ALBERTA NON-PROFIT CORPORATION

1-Hour Service Available

Only $99 + Government Fee

We’re an official intermediary for the Province of Alberta.

Trusted by 1000+ Non-Profit Organizations

Fast. Simple. Transparent. No Hidden Fees.

Alberta Non-Profit Packages

Alberta Society Incorporation

- Registration filed directly with Alberta Corporate Registry

- Name reservation and NUANS report included

- Customized Bylaws and Incorporation Documents prepared

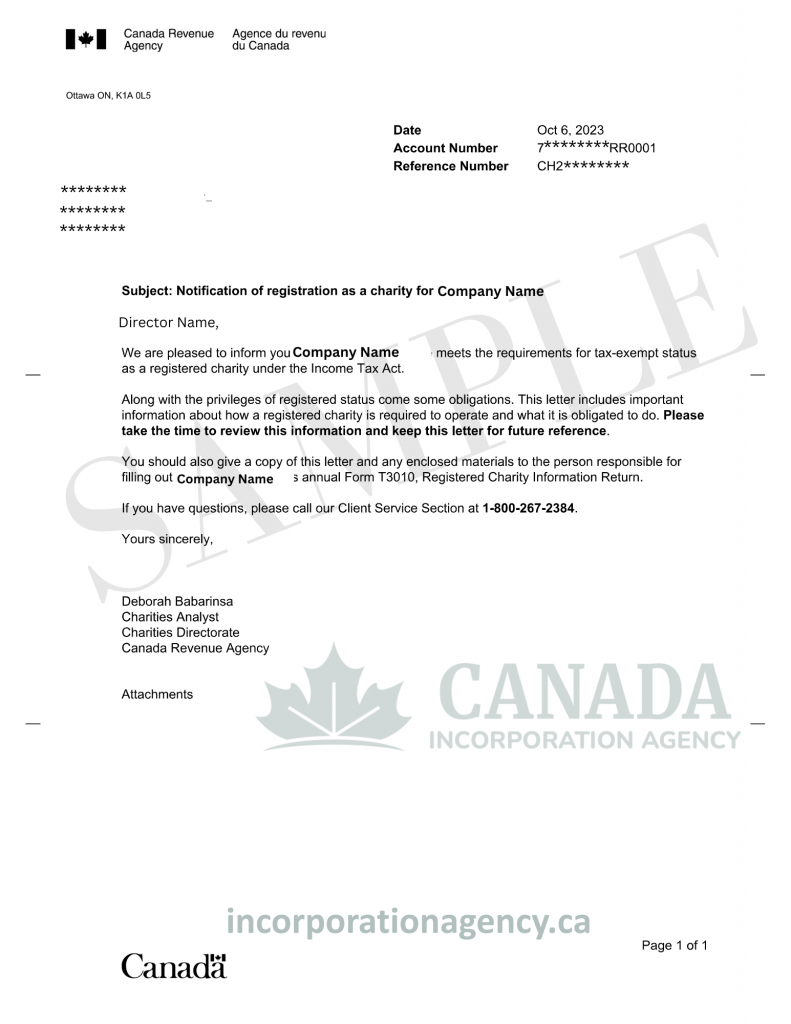

Alberta Registered Charity

- Full CRA charity application preparation and filing

- Eligible for tax exemptions and donation receipts

- Charity registration handled after Alberta society incorporation

Alberta Charity Status Application

- Charitable purpose drafting to meet CRA requirements

- Complete preparation and submission of CRA forms

- Full compliance with federal charity regulations

Alberta Non-Profit

- Corporate governance structure for larger non-profits

- Directors protected by limited liability

- Charitable Article Guidance Included

Benefits of Alberta Non-Profit Corporation

Tax Advantages (When Eligible): While Alberta non-profits are not automatically tax-exempt, eligible organizations can apply for charitable status through the Canada Revenue Agency. Once registered, they may issue tax receipts and qualify for certain tax exemptions.

Limited Liability Protection: Incorporation protects directors, officers, and members from being personally responsible for the organization’s debts and liabilities, as long as they fulfill their duties in good faith.

Enhanced Credibility and Professional Image: Incorporating gives your non-profit official legal status, which helps build trust with donors, funders, government agencies, and community partners. Many funding sources prefer or require organizations to be incorporated.

Access to Grants and Funding:Many government programs, private foundations, and corporate sponsors require incorporated non-profits before awarding grants or contracts. Alberta incorporation helps your organization qualify for these opportunities.

Continuity and Long-Term Stability: An incorporated non-profit exists as a separate legal entity, which means it can continue operating even if leadership or membership changes over time.

Clear Governance Structure: The Alberta Societies Act requires non-profits to adopt bylaws outlining decision-making processes, director duties, membership rules, and dispute resolution, helping organizations function smoothly and transparently.

Key Points About an Alberta Non-Profit Corporation

Alberta non-profit organizations are usually incorporated as societies or non-profit companies and are established for purposes such as community service, education, social welfare, arts, culture, religion, or recreation. They cannot be operated to make profits for members.

Examples of Alberta Non-Profits Include:

- Recreational, social, or hobby groups (sports clubs, cultural associations, community organizations)

- Educational or professional associations

- Religious organizations, charities, or public benefit groups

- An Alberta non-profit must have at least 3 incorporators to apply for incorporation, and at least 3 directors to manage the organization. There is no Alberta residency requirement for directors under the Societies Act (unless specified by bylaws or special regulations).

- A registered office address in Alberta is required. The address must be a physical Alberta location (P.O. boxes are not acceptable).

- The organization’s name must be approved by Alberta Corporate Registry. Certain words or phrases may require special consent, and names must reflect non-profit purposes. A NUANS report is often required to verify name availability.

Start Your Incorporation Now

Just 3 Simple Steps

Complete the online form

Submit your order using our simple form. Secure credit card, PayPal, and e-transfer payments are available.

Prepare and file your incorporation with Alberta

We review your information, prepare your documents, and file with Alberta Corporate Registry.

Get Incorporated

We email your incorporation documents within a few business days of approval.

What Our Clients Are Saying

Trustindex verifies that the original source of the review is Google. 5 stars for Brianna. Was very professional and informative.Posted onTrustindex verifies that the original source of the review is Google. Larry is the best. Responsive, knowledgable, friendly. When I have to incorporate again in the future I'm going to ask for Larry again.Posted onTrustindex verifies that the original source of the review is Google. Brianna has been over the top great! She has worked with me guiding me on every little thing and suggesting things that will make incorporating easier and necessities that I missed. Thanks Brianna!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience incorporating my business with Canada Incorporation. The process was smooth, efficient, and incredibly straightforward. Their team was knowledgeable, responsive, and provided clear guidance every step of the way. I appreciated how quickly everything was handled, and I felt confident knowing my business was in good hands. I highly recommend Canada Incorporation to anyone looking for a reliable and professional service to start their business journey.Posted onTrustindex verifies that the original source of the review is Google. Great Service! Very professional staff.They explained things really well and made the process smooth and easy to understand.Posted onTrustindex verifies that the original source of the review is Google. I had a great experience registering my business with CIA! Communication was seamless and everyone I talked to was very professional. I will definitely use their services again going forward!Posted onTrustindex verifies that the original source of the review is Google. I had a fantastic experience with this company! My registration was completed early! The agent I spoke with was very knowledgeable & friendly! I would definitely use them again in the future 😊Posted onTrustindex verifies that the original source of the review is Google. Staff was helpful, friendly and knowledgeable helping me with my new business. Would definitely deal with Canada Incorporation Agency again!!

Watch our informative guide and learn how to incorporate an Alberta Non-Profit or Society

Frequently Asked Questions

What is the difference between an Alberta Society and a Non-Profit Company?

In Alberta, most non-profits incorporate under the Societies Act for community, educational, or social purposes. A Non-Profit Company (under the Companies Act, Part 9) is typically used for larger non-profits that need more complex corporate-style governance or plan to operate across multiple provinces.

Do directors or incorporators need to live in Alberta?

No. Alberta does not require directors or incorporators to be Alberta residents or Canadian citizens for non-profit incorporation. However, you must maintain a registered office address located in Alberta.

Is tax-exempt status automatic after incorporation?

No. Incorporation as a non-profit in Alberta does not automatically grant tax-exempt or charitable status. You must apply separately to the Canada Revenue Agency (CRA) to register as a charity and obtain tax exemptions.

How many people are needed to incorporate a non-profit in Alberta?

At least three incorporators are required to file the incorporation. After incorporation, you must also maintain at least three directors to govern the organization.

How long does it take to incorporate an Alberta non-profit?

With all documents prepared and approved, incorporation can often be completed in as little as 1 business day, depending on Corporate Registry processing times and name approval.

Latest News & Blog Posts

How to Do a Land Title Search in Ontario: The Complete and Free Beginner’s Guide

Buying a property in Ontario is a huge milestone—whether it’s your first home, a cottage

Federal Name Approval Process: Everything You Need to Know

Opening a Federal Corporation in Canada is exciting — but prior to actually registering your

BC Name Approval Guide: How to Register Your Business Name in British Columbia

Well, you’ve decided to open a business in beautiful British Columbia. Cheers! You’re in for

Ontario Articles of Amendment: Complete Guide for 2026

If your Ontario business needs a makeover – this article is for you. Perhaps you

How to Make Changes to Your Business in Canada: Filing a Notice of Change

Running a business is like being the captain of a ship. Sometimes you need to

How to Register a General Partnership in PEI: Your Guide 2026

If you and your friend have a brilliant business idea, and you want to team