So you’ve made the decision to start your business. Perhaps you’ve had a side business taking off after months of trying, or perhaps you’re ready to launch that idea you’ve been nursing for months. Either way, you’re considering incorporating in Nova Scotia—and that’s a smart move.

The truth is: the process of incorporating can seem difficult when you’ve never gone through it before. Legal language, federal forms, requirements for filings—it may blur the lines for anyone.

Good news? It doesn’t have to be hard. In this guide, you’ll get a step-by-step guide on Nova Scotia company registration basics, selecting your company business name through submitting your articles of incorporation. By the end of it all, you’ll know exactly how to turn your Nova Scotia limited company into a reality.

Let’s get started.

Why Incorporate Your Business in Nova Scotia?

Before jumping into the how, let’s discuss why you should incorporate in Nova Scotia.

Incorporating your business isn’t only about being more professional-looking (even though that’s a nice side benefit). There are some actual practical reasons why incorporating in Nova Scotia might be worth considering:

Limited Liability Protection: When you incorporate, your company is its own legal person. In other words, personal assets—your house, your car, your money—are safe in the event of the company getting into some kind of difficulty.

Tax Benefits: There’s generally lower tax for incorporated businesses compared to sole proprietors.

Credibility: Customers, suppliers, and investors are more serious about corporations. Having “Inc.” or “Ltd.” after your name makes a difference.

Easier to Raise Money: Should you ever wish to bring investors or secure business loans, being incorporated makes it so much easier.

Perpetual Existence: Unlike the sole proprietorships when the owner dies or retires, the corporations continue. It makes it simple for succession planning and selling your company later on.

Now that you’re sure (if you weren’t before), it’s time to discuss how you actually do it.

Nova Scotia Company Registration: Provincial vs Federal

Feature | Nova Scotia Incorporation | Federal Incorporation |

|---|---|---|

Jurisdiction | Registered under the Nova Scotia Companies Act. | Registered under the Canada Business Corporations Act (CBCA). |

Geographic Scope | Legal recognition and name protection apply only in Nova Scotia. | Legal recognition and name protection apply across all of Canada. |

Business Name Approval | Checked and approved by the Registry of Joint Stock Companies (RJSC) in Nova Scotia. | Requires a federal NUANS report to confirm name availability nationwide. |

Registration Process | File incorporation documents through the Nova Scotia Registry of Joint Stock Companies (RJSC). | File incorporation documents online with Corporations Canada. |

Costs (Government Fees) | Provincial incorporation fees apply (generally lower than federal). | Slightly higher incorporation and filing fees. |

Annual Filings | Must file annual returns with the RJSC to remain in good standing. | Must file annual returns with Corporations Canada plus extra-provincial registration in Nova Scotia (and any other province where business operates). |

Administrative Workload | Simpler if business operates only within Nova Scotia. | More complex—requires both federal and provincial compliance filings. |

Recognition | Primarily recognized within Nova Scotia. | Recognized across Canada; often provides more credibility for businesses seeking national presence. |

Expansion Potential | To operate in other provinces, must register as an extra-provincial corporation. | Already recognized nationally, but still must file extra-provincially in provinces of physical operation. |

Best For | Entrepreneurs running a business that will operate mainly in Nova Scotia. | Entrepreneurs who want to expand across Canada or plan national growth. |

Step-by-Step Guide: How to Incorporate in Nova Scotia

It’s time to make it official? Here’s just what you have to do.

Step 1: Decide on Your Business Name

It’s trickier than it seems. Your name must be:

- Original: It can’t be too much alike with the existing businesses in Nova Scotia

- Descriptive: It should give people some idea of what you do

- Available: You must verify the name not being in use

You’ve got two choices here: select a numbered company (such as “3456789 Nova Scotia Limited”) or select a named company. Most find a named company appealing because it’s more memorable and helps with branding.

Before you get in love with the perfect name, you’ll want to run a name pre-search . It checks Canadian business databases for available use of the name you’ve picked.

Tip: Think of 3-5 potential names before you begin. It may well turn out it’s already being used as your first choice. In any case, you don’t want to begin all over again.

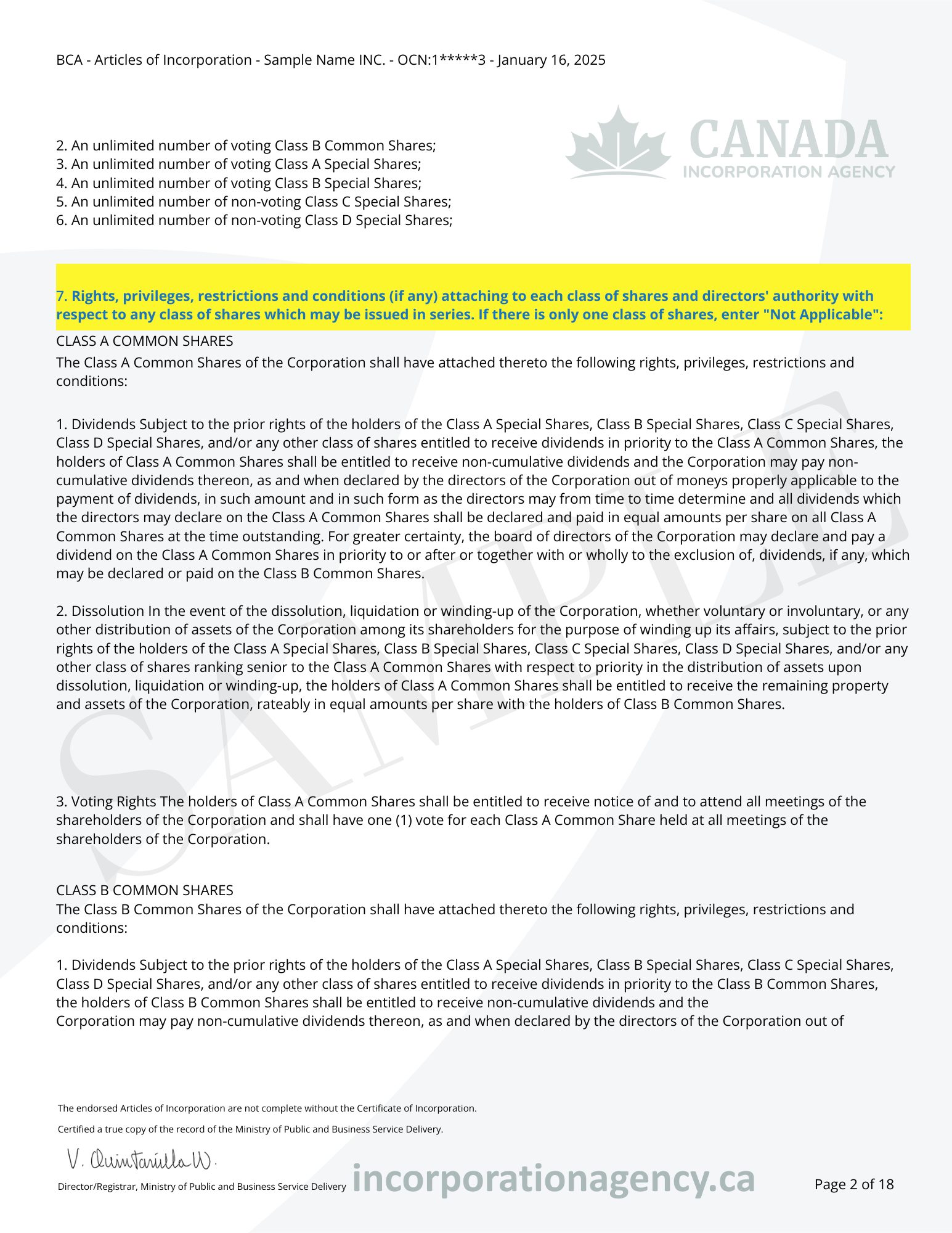

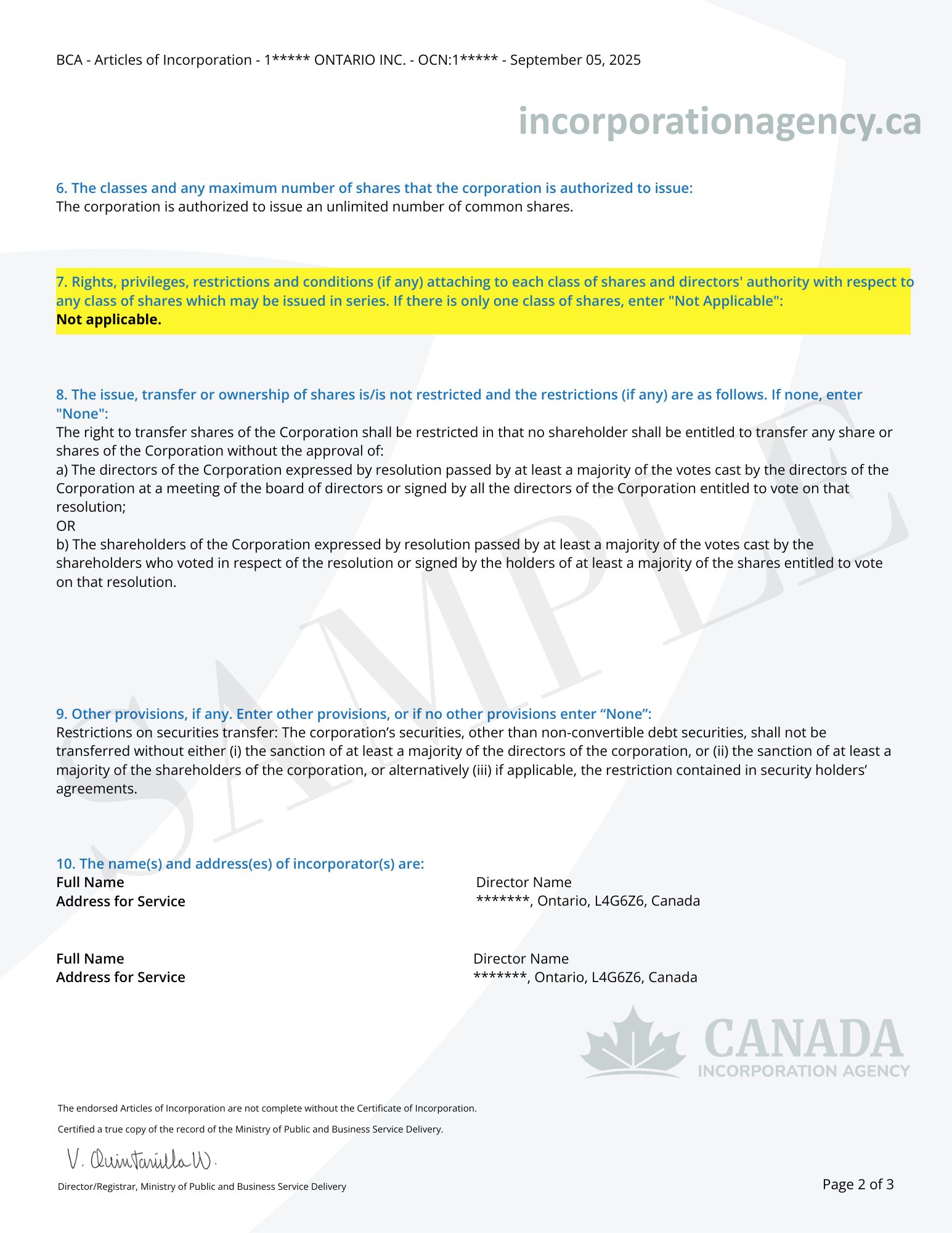

Step 2: Prepare Your Articles of Incorporation

Articles of Incorporation act as the cornerstone of your Nova Scotia limited company. The document contains the basic outline and the regulation of the corporation.

You’ll need to include:

- Business Name: Actual name you desire to register (with the words “Limited,” “Ltd.,” “Incorporated,” “Inc.,” ).

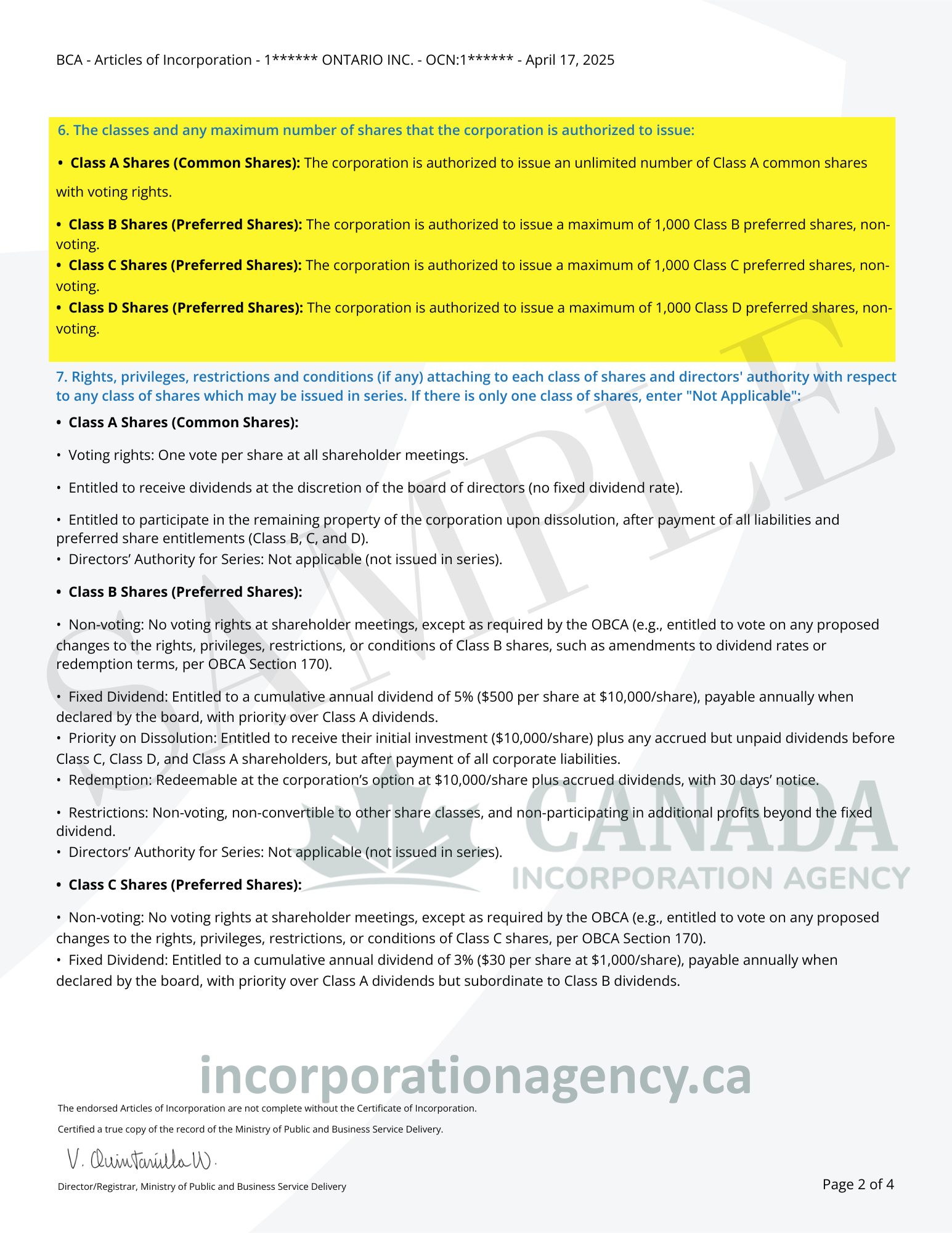

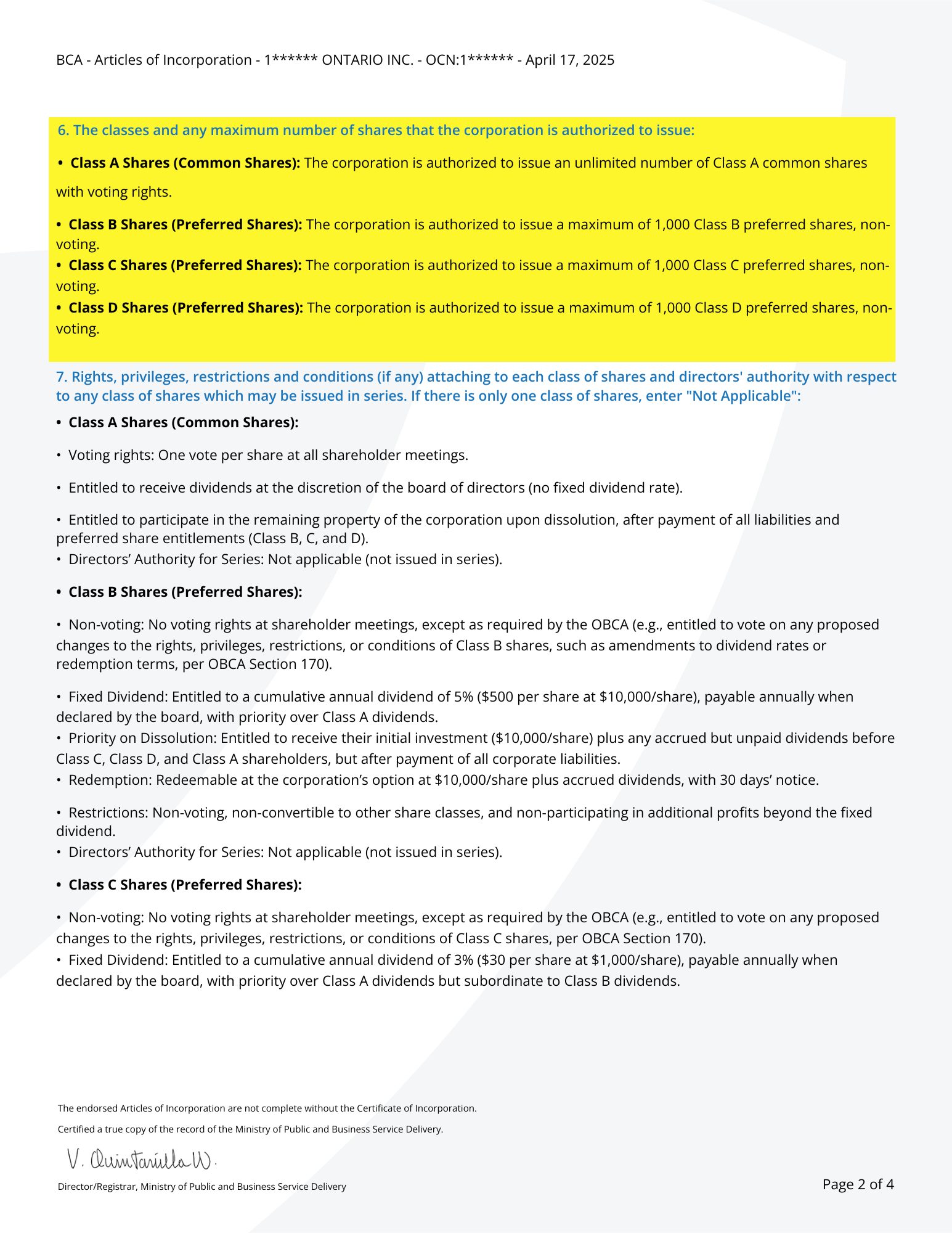

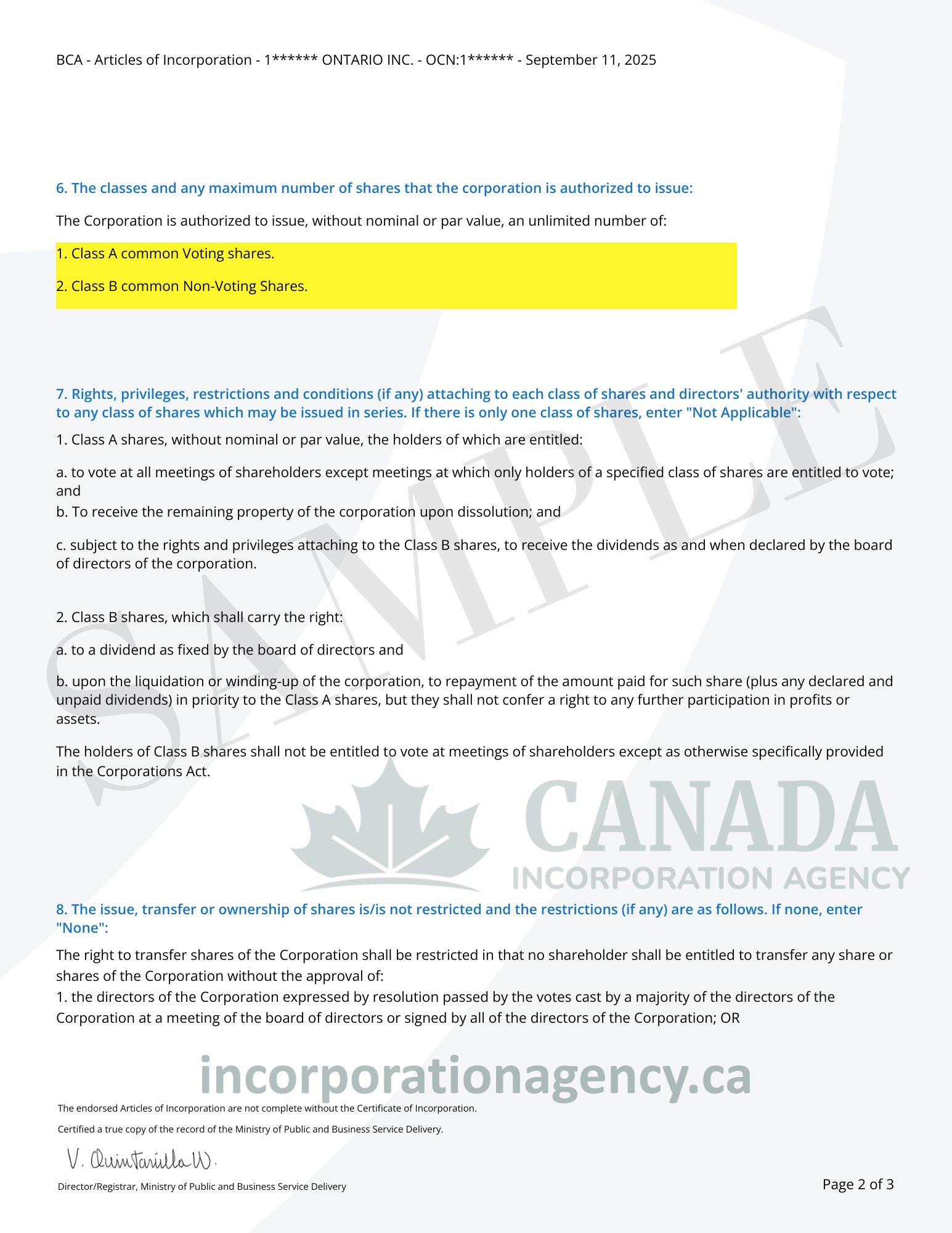

- Share Structure: How many shares you’re authorized to issue, what classes of shares exist, and any special rights or restrictions.

- Business Restrictions: Any restrictions on the company doing (most small businesses select “unlimited” in order to keep it loose).

- Number of directors: How many directors will sit on your board at a minimum of one in Nova Scotia.

- Registered office address: An actual address at Nova Scotia where documents will arrive (Has to be a physical address, not a P.O. box). In case you don’t have a physical address in Nova Scotia, Canada Incorporation Agency can provide a registered office address for you.

- Incorporator information: Name and address of the person who files for incorporation

Don’t panic—there’s already a standard template available that guides you through all of this.

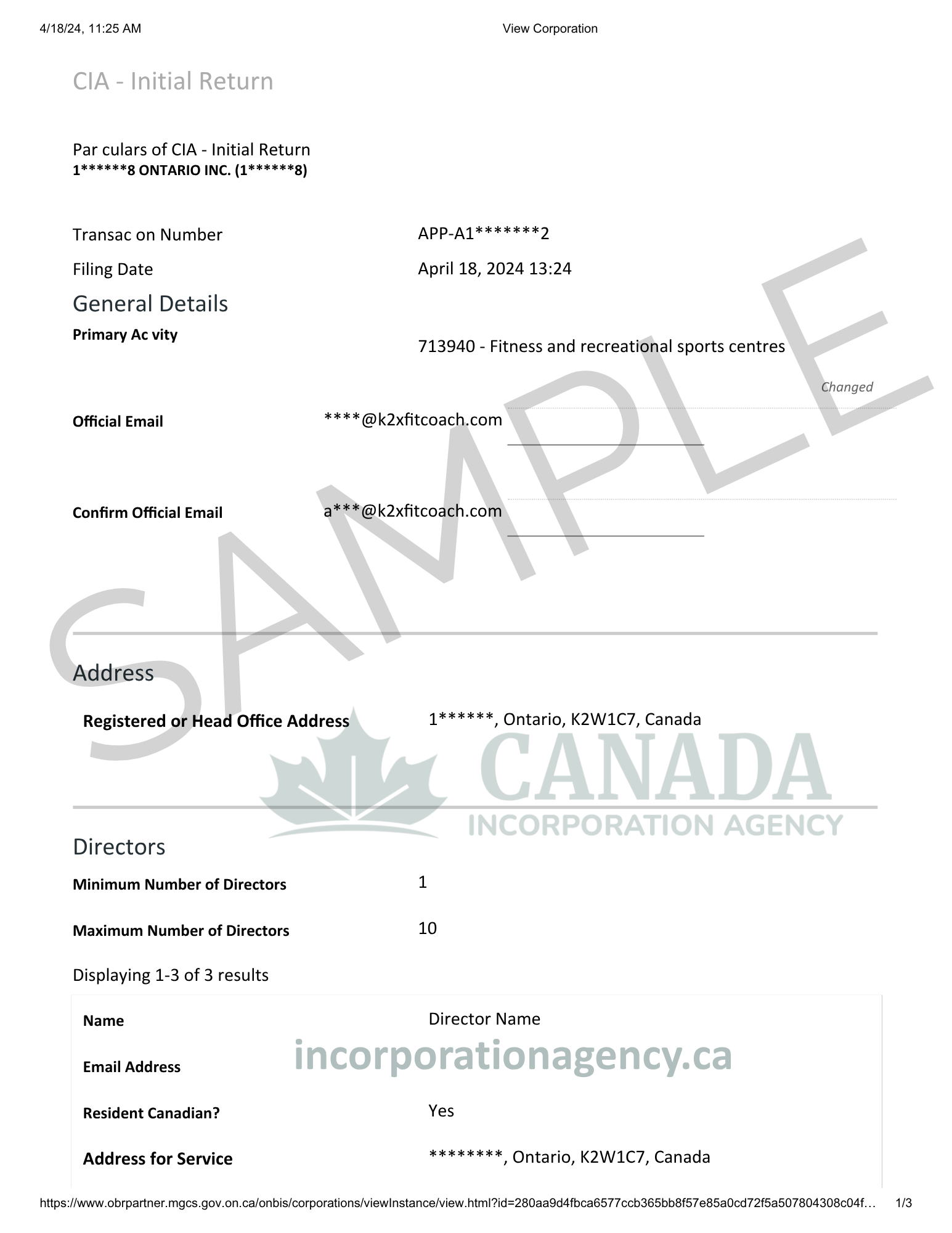

Step 3: Select Your Directors

Each Nova Scotia corporation must have at least one director. Directors are responsible for managing the business and making major decisions.

Requirements for directors:

- Should be at least 18 years old.

- No Canadian residency requirement ( the directors don’t have to be the citizens of Canada or permanent residency holders).

- Can also be the same individual as the officer and shareholder.

For the majority of small businesses the owner just makes himself the only director. Simple.

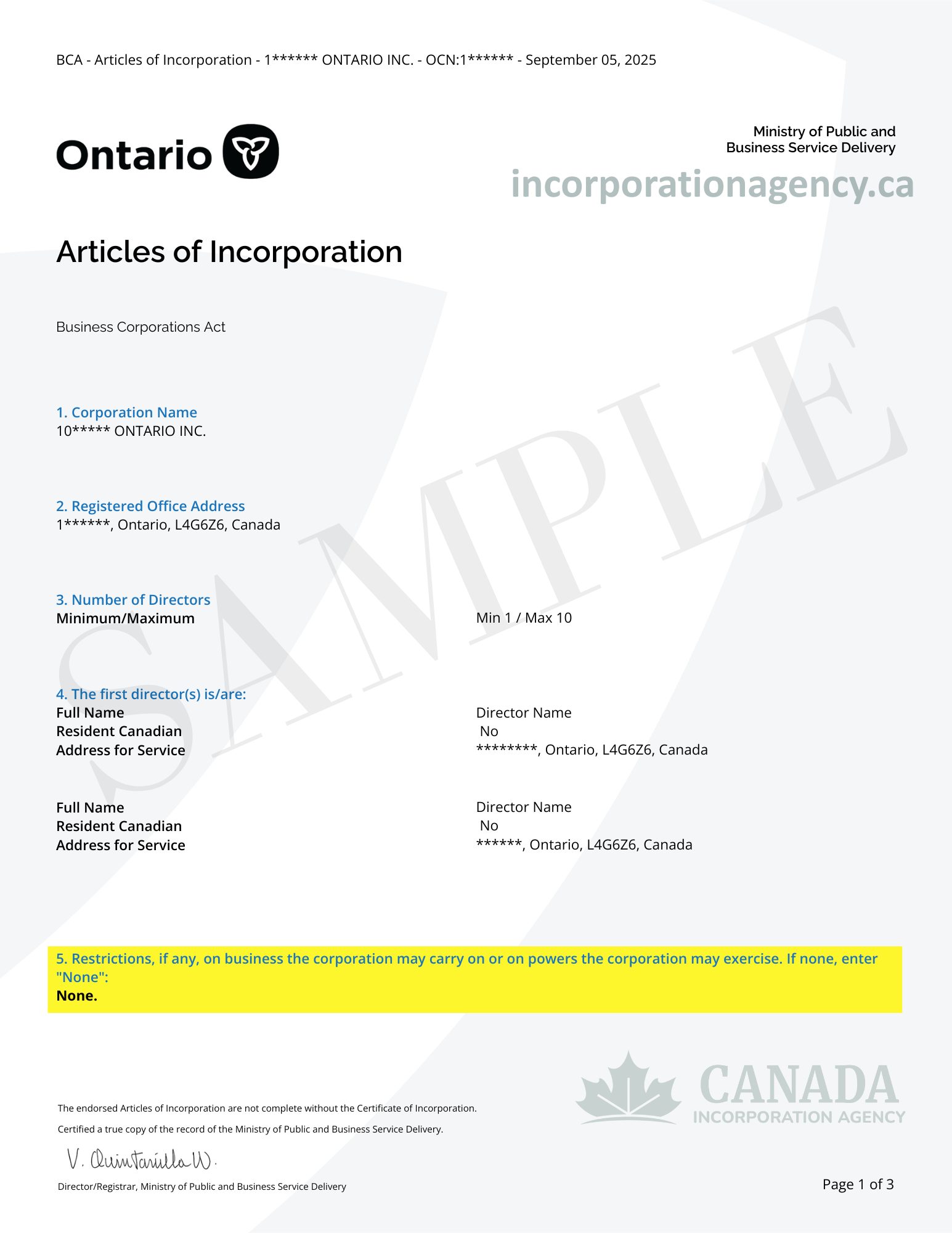

Step 4: File Your Incorporation Documents

It’s time to go official. You’ll register your documents with the Nova Scotia Registry of Joint Stock Companies. Canada Incorporation Agency will do it for you. All you need to do – fill out a simple form on our website. It will not take longer than 10 minutes. Our corporate filing agent will review your application and contact you to confirm everything is up to date. After that, he will create a draft and submit it with the Nova Scotia Government.

Once it’s approved, you’ll get your Certificate of Incorporation by email. Well done—you’re now incorporated.

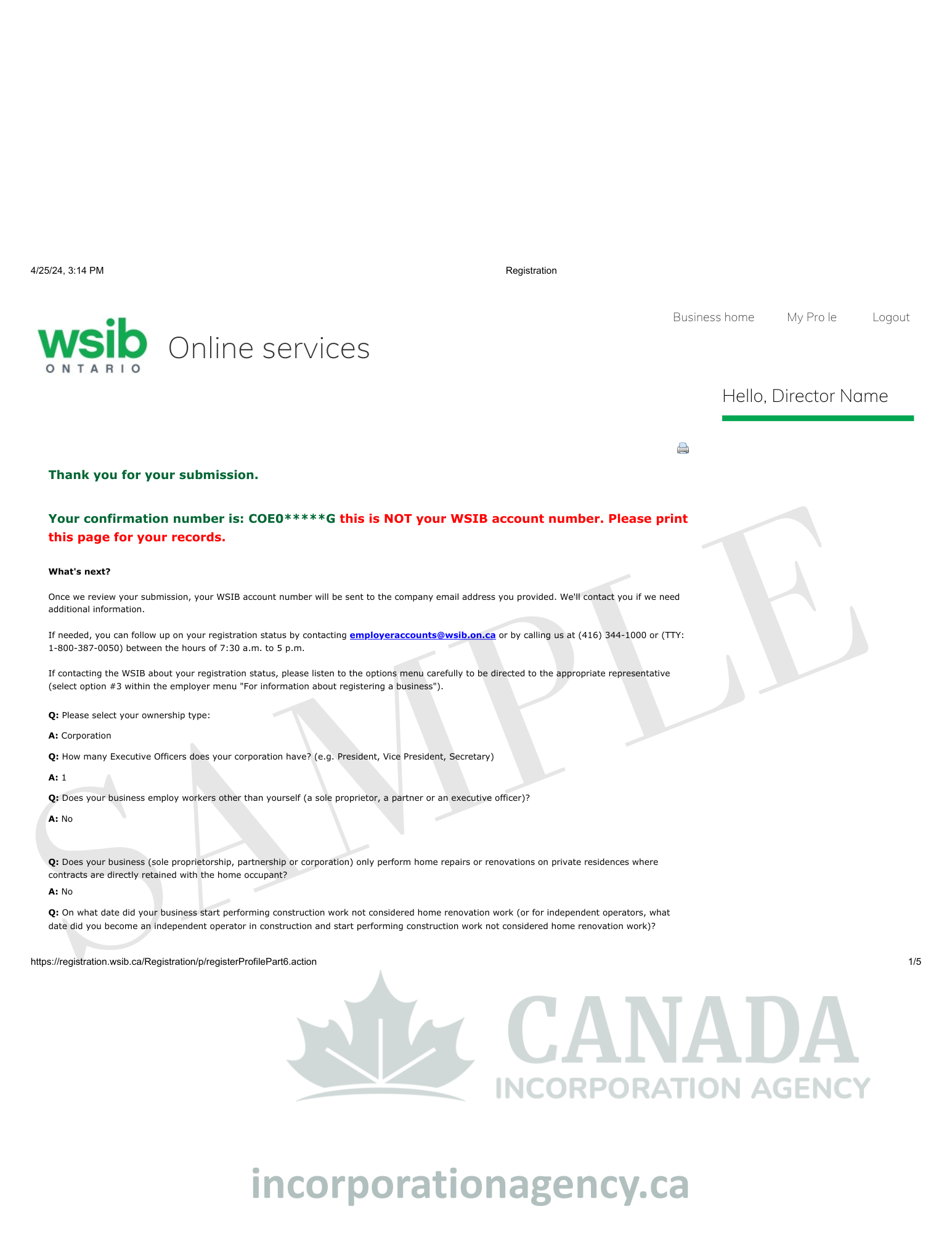

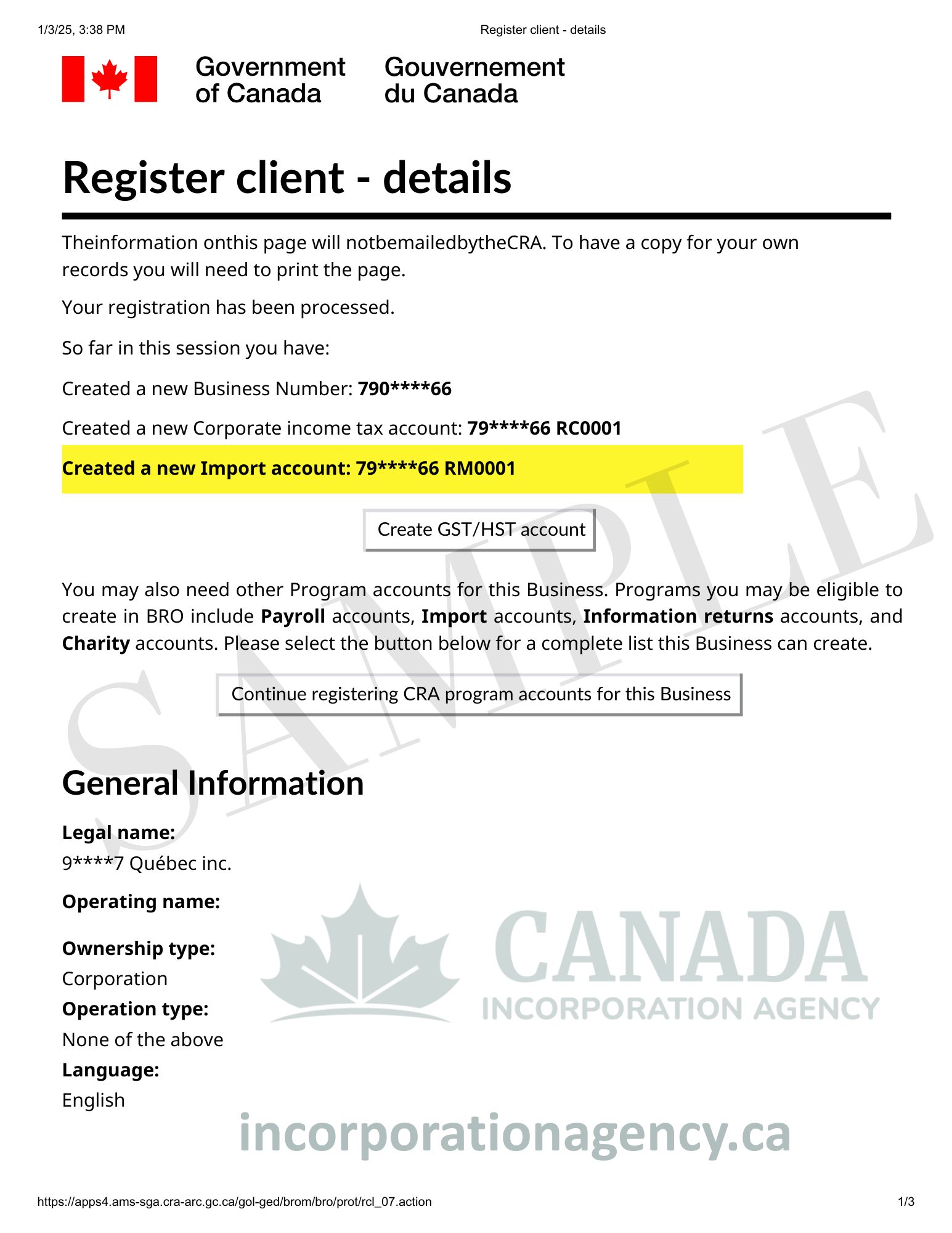

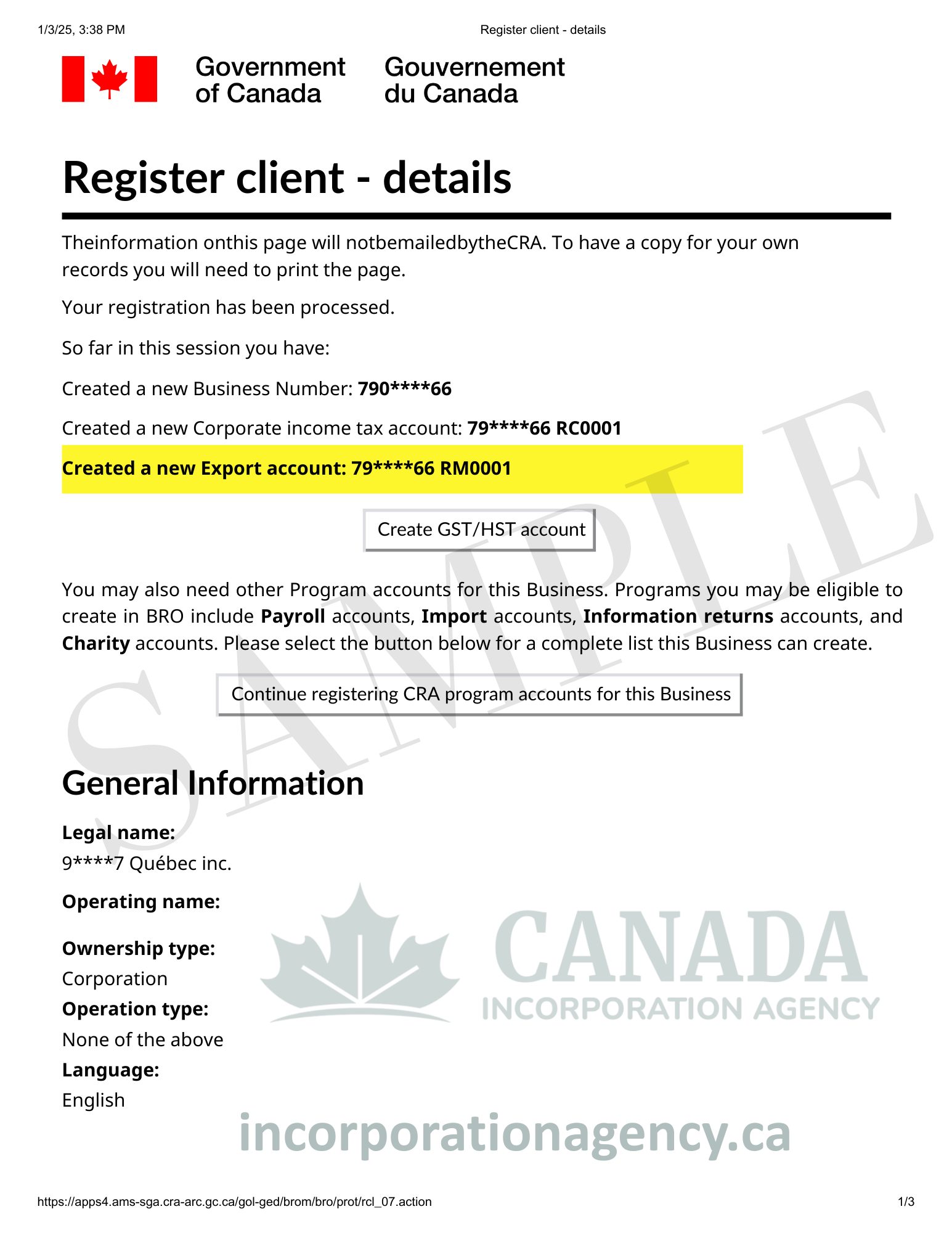

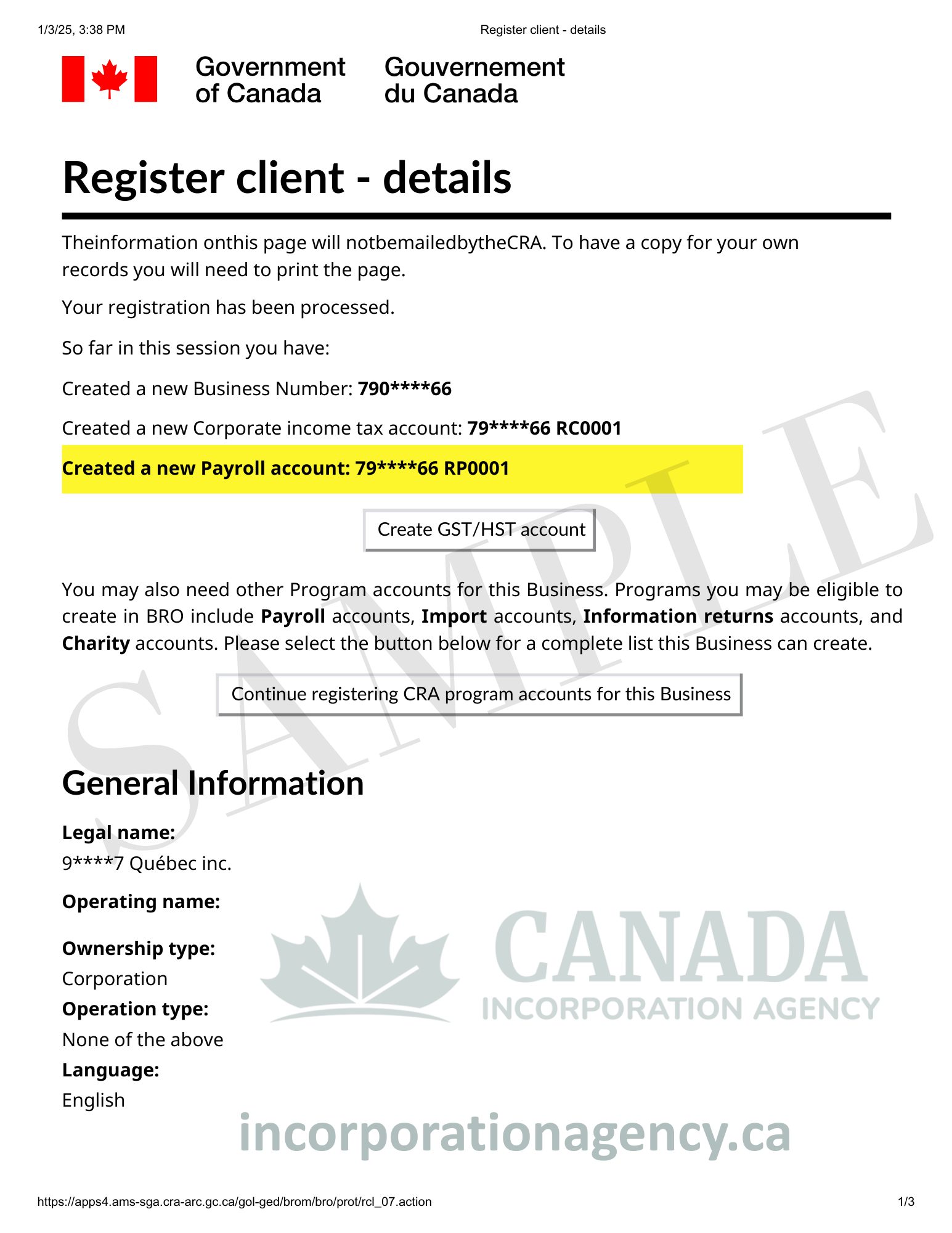

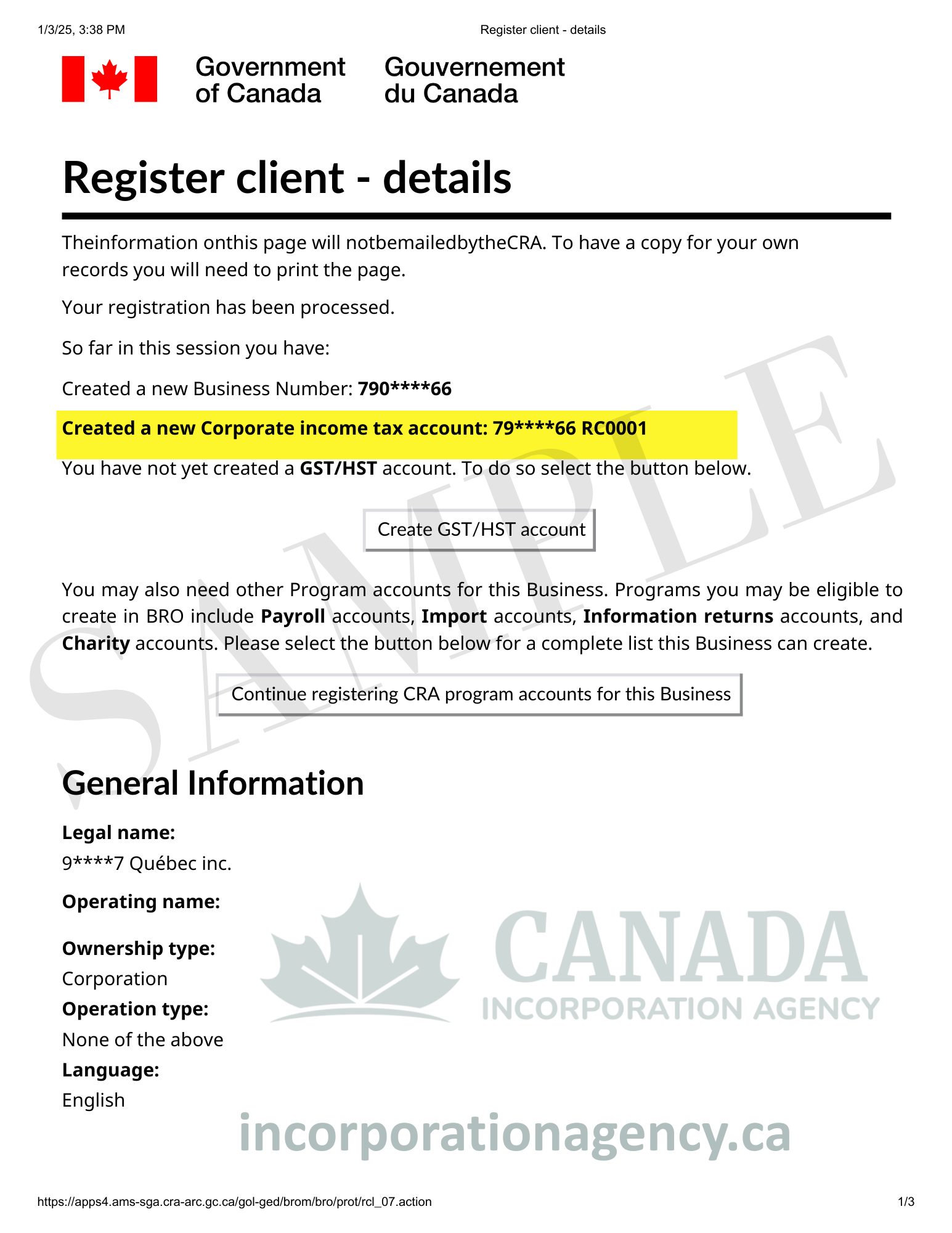

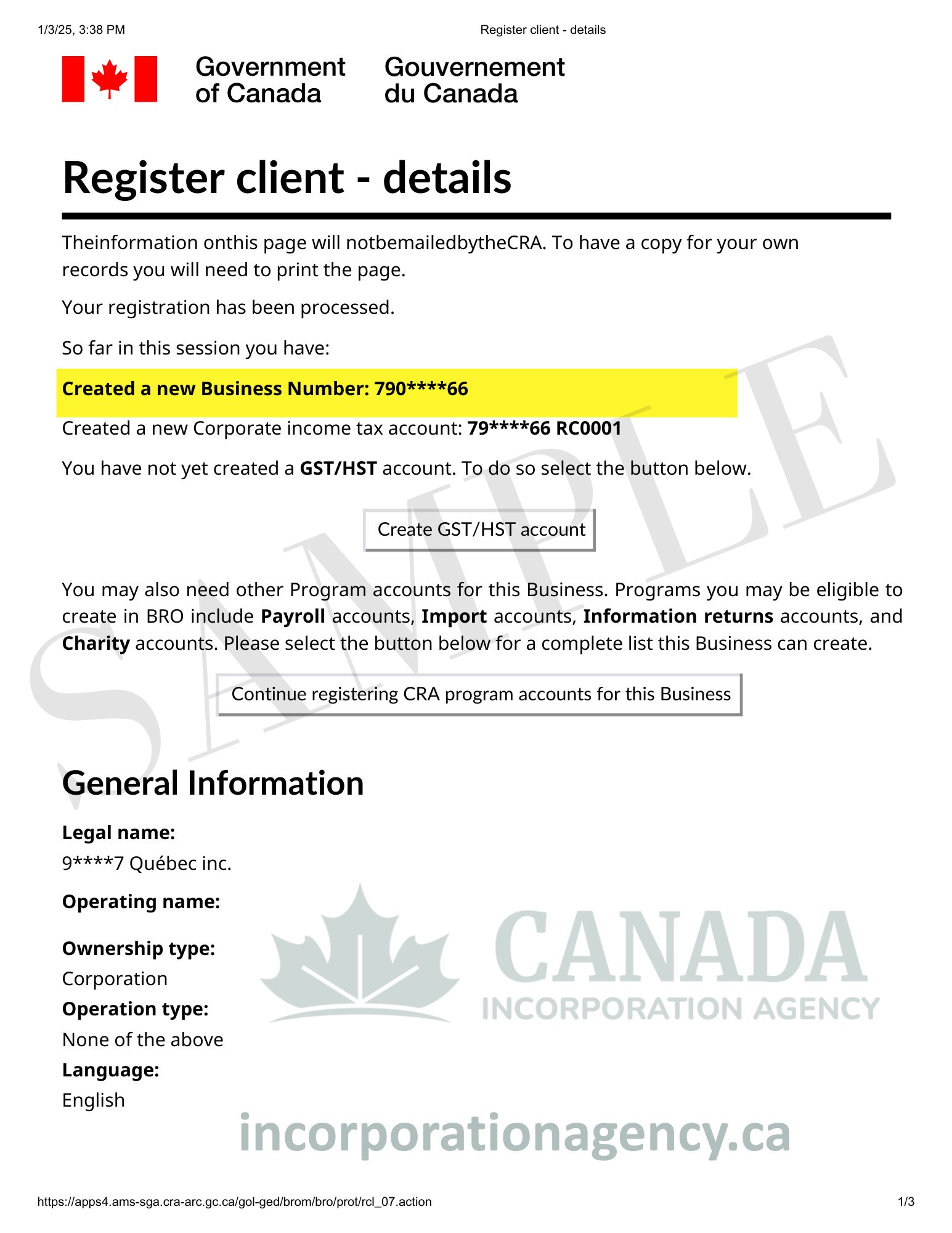

Step 5: Get Your Business Number

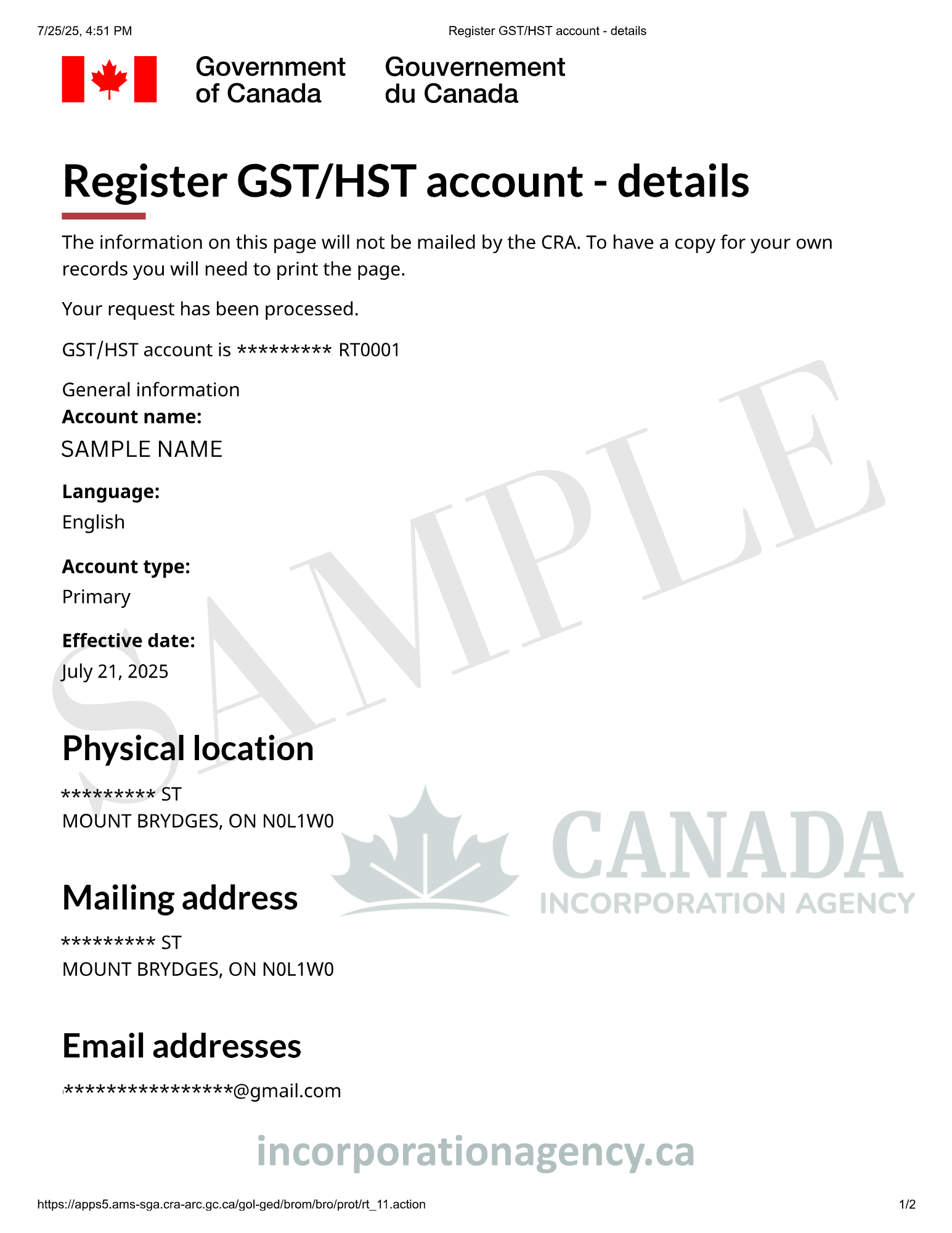

Once you incorporate in Nova Scotia, you must register for the Business Number through the Canada Revenue Agency (CRA). It is the Canada Revenue Agency’s identification number for the company for tax purposes.

Use the Business Number for:

- Subscribe for GST/HST (when needed)

- Open payroll accounts (if applicable for you financially)

- Corporate tax returns filings

Step 6: Create Corporate Records

Your Nova Scotia limited company must hold the right company records. These consist of:

Corporate minute book: A binder (physical or electronic) where all key corporation documents are kept.

- Bylaws: Rules for how your corporation runs on the inside.

- Share certificates: Documents showing who owns shares in the company

- Minutes of meetings: Directory of director and shareholder meetings

- Resolutions: Official decisions by directors or shareholders You may make them yourself using templates, have an attorney draw them up, or use this service as part of the package.

Step 7: Open a Business Bank Account

Now that you’re registered as a company, you must keep company finances entirely distinct from your personal finances. To set up for business bank account you generally require:

- Your Certificate of Incorporation

- Articles of Incorporation

- Business Number for CRA

- The Director and signing authority identification

- Bylaws and corporate resolutions

Shop around—business banks vary their features and charges for business bank accounts. Try to find one with small fees per month, decent internet banking, and decent small business assistance.

Conclusion

Keep in mind, incorporating your nova scotia company is your future investment. It’s not about fees and forms—it’s about protecting yourself, establishing credibility, and positioning your business for long-term success.

The entrepreneurs who succeed aren’t necessarily the ones with the best ideas or the most money. Successful entrepreneurs know how to act when others freeze.

Ready to begin? Contact Canada Incorporation Agency and start your Nova Scotia business journey today!