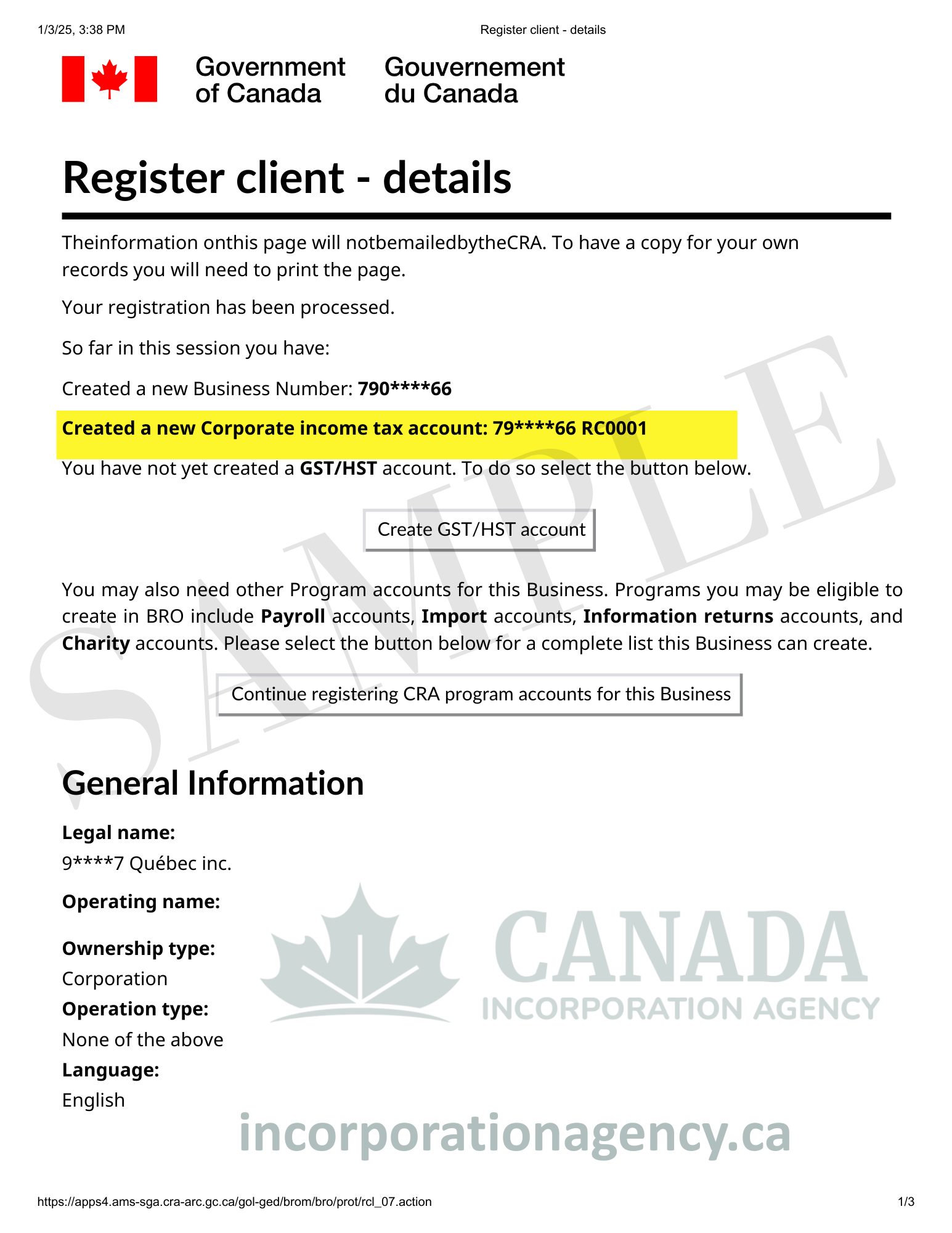

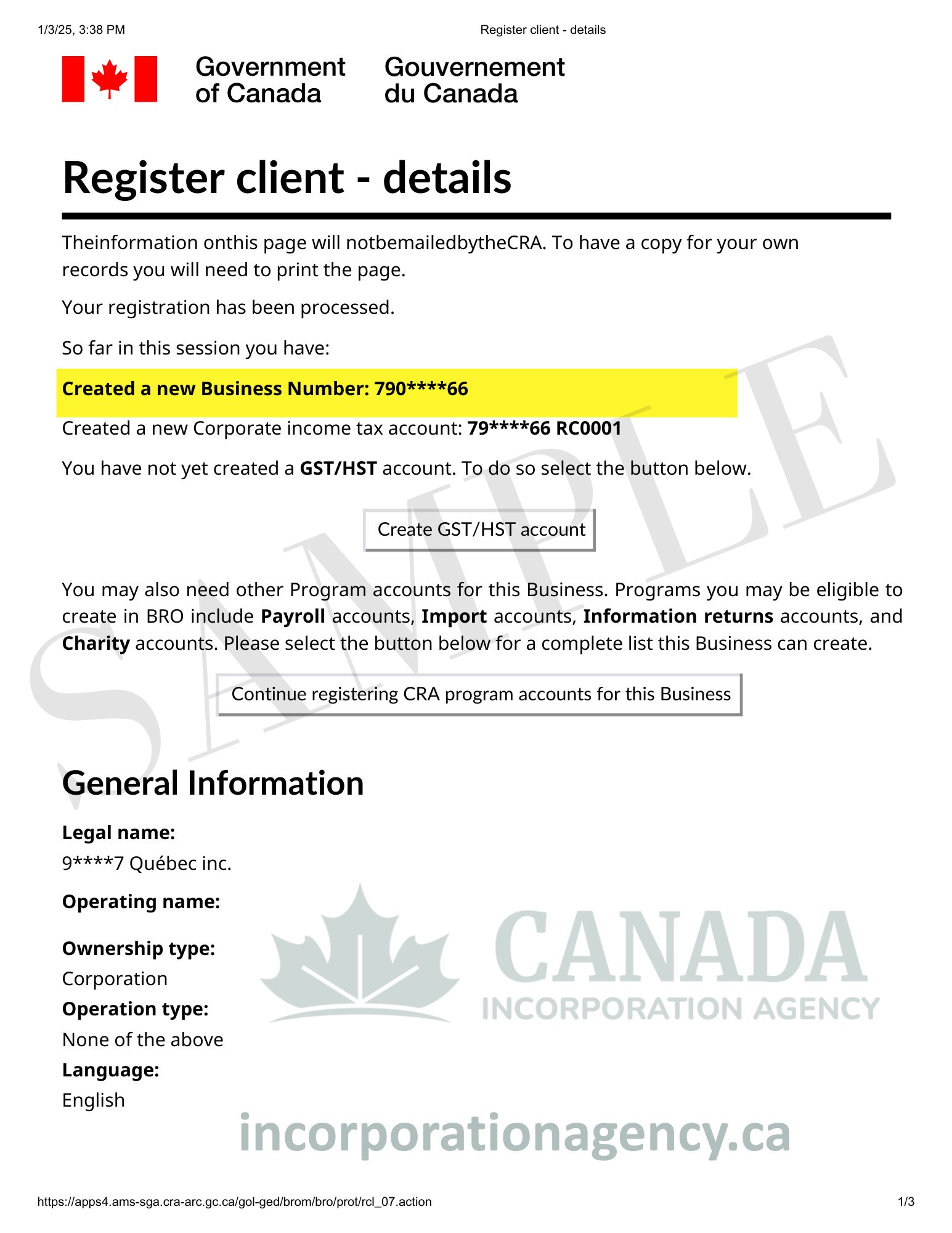

Step 5: Apply for Charitable Status (Optional, But Recommended)

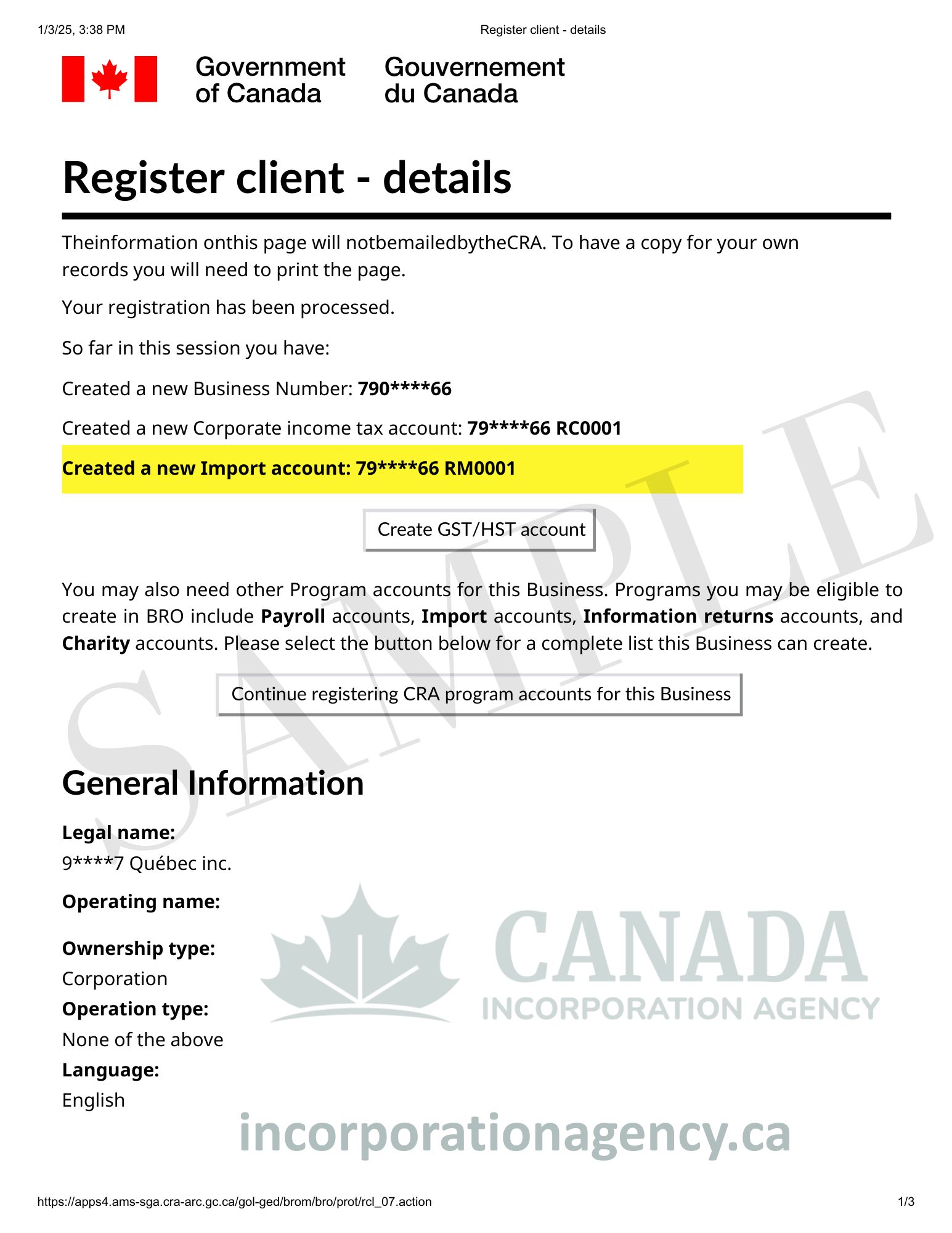

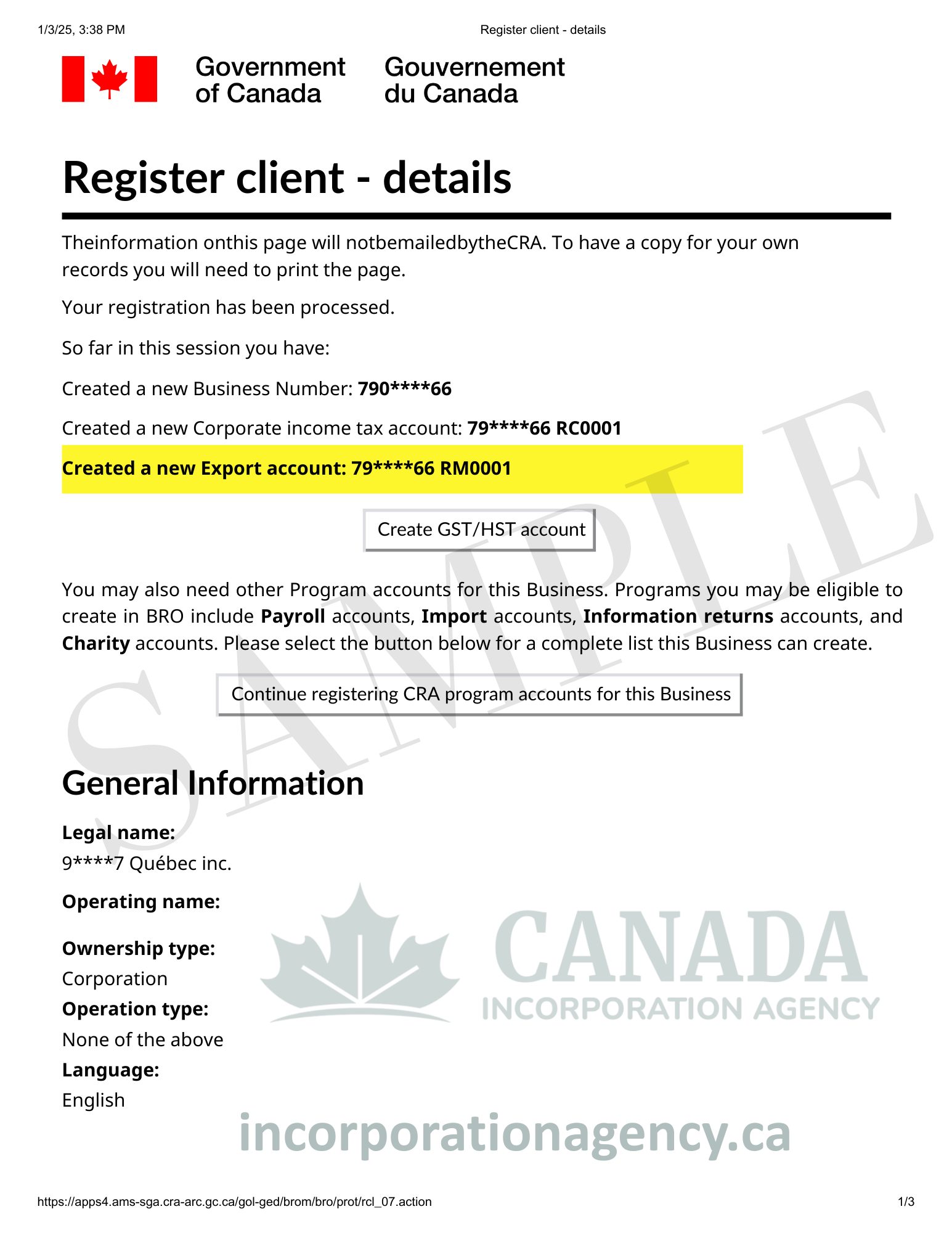

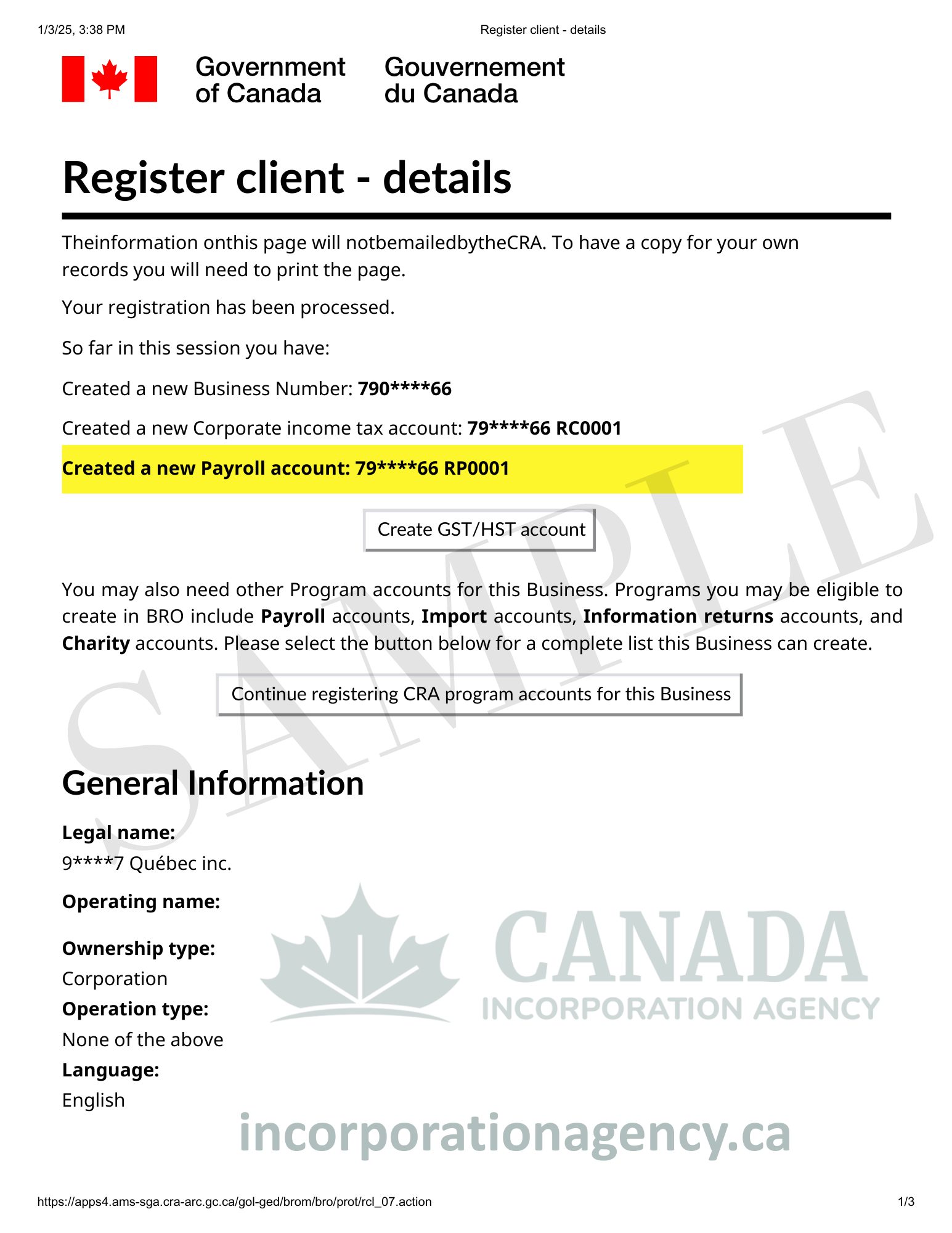

If you’d like tax receipts for your donations, then you will need to become a registered charitable organization with the Canada Revenue Agency (CRA).

- This is separate from incorporation.

- Requires additional forms and documentation about your activities, governance, and financial plans.

Tip: While you do not mean to issue charitable tax receipts at once, registering your non-profit at the CRA requires getting your non-profit incorporated.

Step 6: Obtain a Bank Account and Keep Records

Upon registration, your non-profit becomes a legally recognized entity and can:

- Open a bank account under the organization’s name

- Apply for grants and funding

- Hire staff or contractors

Good record-keeping is essential. Record donations, expenses, and minutes of your meetings. Future auditors and grant givers will be grateful.

Step 7: Maintain Compliance

Congrats! You’re officially a non-profit, but you’re not finished yet. Maintaining your incorporation active involves:

- Annual Return Filing at Alberta Corporate Registry

- Keeping your bylaws and membership records current

- Addressing provincial and federal reporting requirements

It’s not glamorous, but staying compliant ensures your organization can continue to make a difference.

Example: Incorporating a Non-Profit in Alberta

Let’s go back to our “Paws & Claws Rescue Society.” Here’s how they did it:

- Chose a unique name and checked availability with the Alberta corporate registry.

- Prepared Articles of Incorporation and bylaws, outlining their mission, membership, and board structure.

- Filed their incorporation papers online and paid the registration fee.

- Opened a bank account and started keeping detailed financial records.

- Applied for charitable status with CRA to issue tax receipts for donations.

Today, “Paws & Claws Rescue Society” is officially recognized and running adoption events and volunteer programs across Alberta.

Common Mistakes to Avoid

- Skipping the name search – Another organization may already have your chosen name.

- Incomplete bylaws – Clear rules help prevent disputes later.

- Ignoring reporting requirements – Failing to file annual returns can jeopardize your incorporation.

- Mixing personal and organizational finances – Always use a separate bank account.

Why Incorporation Matters

Registration of your Alberta non-profit entails more than paperwork.

It’s about:

- Gaining credibility with donors, volunteers, and partners

- Exempting board members and volunteers from personal liability

- Opening up funding sources that will help your mission succeed

By following these steps, your Non-profit organization Alberta, becomes a reality from a dream—legally, safely, and successfully.

Final Thoughts: From Idea to Impact

Registering a non-profit organization is a crucial step towards realizing your passion as a sustainable entity. From preparing your documents to registering your organization with the Canada Incorporation Agency, it feels like too many steps at one time — but each step gets you that much closer to creating positive change.

So if you’re saving puppies, feeding the hungry, or building the first board game library of the globe, after reading this handbook, you will be able to incorporate in Alberta with confidence. And after incorporating, you will be able to do what’s most essential: doing good while having fun doing it. Ready for step one? Do not wait—your mission is worth it. Ready to take the first step? Don’t wait — your mission deserves it. It’s time to start a business in Alberta, even if it’s a non-profit, and make a difference!

Frequently Asked Questions About Incorporating a Non-Profit in Alberta

Q1: Do I need a lawyer to incorporate a non-profit in Alberta?

Not necessarily! Many people complete the process themselves using the forms from the Alberta Corporate Registry. However, if your bylaws or structure are complex, consulting a lawyer can save you future headaches.

Q2: How much does it cost to incorporate a non-profit in Alberta?

The filing fee is usually around $100, depending on the filing method and any extra services you use. Pretty affordable compared to, say, a daily latte habit!

Q3: How long does it take to incorporate a non-profit in Alberta?

If you file online and have your documents ready, you can be incorporated in a matter of days. By mail or in-person may take longer (and requires patience).

Q4: What’s the difference between a non-profit and a charity?

All charities are non-profits, but not all non-profits are charities. To issue tax receipts for donations, you’ll need charitable status from the Canada Revenue Agency (CRA) in addition to incorporating in Alberta.

Q5: Can a non-profit make money in Alberta?

Yes! Your non-profit can earn revenue through fundraising, membership fees, or even selling products. The key is that the profits must be reinvested into the organization’s mission — not into buying your board a private jet.

Q6: Do non-profits in Alberta pay taxes?

Generally, incorporated non-profits don’t pay income tax, but some may still be subject to GST/HST or payroll taxes if they have employees. Always check with an accountant (preferably one who likes non-profits as much as you do).

Q7: How many people do I need to start a non-profit in Alberta?

To form a society in Alberta, you’ll need at least five founding members. For a non-profit corporation, a minimum of three directors is usually required.

Q8: Can I incorporate a non-profit alone?

For a society, no – you’ll need a group of people. For a non-profit corporation, you may be able to start with fewer directors, but teamwork is key. After all, “non-profit” is basically a group project.

Q9: Do I need to file annual returns for my Alberta non-profit?

Yes! Filing annual returns with the Alberta Corporate Registry keeps your organization in good standing. Forgetting to file can lead to dissolution (and nobody wants that).

Q10: Can my non-profit operate outside Alberta?

Yes, but you may need to register extra-provincially if you plan to carry out activities in other provinces. Basically, if your bake sales cross borders, so does your paperwork.